EUR/USD Eyes $1.0500 as Inflation Data Sparks Market Tension

With EUR/USD trading near $1.0514, traders anticipate CPI data and ECB decisions. Will the pair break below key support or rebound toward $1.0610 resistance? | That's TradingNEWS

EUR/USD Stays Under Pressure Amid CPI Data and ECB Speculations

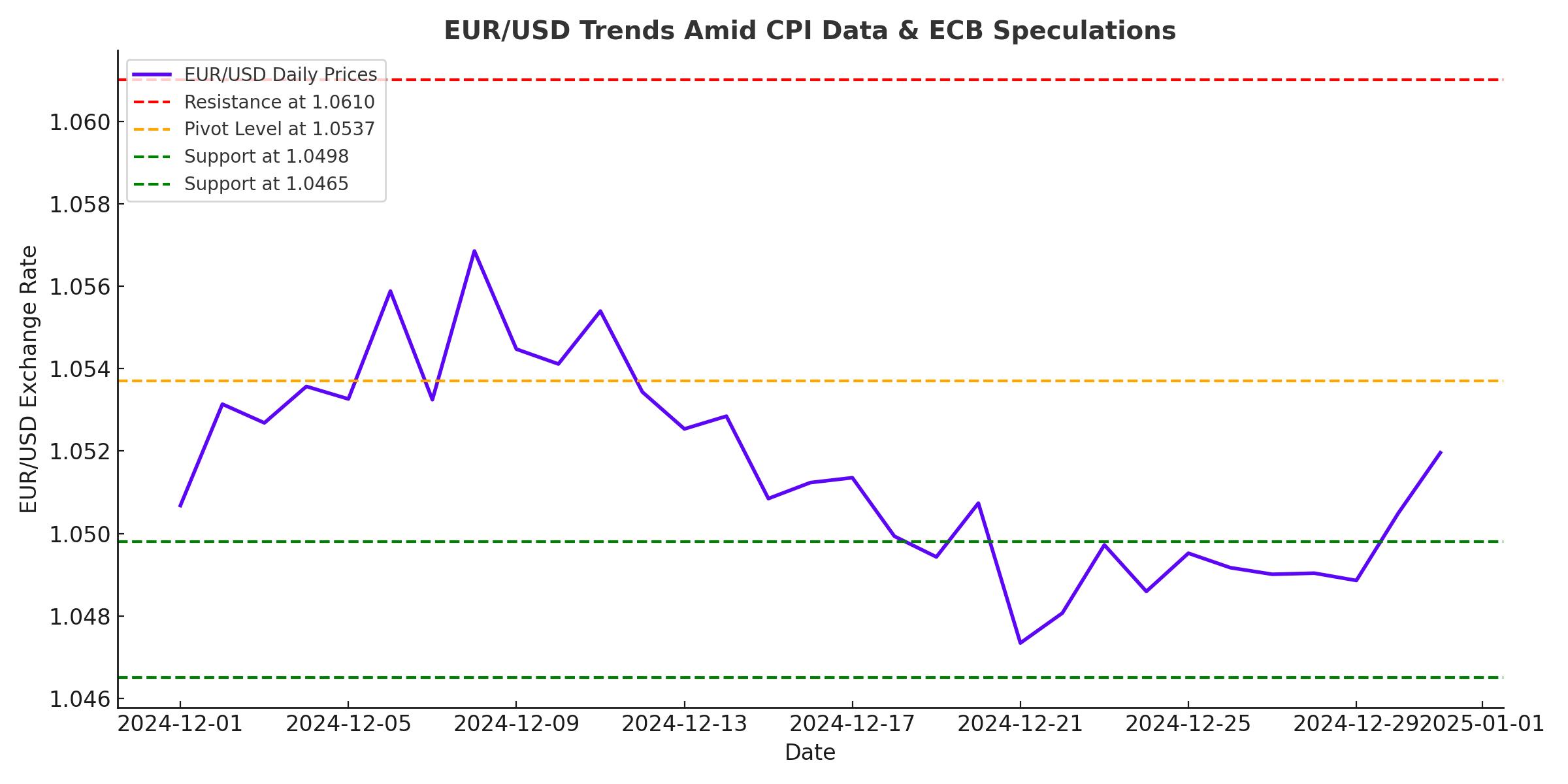

The EUR/USD pair, one of the most closely watched forex benchmarks, continues to trade within a constrained range, reflecting market hesitation ahead of crucial U.S. CPI data and the ECB's upcoming monetary policy decisions. Currently trading around $1.0514, the pair has been fluctuating between $1.0500 and $1.0610, as technical and fundamental factors combine to create a complex trading environment.

U.S. CPI Expectations Weigh on EUR/USD

The imminent release of U.S. Consumer Price Index (CPI) data has amplified caution in the forex markets. Economists expect the headline CPI to rise by 0.3% month-over-month and 2.7% year-over-year, while core CPI is forecasted to remain steady at 3.3% YoY. These figures are critical as they could solidify expectations for a 25-basis-point Federal Reserve rate cut in December, already priced in at an 85% probability by futures markets.

The U.S. Dollar Index (DXY), currently trading around $106.45, reflects these dynamics. A stronger-than-expected CPI print could bolster the greenback, exerting further downward pressure on EUR/USD. Conversely, any signs of inflation easing could provide a lifeline for the euro, particularly if accompanied by dovish signals from the Fed.

Eurozone Economic Weakness Adds to EUR/USD Bearish Bias

On the Eurozone side, weak economic data continues to undermine the euro. German Final CPI data revealed a 0.2% monthly contraction, and Italy's industrial production stagnated with a flat 0.0% reading. Meanwhile, traders are bracing for tomorrow's Italian unemployment data, projected at 6.6%, and the ECB's monetary policy update, which could outline further rate cuts. The ECB's refinancing rate is expected to be held at 3.15%, but forward guidance could shape the euro's trajectory.

Technical Outlook for EUR/USD

The EUR/USD pair remains below its key pivot level at $1.0537, suggesting a bearish undertone. Immediate resistance lies at $1.0567, while further upside could target $1.0595. However, persistent selling pressure at higher levels indicates that bulls face an uphill battle. Support at $1.0498 and $1.0465 could become critical if bearish momentum intensifies.

A breach of the $1.0465 level would likely accelerate declines, potentially opening the path toward the $1.0400 handle. On the upside, a sustained move above $1.0610 is necessary to shift market sentiment, but this scenario appears less likely given the prevailing headwinds.

Short-Term Trading Strategies for EUR/USD

For traders eyeing short positions, the $1.0610 resistance provides an attractive entry point, particularly if accompanied by bearish price action signals like engulfing candles or dojis. Stops should be set above the local swing high, with initial profit targets at 20 pips below the entry and extended targets near the $1.0500 support.

On the long side, bullish price action around $1.0499 or $1.0425 could justify entries, especially if accompanied by clear upward momentum. However, the overall bias remains bearish, and longs should be approached with caution.

Impact of U.S. Dollar Strength on EUR/USD

The greenback’s resilience has been a key driver of EUR/USD's recent struggles. Strong U.S. labor data and robust small business sentiment, as reflected in the NFIB Small Business Index's 101.7 reading, support dollar strength. Treasury yields, particularly the 10-year benchmark at 4.24%, further reinforce this narrative, making the euro less appealing.

Institutional Insights and Broader Market Dynamics

Institutional investors continue to weigh in on the pair, with mixed positions reflecting broader uncertainty. Recent geopolitical developments, including rising tensions in Eastern Europe and the Middle East, have also spurred safe-haven flows into the U.S. dollar. These dynamics, coupled with reduced speculative interest in the euro, suggest limited upside potential for EUR/USD in the near term.

Final Thoughts on EUR/USD Prospects

As of now, the EUR/USD remains vulnerable to further declines, with $1.0465 acting as the next critical support level. The pair’s inability to break above $1.0610 underscores the bearish sentiment, while upcoming U.S. CPI data and ECB guidance could provide the next major catalyst. Traders should remain vigilant, as heightened volatility is likely to dominate the pair’s movements in the coming sessions. The bias remains bearish unless key resistance levels are convincingly breached.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex