Can XAU/USD Regain Momentum Above $2,600?

Gold prices teeter near $2,600 as the Fed's hawkish stance reshapes market sentiment | That's TradingNEWS

Gold Prices Under Pressure Amid Fed’s Hawkish Policy Shift

Gold prices, represented by XAU/USD, have faced significant downward pressure, plunging below $2,600 per ounce, driven by a sharp shift in market sentiment following the Federal Reserve’s less dovish monetary policy updates. The central bank’s decision to cut interest rates by 25 basis points, bringing them to a range of 4.25%-4.50%, initially appeared supportive for the non-yielding asset. However, hawkish projections for slower rate cuts in 2025 and beyond weighed heavily on the market, prompting traders to reassess their positions.

Federal Reserve’s Impact on XAU/USD

Federal Reserve Chair Jerome Powell reinforced a cautious policy stance, stating that inflation risks remain skewed to the upside. The central bank’s updated Summary of Economic Projections (SEP) indicated that only two rate cuts are expected in 2025, with another two slated for 2026. The Fed funds rate is projected to settle at 3.9% by the end of 2025 and decline further to 3.4% in 2026. These forecasts have tempered market expectations for aggressive easing, limiting the bullish momentum for gold.

The Fed’s preferred inflation gauge, the Core PCE, is forecasted to conclude 2024 at 2.8%, falling to 2.5% in 2025 and 2.2% in 2026. These projections signal a protracted timeline for returning to the 2% inflation target, further supporting the Fed’s restrictive stance. Powell also assured that the labor market shows no signs of overheating, indicating stable unemployment rates at 4.4% for the current year and 4.3% for 2025 and 2026.

Real Yields and Dollar Strength Challenge Bullion Demand

Rising real yields have become a formidable headwind for gold. The US 10-year Treasury bond yield climbed by 5 basis points to 4.45%, while real yields gained 7 basis points, reaching 2.14%. These movements underscore the increased opportunity cost of holding gold, making it less attractive compared to yield-bearing assets. Concurrently, the US Dollar Index surged 0.70% to 107.69, reaching a two-year high, further eroding demand for dollar-denominated gold.

Building Permits in November rose significantly by 6.1% month-over-month to 1.505 million, signaling resilience in the housing market. Conversely, Housing Starts dipped by 1.8% to 1.289 million, reflecting mixed economic signals. These data points, combined with robust retail sales growth of 0.7% in November and a solid S&P Global Composite PMI of 56.6, highlight a robust US economy that continues to challenge gold’s safe-haven appeal.

Technical Analysis of Gold Prices

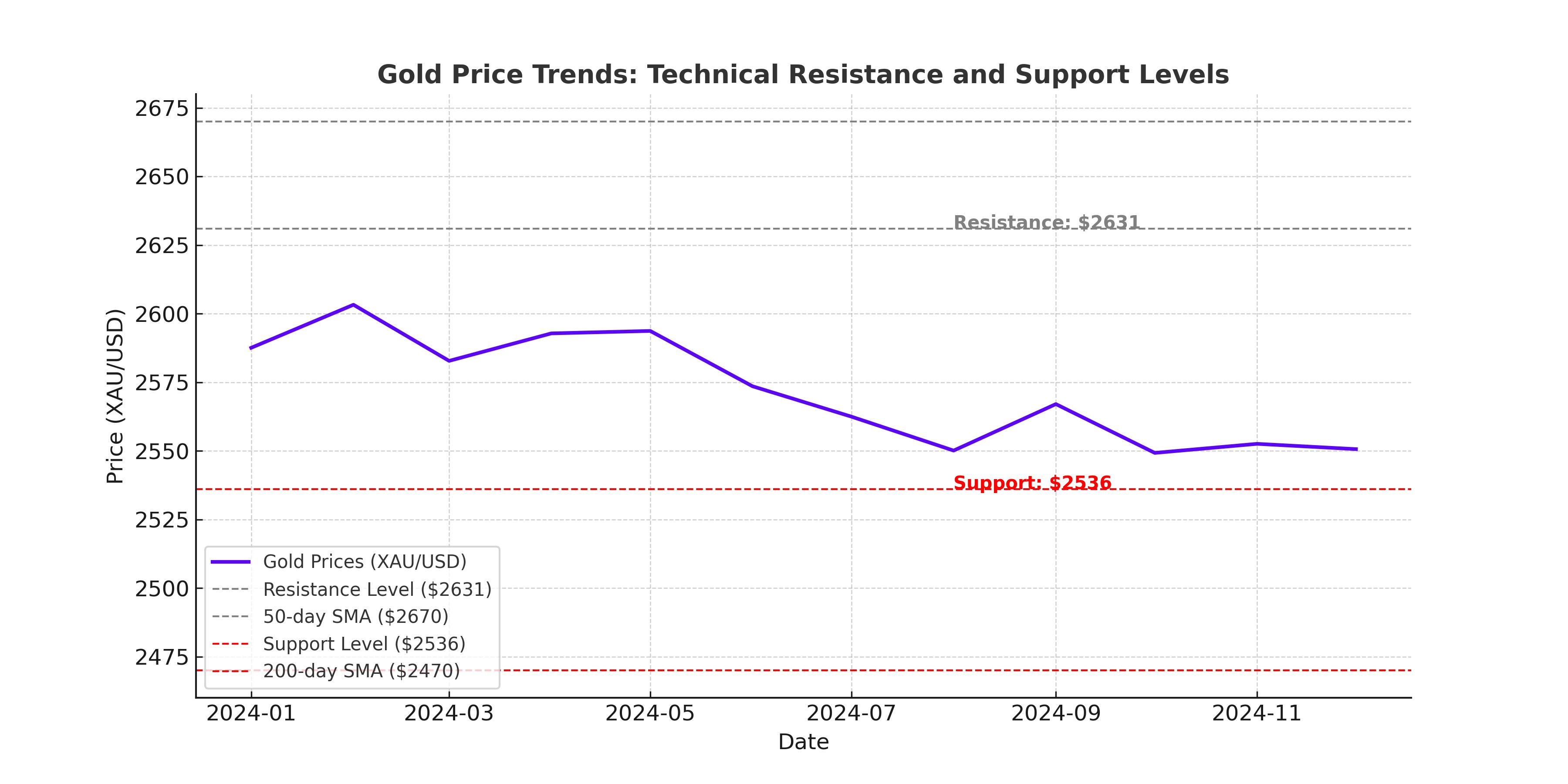

Gold prices remain under technical pressure, trading between critical support and resistance levels. Currently, XAU/USD hovers near $2,613, with immediate resistance at $2,631 and the 50-day Simple Moving Average (SMA) at $2,670. Breaking above these levels could pave the way for a retest of the $2,700 mark. However, downside risks persist, with the 100-day SMA providing support at $2,600. A breach below this level could trigger further declines toward the November swing low of $2,536 and the August peak at $2,531.

The Relative Strength Index (RSI) at 43.15 suggests limited recovery potential, while bearish momentum dominates due to the descending trendline restricting upward movements. The 50-day Exponential Moving Average (EMA) at $2,631 aligns with this bearish outlook, making it a pivotal level for short-term sentiment.

Global Geopolitical and Economic Influences on Gold

Geopolitical uncertainties, such as the risk of a US government shutdown, provide some support for gold as a safe-haven asset. However, the broader risk-on sentiment in equities, fueled by the Fed’s confidence in the US economy, has dampened demand for bullion. Internationally, the Bank of Japan maintained its interest rates at ultra-low levels, while signaling potential policy tightening in 2025. This stance could influence global liquidity conditions and further impact gold demand.

China’s economic struggles add another layer of complexity. Record capital outflows of $45.7 billion in November and a cautious growth target of 5% for 2025 reflect mounting pressures. The lack of substantial fiscal support from Chinese authorities has exacerbated global economic uncertainty, indirectly supporting gold’s role as a hedge against instability.

Market Outlook and Recommendations

The near-term outlook for gold remains bearish, with the metal likely to test support at $2,536 if current levels fail to hold. Further declines could push prices toward the 200-day moving average at $2,470. On the flip side, any positive developments, such as softer inflation data or geopolitical escalations, could provide a floor for gold and reignite safe-haven demand.

Given the mixed economic signals and technical indicators, gold’s recovery potential appears limited without a significant shift in market dynamics. The current environment suggests a hold stance for long-term investors, while short-term traders may explore selling opportunities on rallies, targeting key support levels for potential profit-taking.

That's TradingNEWS

Read More

-

Salesforce Stock Price Forecast - Why CRM Stock Around $238 Still Discounts Agentforce And 34% FCF

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds Above $2 as Luxembourg EMI and CLARITY Act Cut Regulatory Risk

14.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Oil Breaks Out Toward $62 as Brent Jumps Above $66 on Geopolitical Risk

14.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Slides to 48,977 as BAC, WFC Sink and Gold Blasts to $4,621

14.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds 1.34–1.35 Band As Fed Independence Shock Offsets Strong US Numbers

14.01.2026 · TradingNEWS ArchiveForex