Crude Oil Prices Surge Amid OPEC+ Meeting and Geopolitical Tensions

Market Dynamics and Recent Price Movements

Crude oil prices rose earlier today, driven by anticipation of the OPEC+ meeting on Sunday. Analysts widely expect the group to maintain its production cuts of approximately 2.2 million barrels per day (bpd) through the second half of the year. Brent crude surged above $84 per barrel, while West Texas Intermediate (WTI) gained over $1, topping $80 per barrel. This increase is attributed to OPEC+'s continued production control, which aims to balance the currently oversupplied market.

Impact of the Summer Driving Season

The onset of the summer driving season in the United States typically leads to a seasonal uptick in oil consumption. Initial data from Memorial Day weekend, the traditional start of the driving season, indicates a high number of holiday trips and strong air travel. This trend supports higher crude oil prices, as noted by analysts from ANZ and SS WealthStreet.

Geopolitical Factors and Production Outages

Geopolitical tensions continue to influence oil prices. Recent reports of a Houthi attack on a ship in the Red Sea and ongoing conflicts in the Middle East, including the Israel-Hamas war, have added to supply concerns. Additionally, a production outage at the Buzzard field in the UK's North Sea, which has a capacity of 80,000 bpd, further tightens supply.

OPEC+ Meeting Expectations

OPEC+ is set to review its production policy in a virtual meeting on Sunday. The group is expected to extend its voluntary production cuts. Deutsche Bank analyst Michael Hsueh noted that OPEC+ is unlikely to increase production given the current price levels of Brent crude. Tamas Varga from PVM Oil Associates also anticipates no changes in production due to the virtual nature of the meeting.

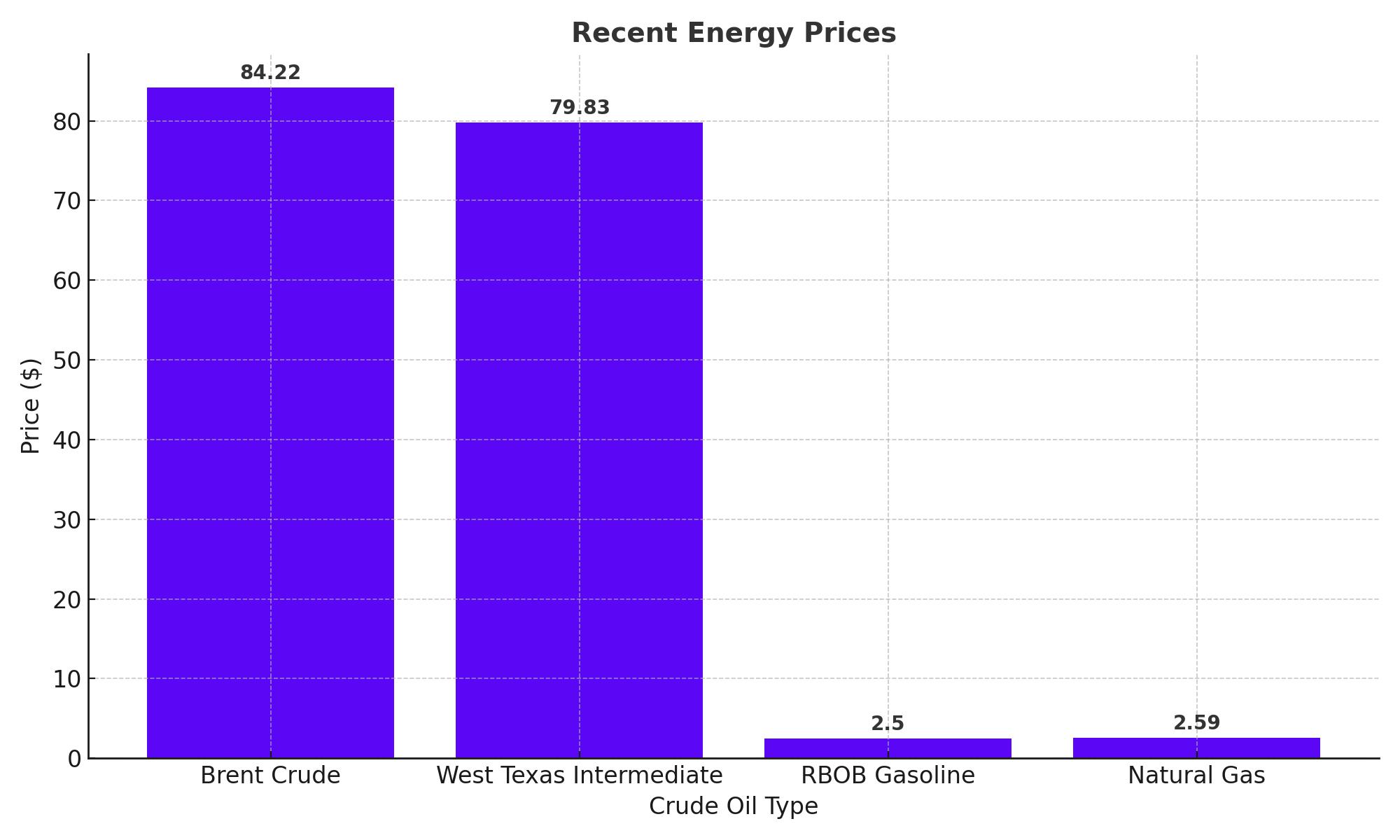

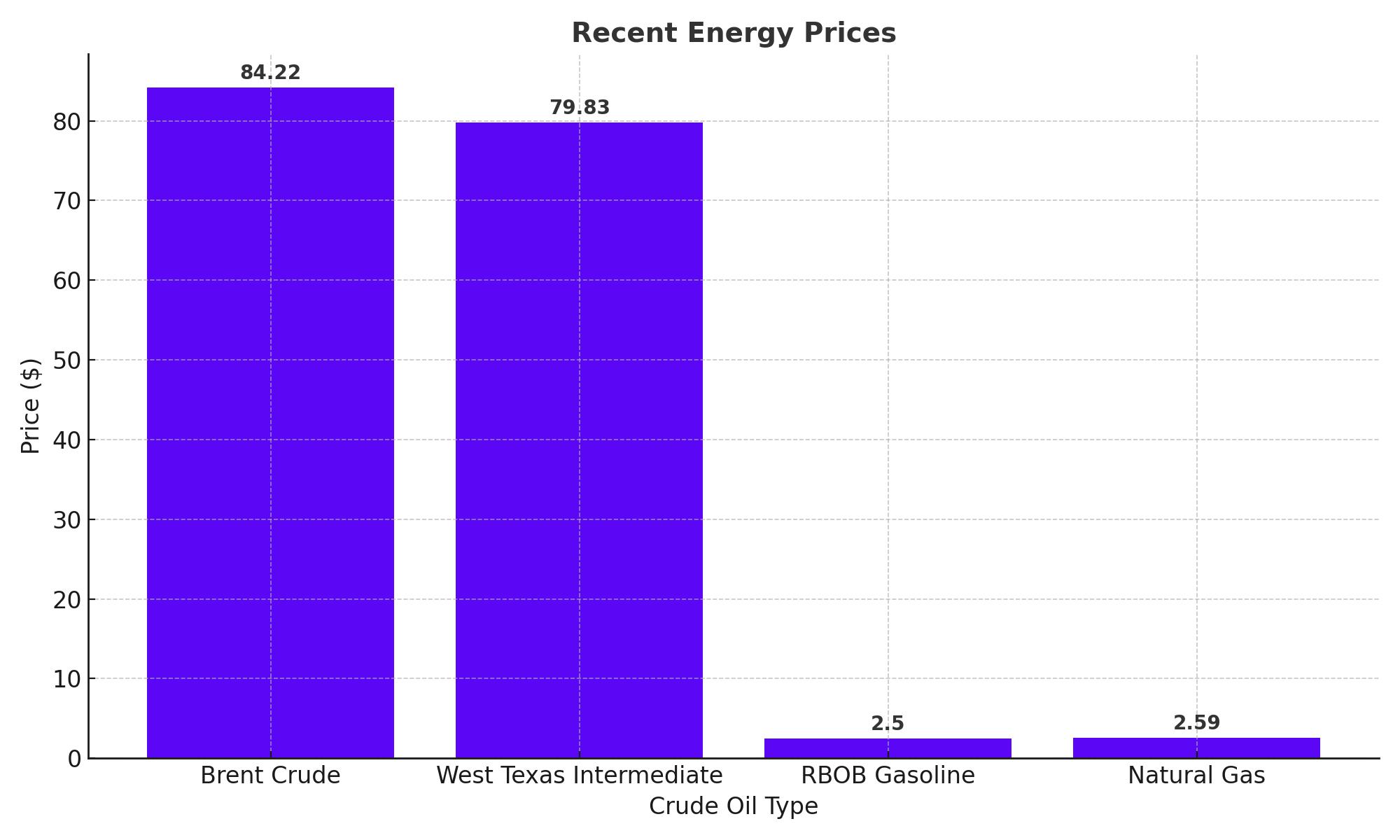

Recent Energy Prices

- West Texas Intermediate (WTI) Crude: $79.83 per barrel, up 2.71%

- Brent Crude: $84.22 per barrel, up 1.35%

- RBOB Gasoline: $2.50 per gallon, up 1%

- Natural Gas: $2.59 per thousand cubic feet, up 2.78%

Deutsche Bank and UBS Forecasts

Deutsche Bank maintains its Brent forecast at $83 per barrel for the second quarter and $88 for the second half of the year, assuming OPEC+ will sustain its current production cuts. However, pressure may build on OPEC+ to raise output after the June meeting. UBS analysts also expect OPEC+ to extend production cuts at least through the next three months.

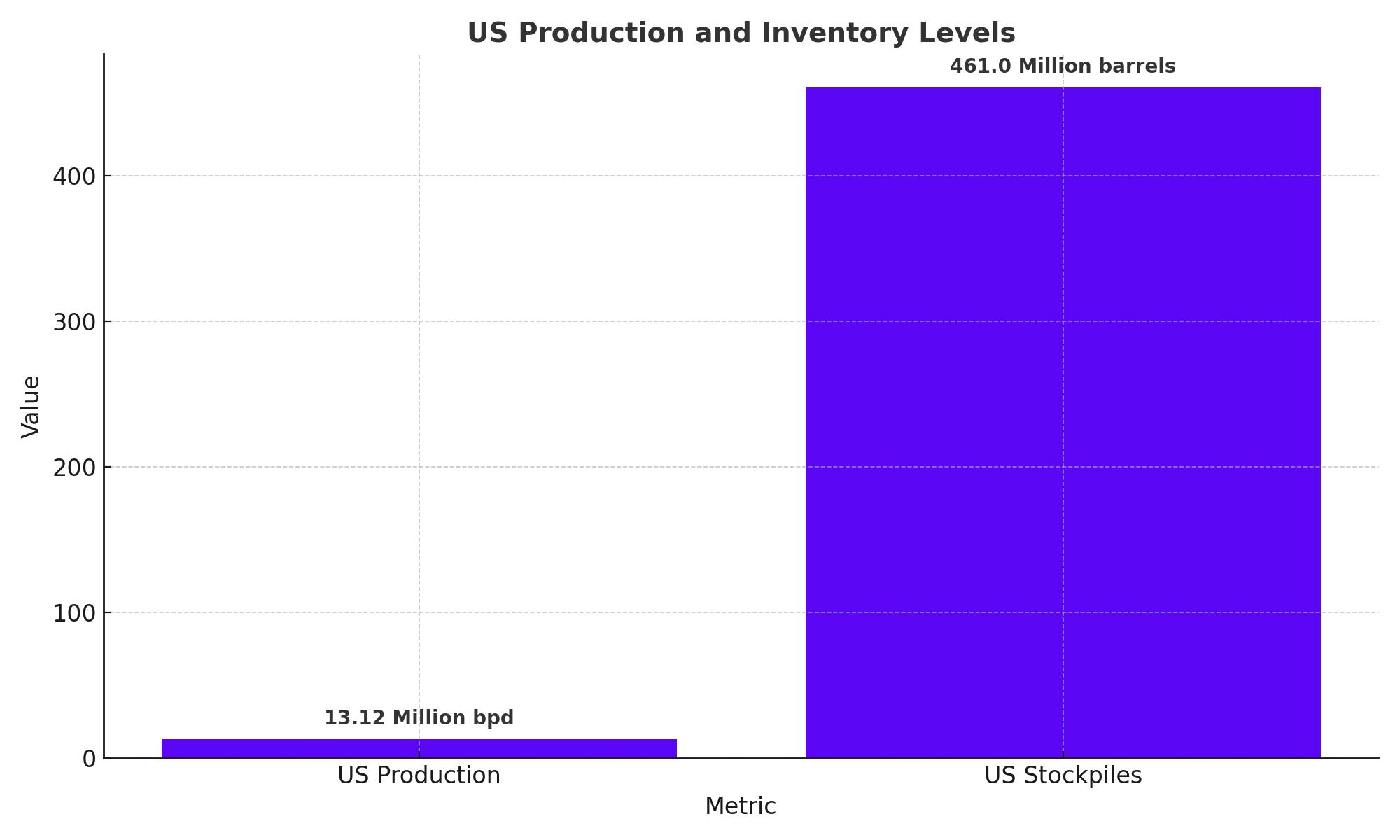

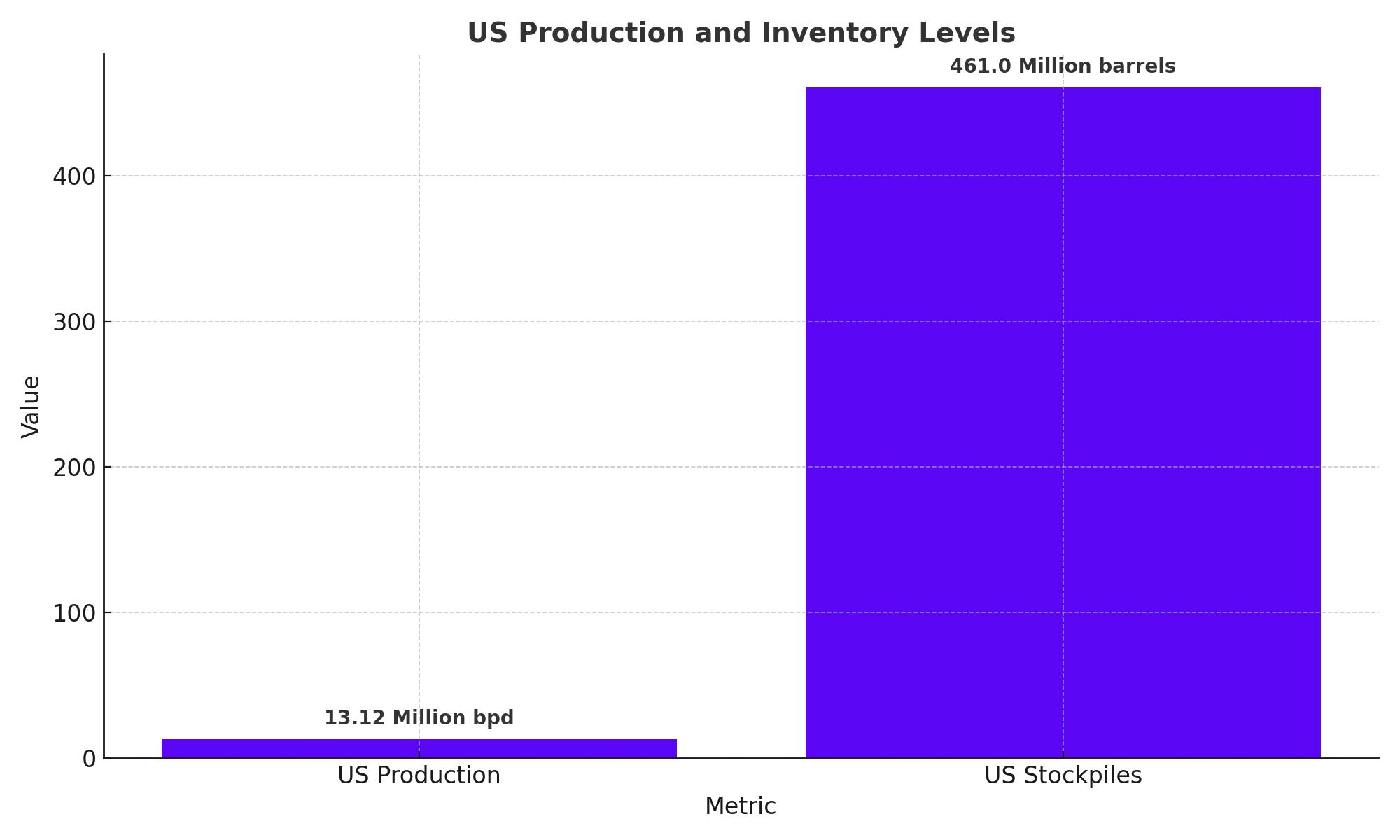

US Production and Inventory Levels

US oil production continues to reach record levels, with the Energy Information Administration (EIA) reporting a rise to 13.12 million bpd. This high production rate poses a challenge to OPEC+'s market share. US oil stockpiles stood at 461 million barrels in late April, just below the 10-year seasonal average, indicating a potential oversupply.

Global Supply and Demand Outlook

According to the International Energy Agency (IEA), global oil supply is expected to reach a new high of 103.8 million bpd in 2024, with demand growing by 1.22 million bpd to 103 million bpd. However, OPEC forecasts a more optimistic demand increase of 2.25 million bpd, driven primarily by Asia.

China's Role in Oil Demand

China remains the largest oil importer, accounting for 80% of oil consumption among non-OECD countries. However, its demand growth is expected to slow due to economic factors and a rapid transition to green energy. This shift may significantly impact global crude oil demand.

Key Takeaways

Crude oil prices are influenced by a combination of OPEC+ production strategies, geopolitical tensions, and seasonal demand patterns. The upcoming OPEC+ meeting and key economic indicators will play crucial roles in determining future price movements. Despite challenges, the market shows resilience with potential bullish trends supported by geopolitical factors and strategic production controls.