Bearish Pressure Remains as RSI Declines

The Relative Strength Index (RSI) for the EUR/USD currently stands at 52, still in positive territory but showing a rapid decline. This sharp move downward highlights waning confidence in an immediate bullish rebound. Simultaneously, the Moving Average Convergence Divergence (MACD) histogram paints a more optimistic picture with rising green bars, signaling latent buyer interest despite the broader bearish undertone. This divergence between RSI and MACD highlights a tug-of-war between bullish and bearish sentiment, leaving traders in anticipation of a decisive move.

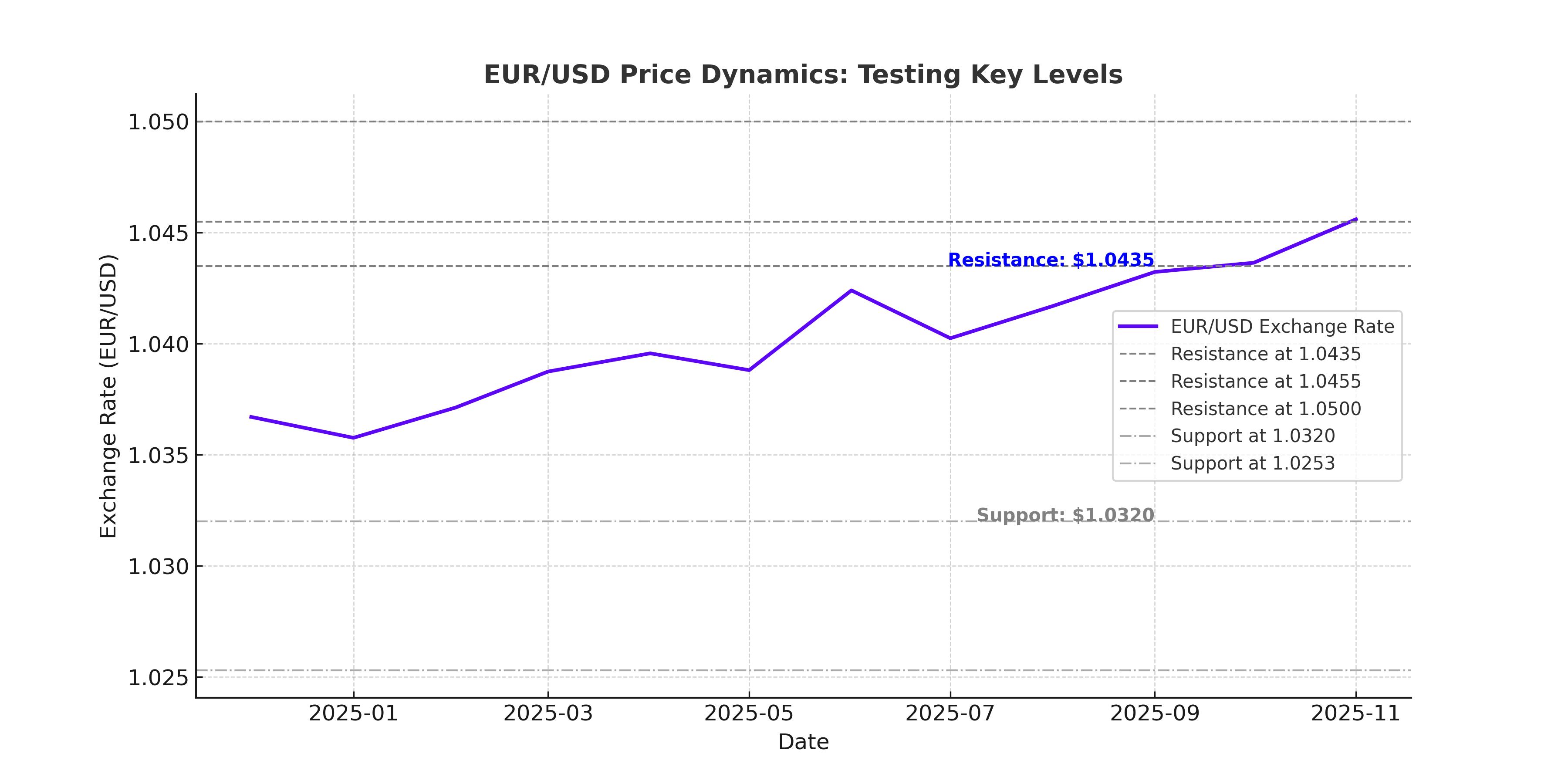

Technical Levels to Watch

The immediate focus remains on whether EUR/USD can stabilize above the key support zone at 1.0320. A sustained breach below this level would expose the pair to further declines toward the month’s low near 1.0240. On the flip side, if the pair manages to reclaim the 1.0400 level and sustain momentum, it could set its sights on the recent peak at 1.0435, a move that would reinvigorate short-term bullish sentiment. However, any move beyond 1.0450 could face stiff resistance, as indicated by past price action.

Impact of US Economic Data and Political Developments

The recent rise in the euro has coincided with a softening in the US Dollar Index (DXY), which slipped by over 1% to settle near 108.25. The decline in the dollar followed conciliatory remarks by US President Donald Trump during his inauguration speech, which temporarily eased concerns over aggressive tariff policies. Markets reacted with a risk-on sentiment, propelling equities and leading to a partial rebound in the euro. This dynamic underscores the sensitivity of EUR/USD to US political and economic developments.

US inflation data further highlighted this divergence, with headline CPI rising to 2.9% in December and core CPI advancing to 3.2%, well above the Federal Reserve’s 2% target. These figures suggest that the Fed may maintain its gradual tightening cycle, contrasting with the European Central Bank’s (ECB) anticipated dovish stance, creating a headwind for the euro.

EUR/USD’s Reaction to German Economic Weakness

On the European front, weak German economic data continues to exert downward pressure on the euro. The recent Producer Price Index (PPI) decline of 0.1%, missing forecasts of a 0.3% increase, signals slowing industrial activity in the Eurozone’s largest economy. Investors are now closely monitoring upcoming German ZEW Economic Sentiment data for further clues on the region’s economic trajectory. With no major economic releases from the Eurozone or US today, political developments, particularly around global trade policies and monetary strategies, are likely to dominate market sentiment.

Bullish Channel Offers Glimmer of Hope

Despite the bearish narrative, the EUR/USD’s technical structure offers a silver lining. The pair has recently traded within a bullish channel, with clear support and resistance trendlines visible on the 4-hour chart. After bouncing off support near 1.0350, the pair has made several attempts to retest the 1.0450 resistance. If bulls successfully defend the 1.0325 support and breach the 1.0455 resistance, the pair could target a longer-term pivot at 1.0500, reinforcing bullish momentum.

Sentiment Indicators Signal Caution

Market sentiment indicators, including the RSI and the stochastic oscillator, suggest mixed signals. While the RSI’s decline dampens optimism, stochastic negativity reflects the likelihood of short-term pullbacks before any sustained rally can materialize. The 200-day EMA at 1.0402 serves as a key resistance level that needs to be overcome for bullish momentum to gain traction, while the 50-day EMA at 1.0315 offers short-term support.

Market Outlook: Consolidation or Breakout?

The current positioning of EUR/USD reflects a period of consolidation, with a high likelihood of a breakout in either direction depending on upcoming macroeconomic triggers. The broader trend remains dictated by central bank policies, with the ECB’s dovish stance contrasting with the Fed’s hawkish tone. If global risk sentiment continues to improve, EUR/USD could benefit, but downside risks persist if US economic data continues to outshine Eurozone figures.

Key Trading Levels to Monitor

- Support: 1.0320, 1.0253

- Resistance: 1.0435, 1.0455, 1.0500

Traders should watch for developments in US trade policies, German economic sentiment, and broader Eurozone data to assess the pair’s next significant move. While EUR/USD remains at a critical juncture, a combination of technical and fundamental factors suggests that volatility will persist, providing both challenges and opportunities for market participants. Whether bulls or bears take control will depend on the interplay between economic data and geopolitical developments in the days ahead.

That's TradingNEWS