WTI and Brent Crude Oil Prices in Focus Amid Geopolitical and Market Dynamics

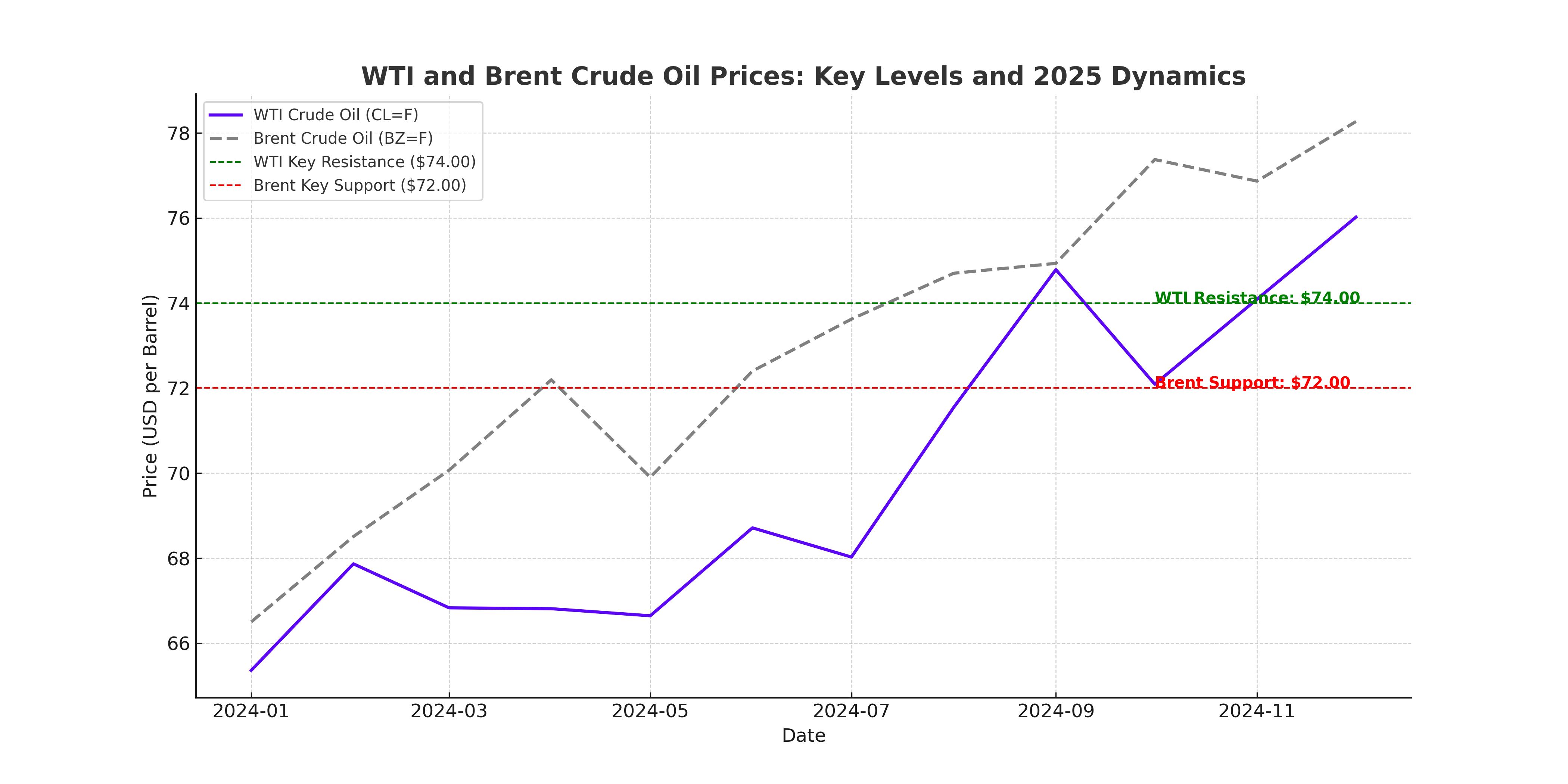

The dynamics shaping the oil markets in late 2024 and early 2025 present a mix of geopolitical uncertainty, production constraints, and demand forecasts. West Texas Intermediate (WTI, CL=F) and Brent Crude (BZ=F) have traded in volatile ranges, driven by inventory trends, OPEC+ production strategies, and broader macroeconomic factors like China’s economic resurgence and U.S. crude output records.

U.S. Crude Inventories and Refining Activity

Recent data from the Energy Information Administration (EIA) underscored a significant drawdown in U.S. crude inventories. The 4.2 million barrel reduction during the week ending December 20 exceeded forecasts, which ranged from a 1.9 million to 3.2 million barrel draw. This decrease came against a backdrop of heightened refinery utilization during the holiday season and increased gasoline demand. The corresponding impact was an uptick in WTI crude, closing at $70.60 per barrel, marking a 1.41% rise in a single trading session.

This trend is compounded by a broader tightening in the domestic supply chain. With U.S. output climbing to 13.15 million barrels per day, its highest level since October, questions arise about the sustainability of current inventory levels if demand rebounds further in early 2025. Analysts expect that further inventory decreases could push WTI toward the psychological $74.00 mark, contingent on broader market sentiment and external shocks.

China’s Economic Growth and Oil Demand Recovery

China, the world's largest crude importer, continues to dominate demand forecasts. The World Bank’s upward revision of China’s economic growth projections for 2025, alongside Beijing’s announcement of a $411 billion treasury bond issuance, signals a robust fiscal intervention aimed at rejuvenating economic activity. This optimism lifted Brent crude prices, which closed at $74.17 per barrel, driven by anticipated increased consumption in transportation and industrial sectors.

However, estimates of China’s oil demand growth have been downgraded throughout 2024. Originally forecasted at 700,000 barrels per day, it was revised to just 180,000 barrels per day by year-end. This tempered optimism may limit any sustained rallies in Brent crude unless consistent demand upticks are reported.

OPEC+ Supply Constraints and Delayed Production Hikes

The OPEC+ alliance’s recent decision to postpone its planned production increases to April 2025 has kept markets cautious. The group, currently withholding 2.2 million barrels per day from the market, aims to unwind cuts gradually through September 2026. This deliberate strategy could tighten supplies, particularly if global demand surprises on the upside.

The International Energy Agency (IEA) estimates that even under current OPEC+ policies, 2025 will see a supply surplus of approximately 950,000 barrels per day. This figure could swell to 1.4 million barrels per day if additional output is brought online post-March. For market participants, this forecast underscores a delicate balance between cautious optimism and potential oversupply risks.

Geopolitical Tensions: A Double-Edged Sword

Geopolitical factors remain a wildcard for oil prices. Heightened tensions in the Middle East and Eastern Europe, combined with President-elect Trump’s proposed sanctions on Iranian and Russian crude, could support prices by curbing supply from these regions. However, any de-escalation of conflicts or successful ceasefire negotiations, such as those reportedly progressing between Israel and Hamas, could alleviate upward pressure on oil.

Simultaneously, U.S. energy policy under Trump’s administration, including aggressive tariff threats and a potential ramp-up in domestic drilling, adds layers of complexity. A “drill, baby, drill” approach might flood the market with additional supply, weighing on prices unless accompanied by robust global demand.

EOG Resources: The Delaware Basin Advantage

EOG Resources (NYSE:EOG) continues to leverage its premium acreage in the Delaware Basin, underpinned by legacy positions acquired through strategic deals like the Yates Petroleum acquisition. EOG’s disciplined approach, emphasizing high-return projects with a 30% after-tax rate of return at $40 per barrel, positions it as a standout among shale players. Its Q3 realization of $77 per barrel significantly outperformed peers, reflecting superior asset quality and operational efficiencies.

EOG’s foray into the Utica shale represents another growth avenue, targeting underexplored gas-rich formations with high demand potential tied to the AI-driven data center boom. With low long-term debt of $3.6 billion, the company’s balance sheet supports both organic growth and shareholder returns, including a robust $3.90 annual dividend yielding 3.28%.

Occidental Petroleum: Buffett’s Big Bet

Occidental Petroleum (NYSE:OXY) has faced challenges, including a 35% stock price decline since April 2024, stemming from debt concerns related to its CrownRock acquisition. However, Warren Buffett’s aggressive accumulation of OXY shares—now controlling nearly 40% of the float—has bolstered investor confidence. With production guidance of 1.47 million barrels of oil equivalent per day in Q4, OXY’s operations in the Permian Basin and beyond remain critical to its valuation.

The company’s focus on debt reduction, aiming to lower long-term debt below $15 billion, underscores a conservative approach to capital allocation. Despite these efforts, its modest dividend yield and lack of special payouts may deter income-focused investors in the short term.

Investment Outlook: Navigating Uncertainty

WTI and Brent crude oil markets are poised at an inflection point. While tightening inventories and potential supply constraints provide bullish momentum, demand uncertainties and geopolitical risks warrant caution. EOG Resources emerges as a compelling buy, offering growth potential through diversified plays and shareholder-friendly policies. Occidental Petroleum, bolstered by Buffett’s confidence, remains attractive for long-term appreciation but may lag in delivering immediate returns.

The interplay of macroeconomic forces, from China’s recovery to OPEC+ strategies, will define the trajectory of oil prices in 2025. For investors, balancing exposure to high-quality producers like EOG with broader market trends could yield favorable outcomes amidst volatility.