Risks and Considerations

Investing in Amazon (NASDAQ:AMZN) comes with its own set of challenges that investors must weigh carefully. One of the most significant risks lies in macroeconomic uncertainties. With inflationary pressures and central bank policies continuing to impact global markets, consumer spending—a critical driver of Amazon’s e-commerce business—could face headwinds. The company’s North America retail segment, which accounts for over 60% of its revenue, is particularly exposed to fluctuations in discretionary spending. A broader economic downturn could erode Amazon’s top-line growth, even as the company continues to invest heavily in its infrastructure.

Regulatory scrutiny also poses a notable threat. As Amazon grows its market share across retail, cloud computing, and advertising, it increasingly attracts attention from antitrust authorities worldwide. This includes investigations into its business practices and marketplace dominance in the U.S., European Union, and other key markets. Any unfavorable rulings or imposed restrictions could dampen Amazon’s ability to operate at its current scale, potentially disrupting its high-margin segments like AWS and advertising, which are critical to overall profitability.

Additionally, the company’s aggressive investments in artificial intelligence, robotics, and logistics infrastructure, while essential for long-term growth, could temporarily constrain free cash flow. For instance, Amazon's $10 billion expansion in Ohio's data center infrastructure and its push to optimize same-day delivery systems represent substantial capital expenditures. Although these initiatives are expected to generate long-term value, they may create short-term pressures on margins and profitability, particularly if economic conditions worsen.

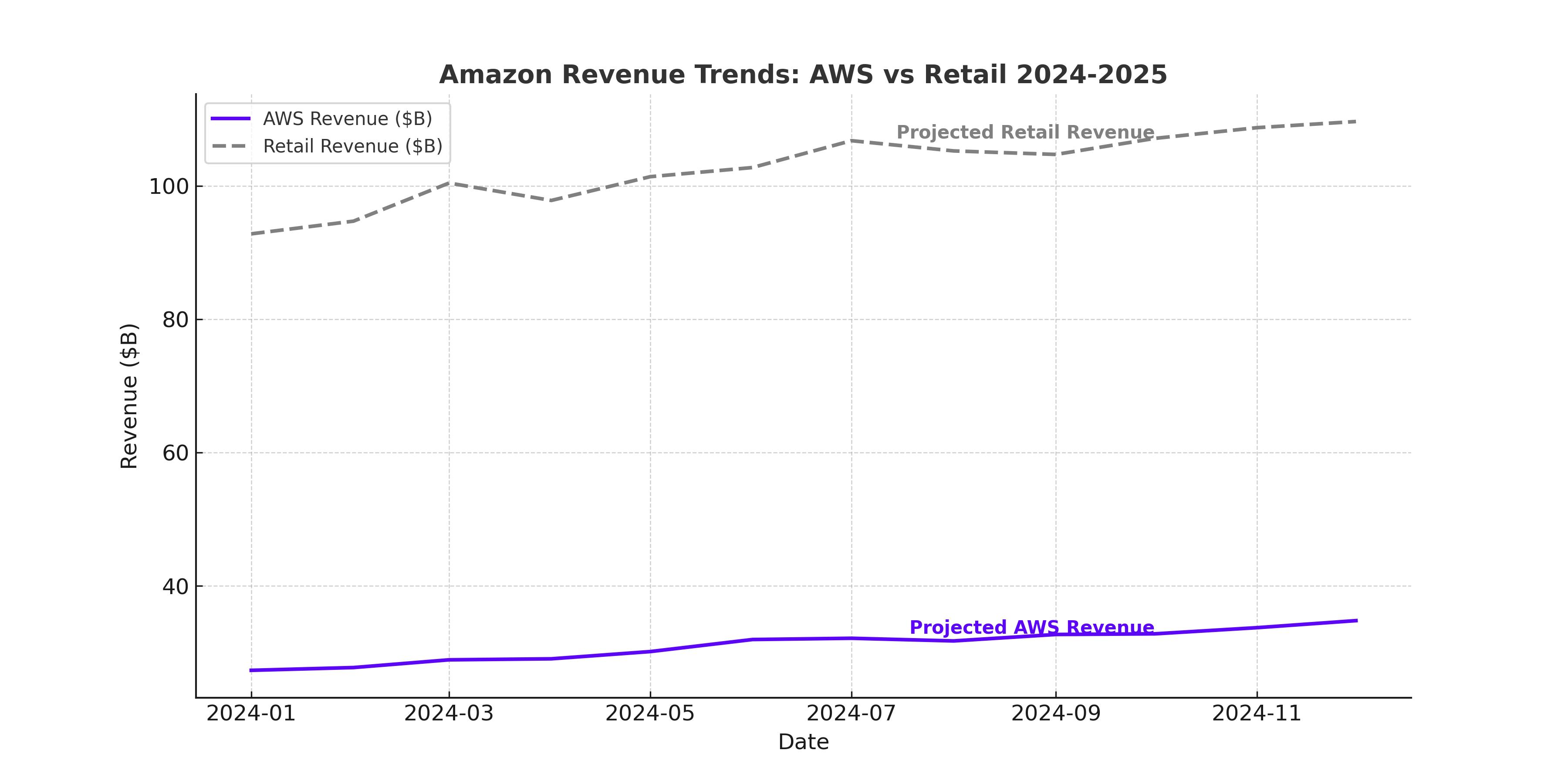

Competition is another ongoing challenge. In e-commerce, Amazon faces rising threats from innovative platforms like TikTok Shop and Temu, which offer competitive pricing and interactive shopping experiences. These platforms are capturing significant market share, with TikTok Shop’s global GMV projected to reach $50 billion in 2024. Meanwhile, in cloud computing, AWS must contend with aggressive competitors like Microsoft Azure and Google Cloud, both of which continue to gain traction in the enterprise market. The ability to stay ahead in this increasingly crowded field will be critical to maintaining its 38.1% operating margins in the AWS division.

Despite these risks, Amazon’s track record of resilience and innovation should not be underestimated. The company has successfully navigated past economic downturns by pivoting its strategies, reducing costs, and leveraging its diversification across high-growth sectors. Its capacity to adapt to new competitive landscapes—such as launching initiatives like “Haul” to counter emerging e-commerce platforms—underscores its ability to safeguard its market position even in volatile environments.

Decision: Buy, Hold, or Sell?

Amazon’s stock is not for the faint of heart, particularly given its current valuation of $225 per share and a forward P/E ratio of 43.45, which positions it at a premium relative to its retail and technology peers. However, this premium is underpinned by a diversified business model that includes dominant positions in e-commerce, cloud computing, advertising, and AI—industries with significant long-term growth potential.

For value-focused investors, the stock’s high valuation might raise red flags, particularly when compared to the average multiples of competitors in the retail sector. However, Amazon’s compelling growth story, fueled by double-digit revenue growth in AWS (up 19% YoY to $27.5 billion) and advertising (up 19% YoY to $14.3 billion), makes it difficult to ignore as a long-term investment. These high-margin segments not only bolster profitability but also provide a robust buffer against potential downturns in the lower-margin retail business.

For cautious investors, a pullback to the $189 support level—identified through technical analysis—could offer a more attractive entry point. This price level aligns with historical trends, suggesting a convergence toward the Hodrick-Prescott filter often seen during corrections. A buy at this level would mitigate some of the valuation concerns while positioning investors to benefit from Amazon’s long-term growth trajectory.

For those with higher risk tolerance, Amazon remains a Buy even at current levels. Its projected upside of 17.5%, based on a fair value estimate of $260 per share, underscores the company’s ability to generate shareholder value through a combination of revenue growth, operational efficiency, and strategic investments. With a market cap that could potentially exceed $3 trillion in the coming years, Amazon offers a unique opportunity to invest in a company that continues to shape the future of e-commerce, cloud computing, and AI.

Track real-time stock performance and insider activity for Amazon Stock Chart.