EUR/USD Outlook: Navigating Diverging Monetary Policies and Market Dynamics

EUR/USD Under Pressure Near 1.0500

The EUR/USD currency pair has been struggling to maintain momentum, hovering near the critical 1.0500 level. Recent price action has been characterized by a series of lower highs and lows, reflecting the persistent strength of the US dollar amid diverging policy trajectories between the Federal Reserve (Fed) and the European Central Bank (ECB). As of now, EUR/USD trades at approximately 1.0498, following a modest recovery from a weekly low of 1.0452. However, the pair remains vulnerable to further downside, given the broader macroeconomic landscape.

Federal Reserve Policy and US Dollar Strength

The Federal Reserve is widely expected to implement another 25 basis point rate cut during its final meeting of 2024, bringing rates closer to a neutral stance as inflation moderates. However, recent economic data, including a stronger-than-expected Producer Price Index (PPI) reading, suggests that inflationary pressures may not dissipate as quickly as anticipated. This has led to speculation about a "hawkish cut," where the Fed could signal a pause in its easing cycle for early 2025.

Fed Chair Jerome Powell’s comments at the post-meeting press conference will be crucial for market sentiment. If Powell emphasizes the resilience of the US labor market and ongoing inflation risks, the dollar could find additional support. This would likely exert further downward pressure on EUR/USD, especially as the Fed’s updated Summary of Economic Projections (SEP) could highlight a more gradual path for rate reductions next year.

European Central Bank’s Dovish Tone Weighs on the Euro

In contrast, the ECB has leaned increasingly dovish, signaling the potential for multiple rate cuts through mid-2025. Bundesbank President Joachim Nagel recently indicated that the ECB could start unwinding its record rate hikes as early as June, provided inflation continues its downward trajectory. The ECB’s dovish stance reflects the Eurozone's ongoing economic challenges, including weak manufacturing activity and political fragmentation within key member states like Germany and France.

The eurozone's sluggish growth outlook is further exacerbated by external risks such as potential trade tariffs from the US under the Trump administration. These factors create a challenging environment for the euro, as widening yield spreads between the Eurozone and the US make the single currency less attractive to investors.

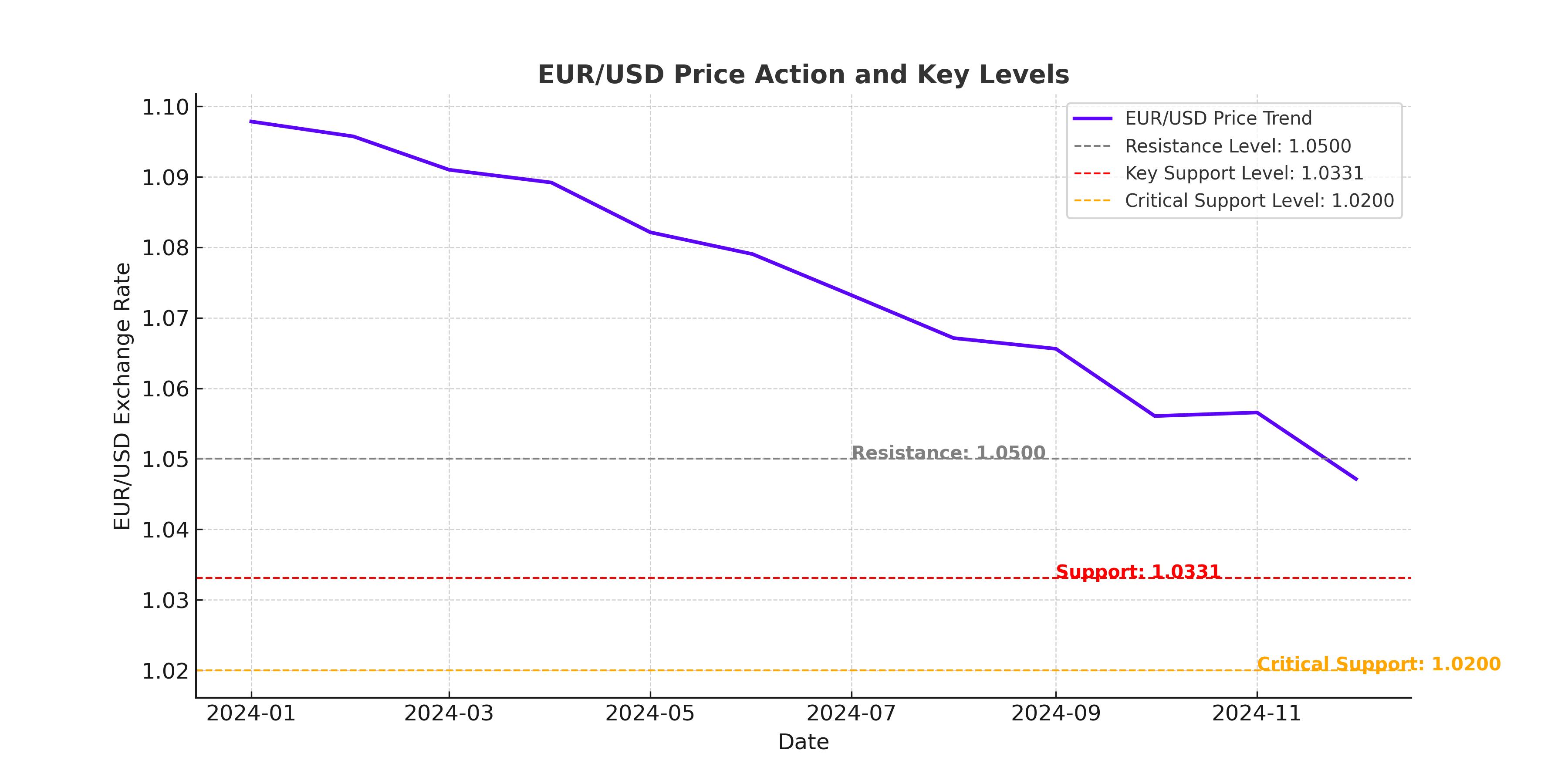

Technical Analysis: EUR/USD Key Levels to Watch

From a technical perspective, EUR/USD is at a critical juncture. The pair has failed to decisively break above the 1.0500 resistance level, which aligns closely with the December 12 high of 1.0530. A sustained move above this level could open the door for further gains toward the 1.0600 psychological barrier, followed by 1.0629, the recent swing high.

On the downside, immediate support lies at 1.0452, the weekly low, followed by the November 26 low of 1.0424. A break below this level would expose the year-to-date low of 1.0331, which is a key inflection point. A breach of 1.0331 could pave the way for a test of 1.0200, a critical Fibonacci retracement level, and possibly the 2022 low of 0.9534 if bearish momentum accelerates.

Momentum indicators like the Relative Strength Index (RSI) suggest that selling pressure has eased slightly, but the broader downtrend remains intact. Traders will need to see a daily close above 1.0500 to gain confidence in a potential short-term reversal.

Macroeconomic Factors Shaping EUR/USD Outlook

The broader macroeconomic environment remains a significant driver for EUR/USD. While the Fed’s measured approach to rate cuts could keep the dollar well-supported, external factors such as President-elect Trump’s fiscal and trade policies could further influence the pair. Large import tariffs on Eurozone goods, for instance, would likely exacerbate the ECB’s dovish stance, increasing downward pressure on the euro.

Additionally, weak eurozone economic data, including lackluster manufacturing activity and political challenges in major economies like Germany, continue to weigh on investor confidence. The euro’s struggles are compounded by the Eurozone’s growing reliance on external demand, which could falter if global trade conditions deteriorate further.

Market Sentiment and Institutional Outlook

Institutional forecasts paint a mixed picture for EUR/USD. Wells Fargo expects the pair to fall below parity in 2025, citing Eurozone weakness and widening yield spreads as key drivers. In contrast, Danske Bank predicts that the ECB will be cautious with rate cuts, potentially delaying them until mid-2025, which could offer some short-term relief for the euro.

Meanwhile, speculative positioning in the futures market suggests a bearish tilt, with net shorts on the euro increasing in recent weeks. This aligns with the broader narrative of dollar strength and euro weakness, particularly as the US economy continues to outperform its European counterparts.

Conclusion: A Fragile Balance

The EUR/USD pair is navigating a precarious balance between dollar strength and euro weakness, shaped by diverging central bank policies and broader macroeconomic trends. With the Fed signaling cautious optimism and the ECB leaning heavily dovish, the pair’s near-term trajectory remains tilted to the downside. Key levels like 1.0452 and 1.0331 will be critical for determining the next leg of the move, while a sustained break above 1.0530 could offer temporary relief for euro bulls. However, given the broader economic backdrop, EUR/USD is likely to remain under pressure as it heads into 2025.