EUR/USD Struggles for Momentum – Can the Euro Regain Strength Against the Dollar?

EUR/USD at a Crossroads – Will the Euro Hold Above Key Support?

The EUR/USD currency pair has been locked in a battle for direction as it hovers near 1.0435, with traders eyeing critical resistance levels while economic data and geopolitical developments dictate sentiment. The euro’s recent attempt to rally was short-lived, as inflation concerns and shifting Federal Reserve expectations boosted demand for the U.S. dollar, forcing the currency pair into a consolidation phase. With economic divergence between the Eurozone and the U.S. widening, the question remains: Is EUR/USD set for a deeper pullback, or can it reclaim higher levels?

Despite a brief push higher to 1.0440, EUR/USD has struggled to maintain momentum, with investors digesting recent U.S. inflation data that came in hotter than expected. The January CPI report showed a 0.5% increase, surpassing the 0.3% forecast, while annual inflation climbed to 3.0%, slightly higher than the 2.9% estimate. This has led to diminished expectations for Federal Reserve rate cuts, reinforcing dollar strength. The euro initially gained after Trump’s announcement of potential peace negotiations in Ukraine, but the rally quickly lost steam as uncertainty over Europe’s role in post-war rebuilding costs weighed on sentiment.

U.S. Inflation Data and Federal Reserve Policy – How It’s Impacting EUR/USD

The Federal Reserve remains at the center of the EUR/USD outlook, as traders continue to adjust their rate cut expectations. With the stronger-than-expected inflation report, the probability of a Fed rate cut in mid-2025 has declined, leading to a surge in Treasury yields. The 10-year U.S. Treasury yield climbed back above 4.55%, further supporting the dollar and making it more challenging for the euro to stage a meaningful recovery.

Fed Chair Jerome Powell reinforced the central bank’s cautious approach, stating that while progress has been made in lowering inflation, monetary policy will remain tight until there is sustained evidence of inflation cooling. This has made rate-sensitive assets like the euro more vulnerable, as the European Central Bank (ECB) has signaled earlier rate cuts than the Fed, increasing the divergence between the two economies.

For EUR/USD, rate differentials have historically been a major driver, and with the Fed maintaining a higher-for-longer stance, the euro is likely to remain under pressure in the near term. The DXY (U.S. Dollar Index) remains elevated at 107.50, reinforcing the headwinds for EUR/USD.

Eurozone Economic Struggles – Can the ECB Provide Support?

The Eurozone economy continues to face headwinds, further weighing on the euro. Recent data showed that Euro Area Industrial Production declined by 1.1% in December, worse than the expected -0.6%, signaling continued weakness in the manufacturing sector. The ECB has acknowledged these struggles, with President Christine Lagarde hinting at potential rate cuts if economic conditions deteriorate further.

With the Eurozone GDP growth expected to stagnate around 0.5% for 2025, compared to the U.S.’s projected 2.0% growth, the disparity between the two economies is becoming more evident. If the ECB moves toward rate cuts sooner than anticipated, EUR/USD could see further downside pressure, potentially testing the 1.0200–1.0300 range in the coming months.

At the same time, elevated energy prices and continued fiscal challenges in key economies like Germany and France could further weigh on the euro. Germany’s factory orders fell by 2.8% last month, raising concerns about the health of the region’s largest economy. The ECB’s upcoming policy decisions will be crucial for EUR/USD’s direction, and any sign of a dovish pivot could drive the pair lower.

Geopolitical Risks – How Trump and Ukraine Peace Talks Affect EUR/USD

Geopolitical developments have been a key factor in recent EUR/USD movements, particularly following Donald Trump’s announcement that negotiations to end the Russia-Ukraine war could begin "immediately." While this initially sent the euro higher, the optimism faded as concerns emerged over Europe’s role in post-war reconstruction and the lack of involvement from EU leaders in negotiations.

A potential end to the war could reduce demand for the U.S. dollar as a safe-haven asset, leading to short-term support for the euro. However, if uncertainty surrounding NATO’s cohesion and the EU’s financial burden for rebuilding Ukraine grows, the euro’s gains could be short-lived.

The broader political landscape in Europe, particularly the upcoming European Parliament elections, could also add volatility to EUR/USD, as investors assess potential shifts in fiscal and monetary policies.

Technical Outlook – Can EUR/USD Hold Above 1.0400?

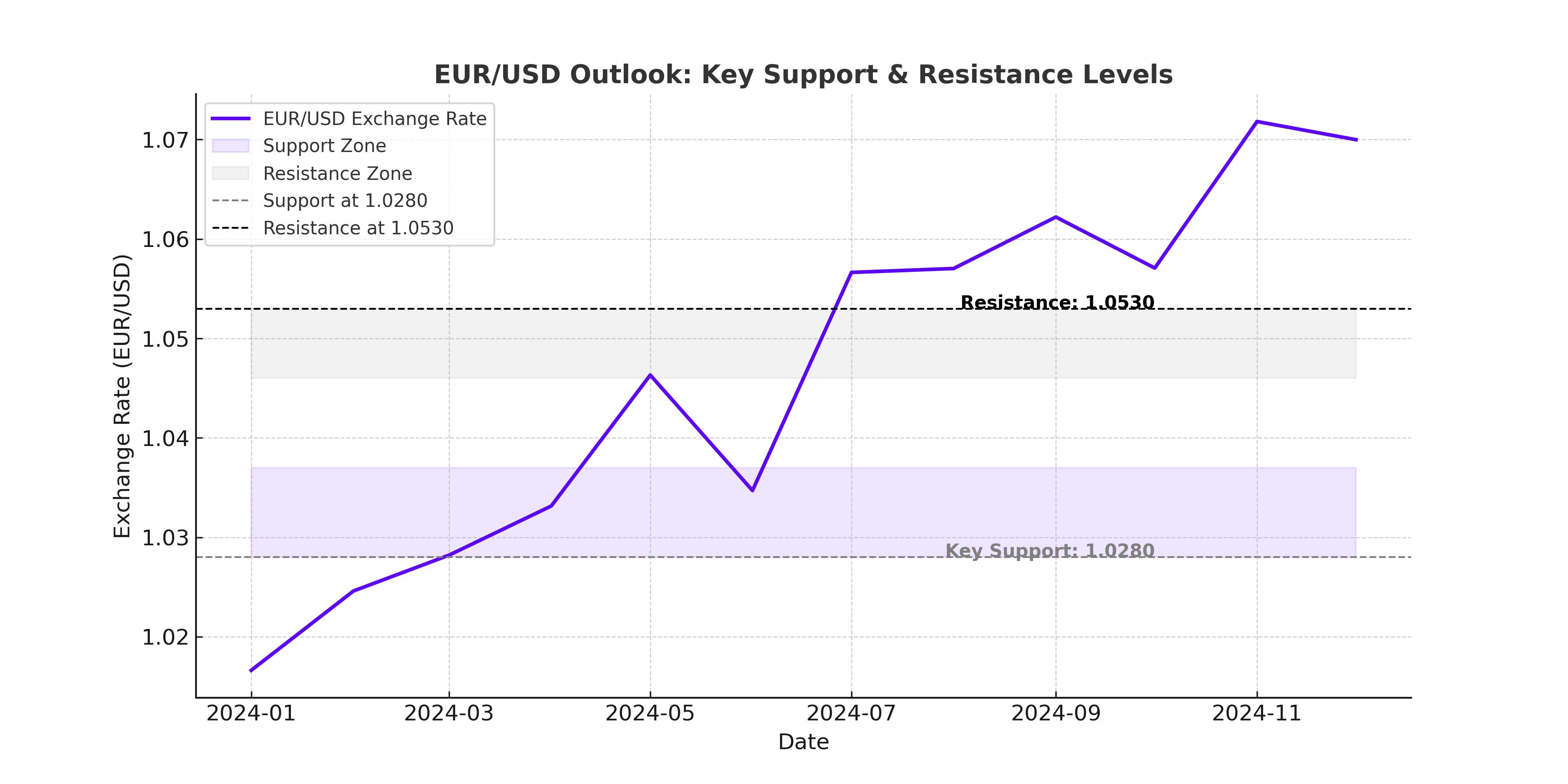

EUR/USD is currently trading around 1.0435, testing key resistance levels between 1.0460 and 1.0530. A decisive break above 1.0530 would confirm a medium-term bullish reversal, but the pair has so far struggled to clear this zone.

Key resistance levels:

- 1.0460 – 1.0530 → A breakout could lead to 1.0600 and beyond

- 1.0700 → A longer-term upside target if bullish momentum accelerates

Key support levels:

- 1.0370 → Minor support level

- 1.0280 → Major support zone, below which EUR/USD could weaken significantly

- 1.0200 – 1.0175 → Critical downside area if bearish pressure intensifies

The 50-day Exponential Moving Average (EMA) at 1.0450 is acting as a dynamic resistance level, while the 200-day EMA near 1.0360 provides some support. The Relative Strength Index (RSI) remains neutral, suggesting that EUR/USD could consolidate further before a decisive breakout in either direction.

If the pair fails to hold above 1.0400, a move toward 1.0280 becomes increasingly likely, reinforcing the case for a bearish continuation. On the other hand, a clear breakout above 1.0530 could shift momentum toward 1.0700 in the coming weeks.

Is EUR/USD a Buy, Sell, or Hold?

Given the current macroeconomic landscape, EUR/USD remains under pressure, with downside risks outweighing bullish catalysts. The stronger U.S. inflation data, resilient economic growth, and higher Treasury yields all suggest that the dollar will maintain its advantage over the euro in the short term.

For traders, EUR/USD remains a sell on rallies, particularly near 1.0500–1.0530, unless the pair decisively clears this resistance zone. If economic data from the Eurozone continues to disappoint and the ECB signals dovish policy changes, the 1.0200 target could come into play sooner than expected.

However, if geopolitical risks escalate, particularly regarding Ukraine or U.S.-China trade tensions, a flight to safety could weaken the dollar and give EUR/USD some upside momentum. A more dovish shift from the Fed would also support a move higher in the euro, though this remains unlikely in the near term.

For now, the trend remains bearish, with EUR/USD likely to test lower support levels before any significant recovery. Traders should watch upcoming U.S. economic data, particularly retail sales and PPI figures, as well as ECB policy decisions, which will be key in determining the next major move in EUR/USD.

If 1.0530 is breached, a short-term bullish case emerges, but as long as the euro remains below this level, the path of least resistance is downward, making further losses likely.