Can Visa Stock (NYSE:V) Sustain Its Growth Momentum?

With a $600B market cap, Visa leads in payments, driven by innovation, robust financials, and a bullish $335 target | That's TradingNEWS

Visa Inc.: A Global Payments Powerhouse Redefining Financial Transactions

Visa Inc. (NYSE:V) stands at the pinnacle of the global payments industry, driving innovation while maintaining an unassailable market position. With a market capitalization exceeding $600 billion, Visa’s influence extends far beyond traditional payment processing. As the largest player in the payments ecosystem, Visa has seamlessly integrated cutting-edge technologies like blockchain while capturing a significant share of global economic activity. Its dominance is built on a scalable, asset-light business model that generates exceptional margins and robust free cash flow. These strengths enable Visa to adapt to evolving financial landscapes, ensuring relevance and resilience in a competitive and highly regulated environment.

Revenue Growth and Profitability: Sustaining Excellence

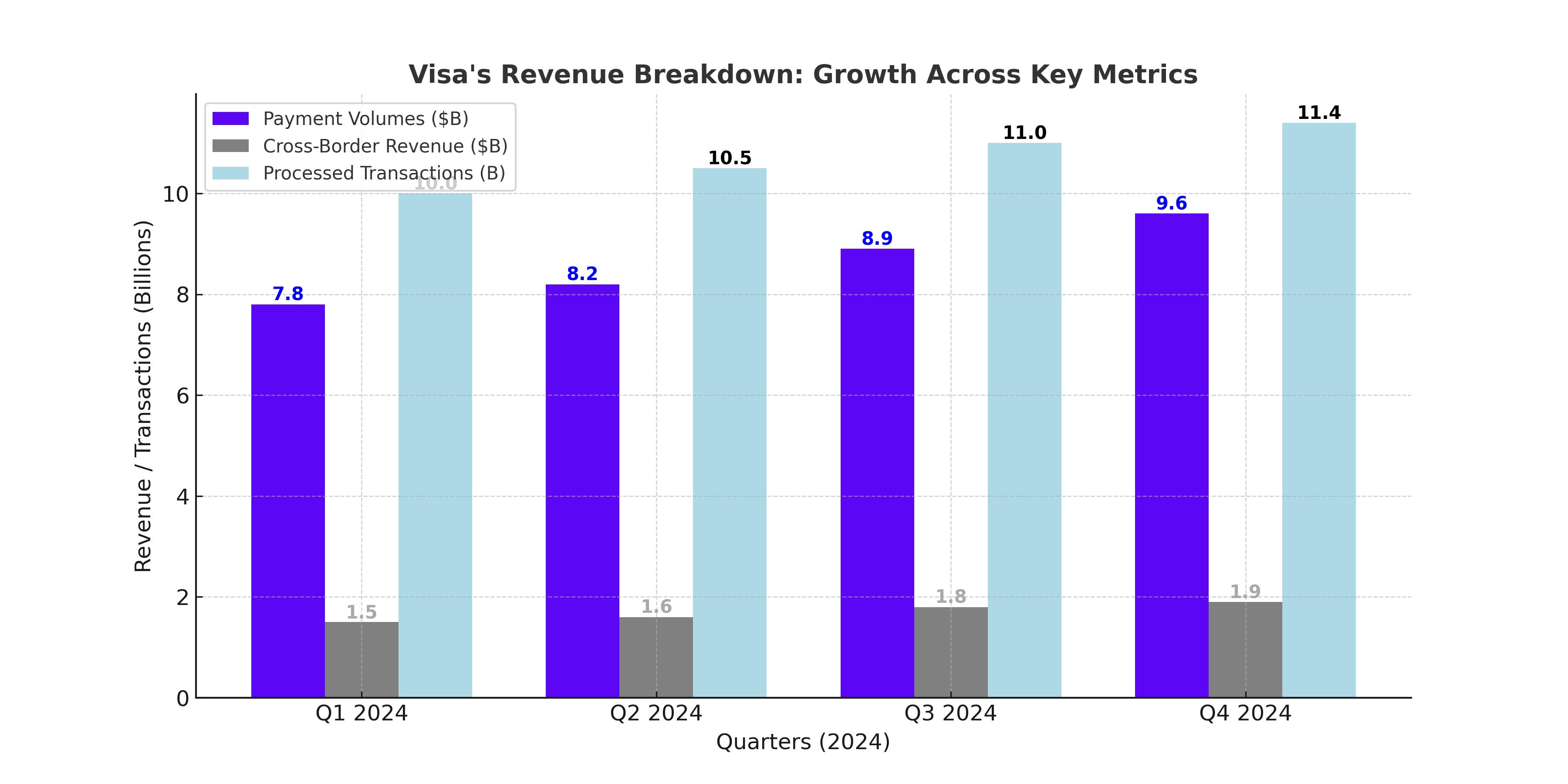

Visa’s fiscal Q4 2024 results confirmed its position as an industry leader. The company reported a 12% increase in revenue, reaching $9.6 billion. This was driven by growth across all major metrics, including a 9% year-over-year rise in payments volume, a 19% jump in cross-border volume, and a 10% increase in processed transactions. These figures highlight Visa’s ability to capitalize on global consumer spending trends, which remain resilient despite pockets of macroeconomic weakness.

Adjusted EPS came in at $2.71, surpassing consensus estimates of $2.58, while net income reached $4.3 billion, a 13% year-over-year increase. Operating margins remained robust, exceeding 62%, even as expenses grew by 7% to $3.27 billion. Visa’s profitability is a testament to its scalable asset-light business model, which allows revenue to grow disproportionately faster than costs. Such efficiency ensures that even moderate revenue growth translates into meaningful profit gains.

Visa’s strong financial position enabled the company to raise its dividend by 13% to $0.59 per share, underscoring management’s confidence in sustainable earnings growth. The payout ratio, though modest in dividend terms, is augmented by aggressive share buybacks. In the last quarter alone, Visa returned $5.8 billion to shareholders through buybacks, complementing its $1.04 billion dividend distribution.

Innovations and Strategic Initiatives: Strengthening the Moat

Visa has made significant strides in integrating cutting-edge technologies into its offerings. The launch of the Visa Tokenized Asset Platform (VTAP) marked a milestone in bridging traditional and blockchain-based finance. Through this platform, Visa allows banks to issue and manage stablecoins on the Ethereum blockchain, paving the way for more secure and scalable digital payment solutions.

The rollout of Visa Protect for Account-to-Account (A2A) Payments in the UK underscores Visa’s investment in leveraging artificial intelligence to prevent fraud in real-time payment networks. Similarly, the Flexible Credential service, which allows users to toggle between payment methods on a single card, enhances consumer convenience and positions Visa as a leader in payment innovation.

These initiatives are critical in an increasingly digital and decentralized financial world. Visa’s ability to integrate new technologies while maintaining the integrity of its core network ensures its competitive edge against emerging fintech disruptors.

Financial Metrics: The Cornerstone of Stability

Visa’s financials reveal a company firing on all cylinders. The company’s return on equity (RoE) exceeds 40%, far surpassing industry peers like Mastercard (MA) and PayPal (PYPL). This exceptional RoE reflects Visa’s capital efficiency, driven by its scalable business model and high-margin revenue streams.

Operating margins, consistently above 62%, highlight Visa’s ability to generate significant profits from each dollar of revenue. This is complemented by consistent EPS growth, which has averaged 11-12% annually over the past five years. Free cash flow remains robust, with Visa generating $6.35 billion in the most recent quarter, a figure that underscores its ability to return value to shareholders while maintaining financial flexibility.

Risks and Challenges: Navigating Regulatory Hurdles

Despite its strengths, Visa faces several challenges. Regulatory scrutiny remains a significant risk, particularly as the U.S. Department of Justice investigates its market practices in the debit card space. The growing pro-crypto stance of the incoming Trump administration also introduces uncertainties. While Visa has integrated blockchain technology into its ecosystem, broader adoption of cryptocurrencies could pressure traditional payment networks.

Another challenge lies in emerging competition. In markets like China and India, domestic payment networks such as UnionPay and RuPay threaten Visa’s market share. However, these risks are mitigated by Visa’s ability to adapt its offerings and maintain its stronghold in developed markets.

Technical Analysis: A Bullish Trend with Room to Grow

Visa’s stock has demonstrated consistent technical strength. The recent breakout above the $290-$293 resistance zone signaled the continuation of a bullish trend, with a price target of $333 to $335 based on the height of the previous consolidation range. The rising 200-day moving average underscores long-term bullish momentum, while RSI levels indicate room for further upside before overbought conditions emerge.

Investors should monitor the $295 level, which represents a key support area. A pullback to this level would offer an attractive entry point for long-term investors.

Valuation: A Premium Worth Paying

Visa trades at approximately 30x forward earnings, a premium valuation reflective of its dominant market position and consistent growth. While not cheap, this valuation is justified by Visa’s strong free cash flow generation, robust margins, and growth potential. The stock’s free cash flow yield of 3.1% is competitive, particularly given the low interest rate environment.

Visa’s ability to pass on inflationary pressures to consumers through higher transaction values further enhances its appeal. This inflation-linked revenue growth makes Visa a compelling investment in both growth and inflationary environments.

Final Analysis: Buy Rating Reinforced

Visa Inc. (NYSE:V) remains a cornerstone investment for long-term portfolios. Its dominant market position, strong financial metrics, and innovative approach to digital payments position it well for sustained growth. While regulatory risks and competitive pressures exist, Visa’s ability to adapt and innovate mitigates these concerns.

The stock’s fair valuation, combined with technical strength and consistent shareholder returns, reinforces its attractiveness. With a price target of $335 and upside potential from continued global economic growth and digital payment adoption, Visa earns a strong buy rating. Investors looking for a blend of growth, stability, and exposure to the secular shift toward cashless payments should consider Visa as a foundational holding.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex