Lululemon Stock Analysis: A Robust Buy in 2024's Volatile Market

Unveiling Lululemon's strategic initiatives and financial prowess that mark its stock (NASDAQ:LULU) as an undervalued gem in today's athleisure industry | That's TradingNEWS

Reassessment of Lululemon Athletica Inc. (NASDAQ:LULU): A Strong Buy Amid Market Turbulence

Overview and Recent Performance

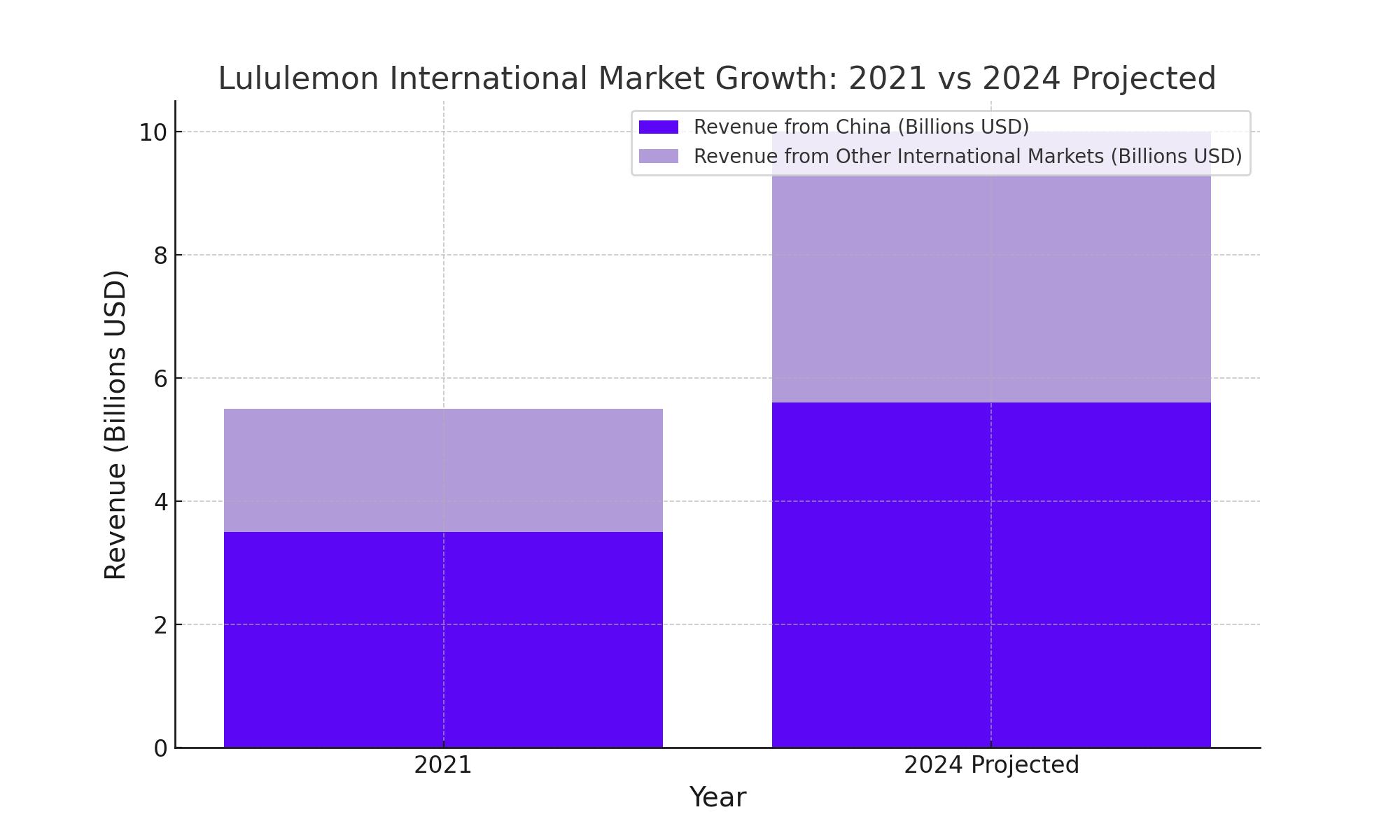

Lululemon Athletica Inc., a leader in the athleisure market, has seen its share price drop by approximately 30% year-to-date, an adjustment primarily attributed to a slowdown in growth rates from previous highs. Despite this deceleration, the company continues to execute on a robust strategic plan known as the "Power of 3x2," which aims to double men’s and digital revenues and quadruple international revenues by FY26. Initially set against a backdrop of a $6.25 billion revenue base in 2021, the company is on track with its ambitious goals, projecting FY24 revenues in the range of $10.7 to $10.8 billion.

Strategic Initiatives and Growth Prospects

The "Power of 3x2" strategy underscores Lululemon’s focus on expanding its male customer base, enhancing its digital footprint, and aggressively growing its international market presence. Notably, the company has made significant inroads in China, where revenue soared by 56% year-over-year in the most recent quarter. This growth is particularly compelling, considering the broader economic slowdown in the region, demonstrating Lululemon's effective brand positioning and localized marketing strategies.

Financial Health and Operational Efficiency

Lululemon's financial stability is reinforced by its robust gross margin of 59.4% as of the last quarter, significantly outpacing competitors like NIKE, Inc. (NKE), which reported a gross margin of 44.8%. This margin advantage is a testament to Lululemon’s premium brand positioning and operational efficiency. Additionally, the company maintains a strong balance sheet with $2.2 billion in cash and no significant debt, providing substantial flexibility for ongoing investments and shareholder returns.

Market Position and Competitive Landscape

While the U.S. market has presented challenges, marked by a softer consumer spending environment, Lululemon's international achievements, especially in China, help counterbalance domestic weaknesses. The company’s growth in China, contrasted with its competitors’ struggles, highlights Lululemon’s unique appeal and effective market strategies. Moreover, Lululemon’s commitment to opening new stores and optimizing existing ones underscores its proactive approach to capturing market share and enhancing consumer engagement.

Innovation as a Growth Lever

Innovation remains at the heart of Lululemon’s strategy. Recent product launches, such as the Cityverse sneakers and the expansion into men's footwear, demonstrate the company’s commitment to diversifying its product portfolio and tapping into new consumer segments. These initiatives not only cater to evolving consumer preferences but also bolster the brand’s reputation for quality and innovation.

Valuation and Investment Perspective

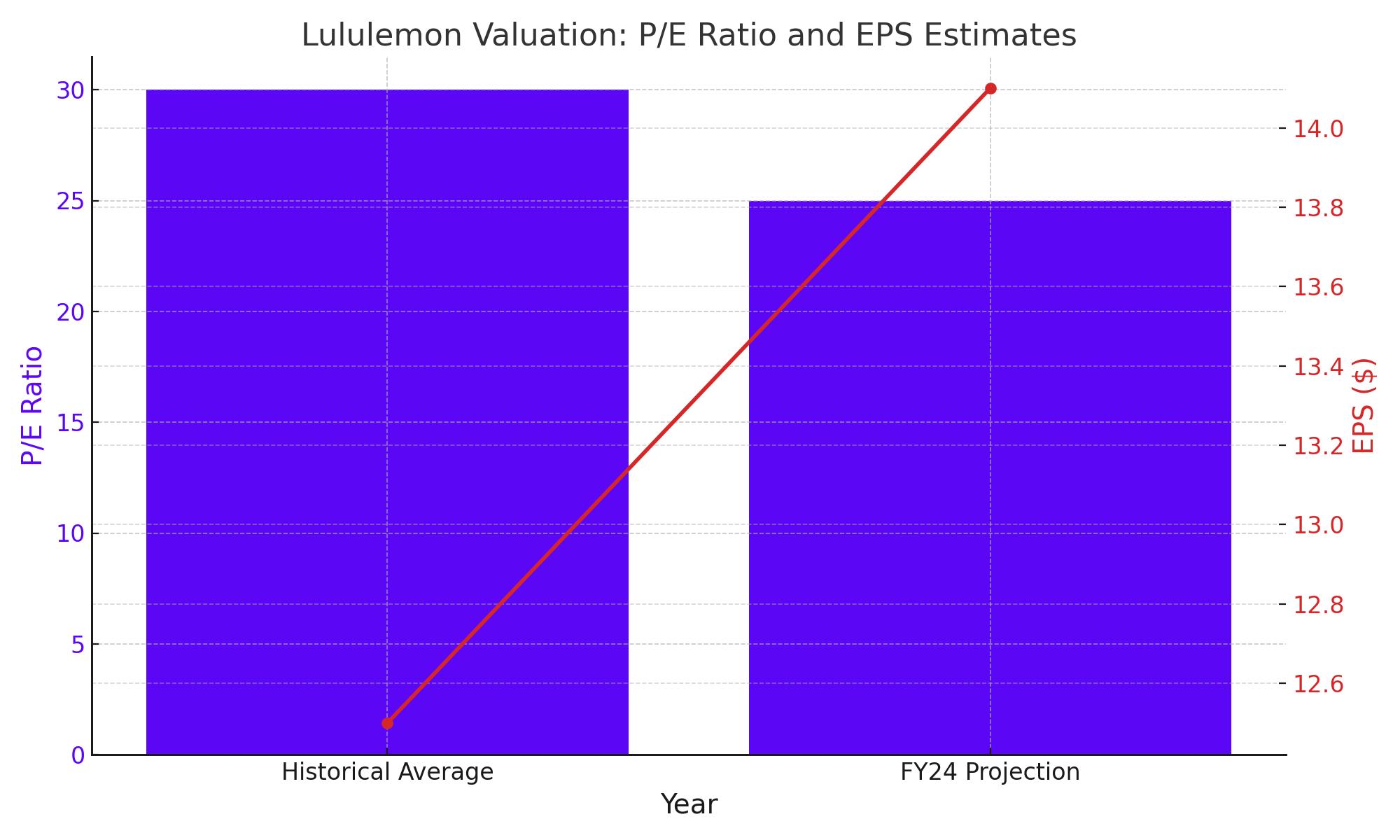

Current valuations present Lululemon as an attractive investment opportunity. Trading at a forward P/E of approximately 25x against FY24 EPS estimates of $14.00-$14.20, the stock is priced attractively relative to its historical premium and growth prospects. The company’s strategic initiatives, coupled with its strong operational metrics, position it well for long-term growth, making the recent dip an appealing entry point for investors.

Risks and Mitigation

Potential risks include shifts in fashion trends and heightened competition, particularly from emerging brands like Alo Yoga. However, Lululemon’s diverse product range, strong brand loyalty, and international market expansion mitigate these risks substantially. Additionally, the company's robust financial position allows it to navigate market volatility effectively.

Final Assessment

Lululemon Athletica stands out as a resilient player in the athleisure industry, with a clear strategic vision and proven operational prowess. Its ability to maintain high growth rates, particularly in international markets, alongside continuous product innovation and strong financial health, supports a strong buy recommendation. The company's adaptability in response to market conditions, combined with its aggressive growth strategy, underscores its potential for significant value creation over the long term.

For further insights and detailed stock information, refer to Lululemon's real-time stock chart and insider transactions for comprehensive investment analysis.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex