Is NASDAQ:QUBT’s 2,804% Rise Backed by Real Quantum Potential?

Quantum Computing Inc. (QUBT) soared 2,804% in 2024. Can its $3.05B market cap match its disruptive promise? | That's TradingNEWS

NASDAQ:QUBT – A Detailed Analysis of Quantum Computing Inc.’s Potential and Challenges

A Transformative Contract: NASA and Quantum Computing Inc.

Quantum Computing Inc. (NASDAQ:QUBT) has garnered significant attention following its announcement of a prime contract with NASA's Goddard Space Flight Center. The agreement focuses on using QCi’s cutting-edge Dirac-3 entropy quantum optimization machine to tackle NASA’s complex phase unwrapping challenges. This involves reconstructing radar-generated interferometric images with enhanced precision. Dirac-3, specifically designed for solving NP-hard problems, is expected to outperform classical computing algorithms in speed and accuracy, thereby underscoring QCi’s ability to handle computationally intensive tasks.

NASA’s reliance on Dirac-3 illustrates the growing trust in quantum solutions for real-world applications. This project aims to not only validate the technology but also set a benchmark for future adoption across industries requiring high-quality big-data optimization. Should the results meet expectations, this contract may solidify QUBT’s reputation as a leader in quantum optimization.

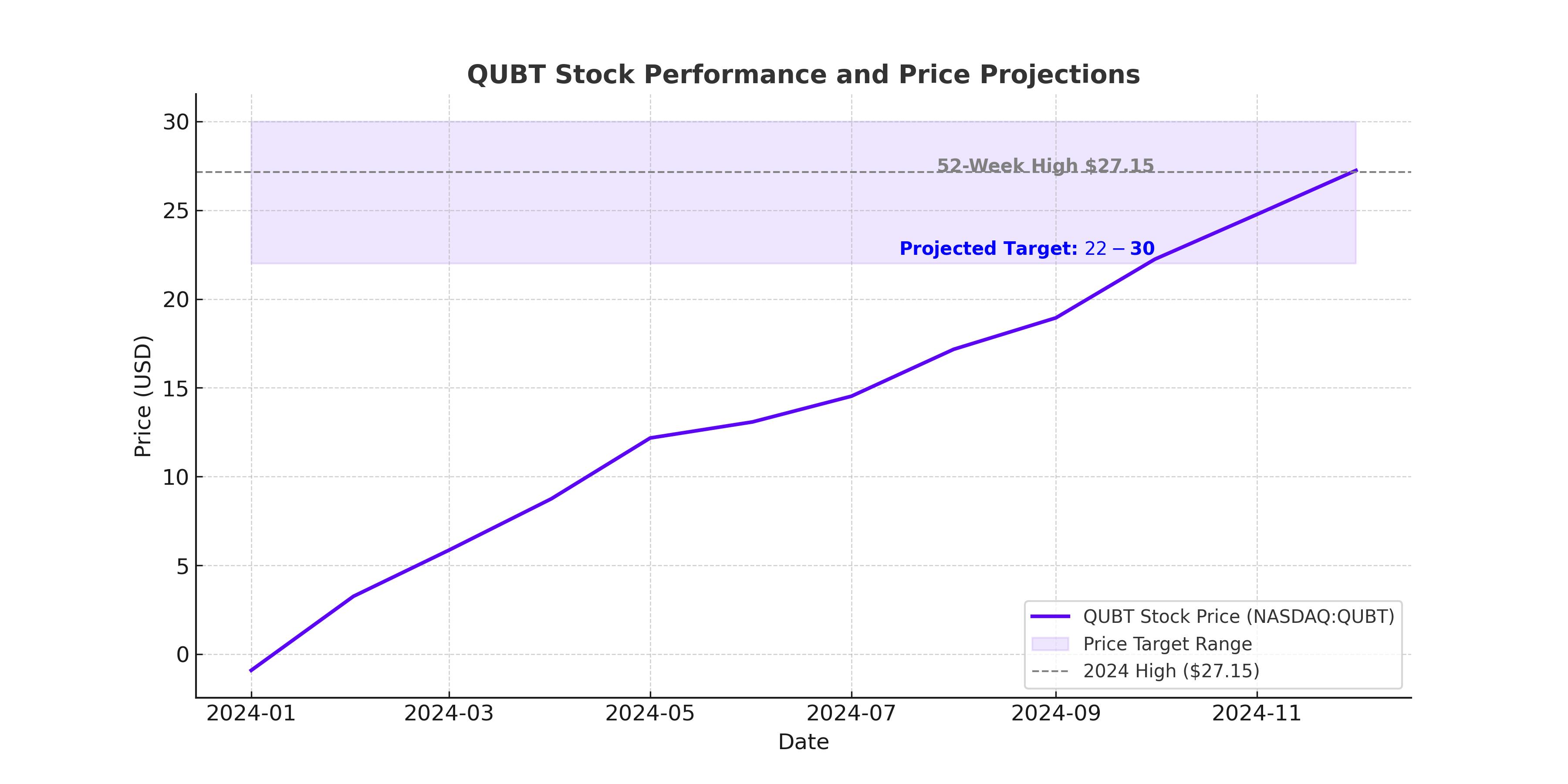

The Spectacular Stock Surge: Performance Metrics

The NASA contract has fueled QUBT's stock price, which has experienced meteoric growth. Over the past six months, QUBT has surged by 1,656%, including a 33% rise following the NASA announcement alone. Year-to-date, the stock has skyrocketed by more than 2,500%, elevating QUBT’s market capitalization to over $2.8 billion. These figures place QUBT among the most aggressively performing stocks in the quantum computing sector.

Despite this growth, QUBT remains an early-stage company with quarterly revenues of just $100,000 in its most recent report. This disparity between market valuation and earnings highlights the speculative nature of QUBT’s investment thesis, which is primarily driven by future potential rather than current financial performance.

Photonic Breakthrough: TFLN Foundry and Market Disruption

In parallel with the NASA contract, QUBT announced its first commercial order for thin-film lithium niobate (TFLN) photonic chips from a major Asian research institute. These chips, produced in the Tempe, Arizona foundry, promise to revolutionize data transmission by doubling speeds to 3.2 terabits per second while significantly reducing energy consumption. This efficiency addresses the growing demands of AI and quantum computing.

The pre-sale agreement for the TFLN chips, which will be delivered starting December 2024, validates QUBT’s technological leadership. However, competition from well-funded players such as HyperLight Corporation, which recently secured $37 million in Series B funding, poses a challenge. Delays in the commissioning of QUBT’s foundry could risk losing market share.

Revenue Streams and Risk Factors

Quantum Computing Inc. (NASDAQ:QUBT) is in a critical phase of its growth journey, with its revenue heavily concentrated on two significant contracts—one with NASA's Goddard Space Flight Center and another with Johns Hopkins University. In the most recent quarter, QUBT reported total revenues of just $100,000, underscoring its reliance on these limited streams. However, the recent thin-film lithium niobate (TFLN) chip order from a major Asian research institute marks a pivotal step toward revenue diversification. The agreement, expected to generate early-stage demand for its photonic chips, could signal the start of broader adoption. The delivery of the first chips is scheduled for December 2024, with completion expected by Q1 2025, providing potential revenue stabilization.

Despite these promising developments, QUBT faces significant financial vulnerabilities. Its inconsistent revenue history makes the company heavily reliant on securing future contracts to sustain operations. To bridge the funding gap, QUBT recently raised $40 million through a registered direct offering of 16 million shares at $2.50 per share, diluting shareholder value. This follows earlier dilutive actions, including equity incentives and convertible promissory notes, which could convert into 17.6 million shares, further impacting existing investors. As a result, shareholder dilution remains a substantial risk unless the company rapidly scales revenue to offset these equity impacts.

Competitive Landscape: Challenges and Opportunities

The quantum computing industry remains in its infancy, characterized by high technological barriers and intense competition. QUBT’s proprietary technology, including the Dirac-3 optimization machine and TFLN photonic chips, positions it as an innovator. However, its market share is far from secure. Rivals like Rigetti Computing (NASDAQ:RGTI) and D-Wave Quantum (NYSE:QBTS) have also made strides, with D-Wave reporting a year-to-date stock surge of over 1,000% on the strength of its quantum annealing solutions.

Furthermore, QUBT faces mounting competition from established tech giants like Google (NASDAQ:GOOG) and Amazon (NASDAQ:AMZN), both of which are investing heavily in quantum technology. Google's Willow chip, unveiled earlier this year, and Amazon’s Quantum Embark initiative highlight the substantial resources these companies bring to the table. In the TFLN photonics space, QUBT contends with HyperLight Corporation, a private player that recently secured $37 million in funding to develop similar chip technology. HyperLight’s funding advantage and market positioning could create significant headwinds for QUBT, especially if the commissioning of its Arizona foundry faces delays.

Financial Metrics and Valuation

Quantum Computing Inc. (NASDAQ:QUBT) is trading at a valuation that underscores its speculative nature. With a price-to-sales (P/S) ratio of 7,600, the stock is significantly overvalued based on its trailing twelve-month revenue of $386,000. This extreme ratio reflects high investor optimism about the company’s quantum computing potential, but it contrasts sharply with the broader industry benchmarks and signals substantial risk for fundamentals-focused investors.

QUBT’s market cap has soared to $3.05 billion, driven by a dramatic 52-week range spanning from $0.35 to $27.15, a surge of over 2,800%. Its enterprise value of $3.06 billion further emphasizes its inflated valuation, especially considering the company’s negative operating cash flow of -$17.41 million and an operating margin of -5,384%. These metrics point to ongoing challenges in achieving profitability.

The recent $40 million capital raise, through the issuance of 16 million shares at $2.50 per share, temporarily strengthened the balance sheet, raising cash reserves to $3.06 million. However, this also increased the total shares outstanding to 118.94 million, resulting in further shareholder dilution. With total debt standing at $7.81 million and a debt-to-equity ratio of 12.92%, the company remains reliant on external financing to complete its Arizona foundry and scale operations.

Performance in Market Extremes

QUBT has demonstrated exceptional resilience during speculative market phases, outperforming rivals like Rigetti and D-Wave in recent rallies. In the past six months, QUBT’s stock has soared 1,656%, with a 33% surge immediately following the NASA contract announcement. This performance reflects investor confidence in its technological edge and growth potential. However, the company’s volatility is a double-edged sword. During broader market corrections, QUBT could face amplified losses due to its reliance on speculative sentiment rather than robust financial fundamentals.

While Rigetti and D-Wave experienced pullbacks during the recent quantum rally, QUBT maintained its upward trajectory. This divergence suggests that QUBT’s narrative around cutting-edge photonic chips and quantum optimization solutions resonates strongly with investors. However, sustained performance will depend on QUBT’s ability to convert this enthusiasm into tangible revenue growth and long-term contracts. A downturn in market sentiment or delays in operational milestones could disproportionately impact QUBT’s valuation, highlighting its high-risk, high-reward profile.

Quantum Computing Inc. (NASDAQ:QUBT) offers a speculative opportunity at the forefront of quantum innovation, with its recent NASA contract and TFLN photonic chip advancements signaling strong potential. The company’s current valuation at a $3.05 billion market cap, bolstered by a 52-week high of $27.15 after a staggering 1,656% six-month gain, highlights investor enthusiasm. However, challenges abound. The company’s trailing revenue of $386,000 underscores its early-stage nature, while its -5,384% operating margin and ongoing cash burn (-$17.41 million in operating cash flow) highlight the financial risks.

The $40 million raised through share dilution at $2.50 per share has secured short-term liquidity for its Arizona foundry, but further dilution remains likely unless the company diversifies its revenue base. Competitive pressures from well-funded rivals like HyperLight and tech giants such as Google add to operational uncertainty. Insider holdings of 21.84% and institutional ownership of 3.33% reflect a mix of internal confidence and limited institutional endorsement.

For speculative investors, QUBT’s potential to disrupt quantum computing and data transmission makes it a compelling high-risk play. However, the company’s sky-high price-to-sales ratio of 7,600 and reliance on future contracts make this an investment best suited for those willing to embrace significant volatility.

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex