Gold Past 2,700$ Nears All-Time High: Geopolitics, Fed Cuts, and Central Bank Buying Propel Rally

With gold prices surpassing $2,700, safe-haven demand surges as geopolitical risks and monetary easing create a perfect storm for the precious metal | That's TradingNEWS

Gold Surges Amid Geopolitical Risks, Rate Cut Bets, and Central Bank Demand

Gold Price Rises on Geopolitical Tensions and Federal Reserve Outlook

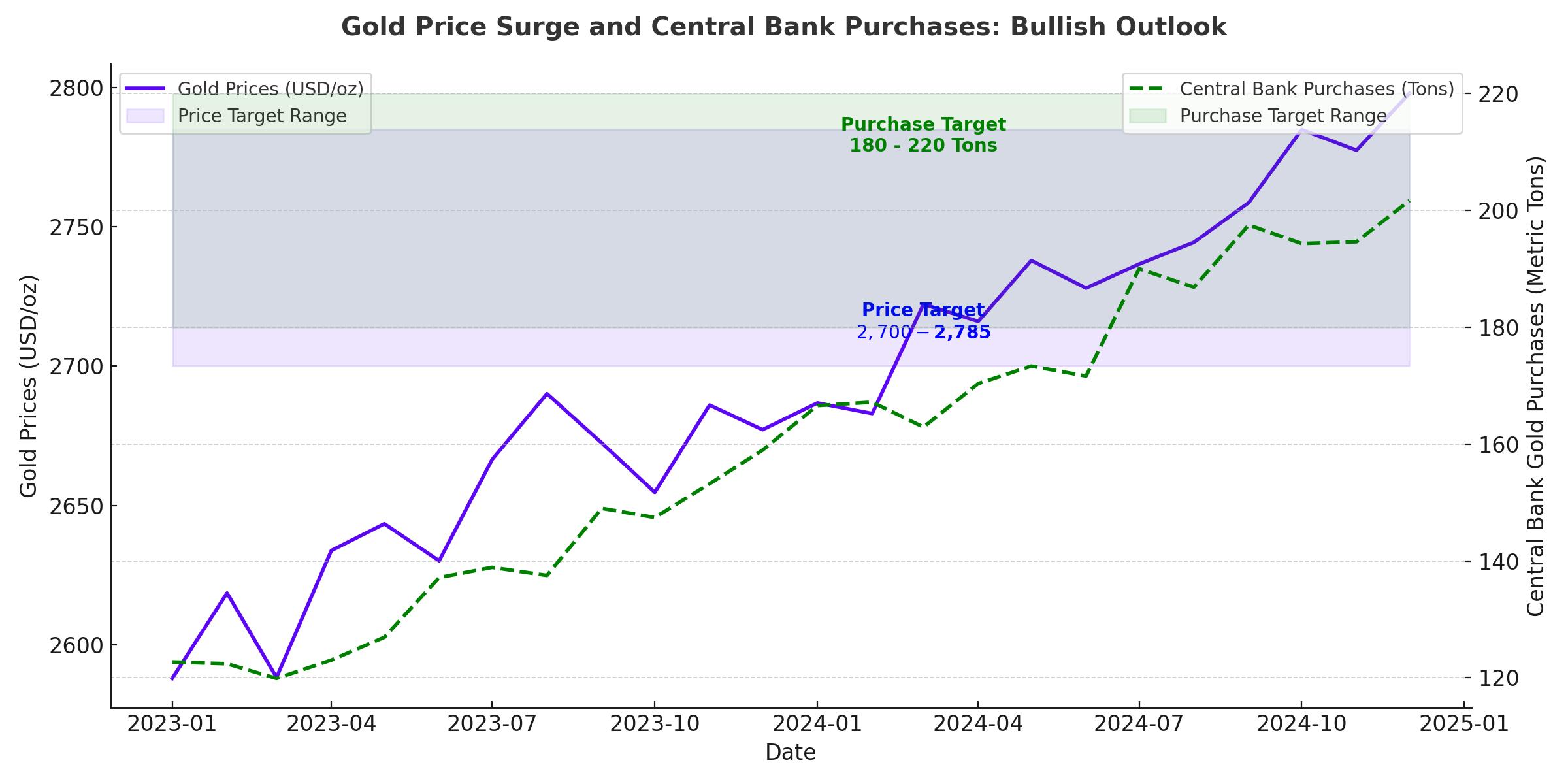

The price of gold (XAU/USD) has demonstrated strong upward momentum in recent weeks, fueled by escalating geopolitical risks, rate cut expectations, and increasing demand from central banks. After beginning December around $2,660 per ounce, gold rallied to touch $2,687 on Tuesday morning, driven by safe-haven buying and supportive monetary policy dynamics. This surge follows a year of remarkable gains, with prices reaching record highs of $2,785.40 in October before moderating slightly.

Key drivers of the recent moves include geopolitical instability stemming from heightened tensions in the Middle East, political turmoil in South Korea, and fears over the implications of U.S. President-elect Donald Trump's proposed trade tariffs. These factors have amplified gold's appeal as a reliable store of value amid growing uncertainty.

China’s Central Bank Resumes Gold Purchases After Six-Month Pause

A major catalyst for gold's recent strength has been China's return to the market. The People's Bank of China (PBOC) reported buying 160,000 fine troy ounces of gold in November, marking its first purchase in six months. This resumption of buying aligns with Beijing's shift toward an "appropriately loose" monetary policy and proactive fiscal measures to support its economy. Analysts believe this renewed interest from the PBOC could sustain higher prices, particularly with additional purchases expected ahead of the Lunar New Year celebrations.

China's monetary policy changes are significant, as they represent a departure from 14 years of "prudent" stances. These developments have underscored the importance of gold as a hedge against currency fluctuations and economic uncertainty.

Fed Rate Cut Expectations Lift Gold as Inflation Looms

The U.S. Federal Reserve's anticipated rate cuts in December have provided further support for gold. According to the CME FedWatch Tool, traders currently price an 85% likelihood of a 25-basis-point cut at the upcoming Federal Open Market Committee (FOMC) meeting. Gold historically thrives in a low-interest-rate environment, where the opportunity cost of holding non-yielding assets diminishes.

Recent U.S. economic data, including the November Consumer Price Index (CPI) due this week, will play a critical role in shaping the Fed's policy trajectory. A weaker-than-expected inflation report would likely reinforce expectations of further rate cuts, boosting gold. However, any upside surprise in CPI figures could cap gains by tempering expectations for additional easing in 2025.

Geopolitical Risks Sustain Safe-Haven Demand for Gold

Geopolitical developments remain a dominant theme supporting gold. In the Middle East, escalating violence, including rebel advancements in Syria and tensions surrounding Russia's nuclear policies, has heightened demand for safe-haven assets. Reports of Israeli forces targeting military positions near Damascus and ongoing conflicts in Gaza have kept the market vigilant, driving inflows into gold as a hedge against global instability.

Simultaneously, Trump's aggressive trade rhetoric, including proposed tariffs on major trading partners such as China and Mexico, has added to the uncertainty. Investors are increasingly concerned about the potential impact on global trade and economic growth, further boosting gold's allure.

Technical Outlook for Gold Prices (XAU/USD)

From a technical perspective, gold's recent breakout above the key $2,650 level has been a significant development. This area now serves as immediate support, with prices consolidating just below $2,700. The next resistance is seen at $2,720, followed by $2,748—a critical level that could pave the way for a retest of the record high at $2,785.

Momentum indicators, including oscillators on the daily chart, point to further upside potential. However, a failure to hold above $2,650 could trigger a corrective move toward $2,625, with the 100-day moving average at $2,590 offering additional support.

Central Bank Buying and ETF Inflows Support Broader Demand

Gold's rally in 2024 has been underpinned by sustained central bank buying. Institutions worldwide added 186 metric tons of gold in Q3 alone, led by Poland with 42 metric tons. This follows significant purchases earlier in the year, including China's acquisition of 22 metric tons in Q1. Central banks view gold as a vital component of their reserves, particularly in an era of geopolitical fragmentation and de-dollarization.

On the institutional side, exchange-traded funds (ETFs) focused on gold have seen renewed interest. The SPDR Gold Shares (NYSE: GLD) and the Sprott Physical Gold Trust (NYSE: PHYS) recorded net inflows, reversing prior outflows. This trend reflects growing investor appetite for the yellow metal amid volatile equity markets and declining bond yields.

Outlook: Can Gold Sustain Its Bullish Momentum?

The outlook for gold remains bullish in the near term, with key drivers such as geopolitical tensions, central bank buying, and Fed rate cuts likely to sustain upward momentum. Immediate resistance at $2,720 will be a critical level to watch, with a breakout paving the way for further gains toward $2,785 and beyond.

However, risks remain. Stronger-than-expected U.S. inflation data or a hawkish shift in Fed policy could temper gains, while profit-taking at elevated levels may lead to short-term volatility. Despite these risks, gold's role as a safe haven and inflation hedge positions it well to remain a favored asset in uncertain times. The balance of risks suggests that gold could continue its ascent, with any dips likely viewed as buying opportunities.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex