Understanding NVIDIA's Leadership in AI and Its Market Implications

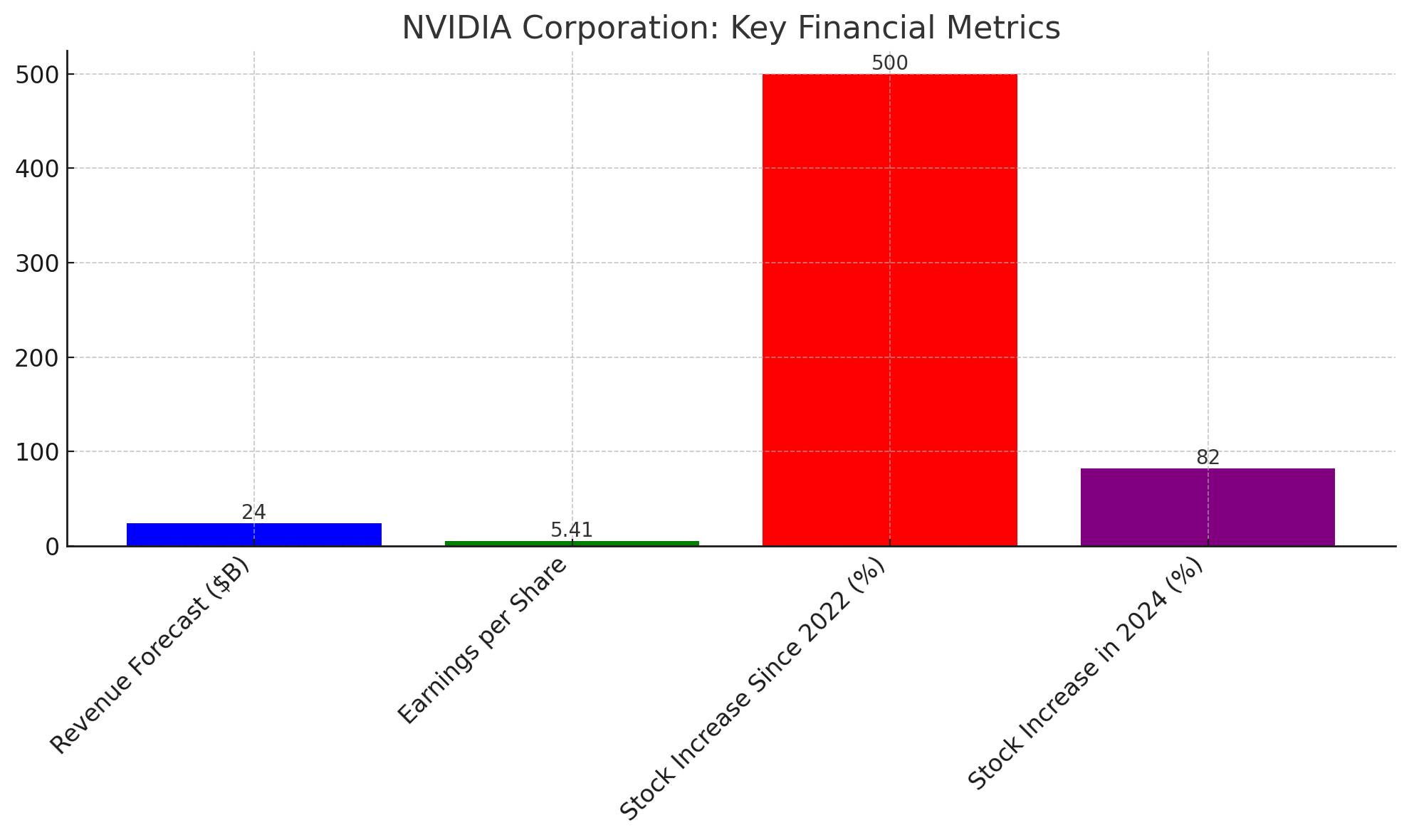

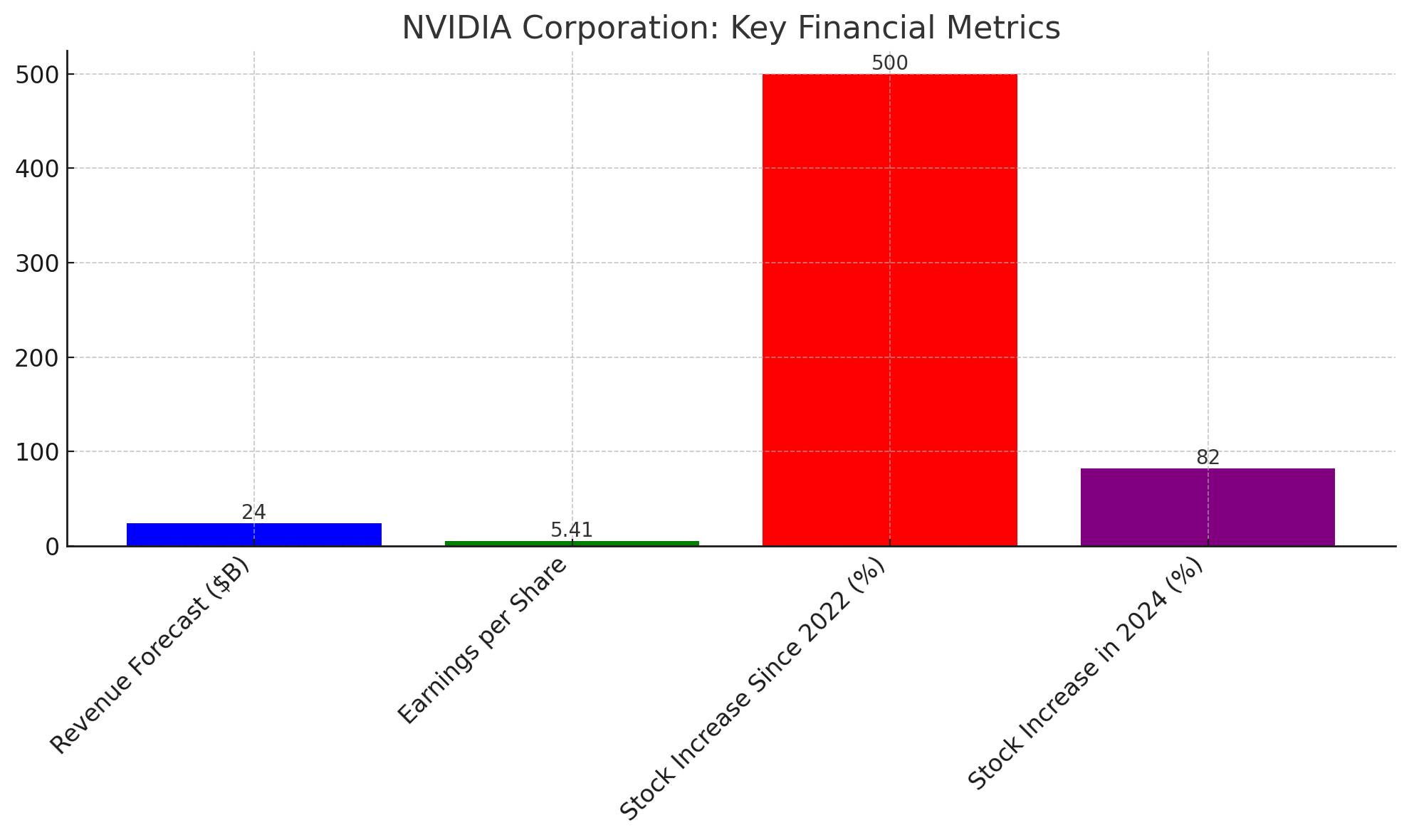

NASDAQ:NVDA has not only positioned itself as a pivotal player in the artificial intelligence (AI) landscape but has also redefined the parameters of success in the tech sector. Under the visionary leadership of CEO Jensen Huang, NVIDIA has consistently outperformed market expectations, propelling its stock to unprecedented heights. With a striking annual revenue forecast of $24 billion and an earnings projection of $5.41 per share, NVIDIA's financial robustness is evident. The company's ability to exceed Wall Street's lofty fourth-quarter earnings estimates is a testament to its innovative prowess and market dominance.

Jensen Huang's philosophy, emphasizing resilience through adversity, has been a cornerstone of NVIDIA's corporate ethos. This mindset has not only cultivated an environment of relentless pursuit of excellence but also fostered a culture of innovation that thrives on challenges. Huang's unconventional advice to Stanford students, advocating for the embrace of pain and suffering as a pathway to greatness, reflects the unconventional strategies that have driven NVIDIA's success.

NVIDIA's Market Performance and the Rising Demand for AI

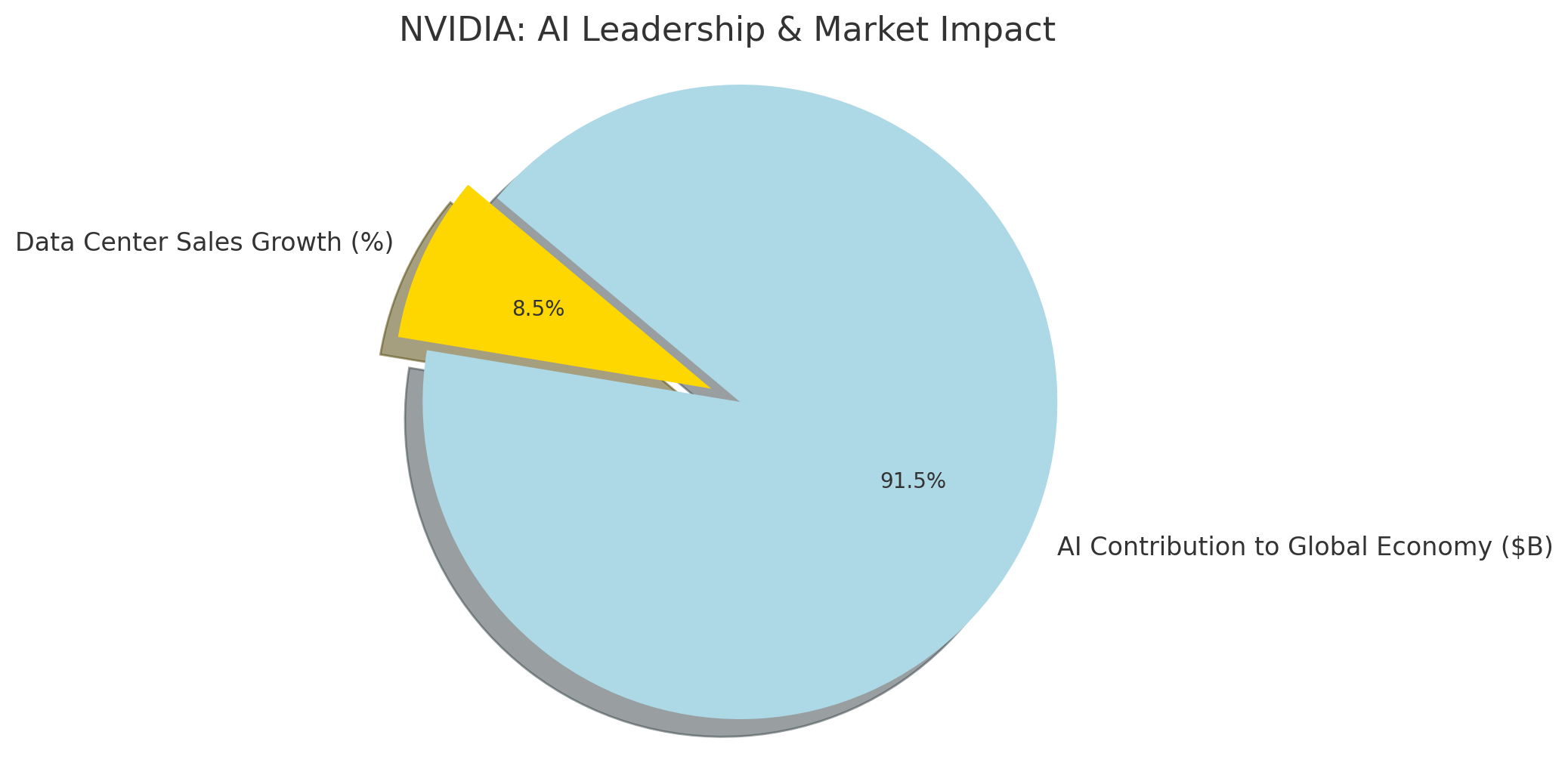

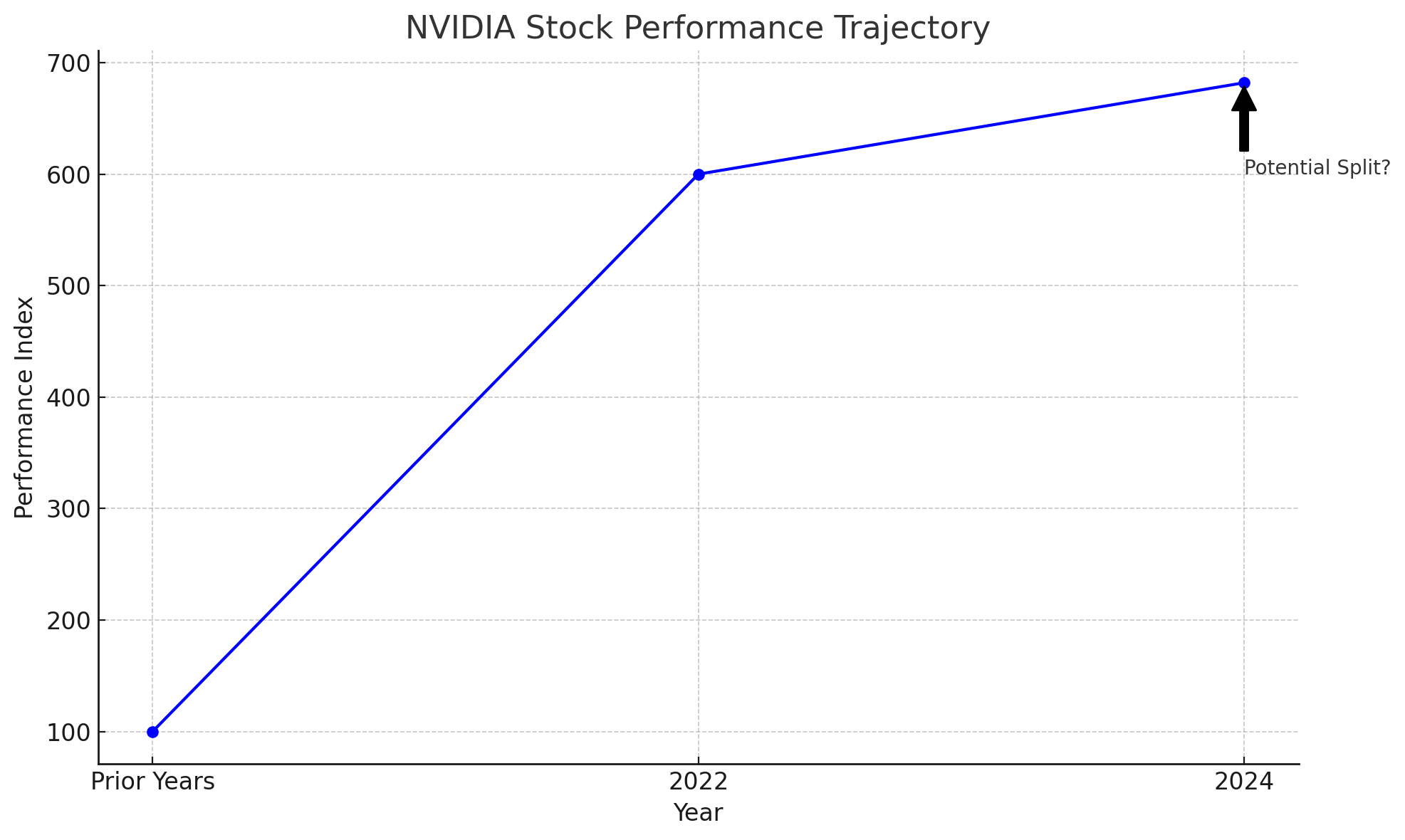

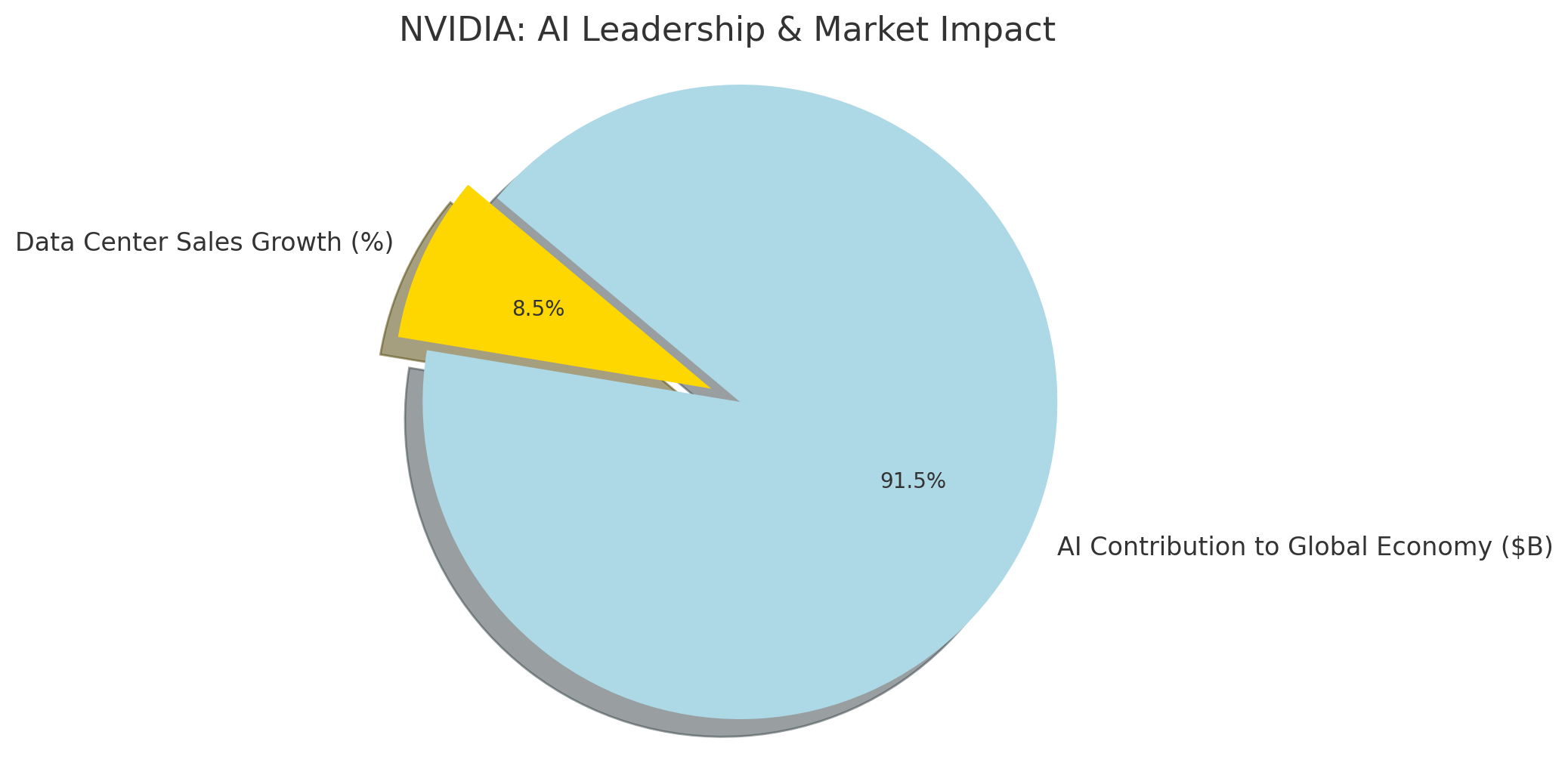

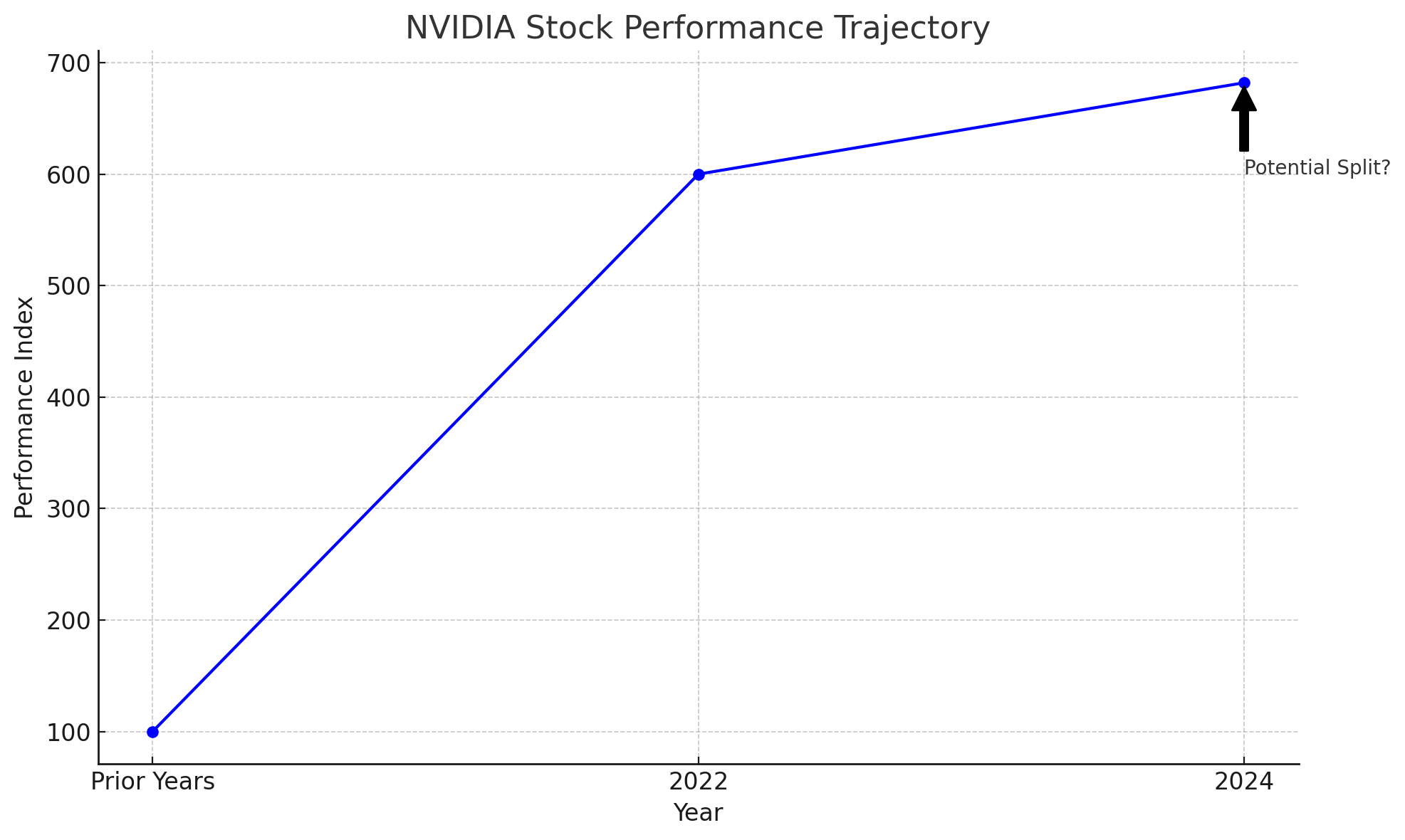

The tech giant's remarkable performance, with a nearly 500% increase in stock value since 2022 and an 82% uptick in 2024 alone, underscores the investor confidence in NVIDIA's strategic direction and its pioneering role in AI. The surging demand for AI applications, projected by McKinsey to add up to $4.4 trillion annually to the global economy, further solidifies NVIDIA's critical role in this burgeoning industry.

NVIDIA's Data Center division, responsible for its AI product lineup, reported a staggering 409% quarter-over-quarter sales growth, indicating the massive monetization potential of AI technologies. However, this extraordinary success raises questions about the sustainability of such growth and the potential for stock splits, given NVIDIA's historical pattern and the implications of its current market valuation.

Analyzing the Potential for a Stock Split in 2024

Considering NASDAQ:NVDA's split history and its performance trajectory, the likelihood of a stock split in 2024 appears plausible. Such a move would aim to make the stock more accessible to a broader investor base, enhancing liquidity and fostering a more vibrant trading environment. The strategic significance of a stock split extends beyond mere financial recalibration; it serves as a strong signal of NVIDIA's confidence in its growth trajectory and its commitment to shareholder inclusivity.

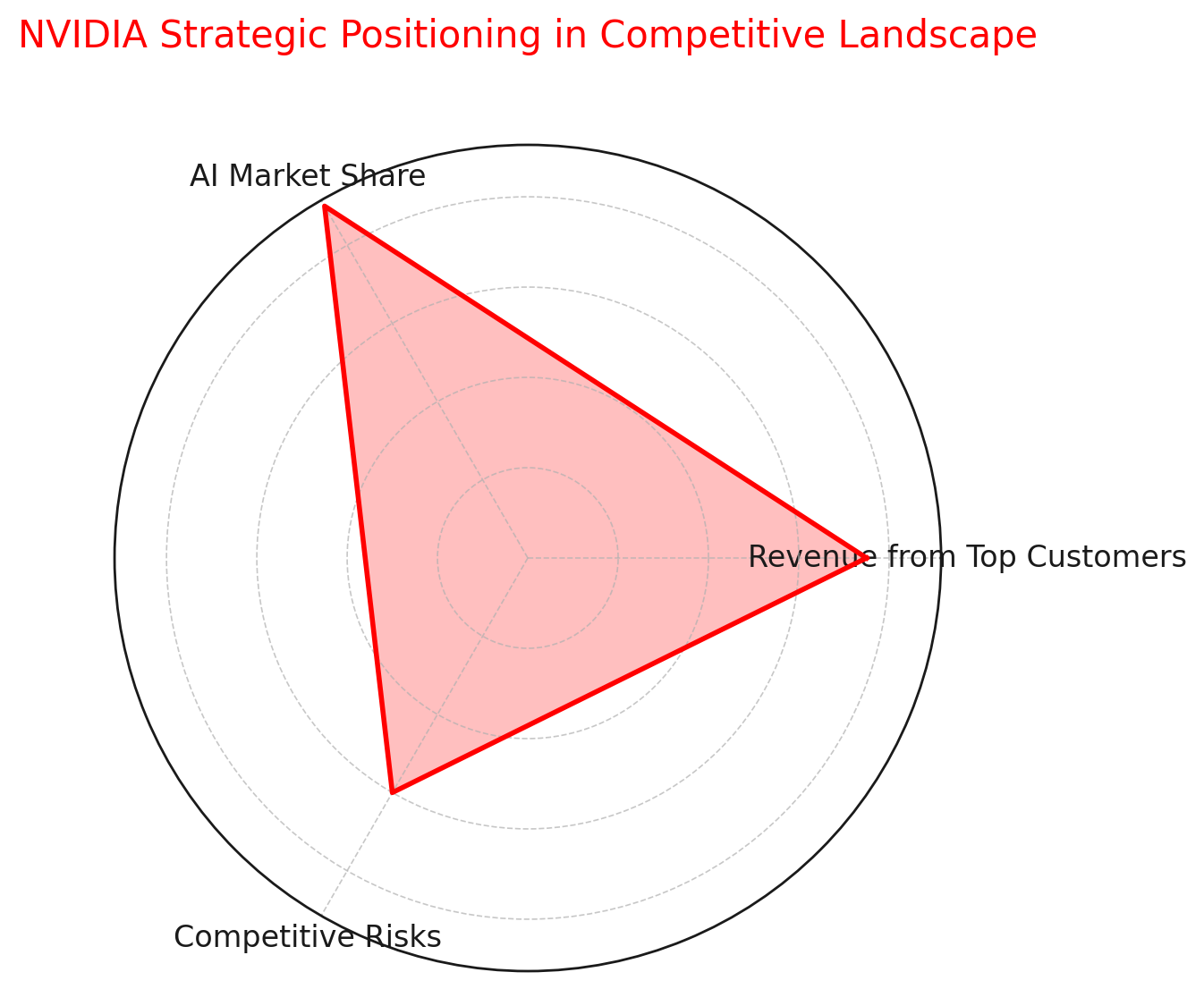

The Competitive Landscape and NVIDIA's Strategic Positioning

While NVIDIA's dominance in AI is undisputed, the competitive landscape presents both challenges and opportunities. The company's top customers, including tech behemoths like Microsoft and Amazon, account for a significant portion of its revenue. This customer concentration, coupled with the trend of these customers developing their AI chips, introduces a complex dynamic that NVIDIA must navigate to sustain its growth momentum.

Furthermore, the broader market sentiment towards AI and NVIDIA's strategic initiatives, such as potential stock splits, will play a critical role in shaping the company's future. With AI's transformative potential across industries, NVIDIA stands at the forefront of a technological revolution that could redefine global economic structures.

NVIDIA's Valuation: A Critical Examination

Despite the exuberance surrounding NVIDIA's market success, a critical examination of its valuation is imperative. The concern of overvaluation looms large, with some analysts suggesting that even optimistic forecasts cannot fully justify the current stock price. This scenario calls for a nuanced analysis that considers not just the bullish momentum but also the fundamental financial health and market positioning of NVIDIA.

In the context of NVIDIA's significant contributions to the AI revolution and its strategic maneuvers in the tech landscape, it's clear that the company is not just a participant but a leading architect of the future of technology. However, the path forward is fraught with both unprecedented opportunities and formidable challenges. As NVIDIA navigates this complex terrain, its strategies, from potential stock splits to innovation in AI, will be closely watched by investors and industry observers alike.

For real-time data and insights on NASDAQ:NVDA, including stock performance and insider transactions, refer to Trading News for comprehensive coverage.

NVIDIA's journey is emblematic of the intricate dance between innovation, market forces, and strategic foresight. As the company continues to chart its course in the ever-evolving tech landscape, its impact on the AI domain and the broader technological ecosystem will undoubtedly remain a subject of keen interest and analysis.

That's TradingNEWS