Gold Price Analysis: Navigating Record Highs and Market Forces Impacting XAU/USD

The gold market is at a pivotal moment as prices hover near all-time highs, reflecting a confluence of geopolitical uncertainties, central bank activity, and economic trends. With XAU/USD trading at elevated levels, investors are analyzing whether gold remains a strong buy amid evolving monetary policies, central bank purchases, and the broader economic landscape.

Gold's Steady Climb and Inflationary Pressures

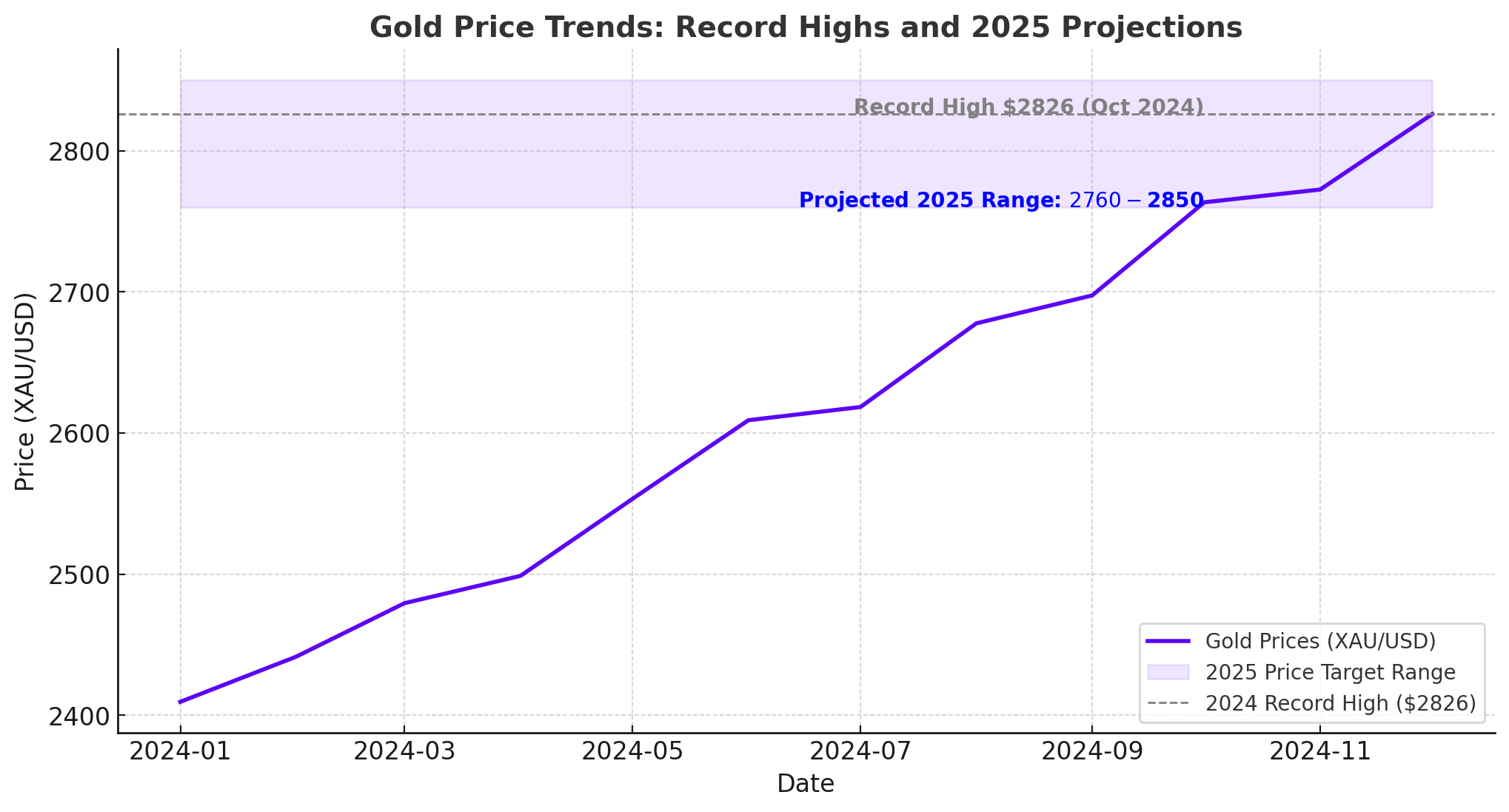

Gold prices have soared in 2024, reaching a record $2,826.30 per ounce in October, marking a 25% year-to-date increase. This rally has been fueled by easing monetary policies, central bank purchases, and safe-haven demand. The U.S. Federal Reserve's easing cycle, characterized by consecutive rate cuts, has lowered the federal funds rate to 4.5%-4.75%, boosting gold's appeal as a non-yielding asset. ING analysts project gold prices to average $2,760 per ounce in 2025, supported by sustained central bank purchases and geopolitical risks.

The Producer Price Index (PPI) and Consumer Price Index (CPI) in the U.S. have reinforced inflation concerns. November's PPI rose 0.4%, outpacing October's 0.3%, while CPI figures show headline inflation holding at 2.7% annually. These metrics highlight ongoing inflationary pressures, prompting investors to seek refuge in gold. Spot XAU/USD recently traded at $2,711, with February futures at $2,742, signaling a bullish outlook as the Federal Reserve considers further easing.

Central Bank Purchases: A Robust Support System

Central banks remain pivotal in driving gold demand. The World Gold Council reported that Poland, India, and Turkey led significant acquisitions, with Poland adding 42 tonnes in Q3 2024, boosting its reserves to 420 tonnes. Central banks are expected to maintain robust buying in 2025, citing geopolitical tensions and economic challenges. A World Gold Council survey revealed 29% of central banks plan to increase gold reserves within the next year, reinforcing long-term support for prices.

Despite a slight slowdown in Q3 2024 due to high prices, institutional demand remains strong. Exchange-traded funds (ETFs) witnessed consistent inflows until November, with North American and Asian markets leading the charge. Analysts predict renewed inflows in 2025 as rate cuts and geopolitical uncertainties amplify demand for gold-backed assets.

Geopolitical Tensions and Safe-Haven Demand

Geopolitical instability has been a consistent driver of gold’s upward momentum. Heightened tensions in the Middle East, Eastern Europe, and Asia have amplified demand for gold as a risk hedge. Gold has historically thrived during periods of geopolitical uncertainty, with current trends indicating sustained interest. The ongoing conflict between Israelis and Palestinians and concerns over European sovereign debt have further solidified gold’s role as a safe haven.

Economic expansion in key markets such as India and China continues to underpin demand. China, the world's largest gold consumer, has seen strong investor interest, although potential U.S. tariffs loom as a risk factor. Meanwhile, India's robust economic growth supports consistent consumer and institutional buying, reinforcing gold's upward trajectory.

Technical and Market Outlook for XAU/USD

Gold's technical indicators suggest sustained bullish momentum. XAU/USD recently surpassed the $2,700 mark, with resistance at $2,721 and further targets at $2,750 and $2,790. Momentum indicators like the Relative Strength Index (RSI) confirm a bullish bias. However, a dip below the 50-day Simple Moving Average (SMA) at $2,685 could trigger a retracement toward $2,650, with support at $2,600 and $2,580.

The U.S. dollar index’s modest rise has exerted slight pressure on gold, but Treasury yield fluctuations and expectations of further Federal Reserve rate cuts continue to favor gold bulls. Goldman Sachs analysts highlight the potential for increased Chinese central bank purchases, driven by local currency weakness, to bolster gold prices further.

Future Drivers: Rate Cuts, Inflation, and Global Demand

As the Federal Reserve signals additional easing, markets anticipate a 25 basis point rate cut in December 2024, with further reductions likely in 2025. Lower interest rates, coupled with inflationary pressures from Trump administration policies such as tariffs, create a favorable backdrop for gold. ING analysts forecast central bank purchases exceeding 500 metric tons in 2025, aligning with long-term trends and supporting higher gold prices.

Asian demand will remain crucial. While Chinese investor behavior may be tempered by tariff concerns, India’s strong economic growth and less exposure to trade risks position it as a key driver for gold. Additionally, gold’s dual role as a financial and industrial asset, particularly in renewable energy technologies, further diversifies its demand base.

Is Gold (XAU/USD) a Buy in 2025?

The evidence strongly supports a bullish outlook for gold, making XAU/USD a compelling buy. The convergence of monetary easing, central bank purchases, and geopolitical risks creates a favorable environment for sustained price growth. While near-term fluctuations are expected, gold’s long-term trajectory points toward continued strength, with prices projected to remain well above historical averages. For investors seeking a hedge against inflation and market volatility, gold remains an attractive asset class.

With record-breaking highs in 2024 and robust demand dynamics, the outlook for XAU/USD suggests further upside potential in the coming years. Investors should closely monitor Federal Reserve policies, central bank activity, and global economic indicators to navigate this dynamic market effectively.