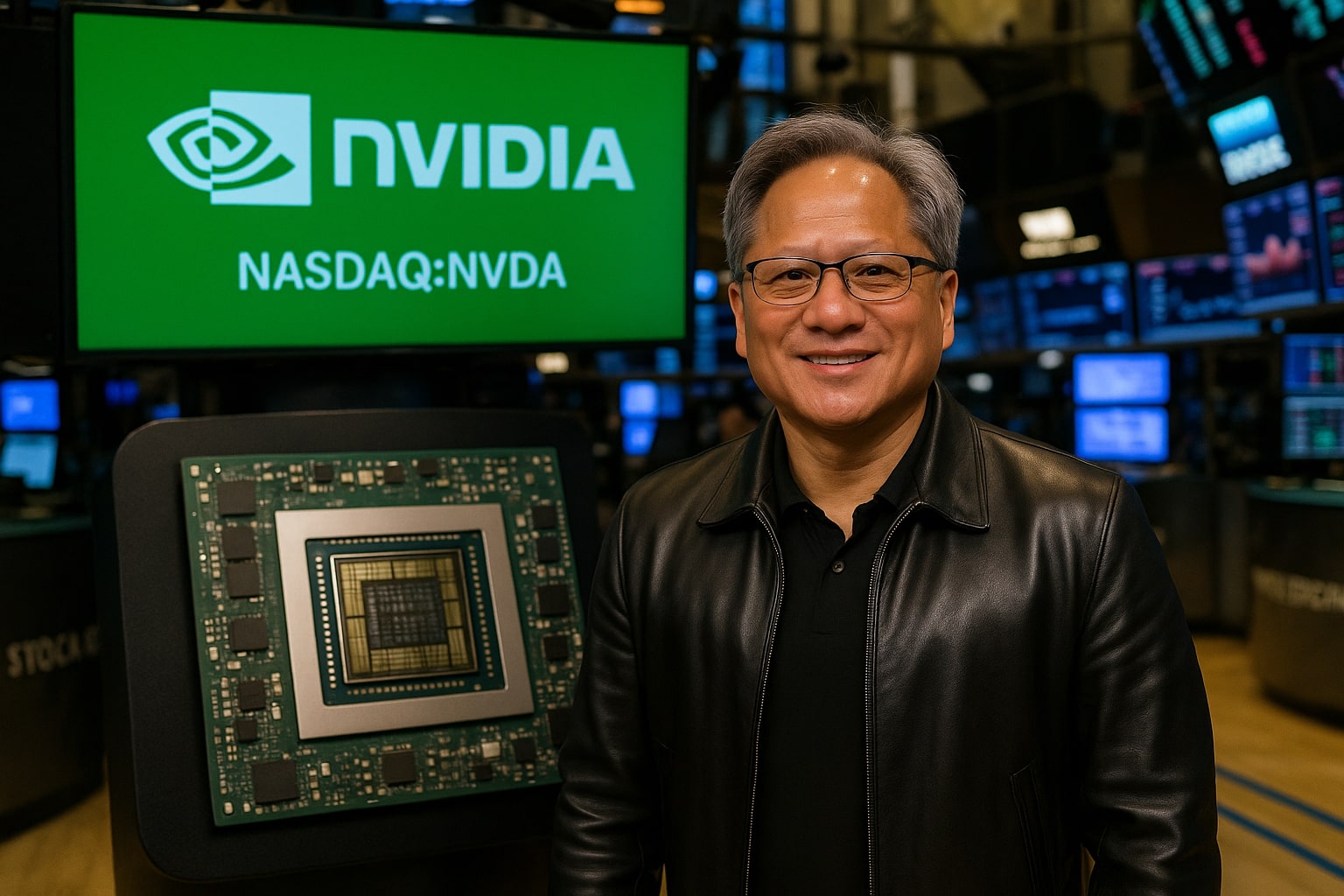

Is NVIDIA (NASDAQ:NVDA) Set to Surge From $462 to $550 Thanks to $60.7B in Free Cash Flow?

With NVDA trading around $462, can its Blackwell NVL72 inference platform and 5.9 million CUDA developers push the stock past $650 despite export controls? | That's TradingNEWS

Harnessing Free Cash Flow: NASDAQ:NVDA’s $60.7 Billion Power Engine

NVIDIA’s FY2025 free cash flow surged to a record $60.7 billion, a level that underpins a three-tiered DCF valuation ranging from a bear-case $50 per share to a base-case $100, and stretching as high as $469 under bull assumptions. The calculation begins with a conservative 25 percent FCF CAGR over the next five years, discounted at a 10 percent WACC, yielding a present value of projected cash flows through 2030 of roughly $453 billion, complemented by a terminal value of about $1.99 trillion. At 24.4 billion shares outstanding, the base-case intrinsic value emerges near $100 per share—remarkably close to NVDA’s current $457–$462 trading range (see the real-time chart). Under an optimistic scenario of 30 percent FCF growth, an 8 percent WACC and a 6.5 percent terminal growth rate, the DCF balloons to an eye-popping $469. Conversely, applying a more cautious 15 percent CAGR, a 12 percent discount rate and 2 percent terminal growth concedes a bear-case valuation around $50.

From Training Peaks to SaaS-Style Inference: The Blackwell NVL72 Pivot

The rollout of the Blackwell NVL72 platform marks NVIDIA’s transition from episodic training cycles to continuous inference monetization. Where Hopper architecture centered on massive one-off training runs, Blackwell is architected for low-latency, high-throughput inference across distributed clusters. The introduction of Dynamo, NVIDIA’s inference orchestration library, de-aggregates GPU resources and smartly routes context windows for large-language models. By packaging GPUs, high-speed interconnects, TensorRT-LLM and software runtime into a single turnkey solution, NVIDIA converts each inference prompt into a recurring revenue stream—much like subscription licensing—delivering gross margins north of 90 percent on software and compounding wallet share within customer data centers.

The 5.9 Million Developer Moat: CUDA’s Unrivaled Ecosystem

NVIDIA’s CUDA software abstraction layer now boasts over 5.9 million registered developers, a level of vendor lock-in unmatched in semiconductors. Each CUDA-penned line of code for GPUs, DPUs or DPX units deepens the protocol capture, making any migration to alternative hardware prohibitively expensive in time and engineering resources. This network effect, reinforced annually through “One Architecture, One Stack” updates, cements NVIDIA’s position as the de facto AI operating system and justifies premium valuations well above the semiconductor group median.

Geopolitical Crosswinds: Export Controls, Tariffs and the Mexico Pivot

In January 2025, the U.S. expanded export controls to require licenses for nearly all high-end chips, injecting uncertainty into NVIDIA’s supply chain. Simultaneously, a 32 percent tariff on Taiwan-manufactured AI servers threatened margin compression. NVIDIA’s response has been to nearshore final assembly to Mexico under USMCA, preserving throughput at key customer fabs while sidestepping punitive duties. This geopolitical hedging, however, remains a structural risk: any further escalation or export-license denials could shave north of 10 percent from top-line forecasts, a vulnerability competitors in China and Israel are eager to exploit.

Competitive Landscape: Broadcom, Startups and the Yield Gauntlet

Broadcom’s rumored 20 percent slice of the AI accelerator market looms large as it scales its custom silicon efforts. Meanwhile, startups like Pensando (now part of AMD) and Fungible are carving out niches in smart NICs and DPUs. NVIDIA’s ability to maintain 5 nm ASIC yields and accelerate product cadence is critical; any slip in manufacturing or late pivot in architecture risks surrendering design wins at hyperscalers. The company’s deeper software-hardware integration and annual SDK releases remain its strongest bulwark, but the margin for operational error is razor-thin in an arms race measured in months, not years.

Valuation Unpacked: From 12× Forward Sales to a Cogent Cash-Flow Premium

At roughly 12× forward revenue and 22× forward GAAP earnings, NVIDIA trades at a modest premium to the broader semiconductor sector—but a steep discount to software peers when adjusted for its emerging inference-as-a-service profile. Its forward PEG of 0.62 stands in stark contrast to the sector median above 1.3, suggesting earnings growth is underappreciated. A direct EV/EBITDA comparison underscores the gap: NVIDIA’s 14.6× multiple sits near 2023 troughs, compared with Broadcom’s 20× and Intel’s 18×. When benchmarked to its own historical averages and suite of platform economics, the stock appears to be trading below reasonable intrinsic thresholds implied by its foundational DCF.

Technical Terrain: $440 as Support, $500 as the Next Hurdle

Technically, NVDA’s weekly chart reveals emerging support at $440—an area that saw heavy volume in late 2023 and early 2024. A sustained close above $500, near the 50-week moving average, would validate a more durable base breakout and attract renewed institutional flows. Failure to hold $420 risks a retest of the March lows around $380, potentially triggering mechanical stop-loss liquidations before any recovery can take shape.

Tactical Accumulation: Building on Strength Above $440 with a $380 Cushion

Given the extreme valuation compression and deeply oversold technical readings, a tactical accumulation strategy suggests layering into NVDA on moves above $440 while maintaining a protective stop below $380 to guard against a broader market derating or unforeseen capex slowdowns. This approach offers asymmetric upside of 10–20 percent in base-case scenarios and up to 40 percent in bull-case outcomes, aligning risk capital with a clear reward-to-risk framework.

Hold, Buy or Sell? A Clear Call for Patient, Long-Term-Oriented Investors

Weighing the structural inference monetization shift, the unassailable developer moat, robust free cash flows, and convex DCF outcomes against geopolitical friction and near-term capex cyclicality, the evidence favors a BUY stance on NASDAQ:NVDA. The stock’s current consolidation around $457–$462 per share represents a well-priced entry point for exposure to the AI platform company of record, with a base-case target near $550 and bull-case potential above $650 over the next 12–18 months.

That's TradingNEWS

Read More

-

VOO ETF At $638 With The S&P 500 At 6,966: How Jobs Data, $37.6T U.S. Debt And Trump’s $1.5T Defense Plan Hit The ETF

10.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Hold $1.47B as XRP-USD Price Hovers Near $2

10.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Near $3.13 As Warm Winter Smashes The Winter Premium

10.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Dollar Near 158 As Fed Hold Bets Grow And BoJ Stays Cautious, 161.94 High Back In Play

10.01.2026 · TradingNEWS ArchiveForex