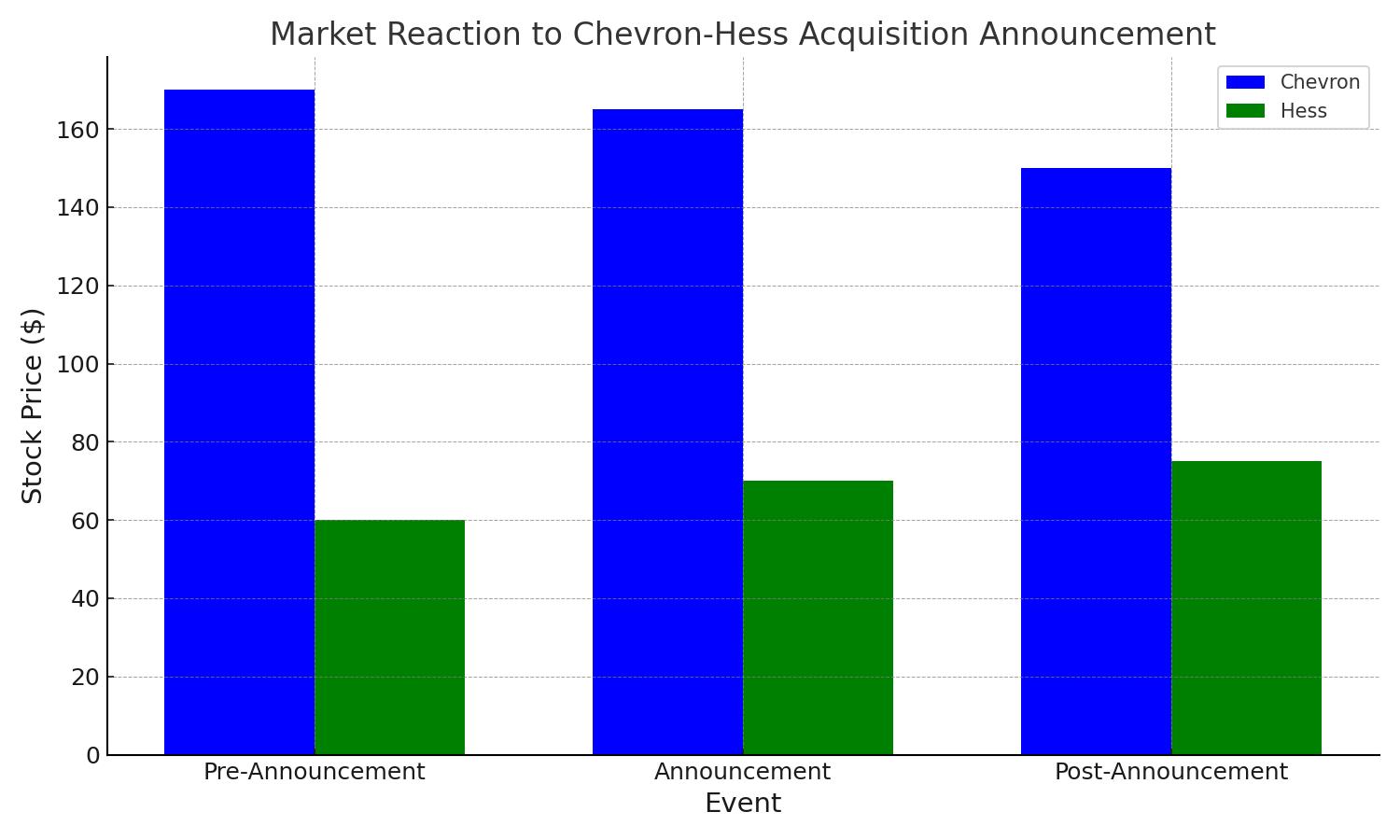

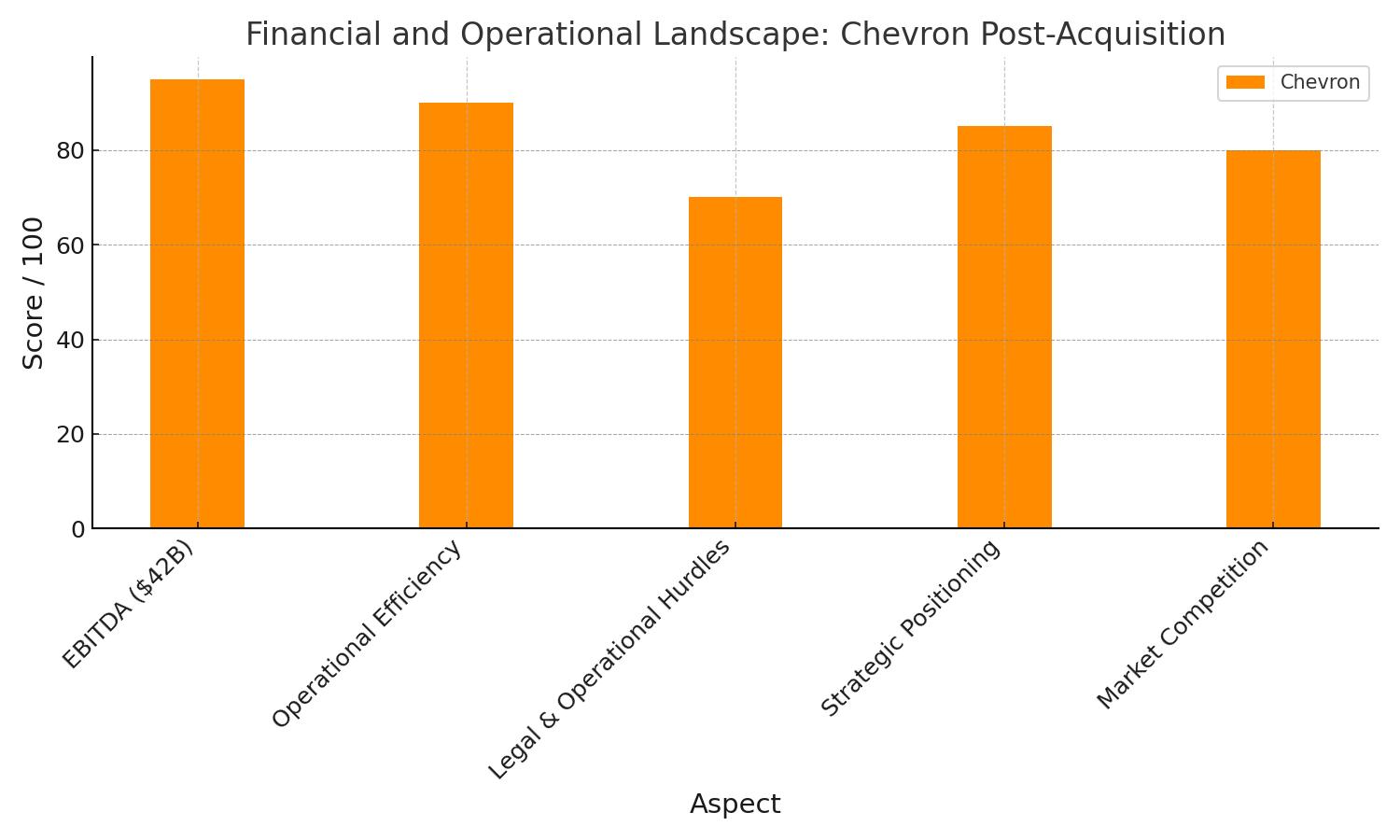

Chevron Eyes Future Growth with $53 Billion Hess Acquisition

Exploring the strategic rationale behind Chevron's ambitious move, market reactions, and the potential pathways to success amidst Exxon Mobil's arbitration challenge | That's TradingNEWS

3/29/2024 12:00:00 AM

Chevron's Strategic Move: The Hess Acquisition and Market Dynamics

Read More

-

Alphabet Google Stock Price Forecast - GOOGL Around $320 Leverages AI and Gemini Momentum Toward a $360 Target

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD at $2.21 on 25% 2026 Rally as Bulls Target $3.00

07.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI at $56 and Brent at $60 as Trump’s Venezuela Oil Grab Hits Crude Markets

07.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Holds 49,000 Record as Venezuela Oil Deal Slams Crude and Rotates Flows Into AI, Refiners and Bitcoin Plays

07.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Clings to 1.35 as Dollar Wobbles Below 99 Into ISM and NFP

07.01.2026 · TradingNEWS ArchiveForex