Is EUR/USD Positioned for Recovery Above 1.0400 or Headed Lower?

EUR/USD rebounds after Fed-induced sell-off. Key technical levels hint at potential breakout or further downside risks | That's TradingNEWS

Can EUR/USD Reclaim Stability Above 1.0400 Amid Diverging Central Bank Policies?

The EUR/USD pair faces mounting challenges as it attempts to stabilize above the 1.0400 threshold following a sharp decline triggered by the Federal Reserve's hawkish guidance. After a steep drop to 1.0340, the pair managed a modest recovery of 0.45% to 1.0400 on Thursday. However, this rebound appears to lack conviction, reflecting persistent bearish sentiment and macroeconomic headwinds.

Fed’s Hawkish Rate Cut Sparks Dollar Strength

The Federal Reserve’s decision to cut rates by 25 basis points to a range of 4.25%-4.50% was widely expected, but the accompanying forward guidance surprised markets. Projections for 2025 now show only two rate cuts, down from four previously anticipated. Chair Jerome Powell underscored the importance of prudence, citing persistent inflation risks and a strong labor market. This cautious approach bolstered the US Dollar, with the DXY Index climbing to a two-year high of 108.27 before consolidating near 108.00.

The Fed’s revised forecast for core Personal Consumption Expenditures (PCE) inflation to 2.5% in 2025 from an earlier estimate of 2.2% further solidified the Dollar’s dominance. The hawkish tone reflects the Fed’s confidence in maintaining higher borrowing costs, reducing global liquidity and weighing heavily on risk-sensitive currencies like the Euro.

ECB Faces Challenges with Rate Cuts on the Horizon

In contrast, the European Central Bank (ECB) has embarked on a series of rate cuts, reducing the Deposit Facility Rate by 100 basis points to 3.00%. Policymaker Pierre Wunsch highlighted the possibility of four additional 25 basis point cuts in 2025, citing concerns over Eurozone economic growth and protectionist US policies. This divergence in monetary policy paths has significantly widened the yield gap between US and European assets, with the 2-year bond yield spread now exceeding 225 basis points, creating a substantial drag on EUR/USD.

Adding to the bearish sentiment, Eurozone inflation figures for November undershot expectations. Final CPI printed at 2.2% y/y versus a forecast of 2.3%, while German GfK Consumer Climate improved marginally to -21.3 but remains deeply negative. These mixed data points underscore the challenges facing the Eurozone economy, amplifying downward pressure on the Euro.

Technical Outlook: Persistent Downside Risks for EUR/USD

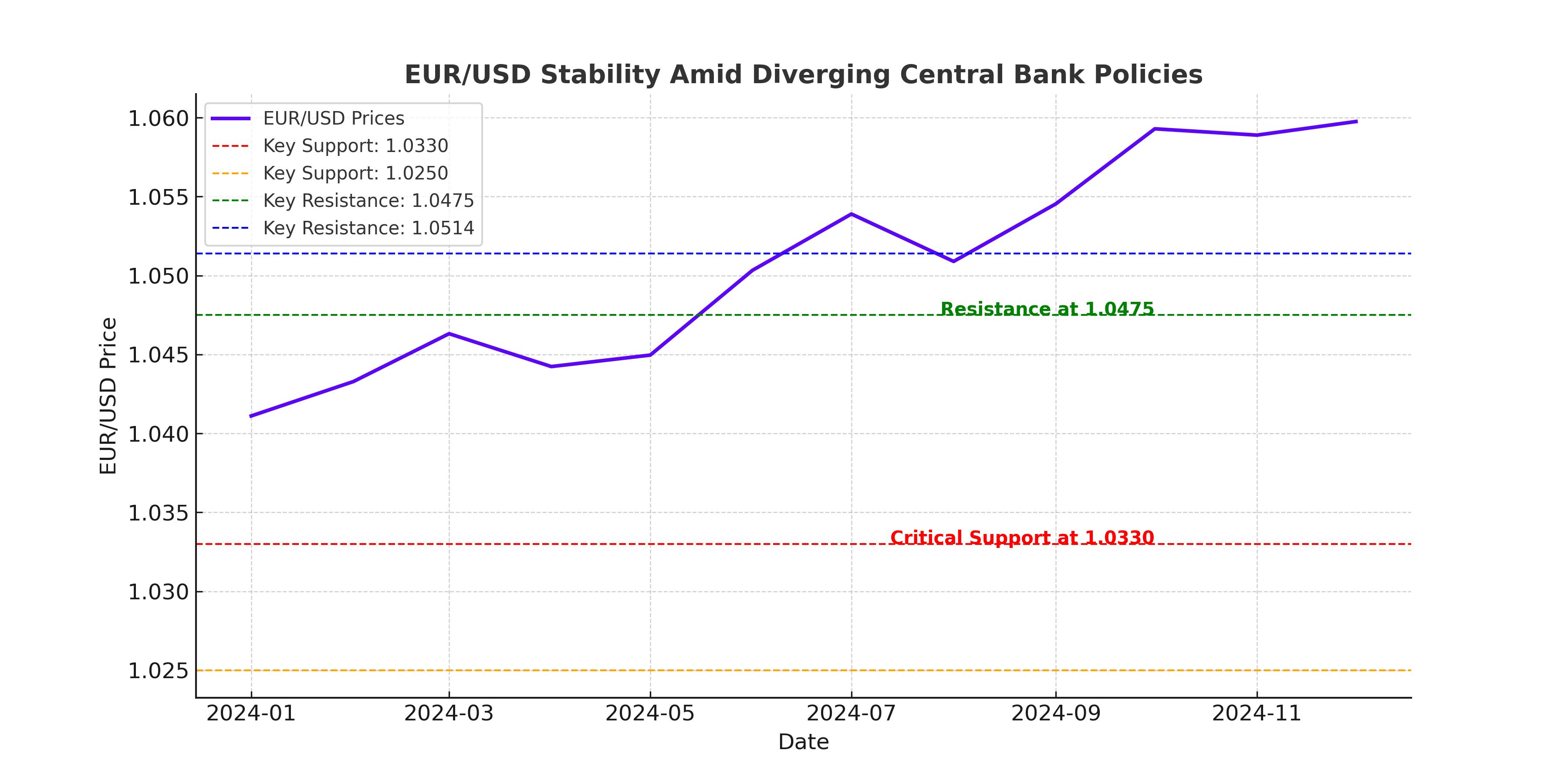

From a technical perspective, EUR/USD remains under significant bearish pressure. The pair trades below key moving averages, with the 50-day EMA at 1.0489 and the 200-day EMA at 1.0585 acting as formidable resistance levels. The RSI has edged up to 35 but remains firmly in bearish territory, while the MACD histogram shows persistent negative momentum despite signs of easing.

Key support is located at 1.0330, the November low, with a break below this level likely to expose the 1.0250 region. Conversely, reclaiming the 1.0475 threshold is essential for the Euro bulls to regain control and shift the pair's short-term outlook toward a more positive stance.

US Economic Resilience and Implications for EUR/USD

The US economy continues to exhibit resilience, as evidenced by stronger-than-expected Q3 GDP growth of 3.1% (up from an initial estimate of 2.8%) and lower-than-anticipated Initial Jobless Claims, which fell to 220,000 against a forecast of 230,000. These robust indicators bolster the Greenback’s appeal, adding to the headwinds facing EUR/USD.

Looking ahead, the core PCE Price Index, the Fed’s preferred inflation gauge, is expected to rise to 2.9% in November from 2.8% in October. Should the data align with expectations, it would further reinforce the case for a strong Dollar, limiting the Euro’s recovery potential.

Diverging Policy Paths: Long-Term Outlook for EUR/USD

The divergence between the Fed’s hawkish stance and the ECB’s dovish trajectory is unlikely to abate soon. While the ECB has signaled aggressive rate cuts through mid-2025, the Fed’s cautious approach ensures that US rates remain relatively elevated. This policy gap, coupled with broader macroeconomic trends, suggests that EUR/USD will likely remain under pressure in the coming months.

Wunsch’s comments about potential Euro-Dollar parity underscore the gravity of the situation. With the Eurozone facing tariffs and weaker growth prospects, further depreciation of the Euro could serve as a buffer against external shocks. However, this comes at the expense of the shared currency’s broader market appeal.

Strategic Implications for Traders and Investors

For traders, the current levels around 1.0400 offer a key battleground. Short-term upside potential appears limited, with resistance at 1.0455 and stronger hurdles at 1.0514 and 1.0604. On the downside, a break below 1.0330 could trigger accelerated selling toward 1.0250 and, eventually, 1.0200. These levels represent critical zones for both speculative and hedging strategies.

Investors with long-term exposure to the Euro should consider the implications of sustained policy divergence and weak regional growth. A cautious stance may be warranted, with potential opportunities arising only if the pair stabilizes above key technical thresholds.

In summary, EUR/USD faces a challenging road ahead as the Fed’s hawkish stance solidifies Dollar strength while the ECB’s dovish policies weigh on the Euro. Without a significant shift in macroeconomic dynamics or central bank rhetoric, the pair’s path of least resistance remains to the downside. Traders should remain vigilant for upcoming US PCE data and Eurozone economic releases, which will likely set the tone for near-term price action.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex