Intel Stock Price Forecast - INTC Slides To $35.98 As AI Leadership Turmoil And Market Share Loss Hammer NASDAQ:INTC

A 5.2% collapse as the stock trades under its $42.48 high and institutional flows swing sharply | That's TradingNEWS

How NasdaQ:INTC Reshapes Its Entire Identity As Market Share Falls And Capital Demands Rise

Intel Corporation (NASDAQ:INTC) trades around $35.98 after a week defined by a 5.2% collapse driven by disappointment in high-profile AI expectations and a sharp recalibration of investor sentiment. The stock had touched a 52-week high of $42.48, rising dramatically from the $17.66 low earlier in 2025, a rally exceeding 85% year-to-date, yet the recent pullback exposes the fragility behind the optimism. Intel’s chart on TradingNews clearly reflects this volatility: https://www.tradingnews.com/Stocks/INTC/real_time_chart.

The challenges stem from Intel's position inside the x86 market, where AMD accelerated its share to 30.9% of all x86 CPUs, up 5.9% YoY and 1.5% sequentially, while Intel has fallen from 75% last year to 69.1% now. The declines strike hardest in entry-level mobile CPUs where Intel's shipment volumes dropped, enabling AMD to dominate mid-range demand. This shift is not isolated; AMD’s server CPU share has reached 27.8%, up 3.5% YoY, while Intel’s server share slid to 72.2% in a segment that carries the industry’s highest margins. The backdrop of system-on-chip softness highlighted by Mercury Research compounds these pressures, as earlier stockpiling inflated prior quarters and exaggerated the latest step-down in Intel’s numbers.

NasdaQ:INTC Fights Market Share Erosion Through A Structural Overhaul That Cuts Thousands Of Jobs While Pouring Billions Into Foundry Expansion

The strategic reset is clearest in Intel’s aggressive workforce reductions. The company is eliminating 669 jobs in Oregon before year-end, following approximately 2,500 cuts over the summer. These layoffs coincide with Intel suspending its dividend in Q4, a dramatic but necessary move to preserve cash as spending escalates on leading-edge fabs and next-generation platforms. This cost discipline is not discretionary; it is survival. Intel is simultaneously building massive U.S. manufacturing capacity, re-architecting its roadmap, and financing multi-year investments in high-performance accelerators, all without the support of dividend payouts.

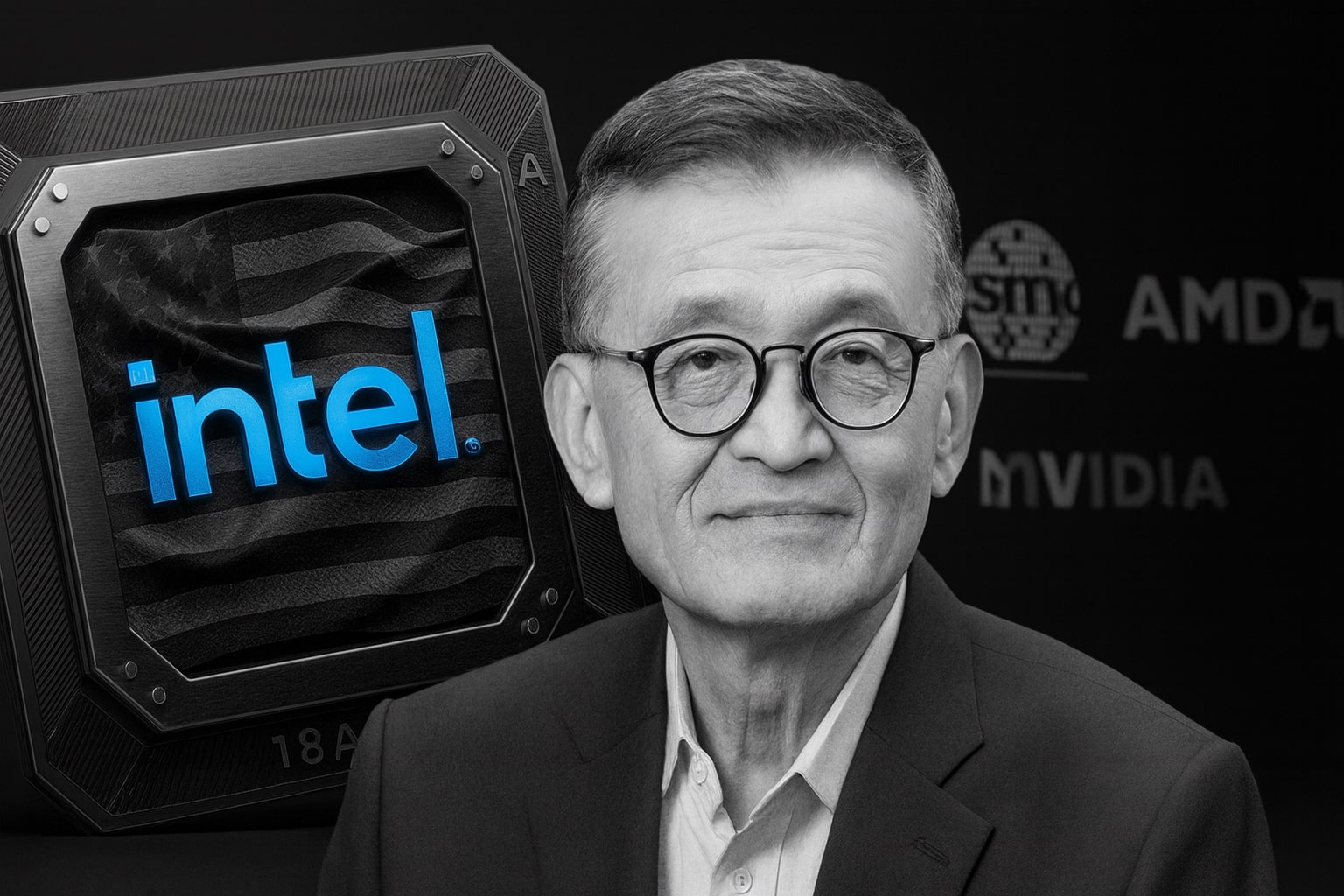

The restructuring goes deeper than payroll cuts. Intel is reorganizing internal leadership at the exact moment the company attempts to reclaim technological credibility. The departure of CTO and Chief AI Officer Sachin Katti, who left to join OpenAI, triggered a symbolic power shift. CEO Lip-Bu Tan has now taken direct control of Intel’s AI and Advanced Technologies operations. The message is unmistakable: Intel places AI execution above all else, and the CEO is assuming personal accountability for it. This reallocation of power reflects both urgency and internal vulnerability; the highest-impact AI leader at Intel defected to the premier AI company in the world. And yet Tan’s new oversight signals the seriousness with which Intel intends to push its 18A process, its Xeon 6+ platform, and its AI silicon portfolio into relevance.

NasdaQ:INTC Encounters A Direct Blow To Its AI Ambitions As Openai Rejects Intel Chips While Nvidia And Softbank Inject Billions Into Intel’S Foundry Bet

The data reveals Intel's AI outlook is a two-sided coin. One side: OpenAI has chosen not to buy Intel’s AI chips, eliminating what could have been a marquee validation for Intel’s AI accelerators. This rejection resurfaced concerns that Intel still trails Nvidia and AMD in AI compute efficiency and developer adoption. The move comes at a sensitive moment—when Tan is reshuffling leadership and when Wall Street remains unconvinced that Intel’s roadmap is tight enough to catch Nvidia’s architectural lead or AMD’s surging relevance.

The other side: Intel continues attracting enormous strategic commitments. Nvidia has invested $5 billion into Intel’s foundry ecosystem and is co-developing data-center and PC chips, while SoftBank deployed another $2 billion into Intel’s future. These are not symbolic gestures; they represent highly informed, deeply institutional bets that Intel will be one of the global centers of semiconductor production in the angstrom era. Intel also secured large U.S. government incentives and partnerships tied directly to fab development. Parallel speculation points to Tesla evaluating Intel Foundry Services for future custom AI and autonomy chips, a shift that could give Intel access to the highest-volume automotive AI workloads on the planet.

Read More

-

PayPal Stock Price Forecast - PYPL At $58 Becomes A Cash Machine With 10 Percent Yield

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast 2026: XRP-USD At $1.85 Eyes $3 Breakout And Path Toward $8

01.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: Can Brent Hold $60 As WTI Slides Toward A $50–$60 Range In 2026?

01.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today And 2026 Forecast: S&P 500 6,845, Nasdaq 23,242, Gold $4,332

01.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds Around 1.34 As Fed Easing And BoE Weakness Set The 2026 Trading Range

01.01.2026 · TradingNEWS ArchiveForex

NasdaQ:INTC Shows Early Signs Of Execution Improvement As Q3 Revenue Hits 13.7 Billion But Margins Expose A Weak Underlying Engine

Intel’s Q3 2025 numbers offer a glimpse of progress. Revenue climbed to $13.7B, up 3% YoY, with the PC Client Group rising 5% YoY to $8.5B, evidence that the consumer and commercial PC market is stabilizing. Yet the Data Center & AI segment slipped 1% YoY to $4.1B, and the Foundry division declined 2% YoY to $4.2B.

EPS paints a more complicated picture. GAAP EPS reached $0.90, but the figure was inflated by government funding and asset sales. Non-GAAP EPS, a cleaner measure of operations, came in at $0.23. For Q4, Intel forecasts $12.8B–$13.8B in revenue with non-GAAP EPS of $0.08, while GAAP EPS is expected to be slightly negative. Profitability therefore remains razor thin. MarketBeat data pegs Intel’s net margin at only 0.37%, and return on equity is slightly negative. Analysts expect Intel to post a loss of –$0.11 EPS for the full year after adjusting for one-time items.

Intel is improving execution on revenue and cost control, but the core earnings engine remains vulnerable. Until Intel’s data-center mix stabilizes, and until its next-gen AI chips begin generating real demand, margins will remain the critical weakness.

NasdaQ:INTC Faces A Divided Wall Street As Institutional Money Rotates And Analysts Remain Unconvinced By The Turnaround Pace

A recent downgrade from Oakoff Investments marked Intel as a “Hold,” citing execution risk and uncertainty around sustaining the rally. MarketBeat shows 2 Buys, 23 Holds, and 8 Sells, with an average price target of $34.84, slightly below current pricing. The “Reduce” consensus reflects the tension between improving fundamentals and persistent skepticism.

Institutional flows confirm the divide.

Vise Technologies opened a position of 43,236 shares valued at about $968K.

Fiera Capital entered with 433,532 shares valued around $9.7M.

However, BBVA cut its position by 18.1%, now holding 1.289M shares worth $29M.

Mitsubishi UFJ reduced its stake by 3.2% to 1.91M shares valued near $42.8M.

Roughly 64–65% of Intel’s stock remains in institutional hands, reinforcing that INTC is still a core component in global tech portfolios. Insider activity remains available directly through https://www.tradingnews.com/Stocks/INTC/stock_profile/insider_transactions, where movements reflect confidence, timing, and management alignment.

NasdaQ:INTC Operates Inside A Semiconductor Supercycle Where The Market Is Expected To Double To 1.6 Trillion And The Stakes Could Not Be Higher

A new BCC Research report projects the global semiconductor market will expand from $737.2B in 2025 to $1.6T by 2030, a 16.1% CAGR. This growth is driven by hyperscale data centers, AI at the edge, EV adoption, robotics, and advanced connectivity. Intel is listed as one of the leading players poised to benefit from this structural expansion. This macro tailwind is the foundation of Intel’s willingness to endure painful layoffs, suspend dividends, and aggressively re-route cash toward fabs and AI silicon. The company is rebuilding itself to capture a slice of a trillion-dollar decade.

NasdaQ:INTC Confronts The Reality Of A Corporate Identity Split Between Falling Market Share And Once-In-A-Generation Investment Momentum

Intel’s position today sits at the intersection of risk and reinvention. The fall in x86 market share to 69.1%, the 5.2% single-day stock drop, the 669 layoffs, the CTO departure, and the OpenAI rejection create a narrative of vulnerability. Yet at the same time, Intel is attracting billions in strategic capital, driving one of the largest U.S. semiconductor expansions ever attempted, generating $13.7B quarterly revenue, gaining PC momentum, and maintaining institutional ownership levels above 64%.

NasdaQ:INTC Final Verdict Backed By All Data

Intel is a Hold with a bullish bias.

The data shows undeniable weaknesses: thin margins, leadership turnover, competitive share loss, and lingering uncertainty in AI adoption. But the investment cycle, strategic partnerships with Nvidia and SoftBank, large U.S. government funding, expanding PC strength, stabilizing revenue, and a multi-trillion-dollar semiconductor market create a powerful long-term foundation. The stock at $35–$36 trades well below its recent $42.48 high, but still high enough that execution—not valuation—will determine the next leg. This setup supports a Hold rating until Intel proves it can convert its massive investments into margin expansion and AI market relevance, at which point INTC shifts from turnaround to growth engine.