NASDAQ:INTC Positioned for Turnaround in 2025

Intel Corporation (NASDAQ:INTC), trading at $34.76, stands at a critical juncture as the semiconductor giant embarks on a bold turnaround strategy aimed at reclaiming its competitive edge. With a year-over-year revenue decline of 6% in Q3 2024 to $13.28 billion, Intel faces significant headwinds but remains committed to reshaping its future through strategic investments in AI, data centers, and cutting-edge manufacturing technologies.

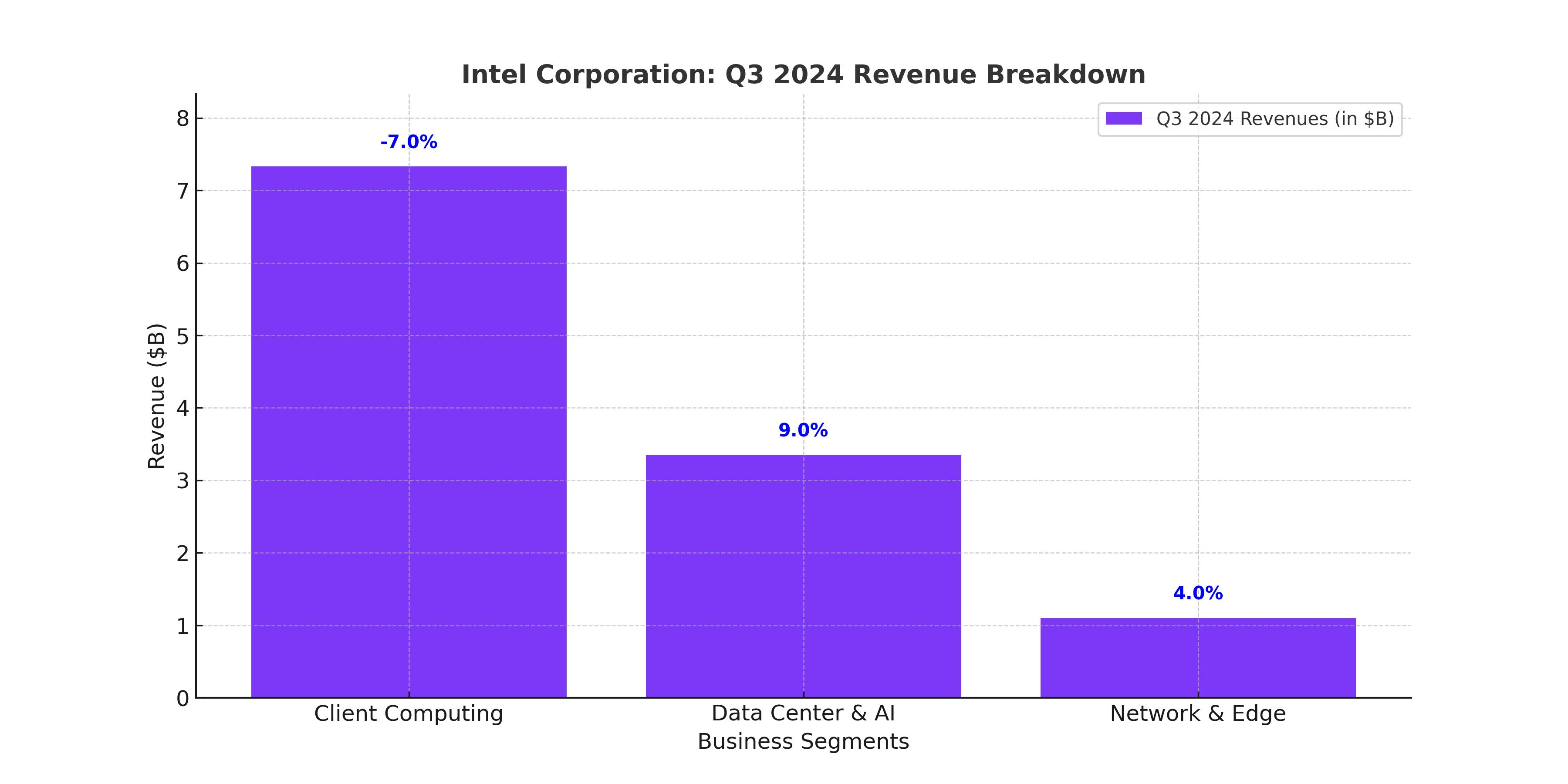

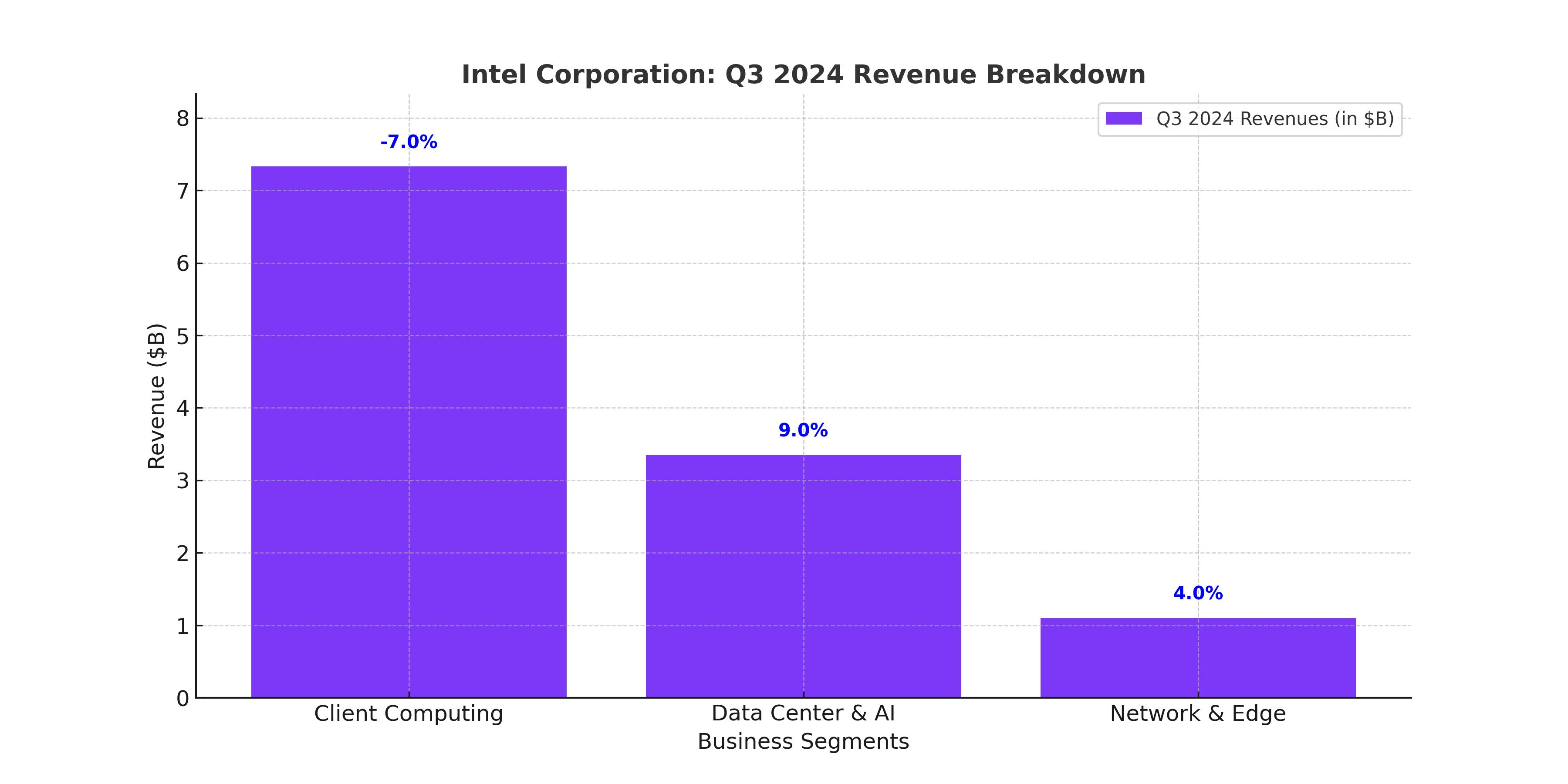

Revenue Analysis: Signs of Stability Amid Challenges

Intel’s Q3 performance highlighted mixed results across its business segments. While client computing revenue, which constitutes 55% of the company’s total revenue, fell 7% year-over-year to $7.33 billion, the Data Center and AI (DCAI) division posted a 9% increase to $3.35 billion. This growth in DCAI reflects Intel's successful launch of high-margin Xeon 6 processors, catering to the rising demand for AI-driven workloads and cloud computing solutions. The Network and Edge segment also delivered a 4% revenue increase, generating $1.1 billion and underscoring the growing adoption of decentralized networking models.

However, profitability remains a pressing concern. Intel’s non-GAAP gross margin dropped to 18%, a sharp decline from 46% in the prior year. This contraction stems from pricing pressures and inefficiencies in manufacturing, but management has outlined plans to restore margins to 40% through aggressive cost-cutting and efficiency measures by the end of 2025.

Strategic Investments in AI and Foundry Operations

Intel’s leadership has identified AI and advanced manufacturing as pivotal growth drivers. The Gaudi 3 AI accelerators, launched in late 2024, promise to enhance AI training and inference capabilities for enterprise applications. Complementing this, Intel has committed to producing 40 million AI-enabled PC processors by the end of 2025, targeting a burgeoning market expected to grow at an annualized rate of 44% over the next five years.

The foundry division, an area where Intel lags behind competitors like Taiwan Semiconductor Manufacturing Company (TSMC), is undergoing a transformation. New investments in fabrication plants across Arizona, New Mexico, and Ohio are supported by $3 billion in U.S. government funding. Intel’s goal to become the second-largest external foundry by 2030 underscores its intent to diversify revenue streams and capture market share in semiconductor manufacturing.

Technical Trends: Oversold Conditions Point to Recovery Potential

From a technical perspective, NASDAQ:INTC appears to be in oversold territory, with the Relative Strength Index (RSI) at 22 and stochastics signaling a potential buying opportunity. Shares are trading below their 50-day and 200-day moving averages, reflecting bearish sentiment. However, recent insider transactions suggest confidence in Intel’s recovery strategy, as detailed on the Insider Transactions page.

Valuation Metrics Highlight Undervaluation

INTC’s current valuation metrics indicate a compelling buying opportunity. The stock’s P/E ratio of 10.2x for FY2025 is significantly below the semiconductor industry average of 20.8x. Using a Discounted Cash Flow (DCF) model, Intel’s intrinsic value is estimated at $48.30, suggesting a 39% upside from current levels. This undervaluation reflects the market’s skepticism about Intel’s ability to execute its turnaround strategy, offering contrarian investors a favorable risk-reward profile.

Risks and Competitive Landscape

Intel’s path to recovery is fraught with challenges, including fierce competition from Advanced Micro Devices (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA) in the data center and AI markets. AMD’s EPYC processors have steadily gained market share, and Nvidia’s dominance in GPUs poses a significant hurdle for Intel’s DCAI segment. Additionally, delays in product rollouts and execution risks could hinder the company’s ability to capitalize on emerging opportunities.

Geopolitical tensions also present a double-edged sword. While rising U.S.-China tensions underscore the importance of onshoring semiconductor production, they also exacerbate supply chain complexities. Intel’s reliance on cutting-edge manufacturing nodes—an area where it lags behind TSMC—remains a critical vulnerability.

Outlook for 2025 and Beyond

Intel’s guidance for Q4 2024 includes revenues of $13.8-$14.2 billion and adjusted earnings per share of $0.12-$0.14, signaling a potential return to profitability. With a focus on AI, data centers, and foundry services, Intel aims to achieve sustainable growth starting in FY2025. Analysts project full-year revenues to grow by 6% to $58.2 billion in FY2025, driven by strong demand for AI solutions and improved operational efficiencies.

For real-time updates and performance tracking, visit the Intel real-time chart.