Citigroup (NYSE:C): Stock Resilience and Poised for Growth

Analyzing Citigroup's Robust Q2 2024 Performance and Stock NYSE:C Future Growth Prospects | That's TradingNEWS

Citigroup Inc. (NYSE:C): Resilient Performance and Future Growth Prospects

Citigroup Inc. (NYSE:C) has shown resilience and robust performance metrics, making it an attractive investment. Despite facing various market challenges, Citigroup has demonstrated its ability to navigate through tough economic conditions and deliver strong financial results. Here, we delve into the details of its recent performance, future growth prospects, and why NYSE:C remains a compelling buy.

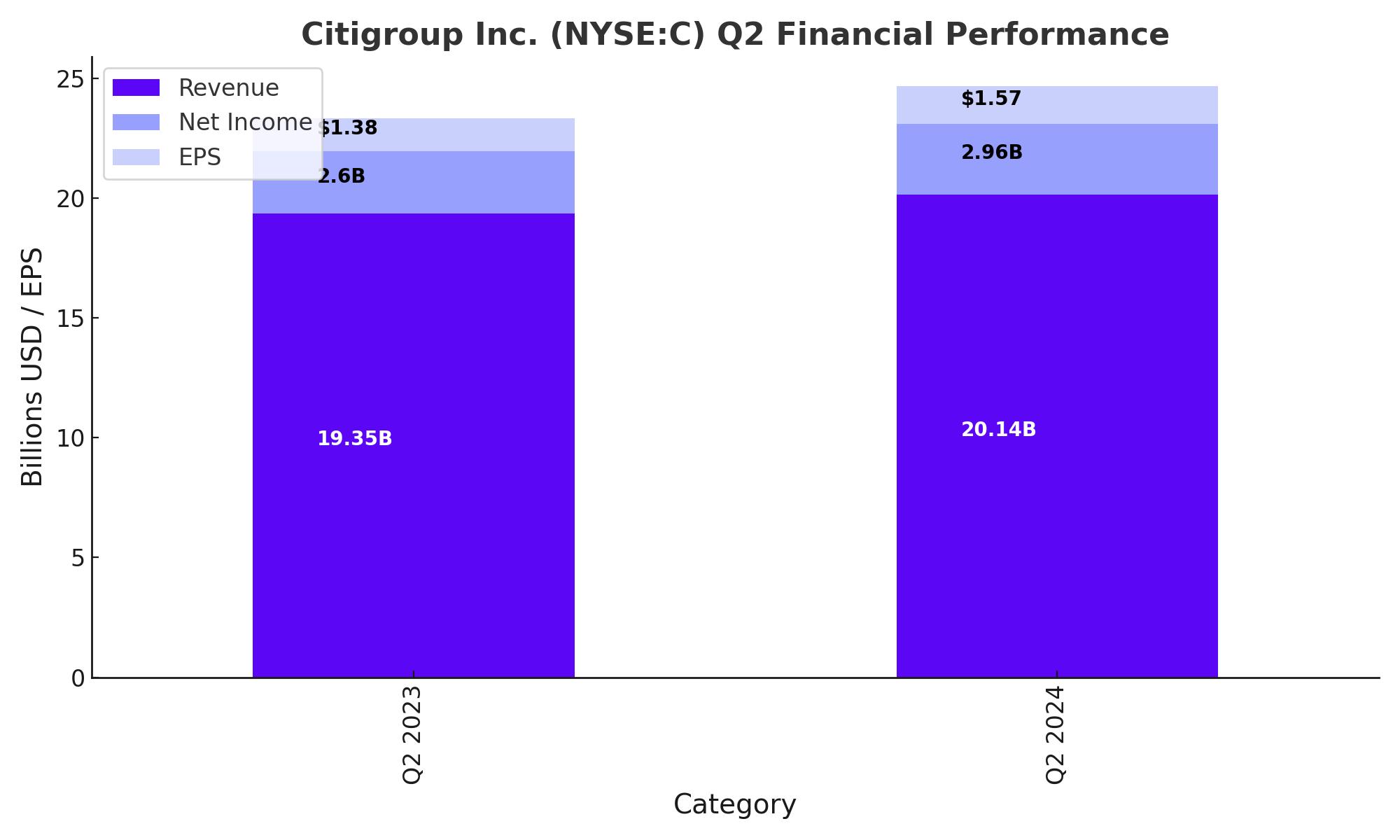

Strong Financial Performance in Q2 2024

In the second quarter of 2024, Citigroup reported revenues of $20.14 billion, up 4% year-over-year, surpassing analyst expectations by approximately $50 million. The company's net income stood at $2.96 billion, translating to an earnings per share (EPS) of $1.57, a 14% increase year-over-year. The bank's Return on Common Equity (ROCE) also improved to 7.2%, up from 6.4% in the previous year.

This strong performance was driven by growth in its Markets and Investment Banking divisions, which saw revenues increase by 6% and 38%, respectively. Investment banking fees surged by 60%, reaching $853 million, primarily due to robust activity in Debt Capital Markets and increased IPO activity.

Expense Management and Profitability

Citigroup managed to reduce its expenses by 2% year-over-year to $13.35 billion in Q2 2024, demonstrating effective cost management. The company's efforts to streamline operations and reduce overhead costs contributed to this decrease. Additionally, credit costs were reported at $2.5 billion, comprising net credit losses of $2.3 billion and an allowance for credit losses of $0.2 billion.

Despite the overall solid results, Citigroup's shares fell nearly 2% following the earnings report due to concerns about higher projected expenses for the full year 2024. The bank expects operating expenses to be around $53.5 to $53.8 billion, which is at the higher end of its previously guided range. However, management reiterated that the bank is on track to achieve its revenue targets for FY 2024, projecting revenues in the range of $78-79 billion.

Growth Prospects and Strategic Initiatives

Looking ahead, Citigroup aims for a 4-5% compound annual growth rate (CAGR) in revenues through 2026, targeting a topline of $87-92 billion. Several key factors contribute to this optimistic outlook:

- Treasury and Trade Solutions (TTS): Approximately half of the FY 2023 revenue increase in this segment was not rate-driven. Extrapolating this growth rate through 2026 could add $4 billion to the topline.

- Investment Banking: Expected to rebound from a low base, potentially increasing fees by $1-3 billion as economic activity picks up.

- Wealth Management: Citigroup is optimistic about capturing additional market share, potentially contributing an additional $2-3 billion in revenue.

- Markets/Trading Division: Further growth in this area could add $2-3 billion, helping to achieve the 4-5% CAGR revenue growth target.

Valuation and Stock Performance

Citigroup's current valuation remains attractive, with forward price-to-earnings (P/E) ratios close to the sector median. The bank is expected to generate robust EPS growth at a CAGR of 15.2% through FY 2026, compared to its historical growth rate of 2.5% between FY 2016 and FY 2023. This positions Citigroup as a relatively undervalued stock with substantial growth potential.

Based on the updated EPS estimates of $6.05 for 2024, $7.25 for 2025, and $7.4 for 2026, and considering a terminal growth rate of 2.5% post-2026, the fair implied share price for Citigroup is calculated at $92. This represents a notable upside potential from the current trading levels.

Insider Transactions and Shareholder Returns

Citigroup has shown commitment to returning value to shareholders through share buybacks and dividend increases. In Q3 2024, the bank announced $1 billion of share buybacks, retiring 17.9 million shares over the last twelve months, equivalent to a 0.9% reduction in its float. Additionally, Citigroup raised its annualized dividend to $2.24, implying a forward yield of 3.44%.

Institutional investors have also shown confidence in Citigroup's future prospects. Significant purchases by Norges Bank, Bank of New York Mellon Corp, and Fisher Asset Management LLC reflect a positive outlook on the bank's performance and growth potential.

Analyst Ratings and Market Sentiment

Several research analysts have recently upgraded their price targets for Citigroup. Keefe, Bruyette & Woods increased their target price from $66 to $69, while Piper Sandler raised theirs from $70 to $73. Oppenheimer and Jefferies Financial Group also provided optimistic ratings, highlighting the stock's potential for further growth.

Conclusion: Strong Buy for Citigroup (NYSE:C)

Considering Citigroup's strong financial performance, effective cost management, and strategic growth initiatives, the stock presents a compelling investment opportunity. With a fair implied share price of $92, substantial upside potential, and ongoing shareholder returns, Citigroup (NYSE:C) is well-positioned for future growth. Investors should consider adding Citigroup to their portfolios to capitalize on its resilient performance and promising outlook. For real-time updates and further analysis, visit TradingNews.

That's TradingNEWS

Read More

-

QDVO ETF: 11% Yield And AI Heavyweights Keep This Fund Near Its $30.40 Peak

26.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.66 and XRPR at $15.13 as XRP ETFs Build $1B+ Exposure Around $1.84 XRP-USD

26.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Near $4.34 Tests How Strong The $4.00 Winter Floor Really Is

26.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 156 Range Trapped Below 158 as BoJ 0.75% Hike Clashes with Fed Cuts

26.12.2025 · TradingNEWS ArchiveForex