EUR/USD PRICE ANALYSIS: PRESSURE MOUNTS AS THE EURO STRUGGLES AGAINST THE DOLLAR

Where is EUR/USD Headed as Economic Pressures Build?

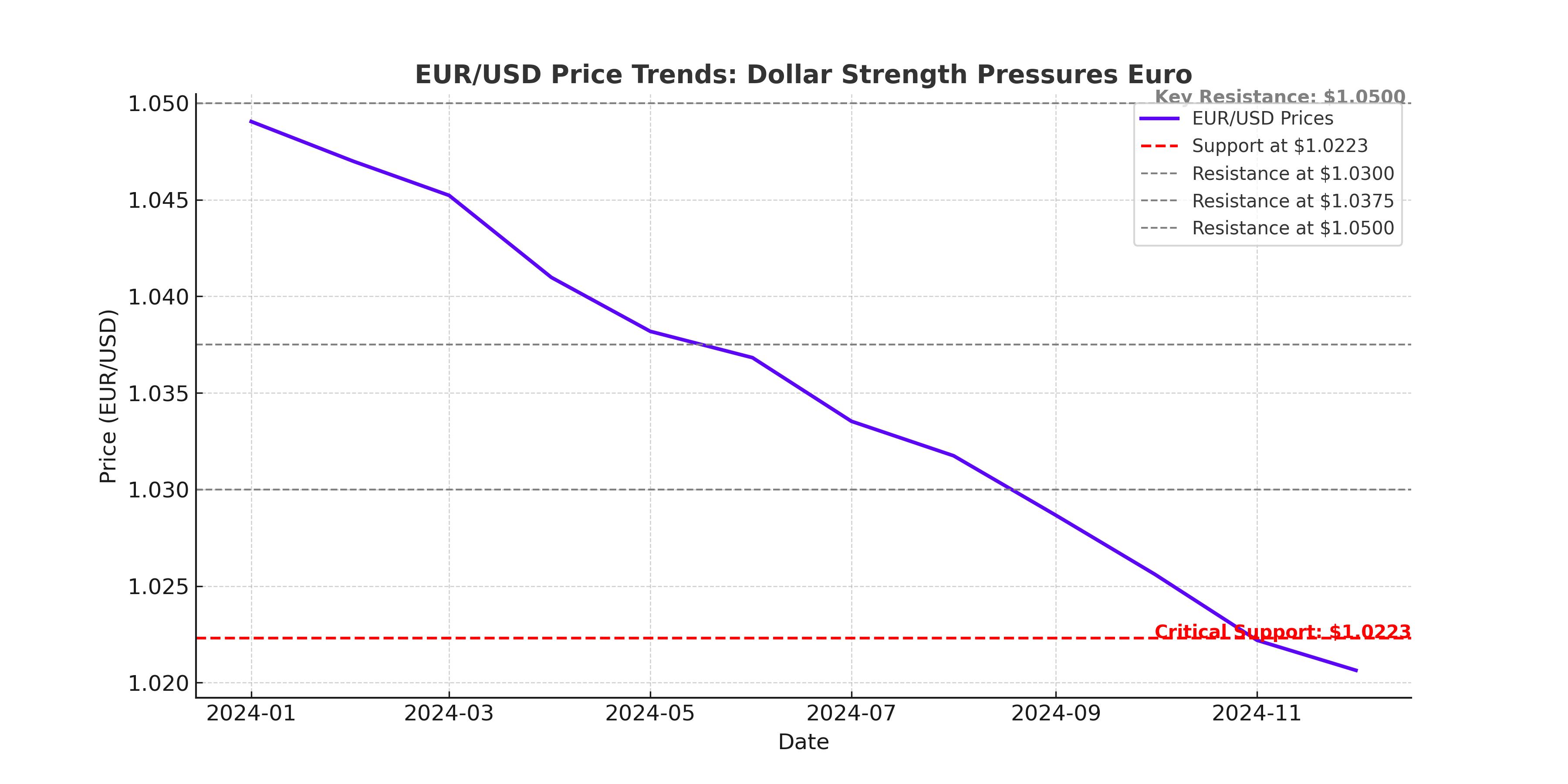

The EUR/USD pair is once again under intense scrutiny as market forces push the euro lower, testing multi-year lows near 1.0320. The pair has been caught in a web of economic pressures, trade war fears, and central bank policies that continue to shape its trajectory. With investors anxiously watching tariff developments from Washington, the latest inflation numbers from Europe, and the Federal Reserve’s next steps, EUR/USD is walking a tightrope.

EURO UNDER PRESSURE AS TRUMP’S TRADE WAR ESCALATES

The latest blow to the euro comes from Donald Trump’s tariff threats, which have sent a shockwave through the markets. While initial concerns revolved around China, Mexico, and Canada, the European Union is now firmly in Trump’s crosshairs. Trump has openly criticized the EU for unfair trade practices, stating, “They don’t take our cars, they don’t take our farm products. They take almost nothing, and we take everything from them.” With over $300 billion in trade imbalances between the U.S. and the EU, Trump’s rhetoric is setting the stage for a potential tariff war.

The EUR/USD pair has already felt the sting, with a sharp decline bringing it dangerously close to the 1.0200 handle. Investors are bracing for more volatility, as the euro’s dependency on exports means that tariffs would hit European manufacturers hard, weakening the region’s economic outlook.

EUROZONE INFLATION AND ECB RATE DECISION: A DANGEROUS MIX

Adding to the euro’s struggles, Eurozone inflation ticked up to 2.5% in January, up from 2.4% in December, primarily driven by rising energy costs. Core inflation, which excludes volatile items like food and energy, held steady at 2.7%, but the service sector showed signs of a slowdown.

Despite rising inflation, the European Central Bank (ECB) is preparing for further rate cuts in the coming months. Christine Lagarde and ECB policymakers are expected to slash interest rates to 2.5% in April, with projections suggesting they could hit 2% by June. The ECB’s easing stance contrasts sharply with the Federal Reserve, which remains committed to a higher-for-longer interest rate strategy.

This divergence between the ECB and the Fed is fueling further downward pressure on EUR/USD, as the higher-yielding U.S. dollar continues to attract capital flows away from the euro.

U.S. ECONOMIC STRENGTH: A NIGHTMARE FOR THE EURO

The U.S. economy continues to deliver strong data, keeping the dollar firmly in the driver’s seat. The ISM Manufacturing PMI rose to 50.9, surpassing expectations of 49.3, signaling that the American manufacturing sector remains resilient. The U.S. labor market also remains solid, with JOLTS job openings expected to come in above 8 million, further reinforcing confidence in the U.S. economy.

For EUR/USD, this means continued downside pressure. With the Federal Reserve unlikely to cut rates before mid-2025, the yield differential between U.S. Treasuries and European bonds remains wide, making the dollar an attractive option for investors looking for higher returns.

TECHNICAL ANALYSIS: IS EUR/USD HEADED BELOW 1.0200?

From a technical perspective, EUR/USD is clinging to support at 1.0320, but the trend remains firmly bearish.

-

Key support levels to watch:

- 1.0220 – a break below this level could accelerate the downside move toward parity.

- 1.0160 – another major support that could come into play if selling pressure intensifies.

- 1.0090 – the last line of defense before EUR/USD potentially tests 1.0000 (parity).

-

Key resistance levels to watch:

- 1.0455 – if EUR/USD manages to rebound, this is the first significant hurdle.

- 1.0510 – breaking above this could ease bearish sentiment in the short term.

The Relative Strength Index (RSI) is hovering near 40, suggesting that the pair is not yet in oversold territory, meaning there is still room for further downside. The 50-day moving average remains firmly above at 1.0470, reinforcing the bearish outlook.

MARKET SENTIMENT AND THE PATH FORWARD

Sentiment around the EUR/USD pair remains negative, with the U.S. dollar continuing to dominate global markets. The combination of Fed hawkishness, strong U.S. data, and Trump’s aggressive trade policies is keeping pressure on the euro.

The only scenario where EUR/USD might find relief would be a significant dovish shift from the Federal Reserve, but that remains unlikely in the near term. If the European Central Bank signals an even more aggressive rate cut path, expect EUR/USD to plunge toward parity sooner rather than later.

IS EUR/USD A BUY, SELL, OR HOLD?

With all factors considered, EUR/USD remains a strong sell in the near term. The fundamentals and technicals both point to further downside risks, and traders should be prepared for more volatility as the U.S. ramps up its trade war threats against the European Union.

- If Trump follows through with his tariffs, expect EUR/USD to break below 1.0200 and head toward parity.

- If the ECB accelerates rate cuts, this will only add to the euro’s weakness.

- Any unexpected dovish pivot from the Federal Reserve could offer a short-term bounce, but the overall trend remains bearish.

For now, the best strategy is to remain short on EUR/USD, with 1.0200 and below as the next key downside targets. Traders should watch closely for any new announcements on tariffs, as they could be the next major catalyst for further euro weakness.