Gold Prices Climb as Inflation Data Fuels Investor Optimism

Analyzing the recent peak and the strategic outlook as softer inflation expectations influence Federal Reserve policy decisions | That's TradingNEWS

Gold's Market

Gold prices recently experienced a notable rally, reaching a peak of $2,341.51 per ounce. This surge was largely driven by the latest release of the US Consumer Price Index (CPI) data, which indicated a more subdued inflation environment than expected. The CPI for May showed a year-over-year increase of just 3.3%, below the anticipated rise, and remained unchanged month-over-month. This is a critical piece of economic data because it helps set expectations around the Federal Reserve's monetary policy moves, which are closely linked to gold’s price movements.

Analysis of Current Gold Price Dynamics

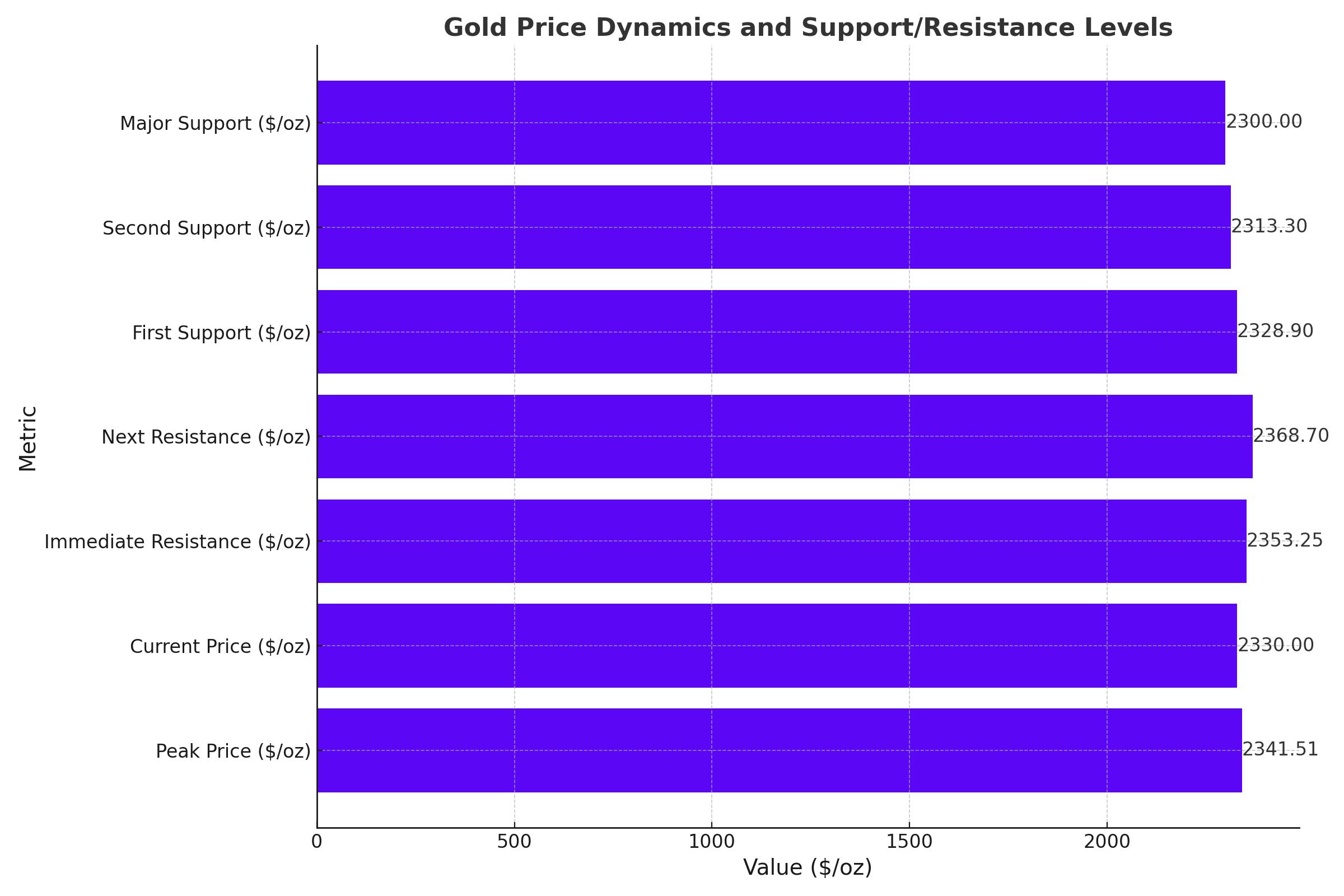

The reaction in the gold market to the CPI figures was swift, with prices peaking shortly after the data release. However, as the trading day progressed, gold prices slightly retreated from their highs, stabilizing above the $2,330 mark. This pullback was due in part to an uptick in demand for higher-yielding assets as equity markets opened, which often inversely affects gold prices.

The core CPI, which excludes volatile food and energy prices, also reported a subdued increase of 0.2% for the month, contributing to the scenario where inflation pressures appear to be moderating. This is particularly significant for gold, as it enhances its appeal as a hedge against inflation.

Federal Reserve's Influence on Gold

Gold prices are intricately linked to the Federal Reserve's interest rate policies. With the CPI data suggesting softer inflation, the market sentiment quickly shifted to anticipate a more dovish stance from the Fed. Prior to the CPI release, the likelihood of a rate cut by September was pegged at about 47%. Post-release, this probability jumped to 63%, reflecting heightened expectations that the Fed might ease monetary policy sooner if inflation continues to show signs of cooling.

The Fed's rate decisions are pivotal for gold because lower interest rates decrease the opportunity cost of holding non-yielding assets like gold. Conversely, higher rates typically boost yields on fixed-income investments, making gold less attractive.

Technical Outlook and Price Support Levels

From a technical perspective, the short-term outlook for gold has become increasingly bullish following the CPI release. The immediate resistance on the daily chart is observed around $2,353.25. Should gold break past this level, it could trigger further buying that tests the next resistance at $2,368.70.

Support levels are crucial for understanding where buyers might step back in if prices dip. The first significant support is found at $2,328.90, followed by $2,313.30. A more substantial support is set at $2,300.00, which if breached could signal a bearish reversal or deeper correction.

Market Sentiment and Strategic Considerations

The market's response to inflation data and anticipated Fed actions suggests a bullish sentiment in the near term for gold. Investors and traders will be closely watching the upcoming Federal Open Market Committee (FOMC) meeting for further clues. Any indication from the Fed that rate cuts are imminent could reinforce gold's bullish trend.

For investors, the strategic implication is clear: monitor Fed communications closely and be prepared for volatility around major economic releases. Gold remains a critical asset in diversified portfolios, not only as an inflation hedge but also as a safe haven during periods of financial and geopolitical uncertainties.

Overall, the dynamics surrounding gold are complex, influenced by macroeconomic data, central bank policies, and global market sentiment. Staying informed and responsive to these factors is key to effectively navigating the gold markets.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex