Gold Prices Hit Record High

Surging Demand from China and Middle East, Economic Data, and Fed Speculations Drive Gold to New Heights | That's TradingNEWS

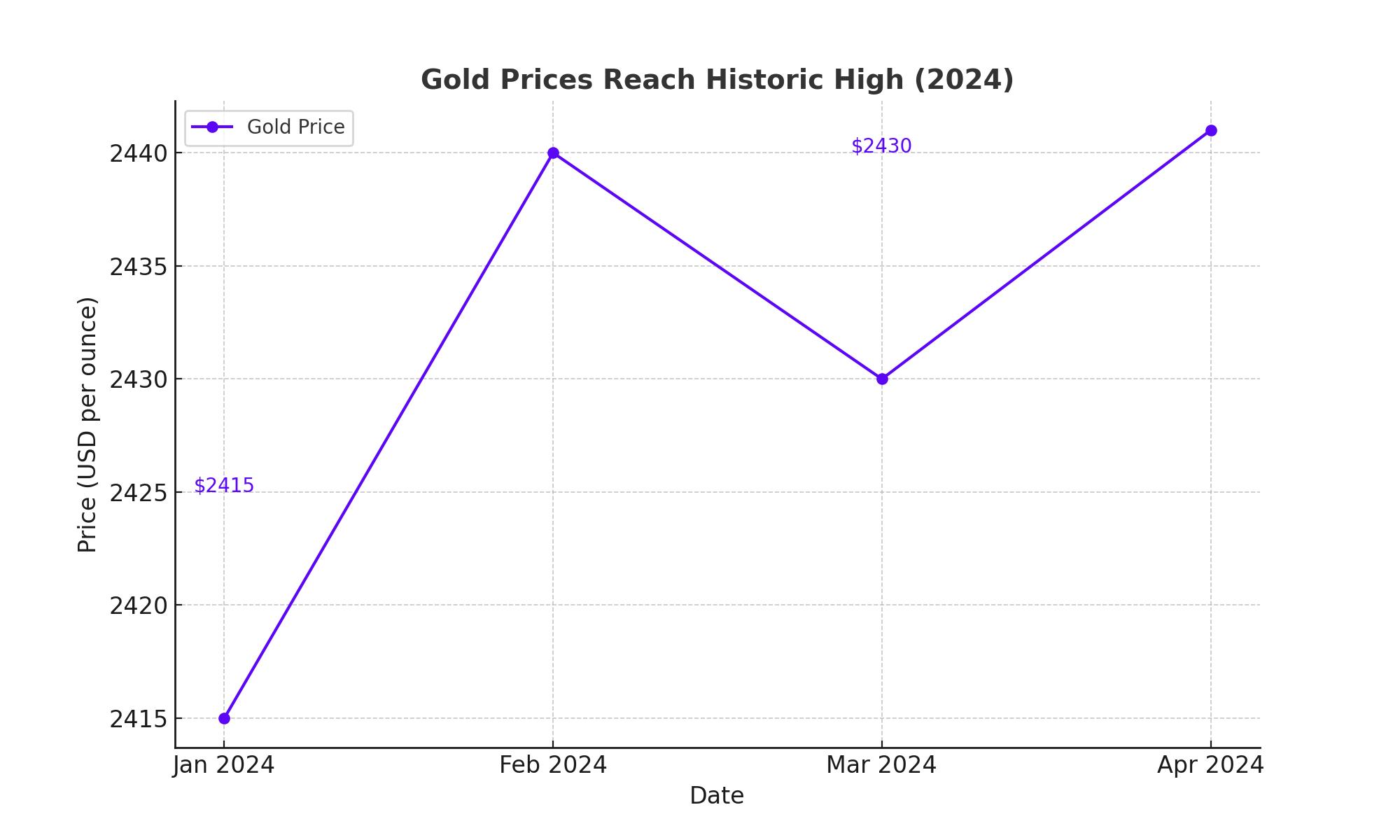

Gold Prices Reach Historic High

Gold prices (XAU/USD) soared to a record high of $2,441 per ounce during early Asian trading hours on Monday. This surge is attributed to renewed hopes for interest rate cuts from the US Federal Reserve (Fed), which traders anticipate might implement two quarter-point cuts this year, likely starting in November.

Geopolitical Tensions and Market Impact

The geopolitical landscape has also played a significant role in this bullish trend. The helicopter crash that resulted in the death of Iranian President Ebrahim Raisi has heightened tensions in the Middle East, contributing to the upward momentum of gold prices. This event follows continuous conflicts in Gaza and the announcement by the Houthis in Yemen to target all ships heading to Israel.

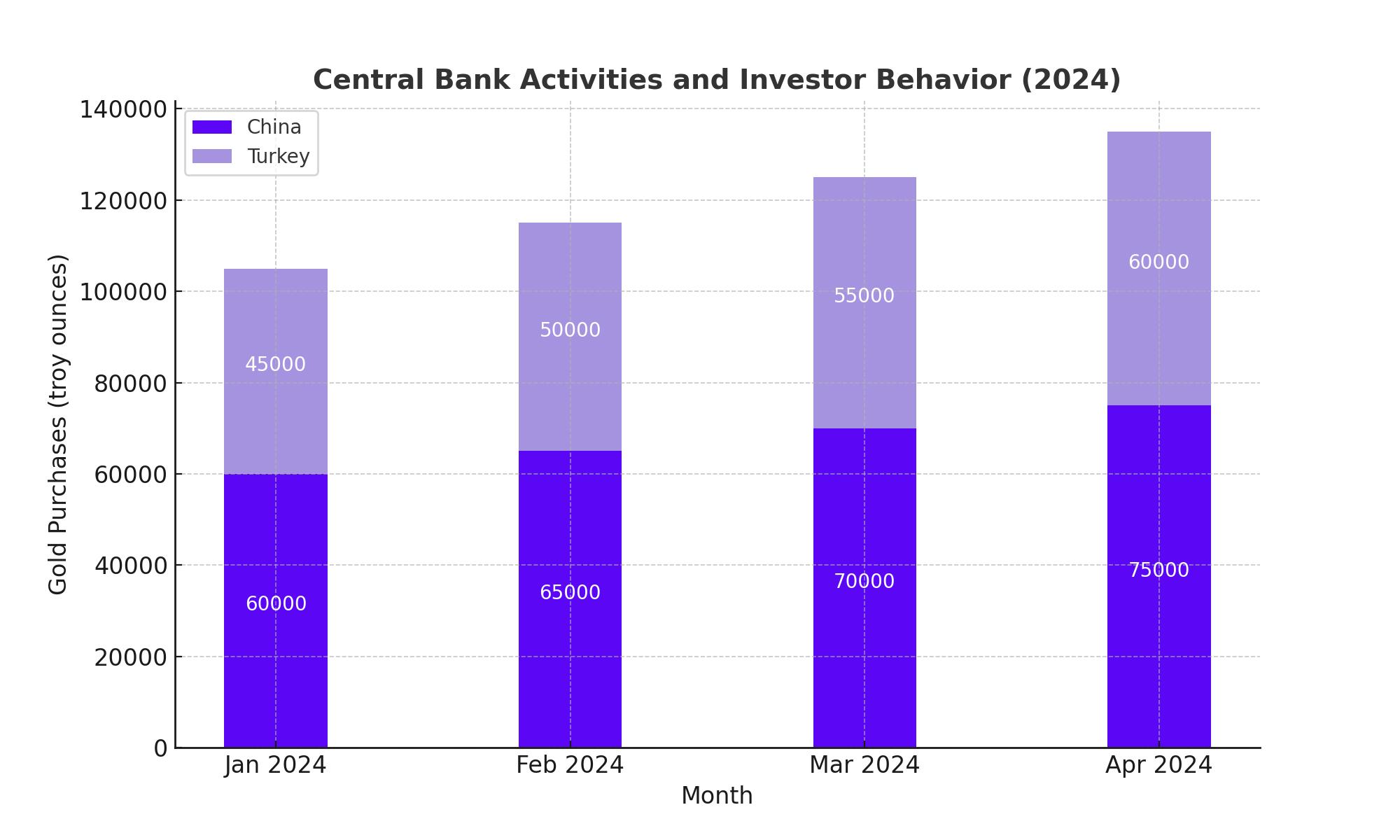

Central Bank Activities and Investor Behavior

Adding to the bullish sentiment, the People's Bank of China (PBoC) purchased gold for the 18th consecutive month in April, acquiring an additional 60,000 troy ounces. This move reflects Chinese investors' preference for gold as a safe-haven asset amid economic uncertainties. Similarly, countries in the Middle East, including Turkey, have ramped up their bullion purchases, further propelling gold prices.

Economic Indicators and Federal Reserve Speculations

Economic data from the US indicating easing inflationary pressures have weakened the dollar, boosting gold prices. The US consumer price index (CPI) rose by only 0.3% in April, falling short of the expected 0.4% and lowering the annual rate to 3.4% from 3.5%. This has sparked optimism about potential interest rate cuts from the Fed, enhancing gold's appeal as a non-yielding asset.

Technical Analysis and Key Levels

Gold prices have seen significant gains over the past two weeks, with a notable 2.33% increase last week, closing at $2,415 on Friday. The recent rise to $2,440 highlights the market's response to favorable economic data and geopolitical risks. Key support and resistance levels to watch include $2,400 and $2,430, respectively. Sustained trading above $2,430 could further accelerate the upward momentum.

Broader Market Dynamics

The rise in gold prices is not isolated but part of a broader trend of increasing commodity prices. China's efforts to de-dollarize ahead of the US elections and its substantial increase in gold reserves underscore this trend. The renminbi's rise to become the fifth most traded currency globally further influences this dynamic.

Future Projections and Analyst Insights

Market analysts are closely monitoring the dollar index, currently at 104.45, and US 10-year bond yields around 4.42%. The anticipation of a future interest rate cut from the Fed, along with prevailing geopolitical risks, continues to bolster gold prices. Analysts highlight that technical indicators like VWAP, Moving Averages, and Bollinger Bands point towards an ongoing upward price movement, despite gold being overbought on most oscillators, including the RSI.

Conclusion

With gold prices hitting new records, the market remains focused on key economic and geopolitical developments. The combination of favorable economic data, central bank activities, and geopolitical tensions creates a robust environment for further price increases in the precious metal. Investors should continue to monitor these factors closely to gauge future market movements.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex