Exploring the Strong Buy Rating for Palo Alto Networks NASDAQ:PANW Stock

Unpacking the strategic evolution and financial health of NASDAQ: PANW as it embraces platformization and vital industry partnerships, enhancing its market position and investor appeal | That's TradingNEWS

Palo Alto Networks: Strategic Review and Financial Analysis

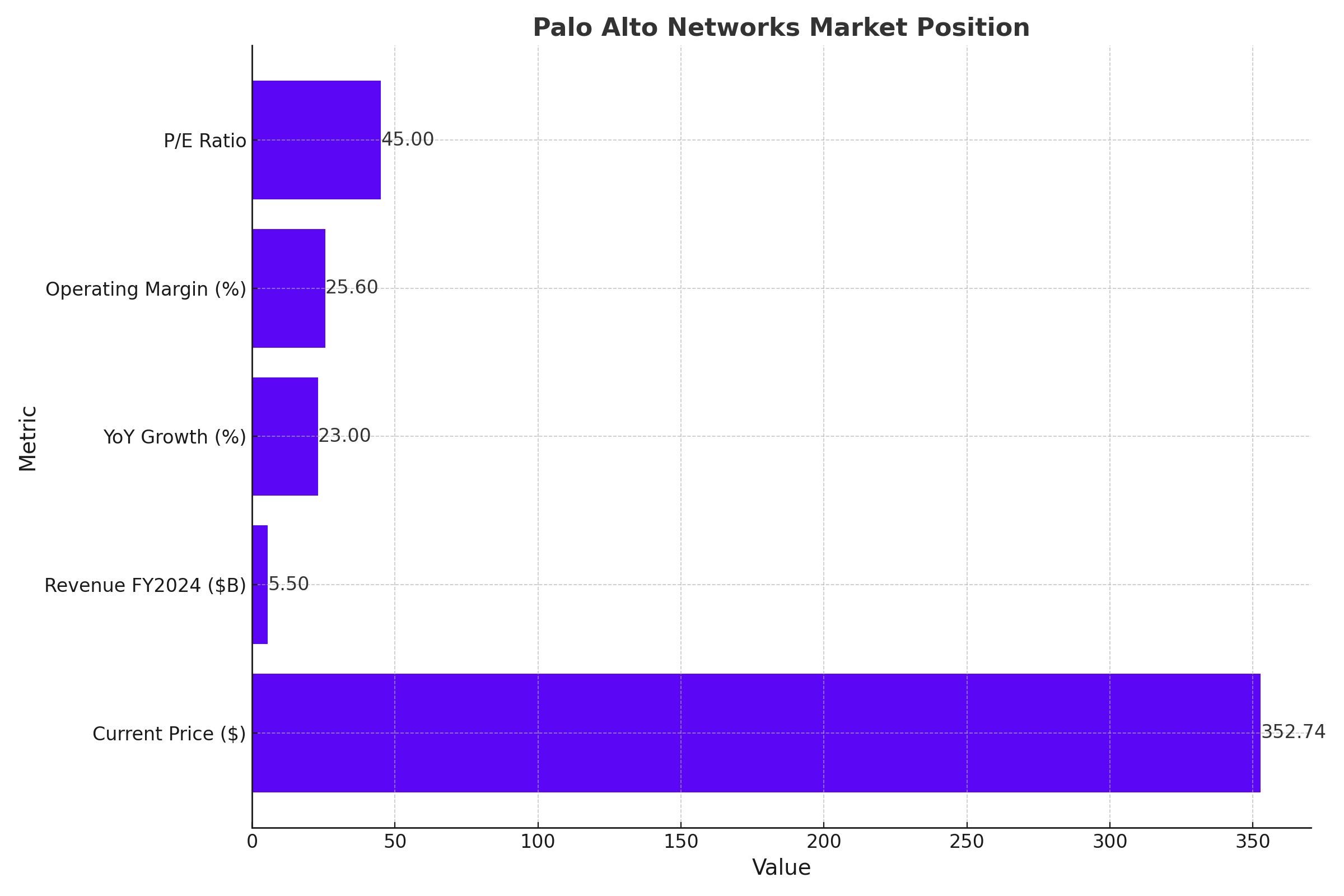

NASDAQ: PANW Current Market Position

As of the latest trading period, Palo Alto Networks (NASDAQ: PANW) has shown remarkable market resilience with a current trading price of $352.74 per share. This price reflects a strategic positioning in the cybersecurity market, bolstered by recent developments and transformations within the company.

Recent Financial Performance

Palo Alto Networks reported a substantial revenue figure of approximately $5.5 billion for FY2024, marking a significant year-over-year growth of 23%. This growth trajectory is supported by their recent shift towards a platform-based service model, enhancing their ability to upsell and cross-sell various integrated security solutions. Operating margins have seen an uplift from 23.6% to 25.6%, showcasing effective cost management and profitability enhancement.

Insider Transactions and Investor Confidence

Recent insider transactions, which can be reviewed in detail here, indicate a stable confidence level among the company's executives, with significant shares still held post-transaction, suggesting a positive outlook by those with the closest understanding of the company's operations.

Platformization Strategy Impact

In the transformation to a platform-centric approach detailed in their Q3’24 earnings call, Palo Alto Networks emphasized their shift from singular product offerings to a comprehensive security platform. This strategy is anticipated to significantly increase operational efficiencies by 30-40% for their clients, reflecting direct impacts on customer satisfaction and retention rates.

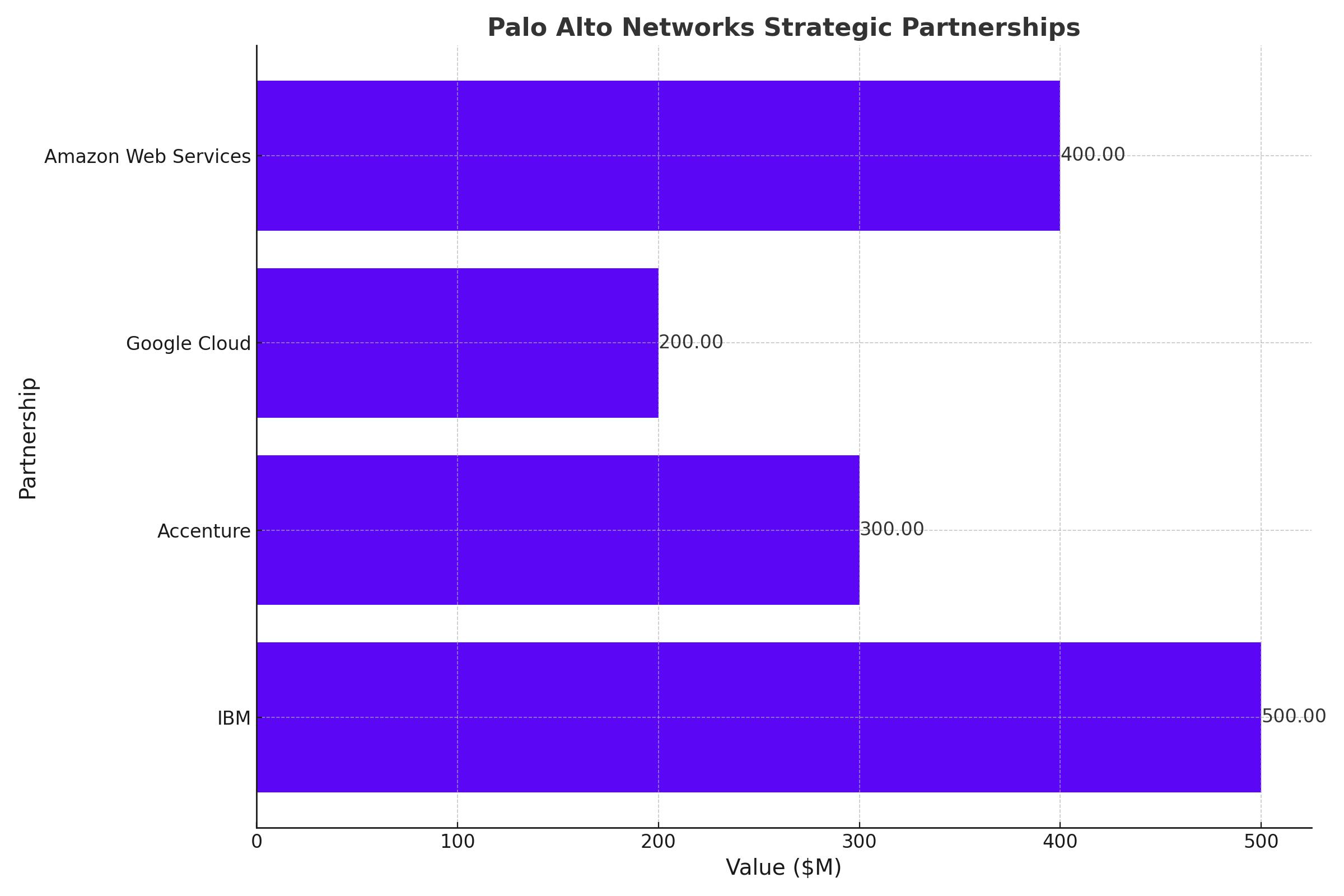

Strategic Partnerships and Market Expansion

Strategic collaborations, such as those with IBM and Accenture, have been pivotal. These partnerships aim to integrate Palo Alto’s advanced AI-driven security solutions within broader digital transformation initiatives across enterprises. The partnership with IBM involves a critical exchange of assets worth $500 million, emphasizing the scale and potential of these collaborations to enhance Palo Alto's market offerings.

Market Valuation and Investment Outlook

With a current P/E ratio of approximately 45, Palo Alto Networks is positioned competitively within the tech and cybersecurity sectors. The stock is currently trading at 13.64 times trailing twelve-month sales, which is aligned with industry standards given its growth rate and market expansion strategies. The price target adjustment to $352.74 reflects a nuanced understanding of both the opportunities and challenges faced by the company.

Risk Factors and Future Projections

Investors should consider the potential risks associated with global geopolitical tensions, particularly in technology supply chains and cybersecurity threats, which could impact market performance. Additionally, the ongoing global economic fluctuations and their unpredictable impacts on investment in cybersecurity need careful monitoring.

Conclusion

In conclusion, Palo Alto Networks (NASDAQ: PANW) presents a strong buy opportunity based on its robust financial growth, strategic market positioning, and forward-looking management strategies aimed at capitalizing on emerging technology trends. The company's proactive approach in expanding its platform services and forming strategic alliances positions it well for sustained long-term growth. For continuous real-time updates on PANW, monitor their stock activity here.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex