Gold Price Surges Toward $3,100 – Can XAU/USD Keep Climbing or Is a Pullback Ahead?

With gold soaring past $2,900 and eyeing $3,100, is this the breakout moment or a warning sign of a pullback? Will central bank buying and economic fears push gold beyond $3,300? | That's TradingNEWS

Gold Price Surges Toward $3,100 – Will XAU/USD Reach Record Highs?

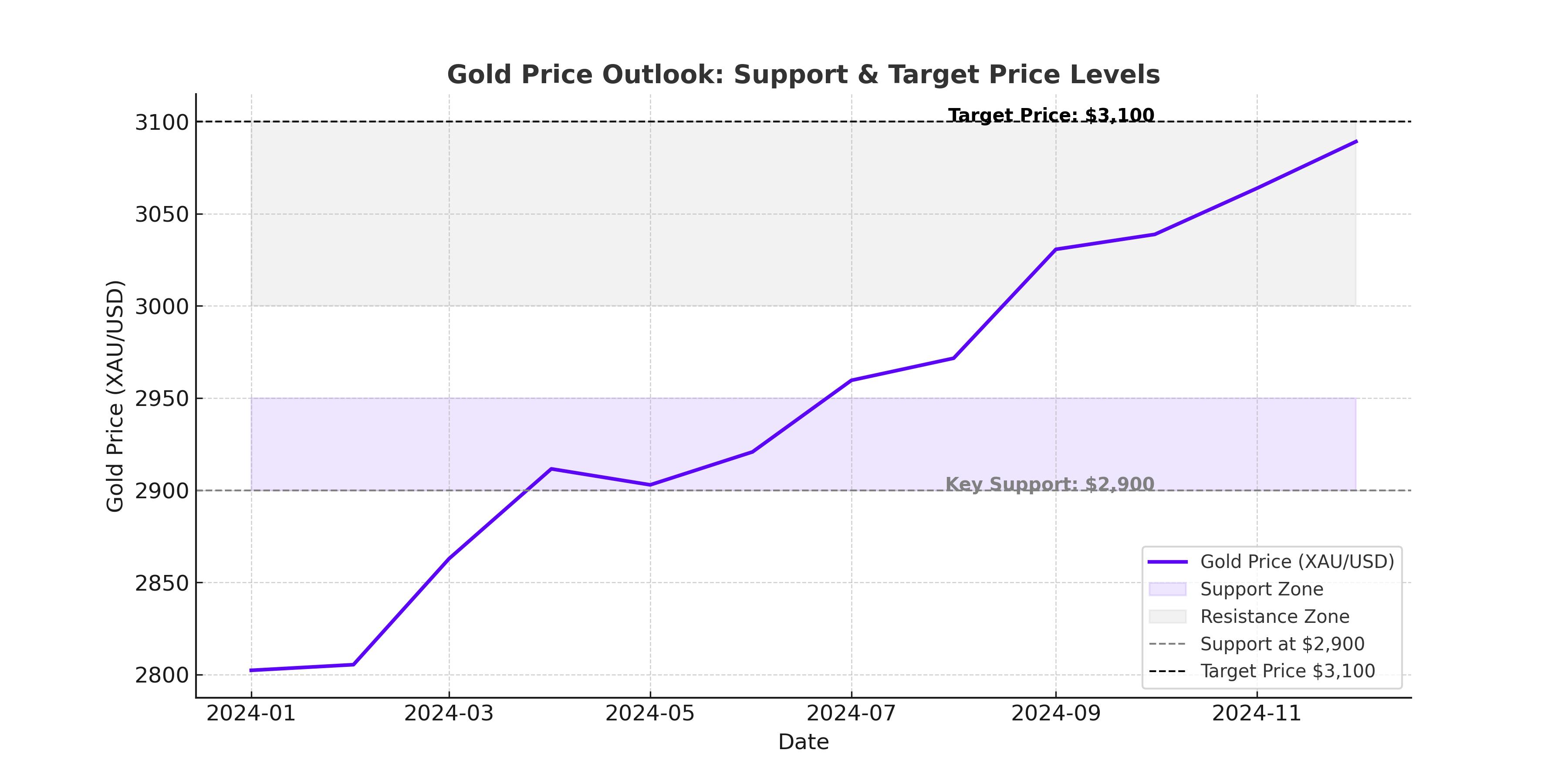

Gold (XAU/USD) has been on a relentless rally, pushing past $2,900 per ounce and eyeing the next major resistance levels. With Goldman Sachs raising its year-end target to $3,100 and a potential speculative surge driving it to $3,300, traders are questioning whether gold's bullish momentum can sustain its historic run. As central bank demand remains elevated and market uncertainty fuels safe-haven buying, is gold still a buy, or are we nearing a peak?

Gold's Bullish Momentum: Key Drivers Behind the Price Surge

Gold has been in a strong uptrend, posting its seventh consecutive weekly gain and solidifying its position as the premier safe-haven asset. XAU/USD is currently trading near $2,933 per ounce, climbing from its February lows of $2,864 and reaching as high as $2,942 last week. Goldman Sachs' latest forecast pushes the year-end target to $3,100, representing a 9% upside from current levels, while UBS believes gold could hit $3,200 before stabilizing.

This rally is driven by multiple factors. Central banks have been aggressively buying gold, with demand surging 54% year-over-year to 333 metric tons following President Trump’s re-election. This aggressive accumulation, especially by emerging-market central banks, has played a critical role in gold’s recent breakout. The World Gold Council reports that annual central bank gold purchases have exceeded 1,000 tons for three consecutive years, representing nearly 29% of total mine supply.

Trump’s Tariffs and Economic Uncertainty Fuel Safe-Haven Demand

Another catalyst behind gold's price surge is growing geopolitical and economic instability. President Trump’s latest tariff proposals on steel, aluminum, and European auto imports have rattled markets, sparking a flight to safe-haven assets. Gold surged over 15% following Trump's election victory and has continued to rally amid fears of escalating trade tensions. Analysts argue that if uncertainty surrounding U.S. economic policy persists, speculative demand for gold could drive prices well beyond $3,100, potentially reaching $3,300 by year-end.

Market volatility has also been exacerbated by concerns over global economic growth. The U.S. Federal Reserve remains cautious on inflation, with Fed officials such as Christopher Waller and Mary Daly emphasizing the need for a restrictive monetary policy stance. The Federal Open Market Committee (FOMC) minutes, set to be released this week, will provide further insight into the Fed’s outlook on interest rates, a key factor influencing gold’s trajectory.

Gold Technical Analysis: Key Levels to Watch

XAU/USD remains in a strong uptrend, but traders must watch for potential resistance at $2,950 and the critical psychological level of $3,000. If gold successfully breaks above these levels, Goldman Sachs' target of $3,100 could be within reach. However, a pullback below $2,900 could expose key support levels at $2,877 (February 14 low) and $2,864 (February 12 low).

On a broader scale, the 20-day and 100-day SMAs are converging near $2,945, suggesting a potential bullish crossover. The Relative Strength Index (RSI) remains elevated but has cooled slightly to 55, indicating that bullish momentum is still intact but slowing. If gold corrects lower, the October 31 swing high at $2,790 will act as a major support zone.

ETF and Mining Stocks Riding Gold’s Bullish Wave

The surge in gold prices has also lifted gold-related equities. Barrick Gold (NYSE: GOLD) has jumped 16% year-to-date, while the SPDR Gold Shares ETF (GLD) has gained 10%. Barrick Gold, in particular, reported its highest net earnings in a decade, with Q4 operating cash flow rising 18% to $1.4 billion and full-year free cash flow reaching $4.5 billion. The company returned $500 million in buybacks and $700 million in dividends last year, reflecting strong capital allocation amid rising gold prices.

Will Gold Hit $3,300 or Face a Major Pullback?

While the long-term outlook for gold remains bullish, traders must consider potential risks. Some strategists warn of short-term exhaustion, given the rapid ascent in gold prices. If the Federal Reserve signals a less dovish stance or global economic uncertainty diminishes, gold could face profit-taking pressure. Additionally, a Russia-Ukraine ceasefire could reduce safe-haven demand, potentially limiting upside momentum.

However, if economic uncertainty remains elevated and central bank gold purchases continue at record levels, the precious metal could break through $3,100 and test $3,300. Goldman Sachs has already warned that "policy uncertainty, including tariff fears, could push speculative positioning even higher."

Final Verdict: Is Gold Still a Buy?

Gold remains a strong buy for long-term investors looking to hedge against inflation, geopolitical risks, and economic uncertainty. The combination of strong central bank demand, a weakening dollar, and rising market volatility continues to support higher prices. With Goldman Sachs and UBS both raising their targets above $3,100, the risk-reward ratio remains favorable for bulls.

However, traders should remain cautious of potential pullbacks near key resistance levels. If gold clears $3,000, it could open the door for an extended rally toward $3,200-$3,300. But failure to hold above $2,900 could trigger a short-term correction, providing a better entry point for investors looking to capitalize on gold’s long-term bullish trajectory.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex