Is Intel Positioned to Benefit from the TikTok Ban and AI Growth?

With a fair value of $31.71 and AI-focused innovation, Intel could surge amidst shifting tech trends | That's TradingNEWS

The Strategic Rebound of Intel Corporation (NASDAQ:INTC): A Case for a Bullish Outlook

Intel Corporation (NASDAQ:INTC) finds itself at a critical juncture, balancing between a tumultuous 2024 and promising prospects for 2025 and beyond. With its stock trading around $20, significantly off its highs, the company appears poised for a compelling recovery story. Despite underperformance driven by restructuring costs, legal challenges, and intense competition, Intel's strategic roadmap, innovations, and industry positioning suggest a substantial upside.

Navigating Through Current Challenges

Intel's revenue for 2024 is projected to decline by 2.6%, a sharp deviation from earlier growth forecasts of 9.5%. Much of this underperformance stems from key segments like the Network & Edge (NEX) and Client Computing Group (CCG), which suffered from weakened 5G chip demand, inventory digestion, and export restrictions. NEX, for instance, saw a 4.1% decline in revenue, compounded by reduced telecom capital expenditure. Meanwhile, CCG faced setbacks due to U.S. restrictions on exports to China, notably impacting desktop CPU shipments.

The company's Data Center and AI (DCAI) division, while showing sequential improvement, continues to contend with competitive pressures. Despite these challenges, Intel's Xeon and Gaudi products are gaining traction in specific markets, laying a foundation for growth in 2025.

Mobileye, Intel's autonomous driving unit, also underperformed, posting a 19.3% decline in Q3 YTD revenue. However, as inventory levels normalize among Tier 1 customers by mid-2025, Mobileye is expected to stabilize and return to growth.

Building for the Future: Lunar Lake and AI Leadership

Intel Corporation (NASDAQ:INTC) is gearing up to redefine its place in the semiconductor market with the upcoming Lunar Lake and Arrow Lake processors, specifically designed for AI-focused PCs. These processors are crucial for Intel's resurgence as they aim to address the growing demand for AI-centric computing in personal devices. The Client Computing Group (CCG), which accounts for over 57% of Intel's total revenue, stands to gain significantly from these innovations. This segment is particularly important given that it generated $22.27 billion in Q3 YTD 2024 alone.

In the Data Center and AI (DCAI) segment, Intel is making strides to capitalize on the growing $150 billion AI market. While its Gaudi 3 accelerator has underperformed expectations so far, the product highlights Intel's long-term commitment to AI solutions. Server demand, a key revenue driver for DCAI, shows signs of recovery, with the segment contributing $3.35 billion in Q3 2024 revenue, up 8.9% year-over-year. The anticipated launch of AI-focused solutions, including next-generation Xeon processors and enhanced accelerators, positions Intel as a critical player in an increasingly AI-driven world.

Intel Foundry: A Long-Term Play

Intel's Foundry Services (IFS) division is central to its IDM 2.0 strategy, which aims to establish the company as a leader in global semiconductor manufacturing. Despite significant losses—operating margins in the segment plummeted to a staggering -61% in Q3 YTD 2024—Intel is doubling down on this effort. The introduction of the 18A process node, scheduled for 2025, is a pivotal milestone. This advanced technology is designed to close the gap with competitors like TSMC and Samsung and potentially reclaim leadership in process technology.

The strategic importance of Intel’s domestic foundries has been bolstered by an $8 billion U.S. government investment under the CHIPS Act. Geopolitical tensions and a growing need for semiconductor self-reliance favor Intel’s operations in Arizona and Ohio. These facilities, along with Intel's broader manufacturing roadmap, are expected to provide a domestic alternative to Asian foundries. As Intel ramps up production, it targets capturing an increasing share of the global foundry market, which is projected to reach $126 billion by 2028.

Profitability and Margin Expansion

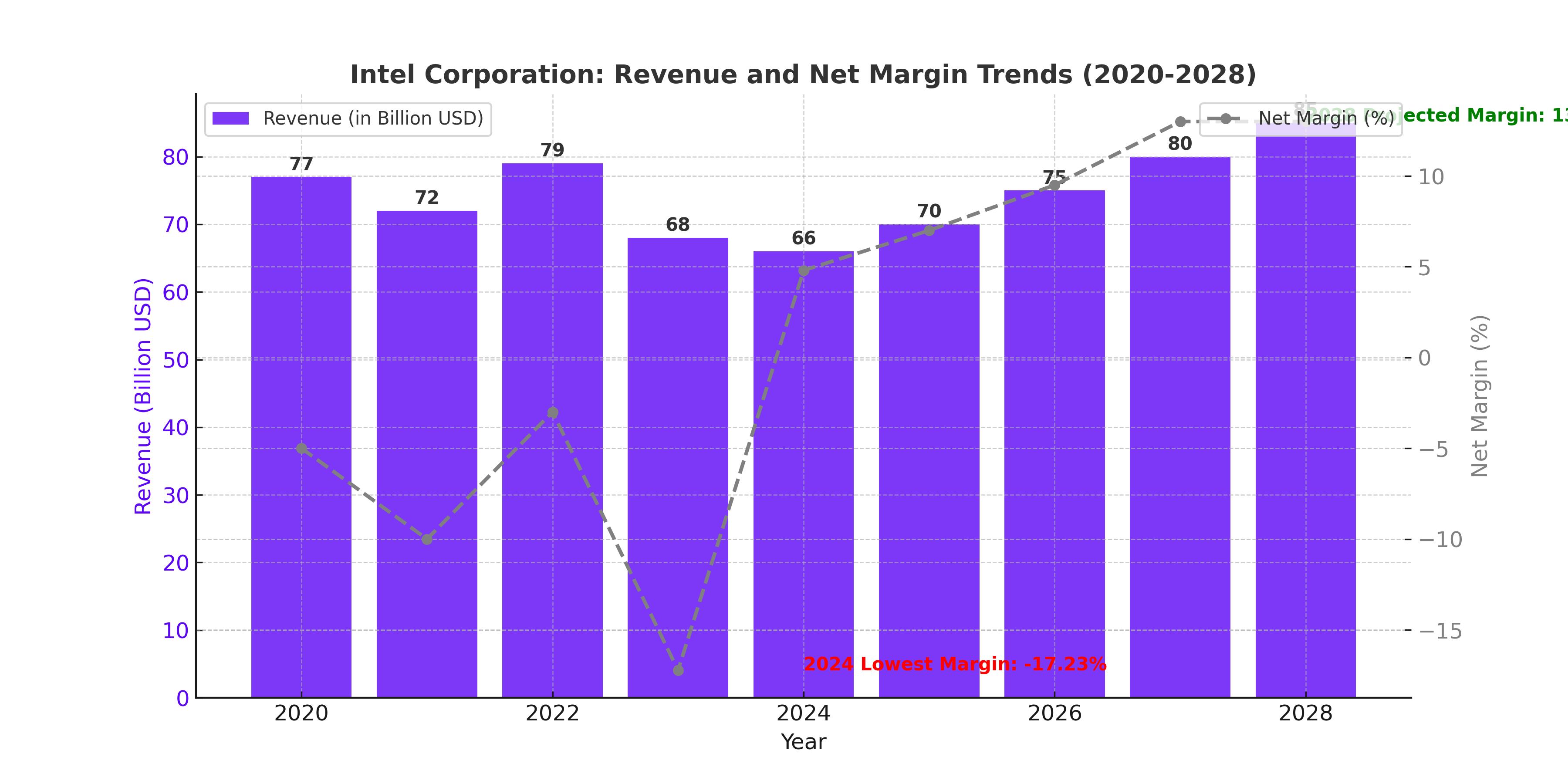

Intel’s profitability has been severely impacted by restructuring charges, legal settlements, and asset impairments in 2024. Restructuring and other costs amounted to $6.9 billion, driving net margins to -17.23% for the year. Legal challenges, including a $1 billion settlement with R2 Semiconductor, further compounded the strain. However, these charges are largely non-recurring, paving the way for significant margin recovery.

By 2025, Intel's net margin is forecast to rebound to 4.8%, driven by economies of scale, cost-cutting measures, and operational efficiency. By 2028, margins are expected to climb to 13%, as Intel capitalizes on its strengthened product portfolio and streamlined operations. Operating cash flow, which took a hit due to restructuring, is projected to stabilize, supporting reinvestment in growth areas like AI and foundry services.

Valuation: Undervalued Amidst Potential

Trading at an enterprise value-to-EBITDA (EV/EBITDA) multiple of 10.12x and with a weighted average cost of capital (WACC) of 7.7%, Intel is significantly undervalued compared to its peers. Competitors like AMD and Nvidia trade at much higher multiples, reflecting investor skepticism around Intel's turnaround. However, this undervaluation presents an opportunity for long-term investors.

A discounted cash flow (DCF) analysis indicates a fair value of $31.71 per share, representing a 54% upside from Intel’s current price of approximately $20. Intel's aggressive push in AI and its foundry business could lead to higher-than-expected revenue growth and margin expansion, driving further valuation upside.

The TikTok Catalyst: Indirect Benefits

Intel Corporation (NASDAQ:INTC) may not operate within the social media sector, but a U.S. ban on TikTok could create ripple effects that benefit the company significantly. Such a ban would likely accelerate domestic investments in artificial intelligence (AI) and technology infrastructure, as policymakers prioritize security and independence from foreign technologies. This potential shift in focus could bolster demand for AI-centric solutions, a field in which Intel is heavily investing.

Intel’s strength lies in its cutting-edge AI chip technology and robust domestic manufacturing capabilities. As a key U.S.-based semiconductor provider, Intel is poised to address the growing demand for localized technology solutions. The company’s development of processors optimized for AI tasks, including its upcoming Gaudi 3 accelerator, positions it as a vital player in this transformation. Furthermore, Intel’s commitment to expanding its domestic foundry services aligns with the anticipated surge in infrastructure projects aimed at ensuring technological self-reliance.

Investor Outlook: A Strategic Buy

For investors with a medium-to-long-term horizon, Intel stands out as a promising opportunity. The company faces near-term challenges, including restructuring costs and fierce competition, but its focus on innovation and alignment with industry megatrends like AI and advanced manufacturing positions it for a significant turnaround. Currently trading at an estimated enterprise value-to-EBITDA multiple of 10.12x and offering a fair value of $31.71 per share, Intel presents a compelling case for undervaluation. This implies an upside potential of 54% from its current levels, making it an attractive buy for value-driven investors.

Intel’s recovery is supported by multiple catalysts: the rollout of next-generation AI-focused products, stabilization in its core markets, and its IDM 2.0 strategy, which includes aggressive investments in semiconductor leadership. The company’s ability to capitalize on these opportunities, combined with projected margin recovery—rising to 4.8% by 2025 and 13% by 2028—strengthens its appeal. Investors looking to navigate current volatility for long-term gains may find Intel a strategic addition to their portfolios.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex