Gold Price Analysis: XAU/USD Poised Between Bearish Pressures and Bullish Momentum

Gold Struggles Amid a Strong US Dollar

Gold (XAU/USD) remains in a tight consolidation zone, struggling to recover from the previous session’s steep decline. As of today, gold is trading near $2,740 per ounce, marginally up from its multi-day low but significantly weighed down by a stronger US Dollar. Gold futures for February delivery have also shown modest gains, hovering around $2,770.22 per ounce. Despite these minor rebounds, gold’s path remains constrained by the resurgent USD, which surged 0.5% during Asian trading, driven by global tech sell-offs and expectations for upcoming Federal Reserve actions.

The USD’s strength has been fueled by U.S. President Trump’s reiteration of tariff hikes, signaling potential inflationary impacts. The Dollar Index climbed further as Trump threatened a universal tariff policy with rates potentially escalating up to 20%. This dollar strength impacts gold negatively, as it increases the opportunity cost for holders of other currencies, thereby lowering demand for the metal. The dollar’s rise has similarly affected other metals, with platinum futures down by 0.7% at $954.75 per ounce and silver futures inching lower to $30.378.

Federal Reserve’s Decision Looms Over XAU/USD

The Federal Reserve’s two-day meeting, beginning today, will likely determine the next leg of gold’s movement. Market sentiment points to the Fed holding rates steady within the 4.25%-4.50% range. However, all eyes are on the accompanying statement, as speculation of dovish commentary could reignite gold’s safe-haven appeal. Trump's recent demands for rate cuts, paired with ongoing concerns over inflation, will add layers of complexity to the Fed's outlook.

Despite gold’s resilience amid geopolitical uncertainties and trade concerns, it faces challenges from rebounding US Treasury yields. The 10-year benchmark bond yield has recovered from its one-month low, reducing gold’s appeal as a non-yielding asset. Nonetheless, if the Fed signals future rate cuts, it could provide the much-needed trigger for a bullish breakout in XAU/USD prices.

Gold’s Position as a Hedge Against Uncertainty

Gold continues to exhibit its traditional role as a safe-haven asset, bolstered by inflationary fears stemming from Trump’s tariff policies. His plans to impose tariffs on pharmaceuticals, computer chips, and steel have triggered concerns over potential trade wars, which typically increase gold's appeal. As such, XAU/USD remains positioned to benefit from heightened economic uncertainty. The Consumer Confidence Index recently dropped to 104.1 from December's 109.5, reflecting weaker economic optimism and potentially boosting gold’s demand as a protective investment.

In the broader context, geopolitical tensions and DeepSeek’s disruptive AI developments have added volatility to equity markets. The sell-off in technology stocks further highlights the metal’s defensive allure, although the current strength of the dollar continues to cap significant upside movements.

Technical Analysis: Key Levels to Watch for XAU/USD

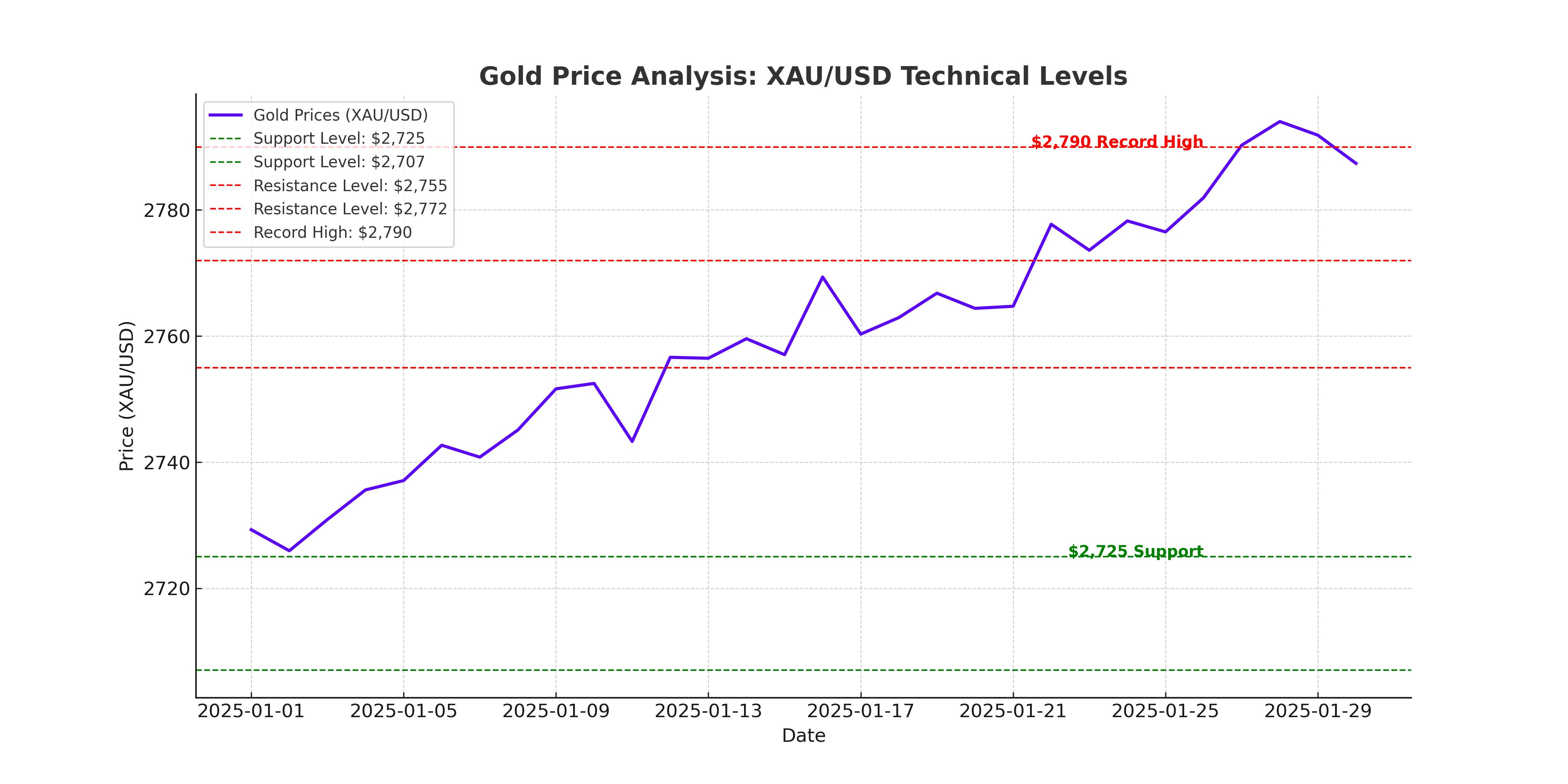

Gold’s technical picture highlights crucial levels that will determine its trajectory. On the downside, immediate support is seen at $2,725–$2,730, aligning with the 23.6% Fibonacci retracement level of the December-January upward trend. A breach of this support could expose the metal to further declines, targeting $2,707 and $2,684, the latter representing the 50% Fibonacci retracement level. However, gold has thus far maintained resilience above these levels, indicating underlying bullish sentiment.

On the upside, immediate resistance is pegged at $2,755–$2,757, followed by $2,772 and the critical $2,790 level—October’s record high. A decisive break above $2,790 would pave the way for a push toward the psychological $3,000 mark, a target widely anticipated by analysts in light of inflationary and geopolitical headwinds. Oscillators, such as the RSI, suggest that momentum remains moderately supportive, with the indicator holding above 50 but failing to signal overbought conditions.

Global Market Dynamics: Weighing on Gold Prices

The global macroeconomic backdrop continues to play a significant role in shaping gold's price dynamics. Weak factory activity in China and the uncertain demand outlook for industrial metals have spilled over into broader commodity markets, with copper and platinum prices retreating. In addition, the introduction of Trump’s emergency 25% tariffs on Colombian imports underscores the administration’s protectionist stance, likely reinforcing the inflation narrative and supporting gold prices in the long term.

Meanwhile, the International Monetary Fund (IMF) revised its global growth forecast downward, citing risks from escalating trade tensions and slowing consumer confidence. These factors create a conducive environment for gold, even as short-term pressures from a strengthening dollar and rebounding yields weigh on its immediate outlook.

Gold Price Forecast and Decision

Gold’s near-term trajectory depends heavily on central bank actions this week. The Federal Reserve’s commentary, particularly regarding future rate cuts, will play a decisive role. Similarly, the European Central Bank’s likely rate reduction to 2.75% will impact the EUR/USD pair, indirectly influencing gold prices. Given the current market setup, gold’s path of least resistance appears tilted to the upside, contingent on dovish central bank signals and escalating geopolitical tensions.

XAU/USD currently holds strong long-term potential for further gains. The metal’s ability to stabilize above $2,725 and push toward $2,790 would signal a continuation of the bullish trend, with $3,000 in sight. Investors should closely monitor key levels and global economic indicators as they navigate the unfolding narrative surrounding gold. Based on current conditions and the supportive macro environment, XAU/USD is poised as a "buy" for long-term gains, with downside risks mitigated by persistent geopolitical and inflationary pressures.