Gold Rockets to $2,704 Amid Inflation Buzz and Fed Rate Cut Hopes

XAU/USD nears $2,721 resistance as inflation data and Fed decision drive market action. Could $2,790 all-time highs be next? | That's TradingNEWS

Gold Price Surges Amid Market Anticipation, Inflation Data, and Geopolitical Dynamics

Gold’s Rally and Key Resistance Levels

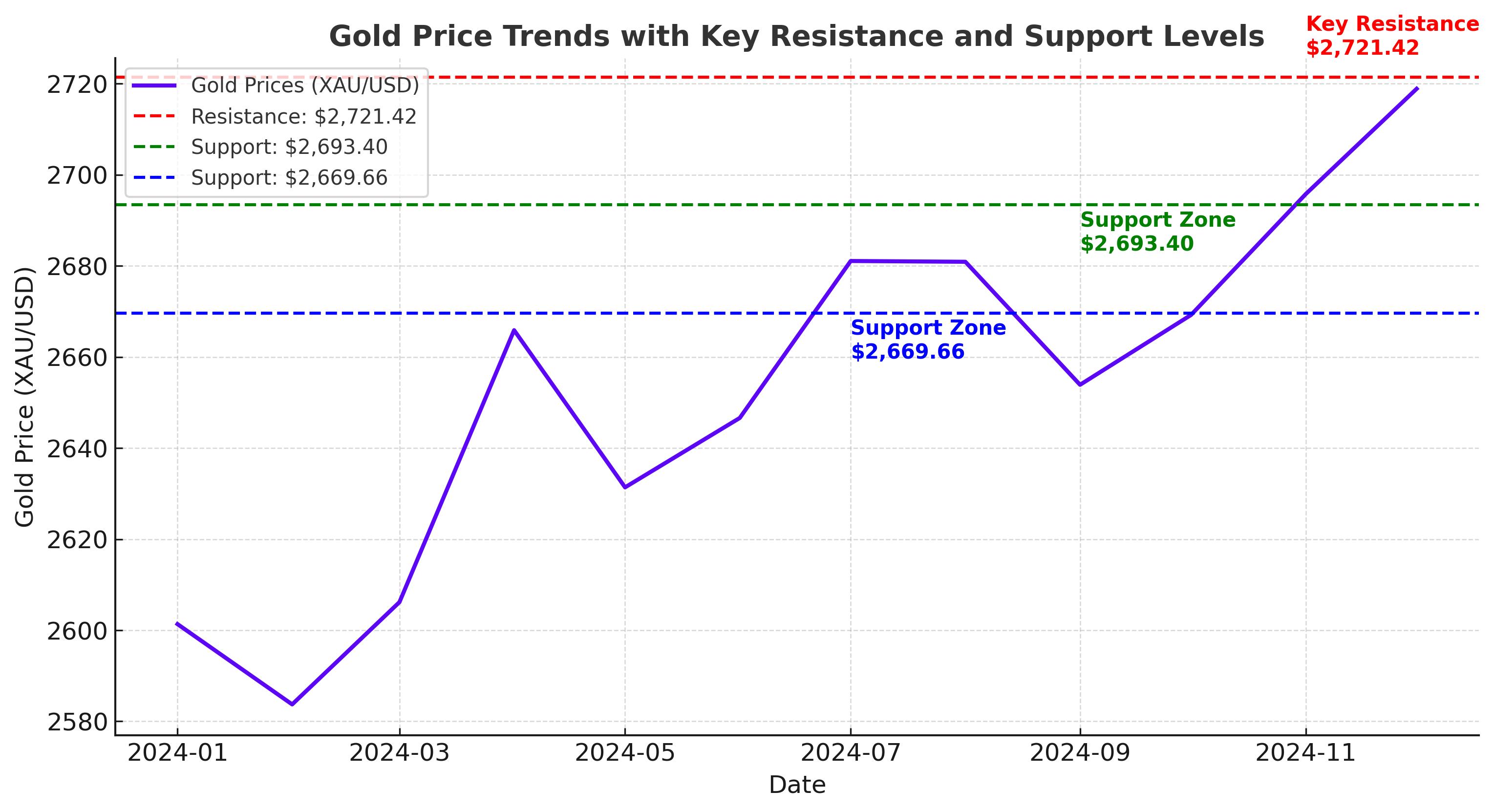

Gold prices surged, with XAU/USD reaching $2,704.45, nearing the critical resistance at $2,721.42. This marks a two-week high, signaling bullish momentum as traders await crucial U.S. inflation data and the Federal Reserve’s December 18 rate decision. Earlier in the session, gold broke above the pivotal Fibonacci resistance at $2,693.40, further fueling optimism. However, the retreat from $2,704 underscores the importance of maintaining above $2,693 as a key level for sustained upward movement. Failure to hold this level risks a pullback to the 50-day moving average at $2,669.66 or further to the $2,663.51 retracement zone.

Inflation and Fed Expectations Shape Market Dynamics

Inflation figures are at the center of market focus. Analysts project a monthly rise of 0.3% in the Consumer Price Index (CPI) and an annual increase of 3.3%. Should inflation align with expectations, it will bolster the market’s 86% probability of a 25-basis-point rate cut by the Federal Reserve next week, according to the CME Group’s FedWatch Tool. Such dovish signals could solidify gold’s appeal, especially as the Federal Reserve’s 2025 outlook remains a pivotal factor for market sentiment. Conversely, an inflation surprise to the upside could dampen these expectations, strengthening the dollar and pressuring gold prices.

Geopolitical Developments and Central Bank Activity

Geopolitical tensions, particularly the regime change in Syria, have bolstered gold's safe-haven demand. Reports of renewed gold purchases by China’s central bank add another bullish layer to the metal’s outlook. Speculation surrounding China’s monetary policy easing and targeted stimulus measures also underpins expectations of stronger demand for the yellow metal. However, the resurgent U.S. dollar—recently trading near a two-week high of 106.36—poses headwinds, especially if inflation data delays the Fed’s anticipated rate cuts.

Technical Outlook and Goldman Sachs’ 2025 Forecast

The technical setup shows a cautiously optimistic outlook for XAU/USD, with immediate resistance at $2,721.42 and the all-time high of $2,790.17 in sight if bullish momentum persists. On the downside, support remains strong at $2,693.40, with further buffers at $2,669.66 and $2,663.51. Goldman Sachs’ long-term projection of $3,000 per ounce by the end of 2025 underscores the metal’s bullish fundamentals, though this target depends heavily on the pace of Fed rate cuts. If fewer cuts materialize, gold could rise only to $2,890, highlighting the delicate balance between monetary policy and market expectations.

Safe-Haven Demand and Global Market Implications

Gold’s traditional role as a safe haven continues to shine, particularly amidst global geopolitical uncertainty and elevated inflation expectations. While a fragile Middle East truce temporarily reduced demand, escalating tensions in Syria and renewed central bank purchases have reaffirmed gold’s importance as a strategic hedge. The recent rally reflects investor confidence in the metal’s resilience, even as rising bond yields and a stronger dollar exert near-term pressure.

Market Trajectory Hinges on Key Data

All eyes are on Wednesday’s CPI figures and the subsequent Federal Reserve meeting. These events are likely to dictate gold’s trajectory heading into 2025. A breakout above $2,721 could signal a test of the all-time high, while a failure to hold critical support levels may trigger profit-taking. With Goldman Sachs projecting continued upside and market volatility on the horizon, gold remains a compelling asset for investors seeking a blend of stability and growth potential.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex