Gold Sell-Off Presents Strategic Buying Opportunity

Leveraging Market Correction and Geopolitical Tensions for Long-Term Gold Investment | That's TradingNEWS

Gold Faces Short-Term Decline but Long-Term Strength Persists

Technical Analysis of Gold and Silver Markets

The gold market experienced a significant dip, reaching the 50-day simple moving average (SMA) on Monday before showing signs of recovery. Despite this rebound, the potential for further declines remains, with the price testing the 50-day SMA again. A close below this level, particularly under $2350.00, could drive gold down to the $2280.00 support zone. On the other hand, silver continued its decline, unable to recover Monday’s losses, and is nearing the 200-day SMA.

Gold’s Technical Outlook

Gold markets dipped early Tuesday but found support at the $2400 level, suggesting buyers are stepping in on dips. The gold market has been on an uptrend, supported by geopolitical tensions and crashing bond yields. Central banks worldwide are also increasing their gold purchases, reinforcing the long-term uptrend. The $2,500 target remains intact unless the price drops below $2,300.

Economic and Geopolitical Factors Influencing Gold Prices

Impact of U.S. Federal Reserve Policy and Economic Data

Gold prices have been influenced by U.S. Federal Reserve policy changes, with expectations of significant rate cuts. The Fed's potential rate cut of 50 basis points in September, driven by deteriorating labor market conditions and a slowdown in manufacturing, could support gold prices. Lower interest rates reduce the opportunity cost of holding gold, making it more attractive.

Geopolitical Tensions and Gold’s Safe-Haven Appeal

Geopolitical tensions, particularly in the Middle East, have traditionally increased gold’s appeal as a safe-haven asset. Recent conflicts involving Hezbollah and Israel, and retaliatory threats from Iran, have added a risk premium to gold prices. Despite a temporary decline, these tensions could push gold higher in the long term.

India’s Import Duty Reduction and Its Impact on Gold Prices

India’s recent reduction in import duties on gold and silver from 15% to 6% significantly impacted the gold market. This move aims to curb illegal imports and make gold more affordable, potentially increasing demand in the long run. The immediate effect was a decline in gold prices, but lower prices could attract new investors.

Market Reactions and Future Prospects for Gold

Investor Sentiment and Market Dynamics

The gold market’s recent decline reflects changing investor sentiment and market dynamics. As investors shift towards riskier assets amid stable geopolitical conditions, gold has faced selling pressure. However, long-term fundamentals remain strong, supported by central bank purchases and economic uncertainties.

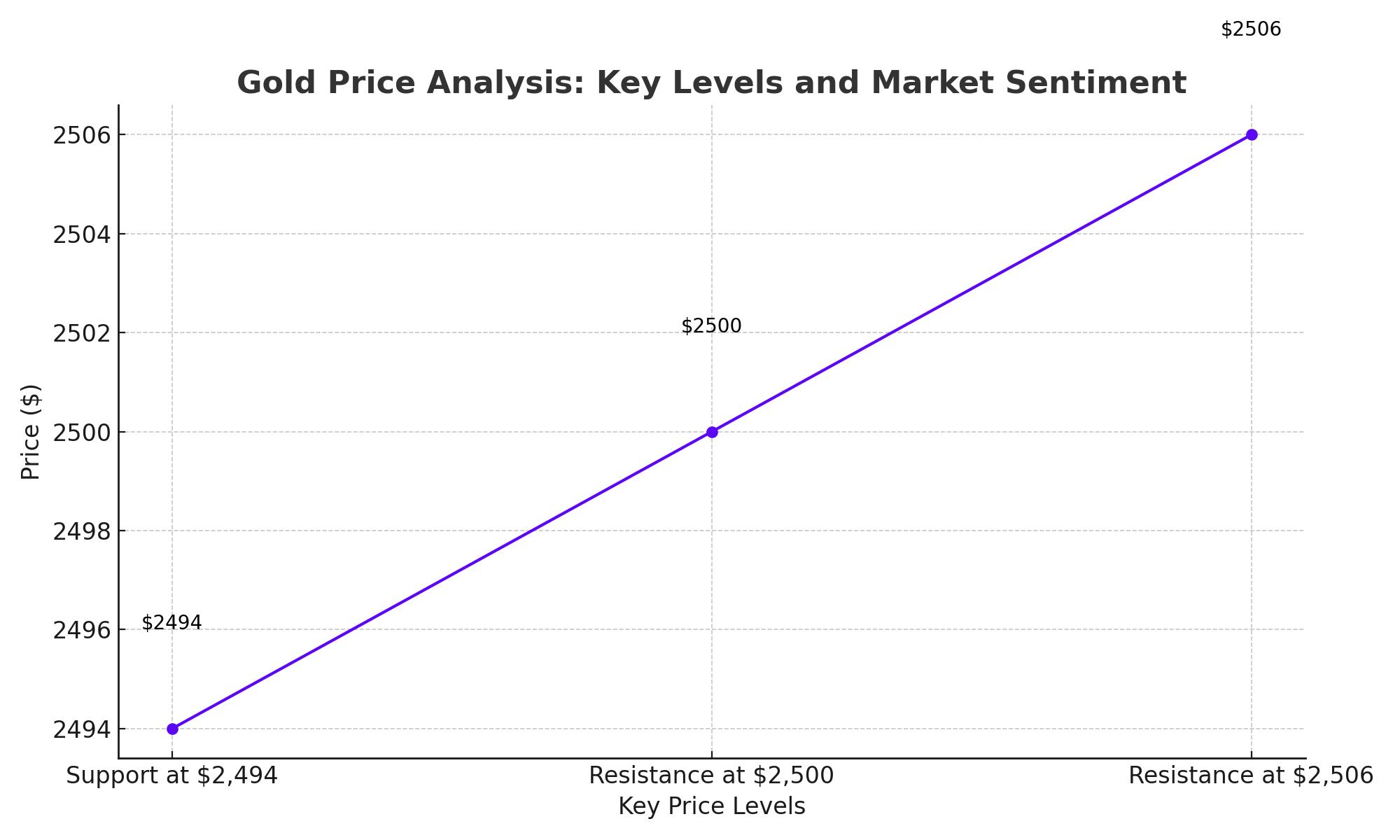

Gold Price Targets and Key Support Levels

Gold’s immediate support level is at $2400, with potential to drop to $2350 if selling pressure persists. Key resistance levels are at $2500, and a break above this could lead to new highs. Silver, on the other hand, is approaching its 200-day SMA, with support at $26.03.

Gold’s Long-Term Outlook and Investment Opportunities

Market Correction and Investment Strategy

The current sell-off in gold offers a potentially lucrative entry point for long-term investors. With spot gold recently testing key support at the $2,400 level, the market conditions suggest that prices could rebound, particularly if the Federal Reserve proceeds with anticipated rate cuts. Historically, lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it more attractive. Moreover, ongoing geopolitical tensions, such as conflicts in the Middle East and other global hotspots, add to the safe-haven appeal of gold. Investors should closely monitor these support levels and the broader economic indicators to strategically time their entries into the market. Additionally, the potential for further economic disruptions and volatility highlights gold's utility as a hedge against currency devaluation and economic instability.

Conclusion

Despite facing short-term pressures, the long-term outlook for gold remains positive. Factors such as Federal Reserve policy shifts, geopolitical instability, and central bank activities are likely to provide ongoing support for higher gold prices. Investors are advised to stay informed about these developments and to consider gold's strategic role as a safe-haven asset in their portfolios. The current market environment underscores gold's importance in mitigating risk and preserving wealth amidst economic uncertainties and market volatility. By keeping a close watch on market trends and geopolitical events, investors can make well-informed decisions that align with their long-term investment strategies.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex