Gold Prices Soar to Record Highs Amid Global Tensions

Understanding the Drivers Behind Gold's Surge to $2,450 per Ounce | That's TradingNEWS

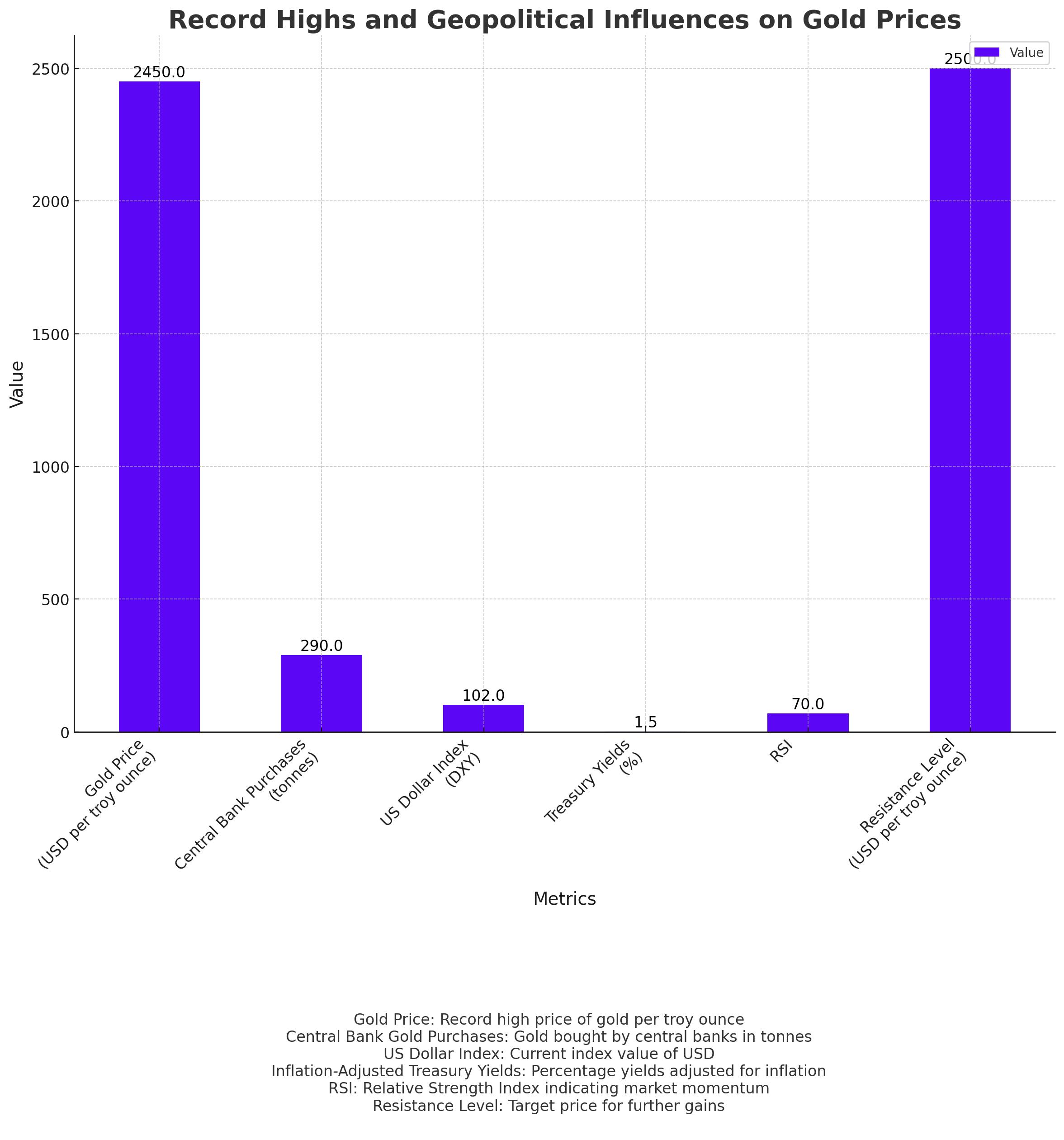

Record Highs and Geopolitical Influences

Gold prices reached a record high of $2,450 per troy ounce on Monday, reflecting a 25% gain since early October. This surge has been driven by geopolitical tensions, particularly between the US, China, and Russia. The recent commitments by Chinese leader Xi Jinping and Russian president Vladimir Putin to counteract US influence have further destabilized global markets, pushing investors toward the safe haven of gold.

Central Bank Hoarding and Market Dynamics

Central banks have significantly increased their gold reserves since 2022, aiming to reduce reliance on the US dollar amid Western sanctions. Notably, China purchased 290 tonnes of gold in the first quarter of 2024, marking the largest early-year acquisition recorded. This aggressive buying spree followed the freezing of approximately half of Russia's $600 billion reserves by the US after the invasion of Ukraine.

Divergence from Traditional Drivers

Despite the usual correlation between gold prices, the US dollar, and inflation-adjusted Treasury yields, recent trends have shown a disconnect. Chris Forgan, multi-asset portfolio manager at Fidelity, attributes this to unprecedented central bank purchases and shifting consumer preferences, particularly in China, where real estate and equity markets have disappointed.

Gold's Global Appeal and Macroeconomic Factors

Gold's appeal extends beyond Western markets. Data from the World Gold Council (WGC) indicates that gold exchange-traded funds (ETFs) saw net outflows in the first quarter of 2024, with the epicenter of demand shifting to Asia. The continuing geopolitical risks and expectations of US interest rate cuts have bolstered gold's position as a hedge against economic instability.

Resilient Demand Amid Volatility

Despite a brief pullback from its high, gold's outlook remains bullish. Analysts suggest that softer US inflation data could lead to Federal Reserve interest rate cuts, enhancing gold's attractiveness as bond yields fall. The Relative Strength Index (RSI) for gold remains in the bullish zone, indicating strong support levels that could pave the way for further gains.

Rising Geopolitical Risks

Middle East tensions have further fueled gold's rally. The death of Iran's President Ebrahim Raisi in a helicopter crash and attacks on oil tankers in the Red Sea have heightened geopolitical uncertainties. These events, combined with the ongoing conflicts in Ukraine and the Middle East, underscore gold's role as a safe haven asset.

Central Bank Strategies and Market Outlook

Central banks, particularly in Asia, continue to play a crucial role in the gold market. While some, like Uzbekistan's central bank, have sold gold to capitalize on high prices, others are increasing their reserves. Uzbekistan's central bank sold 10.9 tonnes of gold in March and 11.8 tonnes in February, following significant sales in 2022.

Technical Analysis and Future Projections

Gold's technical outlook remains positive. The precious metal maintains its upward trend, supported by the 100-period Exponential Moving Average (EMA) and a bullish RSI. Analysts predict that breaking above the $2,450 resistance level could lead to new highs, with the next target around $2,500.

Gold's Strategic Importance

For many investors, gold remains a critical asset for wealth preservation amid growing global risks. Fund managers like Alex Chartres of Ruffer emphasize the importance of owning assets that governments cannot print, such as gold, especially in an era of high inflation and financial repression.

Conclusion

Gold's recent performance highlights its enduring value as a hedge against geopolitical and economic uncertainties. With central banks and consumers driving demand, and global tensions showing no signs of easing, gold is likely to remain a cornerstone of diversified investment portfolios.

Read More

-

SCHD ETF at $27.64: High Dividend, Low Multiple and a 2026 Comeback Setup

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Trade Near Cycle Lows While $1.25B Flows and $1.87 XRP Position for Q1 2026

28.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps From $3.47 to $3.88 as NG=F Tracks Cold Weather and LNG Flows

28.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY 2026 Price Forecast: Dollar–Yen Near 160.60 With BOJ Shift Threatening Carry Trade

28.12.2025 · TradingNEWS ArchiveForex