Can Oil Prices Hold Steady Amid Geopolitical and Market Shifts?

Discover the critical drivers shaping oil prices in 2025, including China's demand trends, U.S. shale dynamics, and OPEC's strategy, with expert insights into WTI and Brent price forecasts | That's TradingNEWS

BP and Iraq: Reviving Kirkuk’s Oil Potential

BP and the Iraqi federal government have taken a significant step toward redeveloping Kirkuk's oil and gas fields, which hold an estimated 9 billion barrels of recoverable reserves. This strategic agreement, focused on rehabilitating existing infrastructure and expanding production capacity, aligns with Iraq's position as OPEC's second-largest oil producer. The fields in Kirkuk, the birthplace of Iraq's oil industry, are crucial to the nation's energy future. BP's long history in Iraq, dating back to the 1920s, provides the expertise needed to stabilize and potentially increase production in this historically significant region. The initial framework includes drilling programs and gas expansion projects aimed at reversing declines and returning production to a growth trajectory. With negotiations expected to conclude by early next year, this initiative signals a critical move in Iraq’s broader efforts to maximize its oil output amidst ongoing geopolitical challenges.

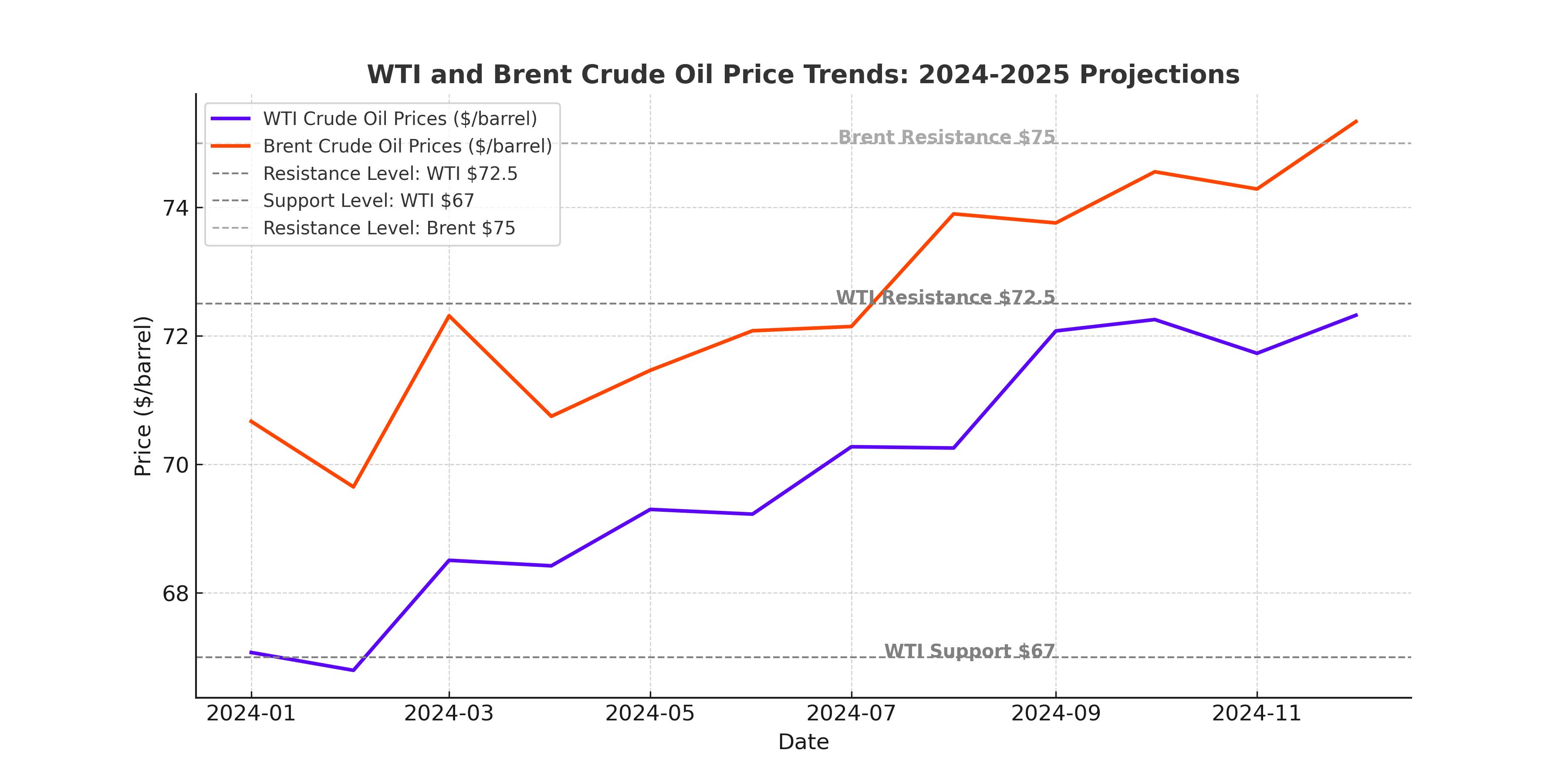

West Texas Intermediate (WTI) and Brent Crude: Navigating Price Volatility

WTI crude oil (CL=F) has been showing resilience, attempting to recover losses incurred after recent Federal Reserve announcements. The $67 support level and the $72.50 resistance level are key technical thresholds, with inflation likely to drive prices upward in the medium term. However, seasonal factors and holiday trading volumes may temper any immediate rallies. Brent crude oil (BZ=F), often lagging WTI, is also demonstrating strength and could mirror WTI's movements as broader economic conditions stabilize. Short-term pullbacks in both benchmarks offer potential buying opportunities, particularly for traders looking to capitalize on seasonal price patterns. Early 2025 may see more significant moves, especially as demand stabilizes and geopolitical factors come into play.

Glencore’s Strategic Expansion in the Middle East

Glencore’s acquisition of a Singaporean refinery and its recent purchases of Middle Eastern crude oil, including Qatar’s Al-Shaheen and Abu Dhabi’s Upper Zakum grades, highlight its aggressive push into the physical oil market. This move positions the commodity trading giant to strengthen its refining operations while gaining more control over crude oil flows in Asia. The Bukom refining complex acquisition allows Glencore to optimize its trading strategies, hedging exposure through futures while securing a consistent supply for refining operations. This aligns with the broader trend of independent traders like Vitol and Trafigura acquiring assets from major oil companies to expand their market influence.

China and U.S.: Shaping the Oil Market in 2025

Oil demand in 2025 is expected to grow by 1–1.4 million barrels per day, driven primarily by China's petrochemical sector. However, transportation demand in China is flattening, with the rise of electric vehicles and LNG-powered trucks offsetting traditional fuel consumption. The U.S., on the other hand, faces challenges in maintaining shale production growth due to higher breakeven costs and the depletion of Tier 1 drilling acreage. Analysts predict that U.S. output may slow, potentially creating supply gaps that OPEC+ could exploit. However, geopolitical and economic factors, including China's evolving demand patterns and potential OPEC policy shifts, will heavily influence global prices.

Russia’s Oil Exports Under Pressure

Sanctions imposed by the EU and the UK continue to target Russia's shadow fleet of tankers and trading firms, aiming to curb revenues supporting the war in Ukraine. Recent measures include bans on port access and insurance for vessels carrying Russian oil priced above the $60-per-barrel cap. Despite these pressures, Russia’s oil exports have shown resilience, supported by high-capacity usage in sanctioned vessels. However, the effectiveness of these sanctions may become more apparent as geopolitical tensions escalate and enforcement tightens. November saw Russian oil revenues decline by 21% year-over-year, attributed to lower global prices and infrastructural maintenance that limited shipments.

U.S. and European LNG Strategies Amid Russian Gas Supply Shifts

With the looming expiration of Russia’s gas transit deal with Ukraine, Europe faces a critical juncture in its energy strategy. Alternatives are being actively explored, including increased imports from Azerbaijan and other non-Russian sources. The EU’s focus on energy security is driving long-term shifts in supply chains, with liquefied natural gas (LNG) becoming an increasingly vital component. This transition underscores the importance of diversifying energy sources to mitigate geopolitical risks and secure stable supply lines.

Chevron and Woodside: Strategic Realignment in Australia

Chevron and Woodside’s asset swap reshuffles their Australian LNG portfolios, allowing both companies to consolidate their positions in operated projects. Chevron’s increased stake in the Wheatstone LNG project complements its focus on Western Australia, while Woodside strengthens its hand in the North West Shelf. This strategic realignment reflects a broader industry trend of optimizing portfolios to improve operational efficiency and financial returns. With LNG demand projected to grow, such strategic moves position both companies to capitalize on emerging opportunities in the global energy market.

Oil Price Forecasts: What Lies Ahead?

Long-term oil price trends indicate a steady reversion to the mean, with inflation playing a significant role in price stability. WTI and Brent are expected to hover around $70–$80 per barrel, barring significant geopolitical disruptions or major shifts in demand. The global energy transition, led by EV adoption and renewable energy investments, is likely to cap long-term demand growth. However, population growth in emerging markets and persistent reliance on fossil fuels in key sectors suggest that oil will remain a critical component of the global energy mix for decades.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex