Global Oil Market Analysis: Rising Prices and Strategic Shifts

Unpacking the Bullish Trends in Oil Prices and the Impact of Global Economic Activities | That's TradingNEWS

Global Oil Market Dynamics: An In-Depth Analysis

Bullish Sentiments in Oil Prices

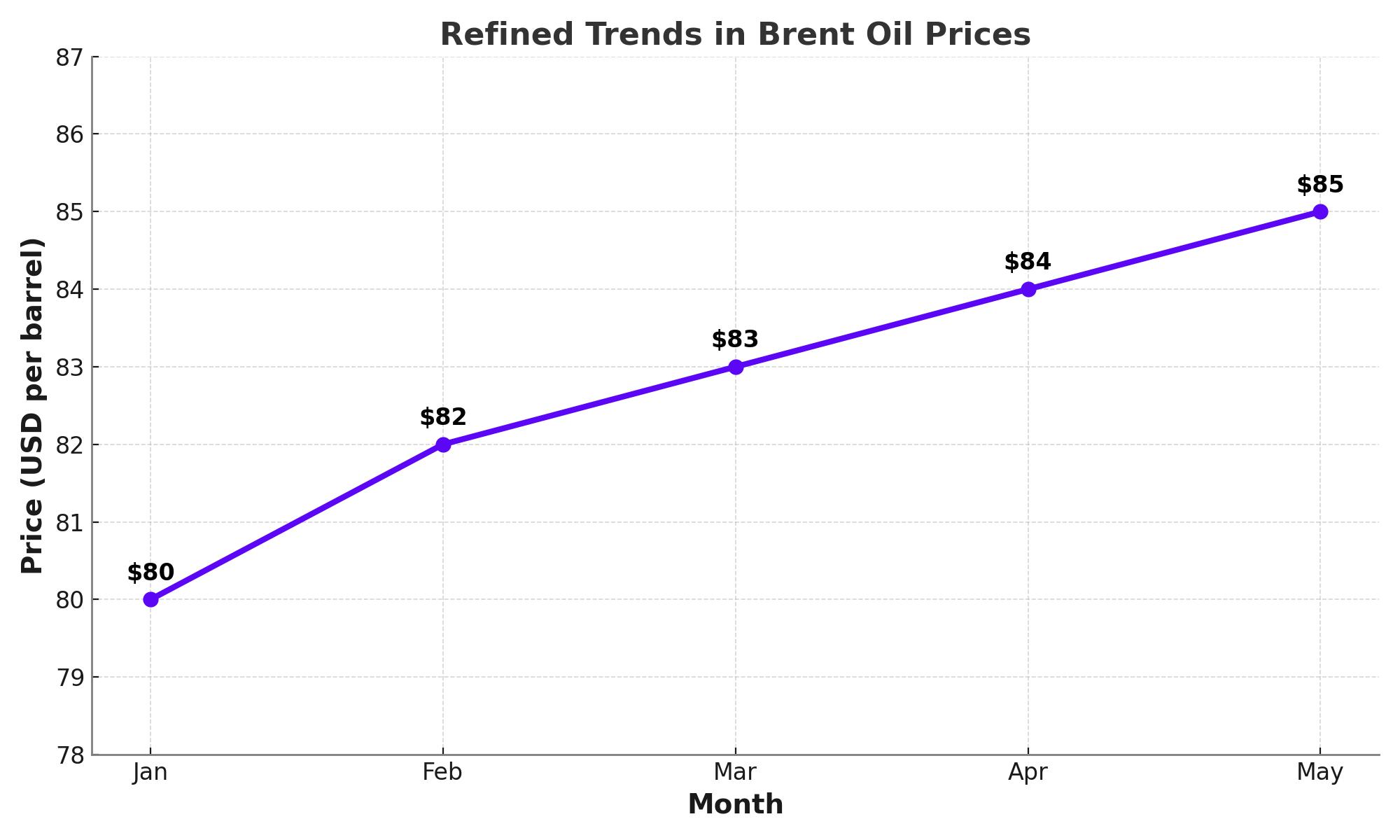

Amid fluctuating global economic signals, oil prices have shown resilience, marking a noticeable rebound. Recent data indicates that Brent futures are nudging towards $85 per barrel, a significant recovery attributed to decreasing U.S. crude inventories and robust oil importation by China—about 10.88 million barrels per day, marking a 5.5% increase from the previous year. This uptick in demand from the world's second-largest economy is a bullish indicator, further supported by heightened refinery activities during significant holidays and an uptick in manufacturing outputs.

Strategic Asset Shifts and Policy Reversals

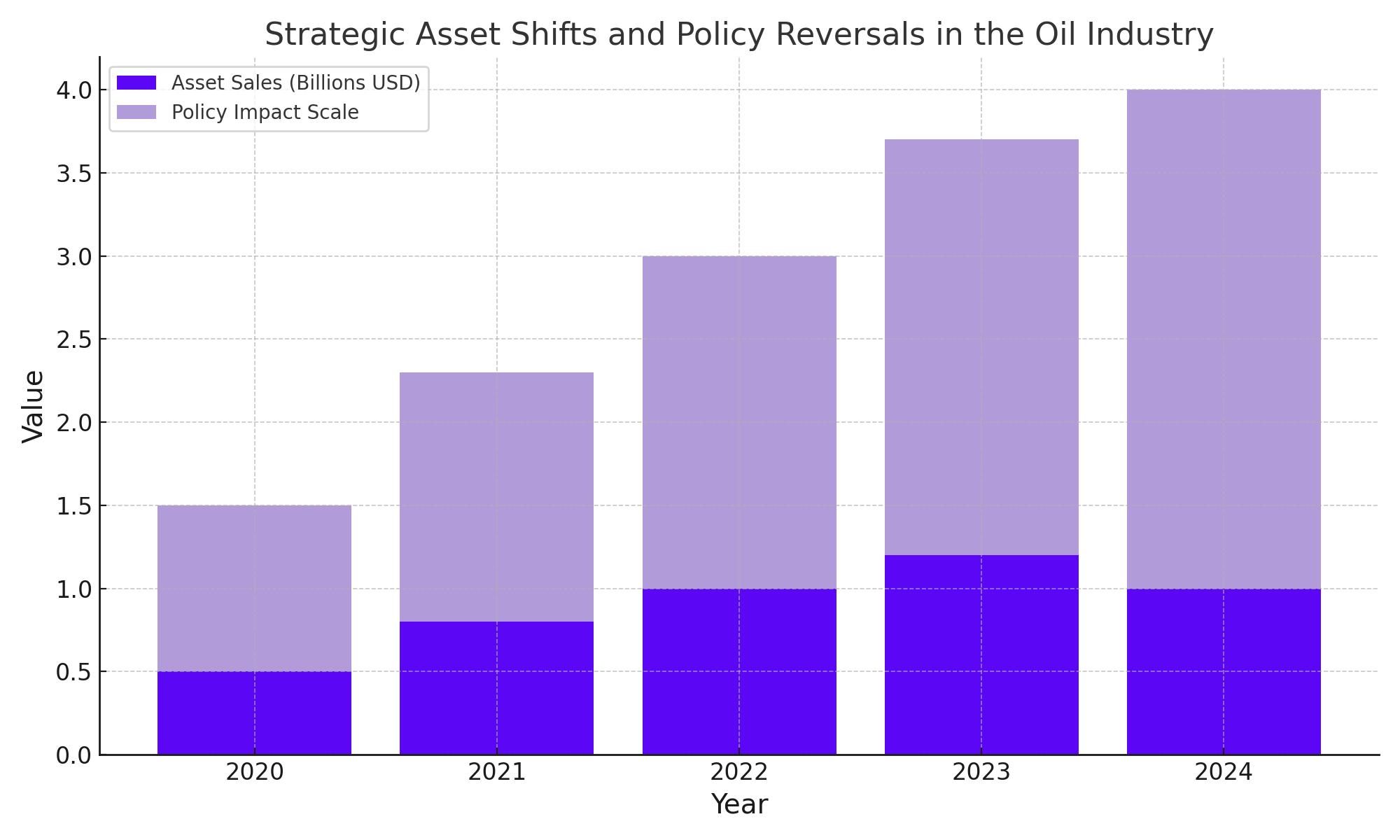

In a pivotal industry move, Shell has offloaded its Singapore Bukom refinery to a Glencore-led consortium for approximately $1 billion, signaling a strategic realignment towards potentially more lucrative or sustainable ventures. Meanwhile, political figures in the U.S., particularly former President Donald Trump, have expressed intentions to dismantle current environmental and energy policies to potentially enhance the LNG export framework, adding a layer of complexity to future oil and gas operations.

Strategic Developments in Guyana’s Oil Sector

In a significant expansion of their energy portfolio, TotalEnergies, Petronas, and QatarEnergy have successfully secured the rights to explore the Guyana S-4 shallow water block. This venture is expected to tap into new oil reserves, potentially enhancing the global oil supply. The bid's approval introduces fresh exploration opportunities in a region known for its underexploited resources, with the consortium preparing to invest in detailed seismic and drilling activities.

U.S. Strategic Petroleum Reserve Enhancements

In response to the volatile oil market, the U.S. Department of Energy has initiated a strategic purchase plan to replenish the Strategic Petroleum Reserve. This proactive measure involves acquiring 3.3 million barrels of oil, targeted for an October delivery to the Big Hill storage facility. This action aims to mitigate the impacts of price fluctuations and ensure a buffer against future economic instabilities, with recent purchasing triggered by a dip in WTI prices to $79 per barrel.

Navigating Legal and Geopolitical Terrain

Regulatory Scrutiny and Market Integrity

The oil sector faces intensified scrutiny from regulatory bodies such as the Federal Trade Commission (FTC), which recently addressed concerns over potential price manipulations in high-profile mergers. The FTC's investigations into practices that might affect market fairness are pivotal, especially with recent allegations against prominent industry executives conspiring to influence oil prices, highlighting the sector's vulnerability to legal and ethical challenges.

Geopolitical Tensions and Market Stability

Geopolitical conflicts, particularly in the Middle East, continue to pose significant risks to the stability of oil markets. These tensions can disrupt supply chains and inflate oil prices, as seen with recent escalations affecting key oil-producing regions. Such instability necessitates vigilant monitoring of global events to manage supply risks effectively and maintain market stability.

Renewable Energy Investments by Trafigura

Amidst a global push towards sustainability, Trafigura is leading the charge by expanding its renewable energy portfolio. The company has recently acquired the Canadian assets of UK-based biodiesel producer Greenergy. This move is part of Trafigura's strategic initiative to diversify energy sources and reduce carbon emissions, aligning with global environmental goals and responding proactively to the increasing demand for greener energy solutions.

Why Oil Is a Buy: Bullish Trends and Strategic Insights

The global oil market is currently exhibiting several bullish indicators that make it an attractive buy. Oil prices are rebounding, with Brent futures nearing $85 per barrel, driven by decreased U.S. crude inventories and a 5.5% year-over-year increase in Chinese oil imports to about 10.88 million barrels per day. This upsurge is bolstered by intensified refinery and manufacturing activities in China, signaling robust demand. Strategic industry shifts are also evident as major players like Shell realign towards more profitable ventures, and exploratory bids by TotalEnergies, Petronas, and QatarEnergy in Guyana promise to unlock new reserves. Additionally, the U.S. government is actively bolstering the Strategic Petroleum Reserve to mitigate price volatility, enhancing market stability. Despite geopolitical tensions that typically inject market uncertainty, the industry's resilience and strategic responses to these challenges underscore its potential for growth. Moreover, companies like Trafigura are expanding into renewable energy, indicating a strategic pivot that aligns with global energy transitions. Collectively, these factors not only demonstrate a robust demand and strategic foresight within the oil sector but also highlight its promising investment potential amidst a landscape ripe with opportunity for growth and innovation.

That's TradingNEWS

Read More

-

SPYD ETF Price at $43.57: Is This High-Dividend S&P 500 Fund Still Cheap for 2026?

30.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Ignite: XRPI at $10.79 and XRPR at $15.43 While XRP-USD Holds the $1.80 Floor

30.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast $4: Storage Slides, UNG Climbs and NG=F Targets $5.50

30.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 158 Ceiling and 154.50 Support Define the 2026 Battle

30.12.2025 · TradingNEWS ArchiveForex