Future of Oil Prices - Strategic Insights and Market Predictions

From technical analysis to geopolitical influences, discover how external factors and market sentiment are shaping the trajectory of Brent crude and WTI oil prices amidst evolving global challenges | That's TradingNEWS

Analysis of Current Oil Market Dynamics and Future Implications

Market Overview: Recent Price Movements and Demand Outlook

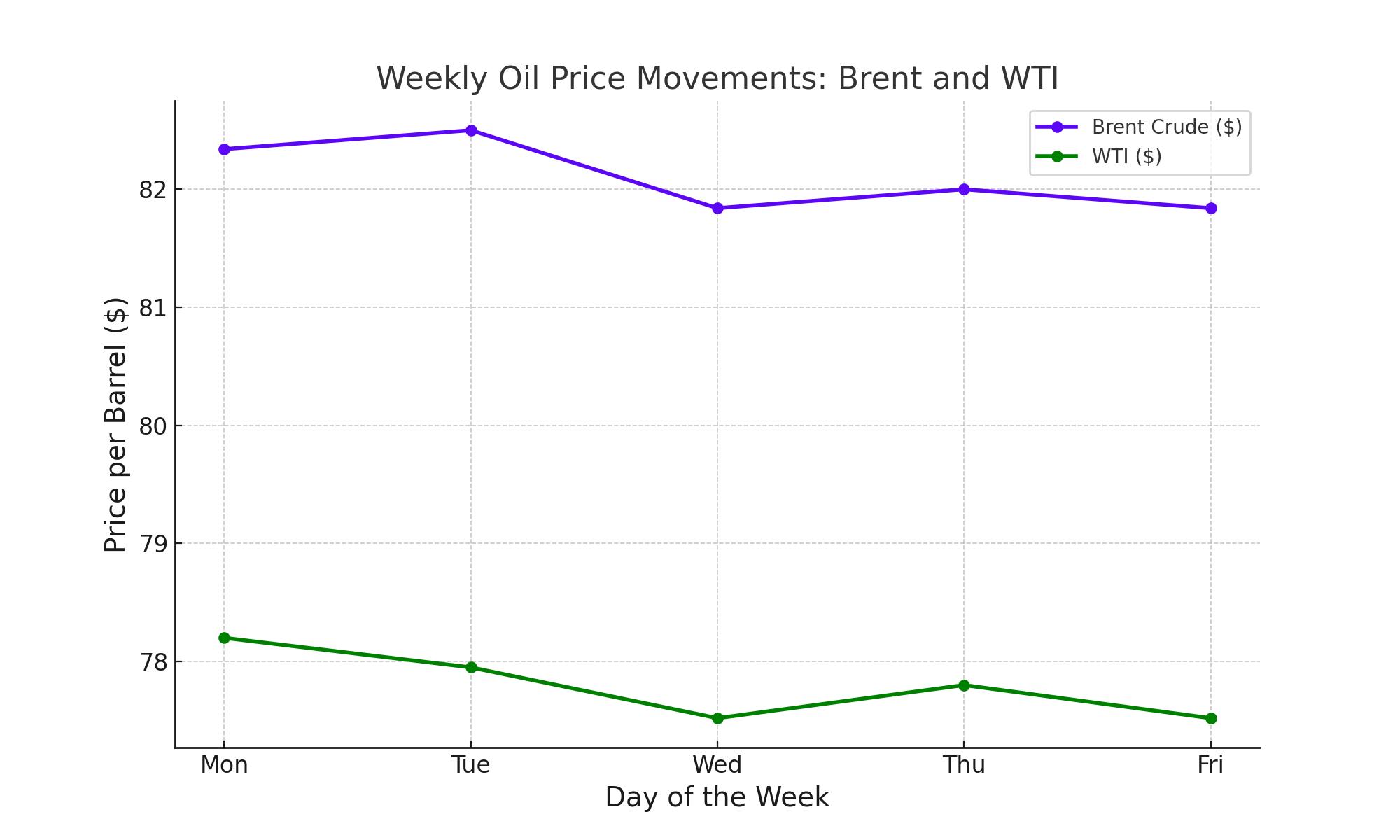

Brent crude and West Texas Intermediate (WTI) experienced slight declines, with Brent at $81.84 per barrel and WTI at $77.52 per barrel. These movements reflect ongoing global economic pressures, notably from developed OECD nations where demand has softened. The International Energy Agency (IEA) adjusted its growth forecast for 2024, decreasing its oil demand growth projection by 140,000 barrels per day to 1.1 million bpd, underscoring concerns about a potential economic slowdown due to persistent inflation.

Inventory Levels and Their Impact on Prices

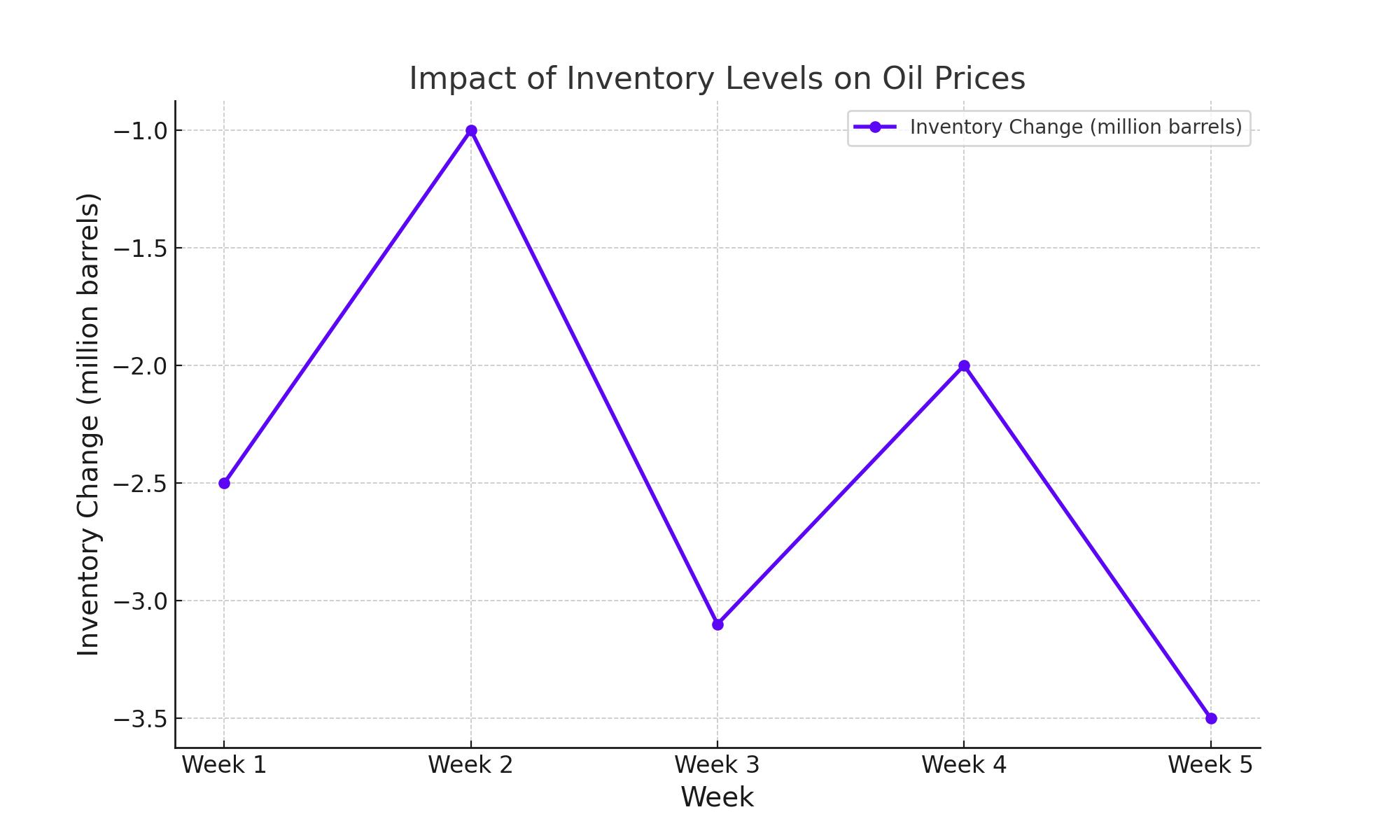

Supporting oil prices, however, are the latest inventory data from the American Petroleum Institute, which reported a significant decrease of 3.104 million barrels in U.S. crude oil stocks for the week ending May 10. This drawdown, alongside drops in gasoline inventories and a rise in distillate stocks, suggests a complex interplay of factors influencing oil prices. The anticipated increase in refinery runs to meet the demand of the northern hemisphere's summer driving season may also support crude prices in the short term.

Technical Analysis and Market Sentiment

Market sentiment remains cautiously optimistic as analysts predict oil prices will stay range-bound between $80 and $90 through the second quarter of 2024. However, expectations shift towards a bearish outlook post-Q2 due to factors including non-OPEC supply growth and potential demand weaknesses. The upcoming U.S. Consumer Price Index (CPI) data will be crucial in shaping market expectations, influencing Federal Reserve rate decisions, which could either spur or hinder economic activity and fuel demand.

Geopolitical Factors and Positive External Influences on Oil Prices

In the current global landscape, external market drivers such as U.S. inflation data and a weakening dollar play a pivotal role in shaping oil prices. A softer dollar typically renders dollar-priced crude oil more affordable for holders of other currencies, potentially boosting demand. This can drive up oil prices, benefiting global oil markets. Furthermore, geopolitical tensions and disruptions in major shipping routes, such as those recently experienced in the Red Sea, while introducing some volatility, also often restrict supply, leading to higher oil prices which could benefit producers and investors looking for gains in oil assets.

Long-term Economic Indicators and Bullish Strategic Implications

Looking forward, the broader economic landscape offers compelling opportunities for the oil sector. While inflationary pressures and interest rate policies warrant a nuanced approach to commodity investments, these factors can also underscore the value of oil as a hedge against inflation. As central banks address inflation, often by tightening monetary policy, commodities like oil can appreciate. Moreover, the structural changes towards sustainability in energy markets are prompting significant investments in traditional and alternative energy sources. The evolving oil tanker market, adapting to environmental regulations which reduce shipping speeds, is tightening available supply and is likely to support higher oil prices long-term, benefiting stakeholders in the industry.

Conclusion: A Bullish Outlook Amid a Complex Market Landscape

The oil market in 2024 is characterized by a dynamic interplay of supply, demand, geopolitical tensions, and macroeconomic factors. As market participants navigate this complex landscape, they can find bullish signals amid the challenges. Enhanced demand driven by a weaker dollar, supply constraints due to geopolitical disruptions, and strategic shifts in energy consumption towards more sustainable sources all suggest a potentially lucrative trajectory for oil prices. Investors and analysts should focus on these developments, leveraging detailed market analyses and trends to capitalize on emerging opportunities. While caution is always advisable, the indicators point towards a robust potential for growth in oil investments, particularly for those positioned to take advantage of the shifting global energy paradigm.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex