Gold Market Analysis: Current Trends and Future Projections

Market Performance and Key Drivers

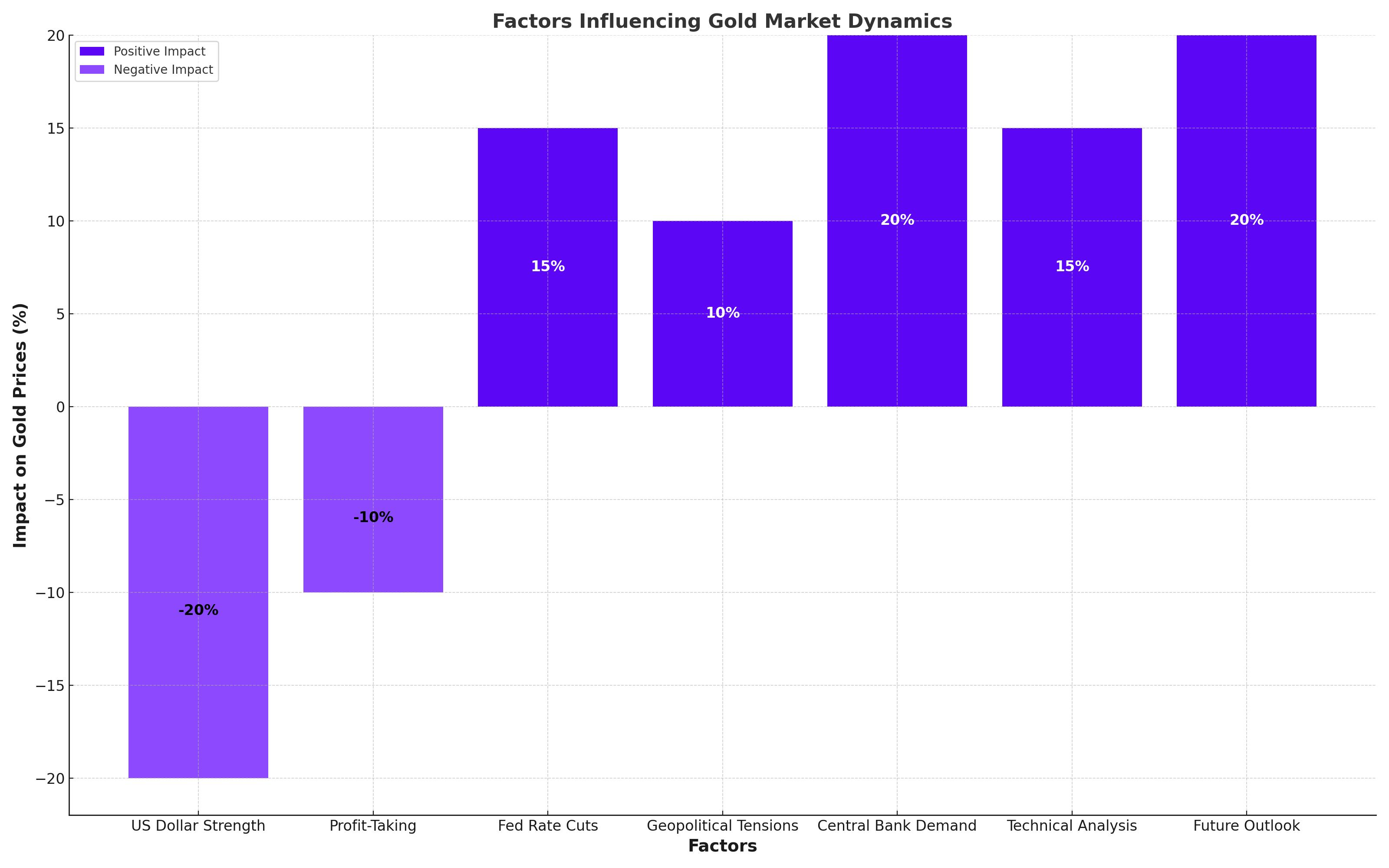

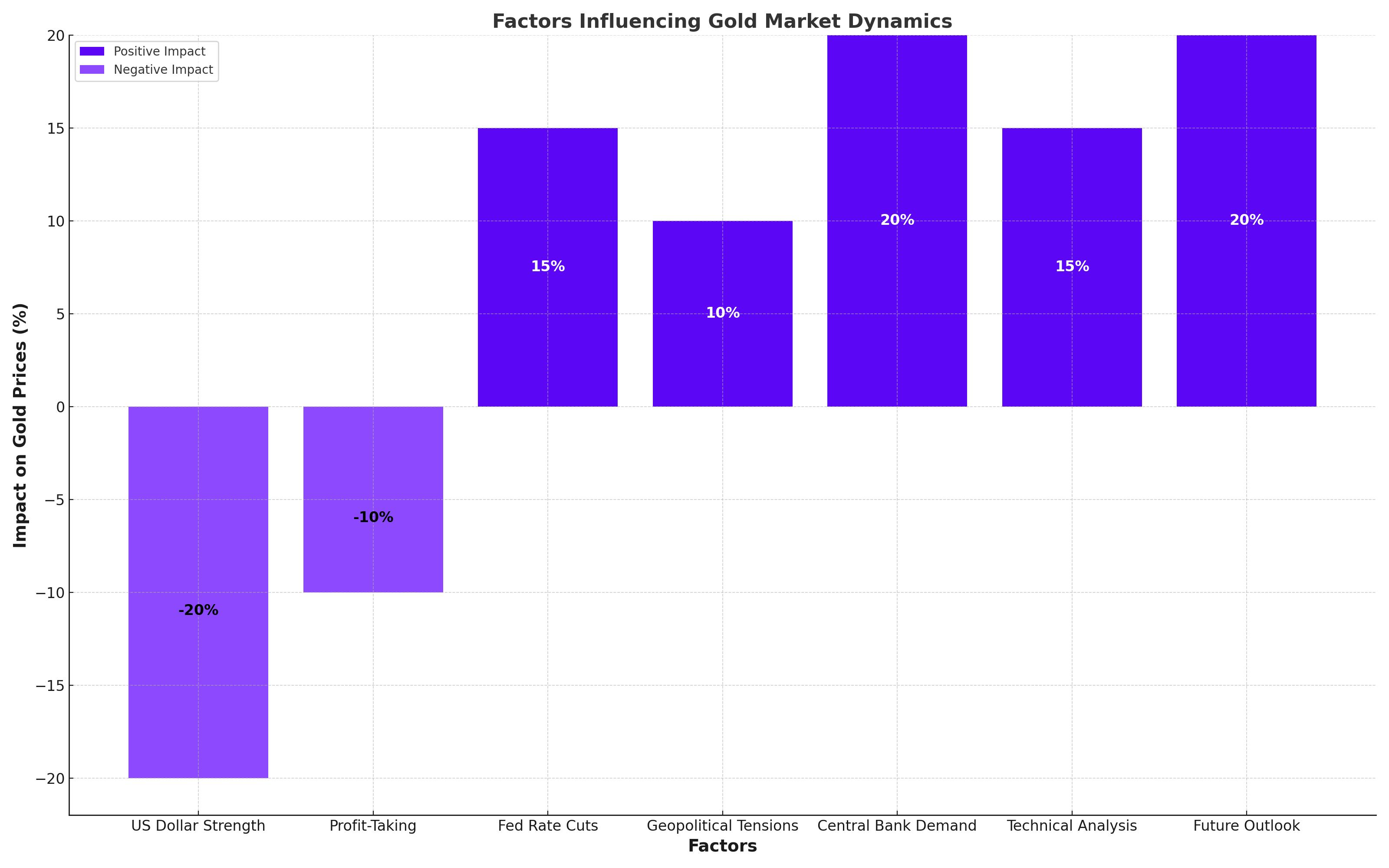

Gold (XAU/USD) has recently extended its losses, with prices falling to around the $2,420 region. This decline comes as the US Dollar (USD) has rebounded strongly, recovering from a four-month low. The strengthening of the USD is a significant factor dragging down the price of gold, alongside some profit-taking after a recent rally that saw gold prices surge by over 6.5% since the beginning of the month.

Economic and Geopolitical Influences

Investor sentiment has been influenced by expectations that the Federal Reserve (Fed) will begin lowering borrowing costs by September, with potential for two additional rate cuts by the end of the year. This anticipation has kept US Treasury bond yields on the defensive, which should typically limit the upside for the USD and support gold prices. However, the broader risk-off mood, coupled with geopolitical tensions, is providing a floor for gold prices, preventing significant declines. Central bank demand and ongoing conflicts in the Middle East and the Russia-Ukraine war further underpin the yellow metal's value.

Technical Analysis

From a technical perspective, gold prices face several key support levels. Immediate support is seen near the $2,413-$2,412 area, followed by the $2,400 mark. A significant support zone lies at the $2,390-$2,385 range. If gold prices break below this support, they could accelerate their decline towards the 50-day Simple Moving Average (SMA) near $2,359-$2,358. Sustained weakness below this level could expose the 100-day SMA around the $2,311 zone, with intermediate support at $2,330-$2,328.

Conversely, resistance is found at the recent high of $2,445. Breaking above this level could see prices climb to the $2,469-$2,470 region. Given the positive oscillators on the daily chart, bulls might aim to retest the all-time high near $2,483-$2,484 and possibly conquer the $2,500 psychological mark.

Future Outlook: Economic and Market Expectations

Analysts expect gold prices to remain strong in the second half of 2024. The World Gold Council notes that bullion prices have strengthened significantly, driven by increased expectations of a shift in monetary policy by the US Federal Reserve. This shift has led to a decline in the USD and bond yields, making gold a more attractive investment.

Gold's performance in 2024 has been notable, with prices appreciating by 16% year-to-date, positioning it as one of the best-performing assets globally. However, high prices have subdued demand in key markets like India, the world's second-largest consumer of gold. Discounts on domestic gold prices compared to international prices have widened sharply, reaching as high as $50/oz.

Long-Term Price Targets

Looking ahead, Citi analysts expect gold to rise to between $2,700 and $3,000 per ounce over the next six to twelve months. This projection aligns with a bullish sentiment driven by economic and geopolitical factors. The recent pullback to around $2,440 could be a precursor to a bullish continuation, provided key support levels hold.

Key Support and Resistance Levels

Initial support levels to watch include the April 12 swing high of $2,431 and the 38.2% Fibonacci retracement at $2,411. The 50% retracement at $2,389, which aligns with a prior interim swing high, is also crucial. A pullback to this zone could offer a buying opportunity for bullish traders. The recent record high of $2,484 marks a long-term target from a large rising ABCD pattern, suggesting further upside potential following a consolidation phase.

Strategic Investment Considerations

Gold's strategic importance as a hedge against inflation and economic instability remains significant. The substantial investments in AI and technological advancements across various industries indicate a continuing trend towards automation and digitalization. However, the physical and intrinsic value of gold provides a tangible asset that can withstand market fluctuations and geopolitical uncertainties.

Conclusion

Gold's recent performance and future prospects underscore its role as a critical safe-haven asset amid economic uncertainties and geopolitical tensions. The combination of a weakening USD, anticipated Fed rate cuts, and strong central bank demand creates a supportive environment for gold prices. While short-term volatility may persist, the long-term outlook for gold remains bullish, with significant upside potential as it continues to attract investors seeking stability and growth in uncertain times.

That's TradingNEWS