Datadog (NASDAQ: DDOG): AI Expansion Powers Revenue Growth, But Is the Stock Still a Buy?

Despite a 27% Revenue Surge and AI Breakthroughs, Datadog (NASDAQ: DDOG) Faces Valuation Challenges Amid Slower Cloud Spending | That's TradingNEWS

(NASDAQ: DDOG)– Datadog Stock Analysis: Growth, Profitability, and Market Position

Datadog (NASDAQ: DDOG) continues to be a key player in the cloud monitoring and observability market, even as its growth starts to moderate. Investors are closely watching the stock's performance, as it has recently seen a mix of bullish innovation in AI and cautious outlooks from analysts due to its high valuation and competitive landscape. This article dives into Datadog's recent performance, financial results, future prospects, and whether it remains a buy, sell, or hold.

DataDog Stock (NASDAQ :DDOG) Recent Performance and Market Overview

As of the latest market close, Datadog stock reached $111.94, reflecting a 0.48% gain compared to the previous day. This performance came amid mixed broader market movements: the S&P 500 inched up by 0.03%, while the tech-heavy Nasdaq gained 0.2%, and the Dow slipped by 0.04%. Despite these daily fluctuations, (NASDAQ:DDOG) has seen a 4.96% decline over the last month, underperforming both the broader Computer and Technology sector, which lost 1.2%, and the S&P 500’s 1.54% gain.

Q3 Earnings Preview for DataDog Stock (NASDAQ: DDOG)

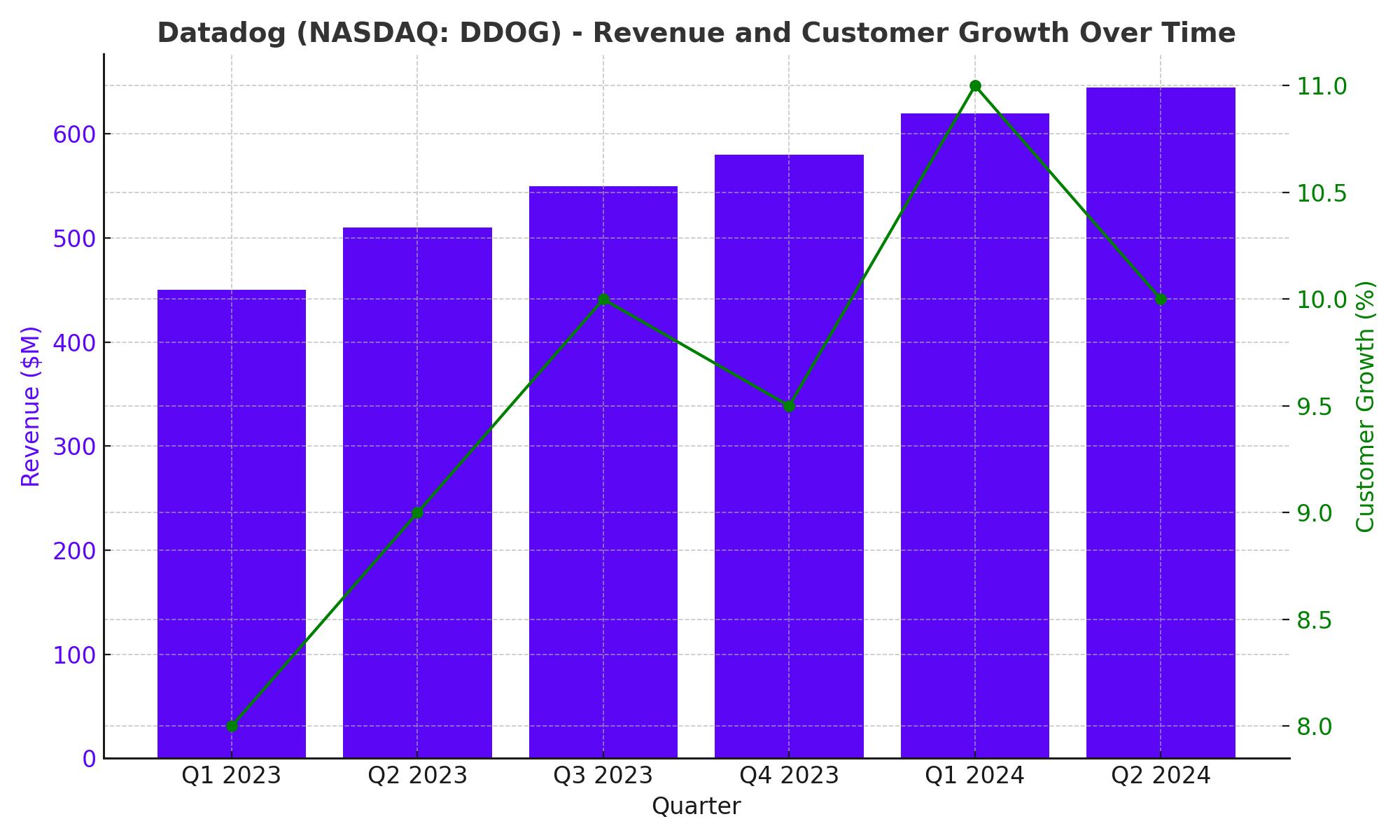

Investors eagerly await Datadog’s upcoming earnings report, where the company is expected to post an earnings per share (EPS) of $0.39, representing a 13.33% decline from the same quarter last year. However, revenue is expected to climb 21% year-over-year to $662.55 million. For the full year, the consensus estimate projects earnings of $1.63 per share and revenue of $2.63 billion, reflecting increases of 23.48% and 23.4%, respectively. These numbers show a company that’s growing, but not at the explosive rates of its earlier days.

Customer Growth and Platform Stickiness

Datadog's strength lies in its sticky platform and increasing customer adoption. At the end of Q2 2024, Datadog boasted around 28,700 customers, a 10% increase from the previous year, when it had 26,100. Even more impressive is the growth in high-value clients: Datadog had 3,390 customers with an annual recurring revenue (ARR) of $100,000 or more, up from 2,990 a year ago. These numbers suggest that Datadog’s platform continues to add value for large enterprises.

Customer product usage has also expanded. In Q2 2024, 83% of customers used two or more Datadog products, 49% used four or more, and 11% used eight or more, all of which show improvement from the previous year. This diversification of product adoption demonstrates Datadog's ability to integrate its offerings deeply into its customers' IT environments.

Product Innovation and Growth Opportunities

At Datadog’s annual DASH Conference, the company showcased its commitment to innovation with several new product offerings, particularly around artificial intelligence (AI). The LLM Observability and Bits AI products are designed to help companies accelerate AI applications and optimize data-driven processes. These tools allow developers to monitor and troubleshoot large language model (LLM) applications and help data engineers optimize workloads. Datadog’s AI integration is critical to its future, as AI-powered automation becomes increasingly essential for enterprise IT.

As the cloud continues to expand globally, Datadog is positioned well to capture more market share with these innovative tools. Additionally, the company is not shying away from potential mergers and acquisitions. While there’s no immediate deal in sight, CEO Olivier Pomel mentioned during the Q2 earnings call that Datadog remains open to M&A opportunities that would enhance its platform and expand its customer base.

Financials: A Healthy Balance Sheet and Profitability

Datadog's financial performance continues to show strength. In Q2 2024, the company reported revenue of approximately $645 million, a 27% increase compared to Q2 2023. Gross margin stood at 82.1%, slightly down from the previous quarter’s 83.3%, but higher than the 81.3% reported a year ago. Datadog also swung to profitability this year, with GAAP net income for the quarter, compared to a loss in the prior year.

Looking ahead, Datadog has raised its revenue guidance for Q3 2024 to between $660 million and $664 million and expects full-year revenue to hit between $2.62 billion and $2.63 billion, a 24% year-over-year increase.

Datadog’s balance sheet remains strong, with $410 million in cash and cash equivalents, and enough current assets to cover all liabilities. The company’s free cash flow also improved, reaching $144 million in Q2, alongside operating cash flow of $164 million.

Valuation: Still Expensive, but Justified?

One of the major talking points surrounding (NASDAQ: DDOG) is its valuation. At a forward P/E ratio of 64.05, the stock is pricey compared to the broader market and its peers in the software sector. For comparison, fellow security stock CrowdStrike (NASDAQ: CRWD) has seen a valuation come down, while Dynatrace (NYSE: DT) a direct competitor, trades at a more reasonable multiple.

That said, Datadog’s forward valuation is somewhat justified by its consistent revenue growth and high retention rates. Its substantial cash position also offers some flexibility for future investments, whether organic or through M&A.

Potential Risks: Cloud Spending and Competition

Datadog operates in a highly competitive market, with rivals such as Dynatrace and New Relic (NASDAQ: DDOG) vying for the same customers. Furthermore, the risk of cloud cost optimization remains a challenge. While larger enterprises continue to grow their cloud spending, small and medium businesses (SMBs) are showing signs of cautious IT spending.

Despite these risks, Datadog's enterprise usage growth has remained strong, according to CFO David Obstler, who noted that customer usage among larger enterprises is higher than it has been in the past, and SMB growth remains stable.

Is DataDog Stock (NASDAQ: DDOG) a Buy, Sell, or Hold?

While Datadog is not cheap, it remains a high-quality performer with solid fundamentals, a growing customer base, and significant market potential driven by AI and cloud expansion. However, its valuation leaves limited room for significant upside unless the company delivers exceptional results in the coming quarters. For investors with a long-term view, Datadog remains a strong buy due to its growth prospects, while short-term traders may find it a hold given the stock’s premium price and market volatility.

For real-time updates, investors can view Datadog’s stock movements on this chart.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex