Gold Price Trends as XAU/USD Faces Market Pressures Amid Broad Sell-Off

Gold prices, represented by XAU/USD, saw a notable decline on Monday, dropping by 1.3% to $2,736.75 per ounce as of 1:49 PM ET. This drop comes on the heels of gold nearly reaching its all-time high of $2,790 on Friday. U.S. gold futures also settled lower, down 1.5% at $2,738.40 per ounce. The recent downturn is largely driven by a broader market sell-off, heightened by developments in Chinese AI technologies and concerns over the Federal Reserve's policy direction.

Gold Retreats Amid Global Sell-Off

The sharp pullback in gold aligns with declines across equity markets, with major indices like Nasdaq futures plunging as much as 4.4%. Investors are witnessing a liquidity-driven sell-off, as market participants liquidate assets to cover margin calls on over-leveraged positions. This broader equity sell-off triggered a drop in U.S. Treasury yields, with the 10-year yield declining to a one-month low of 4.5%, and the Dollar Index (DXY) sliding to a one-month low of 107.16.

Gold’s safe-haven appeal remains intact despite this short-term dip, as geopolitical risks and inflation concerns continue to loom large. Analysts suggest that the recent sell-off was exacerbated by profit-taking after gold’s stellar performance in 2024, during which it gained 26.6%—its best year in over a decade.

The Role of Central Banks in Gold's Trajectory

Central bank policies are a critical factor shaping gold prices. This week, the Federal Reserve is widely expected to maintain its current interest rate range of 4.25%-4.50%, with odds of no change standing at 99.5% according to the CME FedWatch tool. Market participants will closely monitor Fed Chair Jerome Powell’s comments for insights on future rate adjustments, particularly as inflation has moderated to 2.8% in November, down from its 40-year high in 2022.

Across the Atlantic, the European Central Bank (ECB) is expected to cut its deposit facility rate by 25 basis points to 2.75% during its policy meeting on Thursday. While rate cuts typically weigh on the euro, they could indirectly boost gold as investors seek refuge from potential economic instability in the Eurozone.

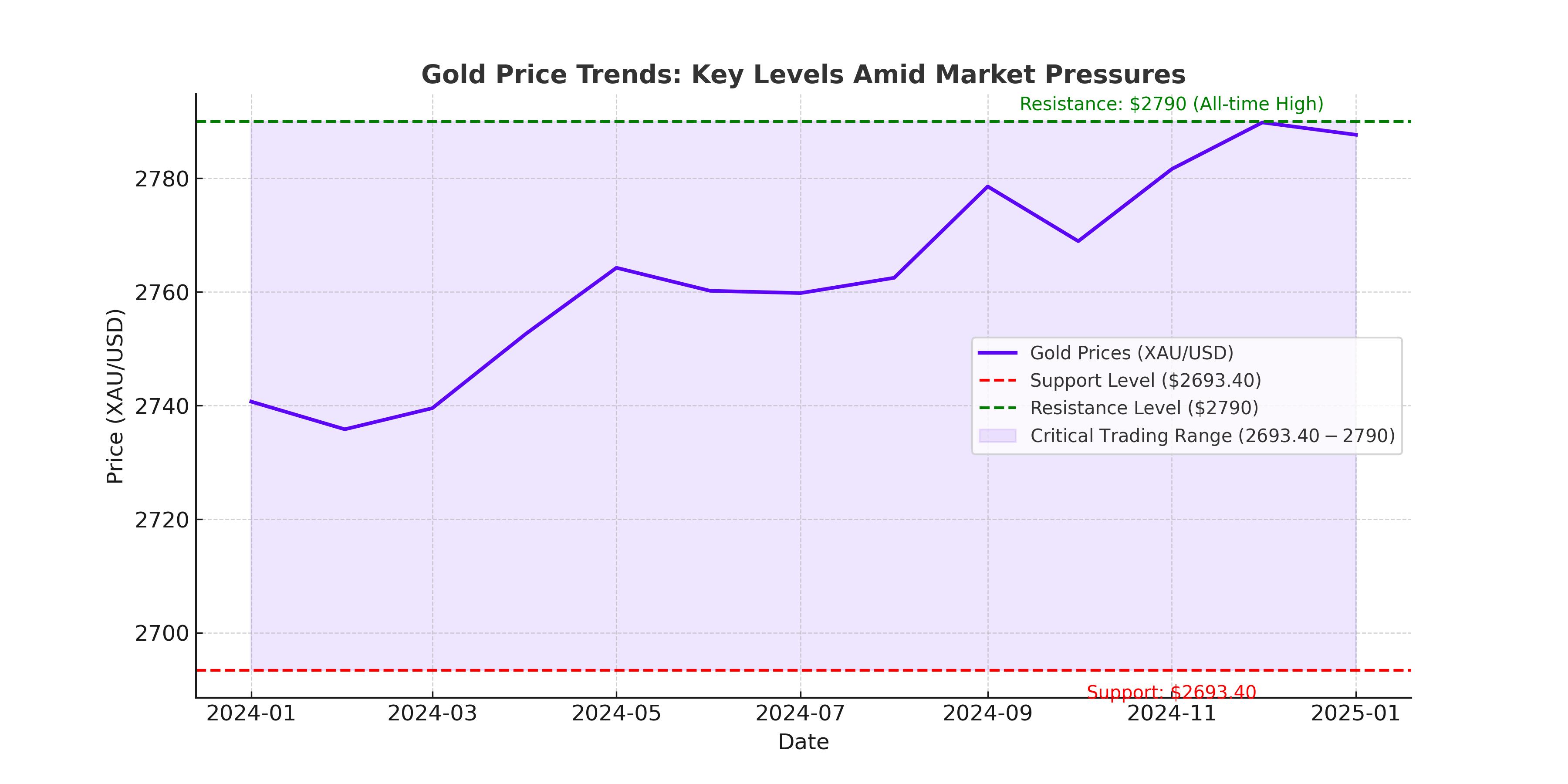

Technical Analysis of XAU/USD

Gold’s technical outlook shows key support and resistance levels that could dictate its near-term trajectory. Spot gold is currently trading near $2,736, with immediate support at $2,693.40. A failure to hold this level could push prices lower, potentially testing $2,660. On the upside, a breakout above $2,790 could pave the way for gold to reach the psychological milestone of $3,000 per ounce.

The 50-day EMA at $2,735 is a critical support level, with the 200-day EMA at $2,710 acting as a broader trendline. Bullish sentiment remains strong, as evidenced by the RSI staying above the 50-mark, signaling room for further upside.

Global Events Impacting Gold

In addition to central bank policies, geopolitical developments are adding to gold’s volatility. President Trump’s recent tariff threats against Canada, Mexico, and the EU, coupled with trade negotiations with Colombia, are fueling market uncertainty. These tariffs, set to take effect on February 1, 2025, could stoke inflationary pressures, indirectly supporting gold as a hedge.

Meanwhile, in China, gold prices on the Shanghai Gold Exchange slipped to ¥646 per gram, translating to a $6 per ounce premium over London prices. This shift comes as Chinese markets prepare for the Lunar New Year holiday, typically a period of heightened gold demand.

ETF Flows and Investment Trends

Gold-backed ETFs are experiencing mixed activity. The SPDR Gold Shares ETF (GLD) recorded a significant outflow of 2.7% last week, its largest in 30 months, as prices approached all-time highs. Similarly, the iShares Gold Trust (IAU) saw a 0.6% decline. Conversely, silver ETFs such as the iShares Silver Trust (SLV) posted smaller weekly losses of 0.9%, reflecting investor caution across precious metals.

Despite these outflows, central bank buying remains a cornerstone of gold demand. In 2024, central banks added nearly 1,200 metric tons of gold to their reserves, marking a record year of accumulation. Analysts expect this trend to persist in 2025, driven by diversification efforts and geopolitical tensions.

The Path Ahead for Gold

Gold’s near-term outlook hinges on several key factors, including Federal Reserve and ECB decisions, geopolitical developments, and broader market sentiment. If the Fed maintains its dovish stance and global uncertainties persist, gold could reclaim its upward momentum, with $3,000 per ounce remaining a viable target. However, any signs of hawkishness from central banks or stabilization in equity markets could cap gold’s gains.