Copper Price at $9,943: Fed Cut, Dollar Rebound, and 880k Tons Lost Supply Shape Market

With copper facing $10,160 triple-top resistance, 2025 disruptions equal to 3.7% of global output and IEA projecting a 30% deficit by 2035, traders eye $11,000 | That's TradingNEWS

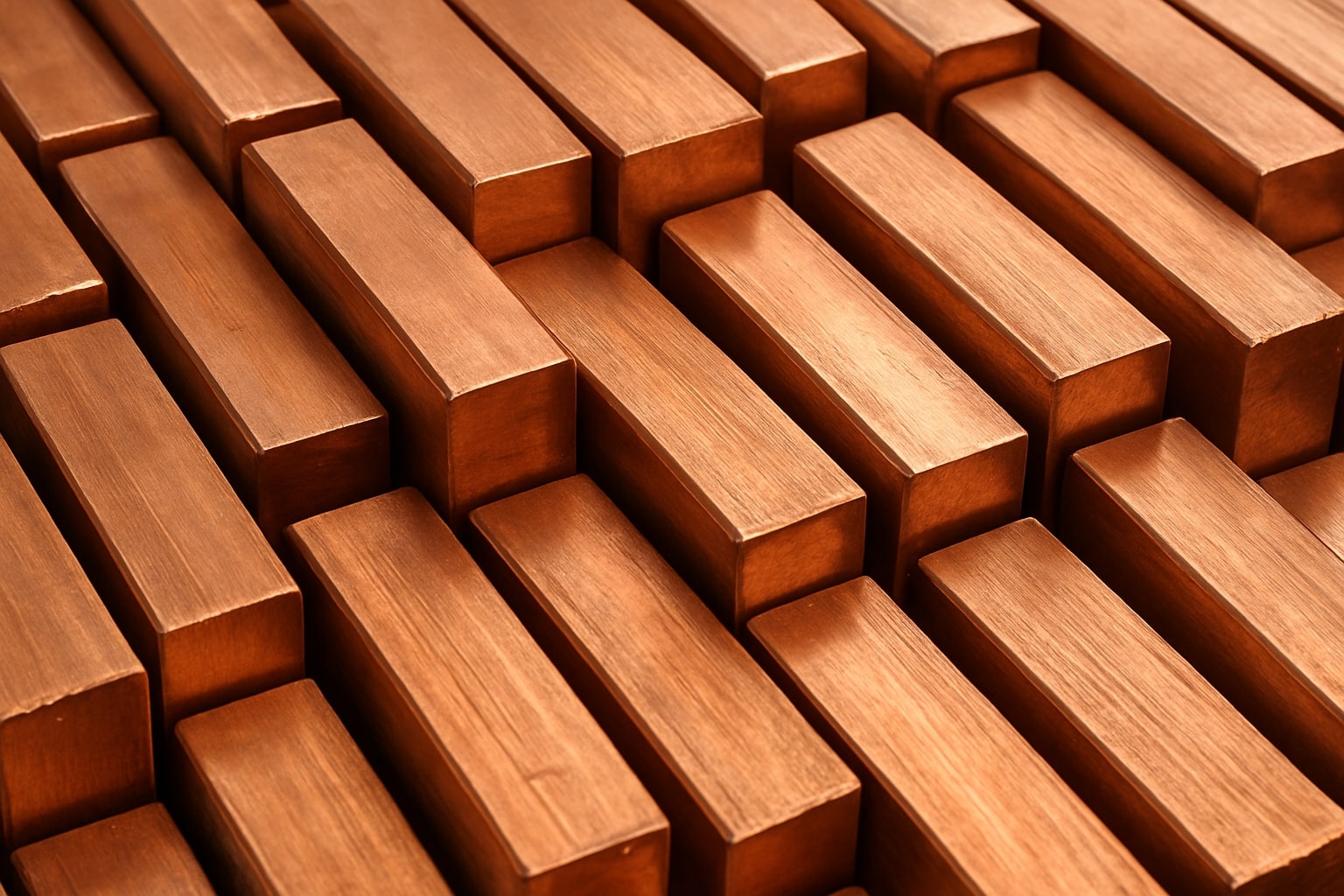

Copper Price (HG=F) Testing $10,000 Barrier

Copper is holding just under $10,000 per ton, with spot prices retreating to $9,943 after peaking at $10,200, the highest level in 15 months. Thursday’s dip to $9,917 came on the back of a stronger Dollar Index at 97.46 following the Fed’s quarter-point rate cut. While the pullback reflects short-term profit-taking, the broader setup points to an extended tug of war between oversupply and structural demand.

Supply Concentration and Disruptions Define Risk Premium

Global copper supply remains fragile. Chile and Peru account for more than 40% of global mining output, and China dominates refining, handling 40% of global copper and nearly 90% of rare earths. Political leverage is growing, with Beijing already restricting exports during trade disputes. Operationally, Wood Mackenzie estimates 880,000 tonnes of supply losses in 2025, equal to 3.7% of annual production, with Freeport’s Grasberg mine still at 30% capacity. This scarcity narrative keeps risk premiums elevated.

China’s Oversupply Adds Short-Term Pressure

Chinese refined copper production surged 15% year-on-year in August, nearing record highs. On the Shanghai Futures Exchange, copper futures slid 1.35% to ¥79,600 per ton ($11,256), breaking below the critical ¥80,000 threshold. U.S. imports normalized at 15,000 tonnes per week, sharply down from 50,000–60,000 tonnes earlier in 2024, signaling weaker near-term demand. The Yangshan premium has rolled over, showing easing tightness in the physical market.

Demand Tailwinds From Electrification and AI Expansion

Despite soft short-term indicators, demand remains anchored in secular growth. The IEA projects a 30% copper shortfall by 2035, as electrification, EVs, and renewable energy strain the supply base. Meanwhile, Big Tech firms allocate hundreds of billions annually into AI data centers and energy systems. Copper is indispensable for transmission, grid expansion, and cooling, ensuring that demand remains sticky even through cyclical downturns.

Macro Dynamics: Fed Cuts and Inflation Hedging

The Fed’s rate cut to 4.00–4.25% initially lifted copper, but Powell’s pushback against larger easing triggered a dollar rebound, pressuring metals. Long-term, copper remains 30% below its 2011 inflation-adjusted peak, while the Bloomberg Commodities Index is still 70% under 2008 highs. Compared to the S&P 500 tripling since 2007, copper looks undervalued, attracting portfolio managers searching for inflation hedges and diversification as bonds lose defensive utility.

Read More

-

PFFA ETF: 9%+ Preferred Income ETF Holding Its Ground Near $22

24.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Suffer First $40M Red Week as XRP Drops Back Toward $1.91

24.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps 70% To Five-Year High As Winter Storm Fern Slams US

24.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Crashes Below 157 as Intervention Risk and BoJ 0.75% Hit the Dollar

24.01.2026 · TradingNEWS ArchiveForex

Technical Signals Show Resistance at $10,160

Copper faces repeated rejections at $10,160, forming a triple-top resistance zone. Thursday’s close near $9,943 keeps the market above key supports at $9,500 and $9,260. If bulls regain momentum, a breakout above $10,200 could trigger upside toward $10,500–$11,000 into 2026. For now, momentum indicators reflect consolidation rather than exhaustion, leaving the medium-term outlook constructive.

Commodities Supercycle Thesis Re-Emerges

Conditions for a commodities supercycle are falling into place: supply underinvestment, geopolitical leverage, and metal-intensive decarbonization. Previous cycles—the 1970s’ energy shocks and the 2000s’ China boom—lasted for years. Unless supply-side breakthroughs or drastic policy interventions occur, copper could remain structurally tight well into the next decade.

Investment Outlook for Copper (HG=F)

At $9,943 per ton, copper is pressured by Chinese oversupply but supported by long-term scarcity and resilient electrification demand. Supply losses of nearly 4% of global output in 2025 underscore the fragility of balance sheets.

Verdict: Copper (HG=F) is a Buy on pullbacks, with short-term tests of $9,500 likely, but upside targets of $10,500–$11,000 into 2026 if structural deficits persist.