Can WTI (CL=F) and Brent (BZ=F) Sustain Current Levels Amid Supply Surplus?

Oil prices face pressure with WTI at $69.46 and Brent at $72.94, but geopolitical risks could shift the narrative | That's TradingNEWS

Oil Prices Under Pressure: Will WTI (CL=F) and Brent (BZ=F) Hold Key Levels?

Global oil prices are navigating a complex landscape influenced by geopolitical developments, shifting supply-demand dynamics, and macroeconomic policies. On December 20, Brent crude (BZ=F) settled marginally higher at $72.94 per barrel, while WTI (CL=F) gained 8 cents to close at $69.46 per barrel. Despite these modest gains, both benchmarks recorded weekly losses of around 2.5%, reflecting market jitters over Chinese demand forecasts, global production surpluses, and monetary policy signals.

The Role of Chinese Demand and Economic Signals

China's influence on global oil markets remains pivotal, with recent projections indicating that the nation's crude imports could peak by 2025, according to Sinopec's annual outlook. This anticipated slowdown in China's oil demand growth, coupled with weakening gasoline and diesel consumption, is reshaping market expectations. On the supply side, U.S. crude exports surged to a record 771,000 barrels per day in November, driven by favorable WTI-Brent spreads, but rising freight costs and narrowing differentials now threaten to curtail transatlantic shipments.

The Federal Reserve's monetary policy has also contributed to oil price volatility. While the Fed recently cut interest rates, its cautious outlook on future rate reductions has bolstered the U.S. dollar, making oil more expensive for holders of other currencies. These dynamics have tempered the bullish momentum that lifted oil prices earlier in the year.

Supply-Side Dynamics and OPEC+ Strategy

OPEC+ continues to grapple with balancing global supply and demand. The group's recent decision to delay easing production cuts until April 2025 highlights ongoing efforts to stabilize prices amid forecasts of a substantial surplus. The International Energy Agency (IEA) projects a 950,000 barrel-per-day (bpd) surplus in 2025, even if OPEC+ maintains current output levels. If cuts are unwound as planned, this surplus could expand to 1.4 million bpd.

Meanwhile, non-OPEC+ production is expected to rise significantly, with JPMorgan estimating an increase of 1.8 million bpd in 2025. This, combined with tepid demand growth of 1.1 million bpd, underpins expectations of oversupply and potential downward pressure on prices. Fitch Ratings anticipates Brent and WTI averaging $70 per barrel in 2025, down from $80 this year.

Geopolitical Risks and Potential Upside for Oil Prices

Despite the bearish supply outlook, geopolitical risks could provide upside potential for oil prices. Recent sanctions targeting Russia's "shadow fleet" of oil tankers, as well as ongoing tensions in the Middle East, underscore the vulnerability of global supply chains. G7 nations are reportedly exploring stricter price caps on Russian oil exports, which could tighten markets further if implemented effectively.

In addition, hedge funds have increased their bullish bets on WTI by the largest margin in over a year, reflecting optimism over potential Chinese economic stimulus and the impact of sanctions on Iranian and Russian crude. Speculative positioning in WTI futures rose by 57,215 contracts to 161,201 during the week ending December 17, signaling heightened confidence in near-term price recovery.

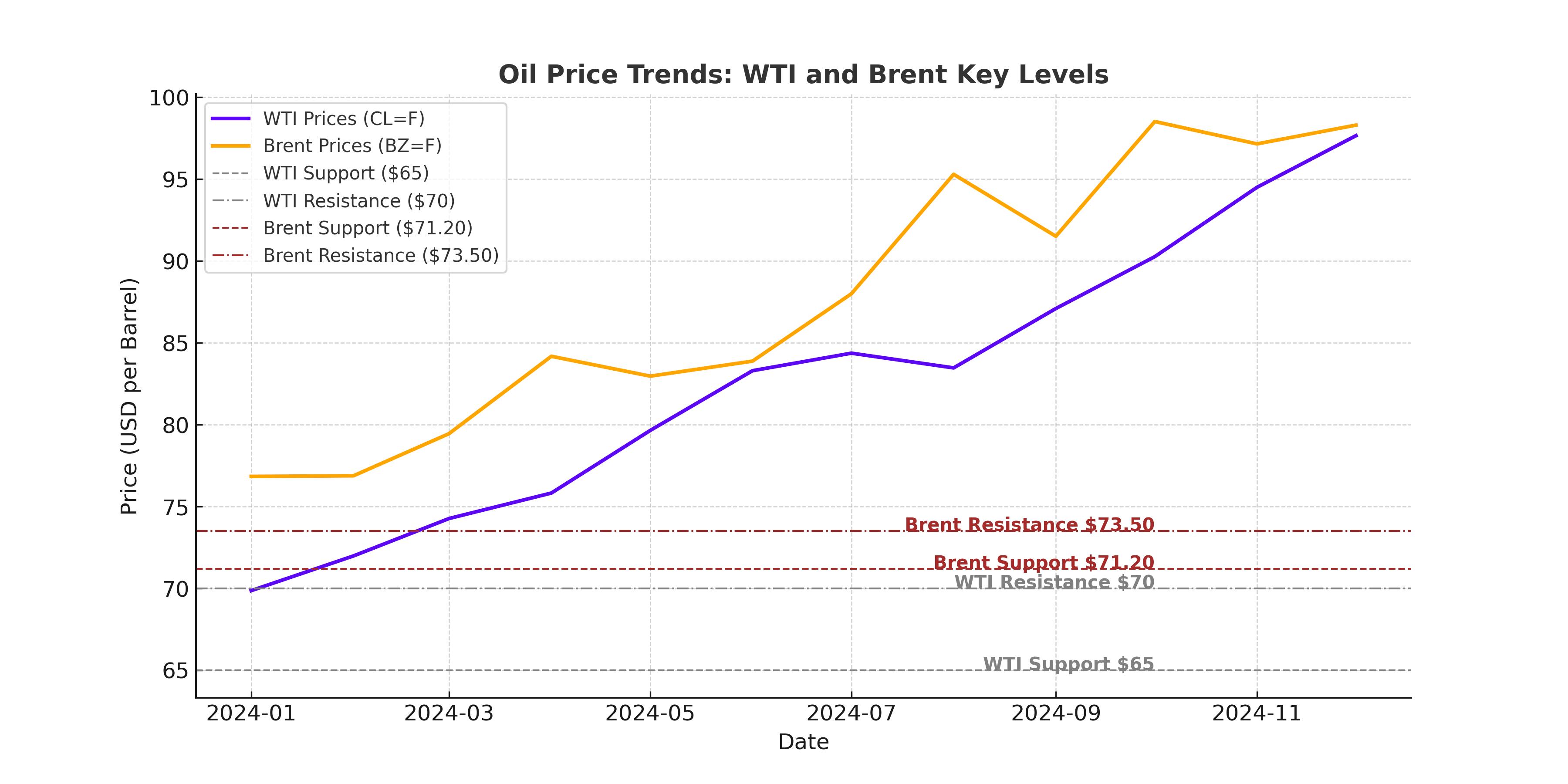

Technical Analysis: Key Support and Resistance Levels for WTI and Brent

WTI and Brent are testing critical technical levels that will determine their near-term trajectories. WTI faces immediate resistance at $70 per barrel, with a failure to breach this level likely leading to a retest of support around $65. For Brent, resistance at $73.50 aligns with the 50-day moving average, while support at $71.20 remains crucial. The narrowing WTI-Brent spread, now at $3.48 per barrel, reflects shifting market dynamics that could influence trade flows and pricing in the weeks ahead.

Conclusion: Navigating a Complex Oil Market

As we approach 2025, the interplay of supply surpluses, geopolitical tensions, and macroeconomic policies will shape the outlook for oil prices. While Brent and WTI face headwinds from rising production and slower demand growth, potential catalysts such as stricter sanctions and renewed Chinese stimulus efforts could offer support. Investors should closely monitor key price levels and geopolitical developments to navigate this volatile market effectively. With WTI at $69.46 and Brent at $72.94, the path forward remains uncertain, but opportunities for strategic positioning persist.

That's TradingNEWS

Read More

-

SCHG ETF Near $32.42: AI Growth ETF Back Toward The Top Of Its Range

16.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR Attract $1.27B As XRP-USD Clings To $2.00 Support Zone

16.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Around $3 As US Surplus Clashes With Europe’s TTF Weather Spike

16.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Hovers Near 158 As Intervention Risk And BoJ Policy Warnings Hit The Carry Trade

16.01.2026 · TradingNEWS ArchiveForex