EUR/USD Breaks 1.0400 – Will the Rally Continue or Crash?

With EUR/USD surging past 1.0400, traders are asking—can the euro maintain this momentum, or is another sharp drop looming? | That's TradingNEWS

EUR/USD Price Outlook – Is the Euro Ready for a Major Breakout or Another Collapse?

EUR/USD Gains Momentum as US Dollar Weakens – But Is the Trend Sustainable?

The EUR/USD currency pair has been making notable moves in recent sessions, gaining traction as the US dollar struggles under pressure from softening economic data and increasing concerns over trade policy. The pair recently pushed above 1.0400, a critical psychological level, driven by the weakening greenback and signs that market sentiment is shifting. However, is this rally sustainable, or is it just a temporary bounce before another major downturn?

US Economic Weakness is Driving EUR/USD Higher

The recent decline in the US dollar comes as traders digest a slew of disappointing economic data. The JOLTS job openings report missed expectations, showing a decline to 7.6 million, compared to a forecast of 8.01 million. Additionally, factory orders fell by 0.9%, worse than the expected 0.7% decline, raising concerns about a potential slowdown in the US economy.

Meanwhile, the ADP private payroll report indicated that the US added 183,000 jobs in January, surpassing expectations of 150,000, but this wasn’t enough to lift the dollar. The market remains focused on the upcoming Non-Farm Payrolls (NFP) report, which could provide further clues on the Federal Reserve's next move.

The ISM Services PMI was another key release, coming in at 54, indicating steady expansion, but the focus remains on the prices paid subindex, which soared to 64 in December, reigniting concerns over sticky inflation. If the data shows another surge in prices, it could fuel speculation that the Federal Reserve may hold interest rates higher for longer, which would be bullish for the dollar and bearish for EUR/USD.

Euro’s Strength: Is It Just a Reaction to Dollar Weakness?

While the euro has rebounded against the dollar, it is important to note that the European economy remains fragile. The Eurozone Services PMI dipped from 51.6 in December to 51.3 in January, signaling a slight slowdown in economic activity. However, inflation in the region remains a concern, with the Eurozone Harmonized Index of Consumer Prices (HICP) rising to 2.5%, slightly above expectations.

The European Central Bank (ECB) recently cut interest rates by 25 basis points, bringing the deposit facility rate down to 2.75%. Despite the cut, ECB officials, including Vice President Luis de Guindos, have hinted that inflation remains under control, and further rate cuts could be in play in the coming months.

However, the biggest risk for the euro is the potential escalation of trade tensions with the United States. President Donald Trump has suggested that the European Union could be the next target for tariffs, a move that could negatively impact the eurozone economy. If trade tensions escalate, it could weigh on the EUR/USD pair and limit further upside potential.

EUR/USD Technical Analysis – Key Levels to Watch

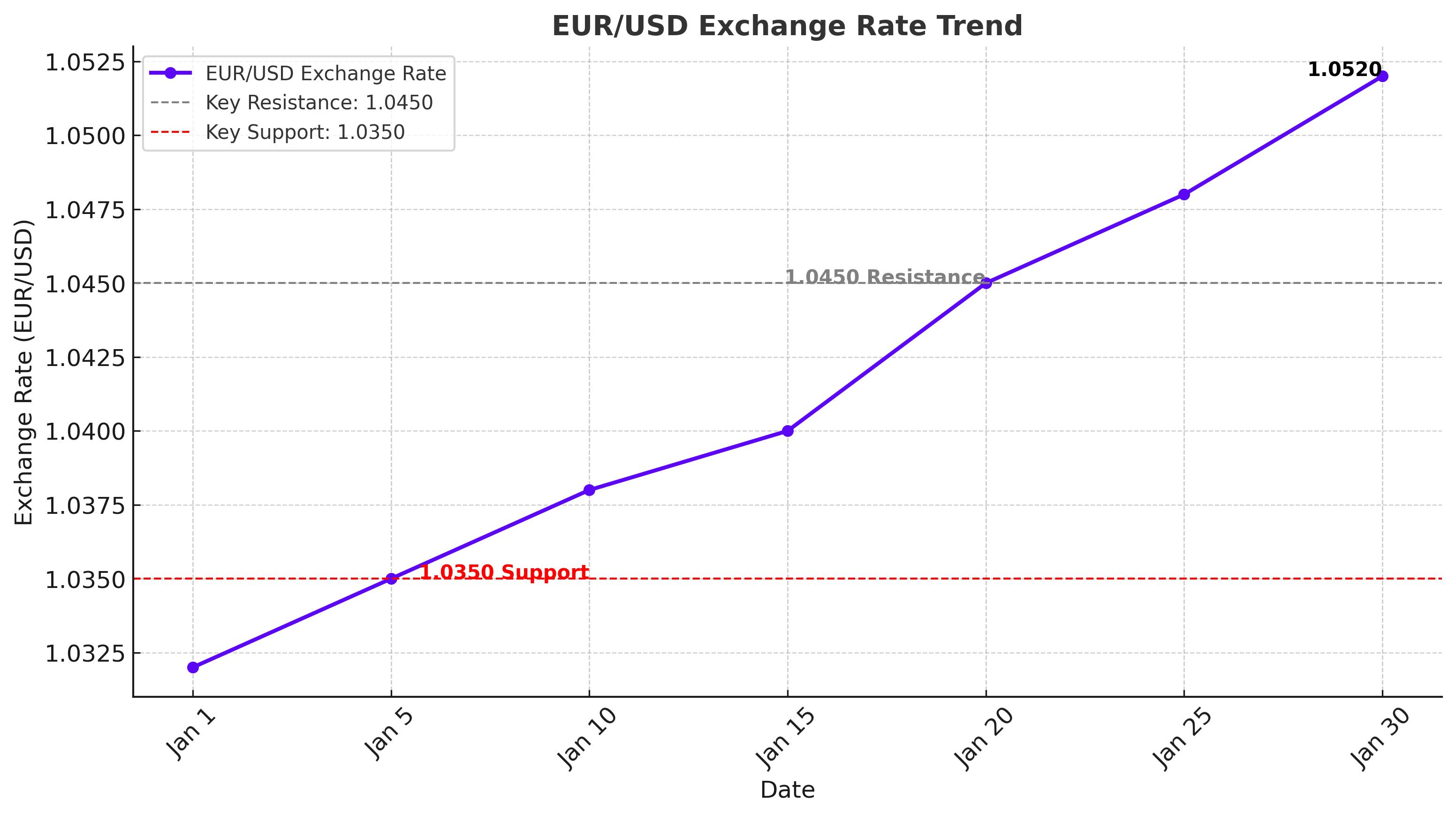

EUR/USD has established a strong short-term uptrend, pushing above the 20-day Simple Moving Average (SMA) at 1.0365, signaling that bullish momentum is building. The next key resistance levels to watch are 1.0450 and 1.0485, and a breakout above these levels could trigger a move toward 1.0520.

The Relative Strength Index (RSI) is currently at 53, indicating moderate bullish momentum, while the MACD histogram is printing rising green bars, suggesting that upward momentum is building. However, bulls must maintain price action above 1.0365 to sustain the current trend.

On the downside, immediate support lies at 1.0350, followed by 1.0320. A break below these levels could signal a return to 1.0225, a critical support zone that has held up multiple times in the past.

Geopolitical Risks and Trade Tensions Could Shift the EUR/USD Outlook

Apart from economic data, geopolitical risks remain a key factor for EUR/USD. US-China trade tensions are escalating, with China retaliating against US tariffs by imposing new duties on American liquefied natural gas (LNG), crude oil, and agricultural goods. This move has increased uncertainty in the markets and could have a ripple effect on currency pairs like EUR/USD.

Additionally, the situation in the Middle East remains volatile, with reports that the US may take further military action in the region. If tensions escalate, it could trigger a risk-off move, boosting demand for the US dollar and putting downward pressure on the euro.

Federal Reserve’s Next Move is Critical for EUR/USD Direction

The most important factor for EUR/USD in the coming weeks will be the Federal Reserve’s monetary policy outlook. Markets are currently pricing in at least two rate cuts from the Fed this year, but stronger-than-expected inflation data could force the central bank to hold rates steady for longer.

If the NFP report on Friday comes in stronger than expected, it could push back rate cut expectations and trigger a dollar rally, sending EUR/USD lower. On the other hand, a weaker-than-expected jobs report could reinforce expectations for Fed rate cuts, supporting further gains in EUR/USD.

Final Outlook – Is EUR/USD a Buy or Sell?

EUR/USD remains bullish in the short term, but geopolitical risks, trade tensions, and economic data will dictate its next move. The euro has benefited from dollar weakness, but the ECB’s dovish stance and potential US-EU trade tensions could limit upside potential.

If EUR/USD breaks above 1.0450, it could open the door for a move toward 1.0520, making it a short-term buy. However, if the US dollar regains strength on strong economic data, EUR/USD could fall back below 1.0350, triggering a bearish trend.

Overall, EUR/USD is a buy in the short term above 1.0365, with a target of 1.0450–1.0520. However, caution is warranted due to trade risks and upcoming US economic releases. Traders should watch for any new developments regarding Federal Reserve policy, geopolitical tensions, and potential US-EU tariffs that could shift sentiment in either direction.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex