Global Gold Market: Surge in Demand Amid Economic Shifts

Decoding Gold’s Price Momentum and Investment Appeal Amidst Geopolitical and Economic Changes | That's TradingNEWS

Global Gold Market Analysis: Surge in Demand Amid Economic Fluctuations

Gold's Resilient Price Momentum

Despite a rebound in the US Dollar, gold prices have experienced significant momentum, primarily driven by expectations of a weakening labor market which could lead to earlier-than-anticipated rate cuts by the Federal Reserve. This adjustment is anticipated to stimulate further economic growth, enhancing gold's appeal as a safe-haven asset. Moreover, geopolitical tensions add another layer of complexity, potentially escalating gold's market value further.

The Impact of Federal Reserve Policies

Conversations around the Federal Reserve's stance on interest rates have introduced a cautious optimism among gold investors. Recent remarks by Fed officials, including those from the Fed's Bowman, Goolsbee, and Barr, hint at a hawkish outlook, which could temporarily pressure gold prices. However, the focus remains on the upcoming US Michigan Consumer Sentiment Index and the Consumer Price Index (CPI) report, which are critical indicators that could influence the Fed's policy decisions moving forward.

Labor Market Indicators and Economic Health

Recent US economic reports have painted a picture of a cooling economy, which is generally favorable for gold. The increase in initial jobless claims to 231,000 and a modest job creation in April suggest potential economic slowdowns. These factors are instrumental in reinforcing the protective allure of gold against economic instability.

Geopolitical Instability and Its Impact on Gold Prices

Geopolitical tensions, particularly the US-Israeli conflict in Gaza, have significantly influenced market dynamics, propelling investors toward gold, renowned for its status as a safe-haven asset during times of uncertainty. Such conflicts can cause fluctuations in market sentiment and have historically resulted in increases in gold prices as investors seek stability.

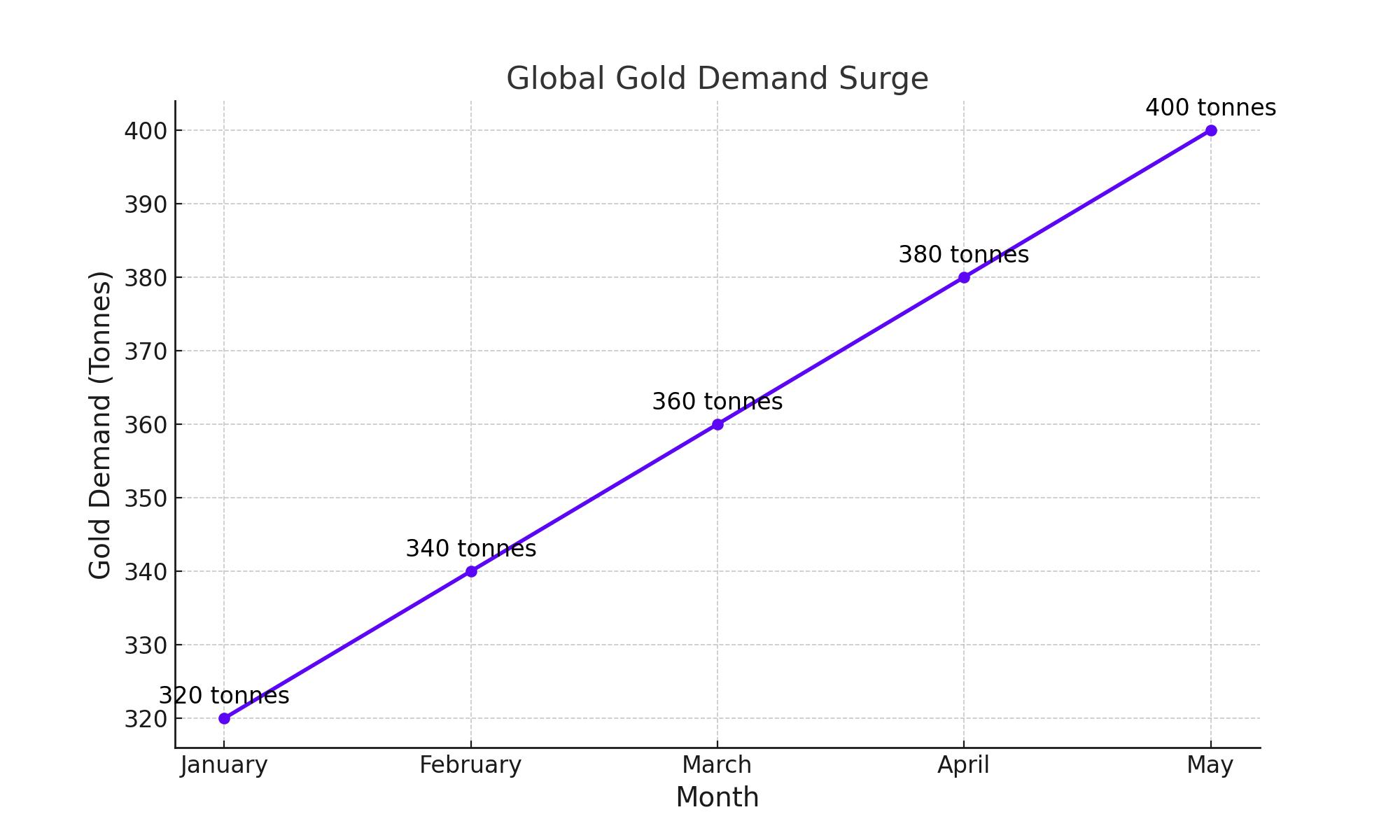

Surge in Global Gold Demand

The World Gold Council (WGC) reports a notable rise in gold investments, with central banks intensifying their acquisitions and robust demand emanating from Asia. These factors collectively exert upward pressure on gold prices, solidifying its role as a fundamental component in diversified investment strategies. For instance, central bank net purchases of gold reached significant levels not seen in previous years, underscoring a strategic shift towards this precious metal.

Gold’s Technical Momentum and Price Trajectory

Gold is currently trading above its 100-day Exponential Moving Average (EMA), a technical signal of a strong bullish trend. It has recently surpassed a key descending trend channel, suggesting a potential rally towards and beyond the $2,400 mark, subject to sustained investor interest. This level has been identified as a critical resistance point; breaching this could set the stage for reaching new peaks, possibly approaching the $2,500 threshold.

Strategic Market Outlook for Gold

As global economic and geopolitical landscapes evolve, gold's role as a financial safeguard is increasingly pronounced. Upcoming Federal Reserve decisions on interest rates and broader economic indicators from major economies like China are pivotal in shaping the market’s direction. Expectations of rate cuts enhance gold’s attractiveness as a non-yielding asset, likely propelling its value. Given these dynamics, gold is positioned for potential price increases, making it an appealing option for investors navigating the intricate interplay of current economic conditions.

Why Should You Buy Gold Now?

Gold's market momentum is strongly influenced by a blend of economic indicators and geopolitical events, making it a compelling buy. The anticipation of earlier-than-expected rate cuts by the Federal Reserve due to a weakening labor market—evidenced by an increase in jobless claims to 231,000 and modest job creation in April—signals potential economic slowdowns that traditionally increase gold's appeal as a safe-haven asset. Additionally, ongoing geopolitical tensions, notably the US-Israeli conflict in Gaza, heighten gold's allure during uncertain times.

Investor sentiment is buoyed by the Federal Reserve's upcoming decisions on interest rates, with key reports like the US Michigan Consumer Sentiment Index and Consumer Price Index poised to influence monetary policies. Furthermore, the World Gold Council highlights a surge in global gold demand, particularly from central banks and Asian markets, which puts upward pressure on prices. Technically, gold shows a strong bullish trend, trading above its 100-day Exponential Moving Average and recently breaking above a critical resistance level, suggesting a potential rally towards $2,500.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex