Gold (XAU:USD) Nears Record High on Fed Rate Cut Bets and Geopolitical Tensions

Expectations of Federal Reserve rate cuts, rising geopolitical tensions, and strong central bank demand propel gold prices towards new highs | That's TradingNEWS

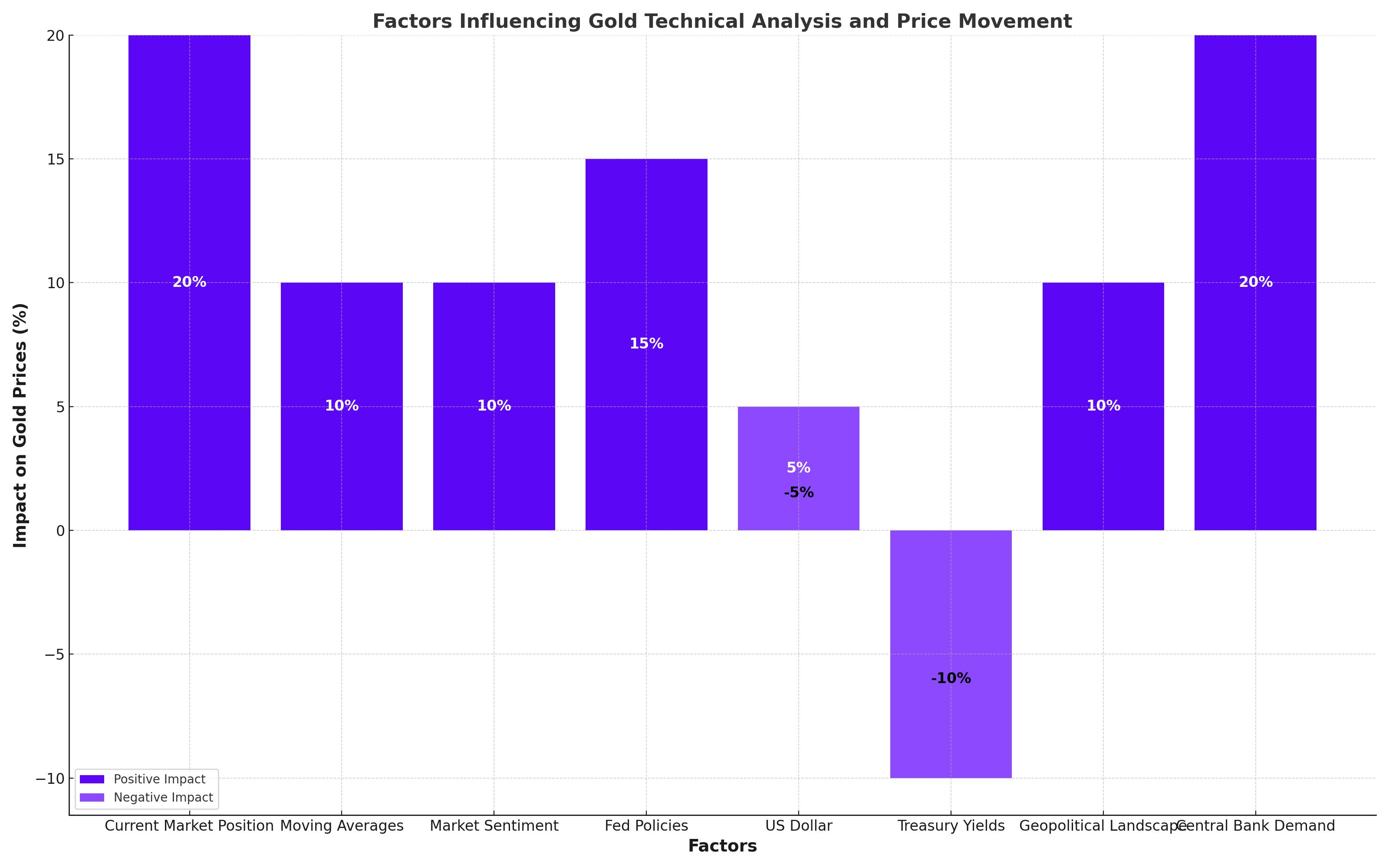

Technical Analysis and Price Movement

Current Market Position

Gold (XAUUSD) has been experiencing a robust upward trend, currently trading around $2,447.95 per ounce. This marks a significant increase, with spot gold prices inching closer to an all-time high, fueled by market dynamics and economic indicators. The recent price action has seen gold pushing past the psychological resistance level of $2,400, suggesting a strong bullish sentiment among investors.

Moving Averages and Indicators

The daily chart of gold shows the price supported by the 20-day and 50-day simple moving averages (SMAs), indicating a well-established upward trend. The Commodity Channel Index (CCI) also suggests that gold is in overbought territory, which might lead to a short period of consolidation before further gains are made. Support levels are currently noted at $2,400 and $2,379 per ounce, respectively, providing a safety net for bullish investors.

Market Sentiment

Retail trader data reveals that 49.86% of traders are net-long on gold, with a short-to-long ratio of 1.01 to 1. The number of traders net-long has decreased by 12.94% from last week, while net-short positions have increased by 16.85%. This contrarian indicator implies that the current sentiment and recent changes strongly suggest a continuation of the bullish trend for gold.

Economic and Political Influences

Federal Reserve Policies

The recent rise in gold prices is closely linked to expectations of interest rate cuts by the Federal Reserve. Slowing inflation in the United States has strengthened bets on a rate cut, with consumer prices falling for the first time in four years in June. Fed Chair Jerome Powell’s recent comments have added to the optimism, indicating that the central bank has greater confidence that inflation is moving towards the 2% target. This dovish stance has bolstered the appeal of gold, a non-yielding asset that benefits in a low-interest-rate environment.

US Dollar and Treasury Yields

The US dollar has experienced fluctuations, rising to 104.2 on safe-haven demand following an assassination attempt on former President Donald Trump. This event has increased political uncertainty and market volatility, pushing the dollar higher. Concurrently, US 10-year Treasury yields rose above 4.2%, rebounding from four-month lows. Markets perceive a Trump victory as potentially inflationary, leading to higher yields and supporting gold prices.

Global Geopolitical and Macroeconomic Landscape

Geopolitical tensions and central bank demand are significant factors supporting gold prices. Gold has traditionally been viewed as a safe-haven asset during times of political and economic uncertainty. The ongoing geopolitical issues and strong central bank buying have provided a solid foundation for gold’s recent rally.

Central Bank Demand

Central bank purchases have played a crucial role in gold’s price dynamics. According to recent surveys, 81% of central banks expect to increase their gold reserves over the next 12 months. This continued demand from central banks, especially in developing economies, has been a key driver of gold prices. For instance, US gold futures gained 0.8% to $2,449.60 an ounce in New York, reflecting the broader trend of increased central bank buying and investor optimism.

Future Outlook and Potential Scenarios

Price Forecast

As gold continues to hover near its all-time highs, the outlook remains bullish. Analysts predict that gold could set a new record high, surpassing the previous peak of $2,450 per ounce. If the current momentum is sustained, further gains towards resistance levels of $2,420 and $2,435 per ounce are likely. However, profit-taking could occur if there is a significant recovery in the US dollar or a calming of geopolitical tensions.

Market Dynamics

The ongoing rally in gold prices is not unexpected. Industry experts have been predicting a fresh record for gold this year, with consultancy Metals Focus and Citigroup forecasting prices between $2,700 and $3,000 per ounce by 2025. The anticipation of US interest rate cuts and increased geopolitical tensions are expected to keep gold’s positive momentum intact.

Investment Strategy

Given the current market conditions, gold presents a compelling investment opportunity. The combination of low-interest rates, geopolitical uncertainty, and strong central bank demand creates a favorable environment for gold. Investors are advised to consider buying gold at every downward level, taking advantage of the support levels at $2,400 and $2,379 per ounce. This strategy aligns with the broader market sentiment and the bullish outlook for gold.

Conclusion

Gold’s current trajectory is supported by a confluence of economic indicators, geopolitical factors, and market dynamics. The precious metal’s strong performance is underpinned by expectations of US interest rate cuts, central bank demand, and global uncertainty. As gold approaches its all-time high, the bullish sentiment remains strong, making it a valuable addition to investment portfolios. The potential for further gains and the safety net provided by strong support levels reinforce gold’s status as a premier safe-haven asset in today’s volatile market environment.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex