Meta NASDAQ:META Financial Performance and Future Outlook

In-Depth Review of Q1 2024 Results, AI Investments, CAPEX, and Strategic Initiatives for Growth | That's TradingNEWS

Analysis of Meta Platforms, Inc. (NASDAQ:META): Comprehensive Review and Future Outlook

Introduction: Market Position and User Engagement

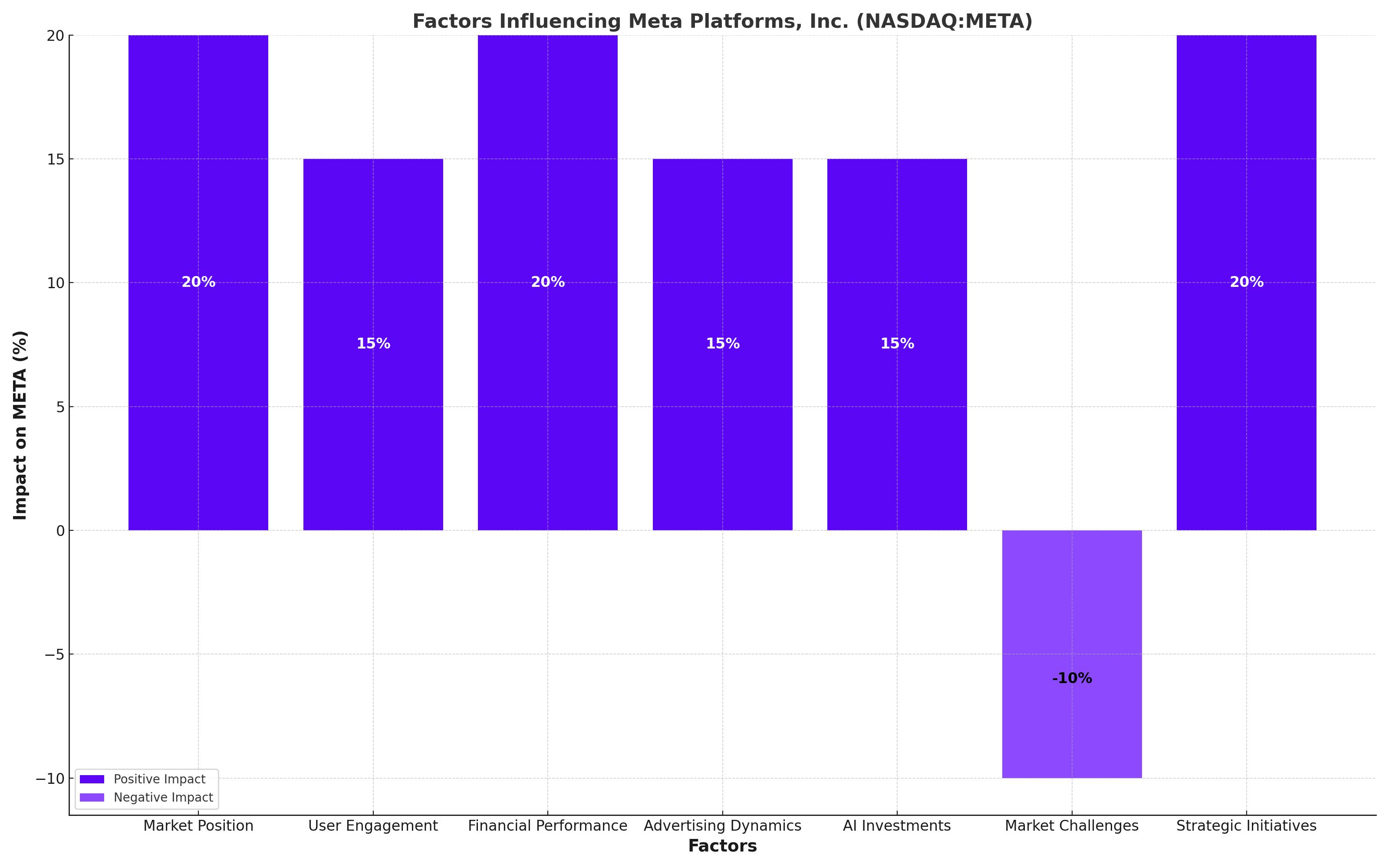

Meta Platforms, Inc. (NASDAQ:META), continues to dominate the social media landscape with its extensive suite of applications including Facebook, Instagram, WhatsApp, and Messenger. With approximately 3.24 billion daily active users, nearly 40% of the global population engages with Meta's platforms regularly. This vast user base provides Meta with unparalleled data collection capabilities, crucial for targeted advertising and strategic business decisions. The daily user count has seen a year-over-year increase of 7%, signifying sustained growth in global digital engagement.

Financial Performance: Q1 2024 Highlights

Meta reported a robust first quarter in 2024, with revenues escalating to $36.5 billion, marking a 27% increase from the previous year. This surge is largely attributed to enhanced ad monetization and an uptick in ad demand. Operating income notably doubled compared to Q1 2023, with cost of goods sold (COGS) remaining well-managed despite broader economic pressures. The operational efficiency improvements are reflected in a 1300 basis point expansion in margins.

Advertising Dynamics

The advertising segment remains Meta's primary revenue generator. The recovery in advertising prices, which increased by 6% year-over-year in Q1 2024, indicates a rebound in the market demand. Meta's strategic enhancements in AI-driven content curation have significantly boosted user engagement rates, thereby attracting more advertisers to its platforms. Companies like Temu and Shein have notably increased their advertising spend, contributing to Meta's revenue streams.

Capital Expenditure and AI Investments

Meta's commitment to innovation is evident in its escalated capital expenditure, projected between $35 billion to $40 billion for 2024. These investments primarily focus on advancing AI capabilities, including acquiring state-of-the-art Nvidia H100 GPUs for developing cutting-edge data centers. This move is aimed at bolstering Meta's AI-driven offerings, from improved content recommendations to new business solutions.

Market Challenges and Risks

Despite its strong market position, Meta faces significant challenges, including intense competition from emerging platforms and potential regulatory scrutiny due to its data handling practices. The company's heavy reliance on advertising revenue also poses a risk, especially in economic downturns when ad spending typically contracts.

Strategic Initiatives and Future Prospects

Looking ahead, Meta is strategically positioning itself to lead in AI integration across its platforms. The company's open-source AI model, Llama, is expected to revolutionize interactions within its ecosystem, enhancing user experience and opening new monetization channels. Moreover, Meta's ventures into virtual reality and augmented reality, through products like the Quest VR headsets, signal its ambition to remain at the forefront of technological advancements.

Financial Outlook

For Q2 2024, Meta anticipates revenues around $38.2 billion, reflecting a 19.5% year-over-year growth. This forecast considers a moderation in growth rate due to tougher year-over-year comparisons. The EPS is projected at $4.7 for Q2, up 57% from the previous year, underscoring Meta's strong profitability trajectory.

Investment Consideration

Meta's stock, currently trading at a forward P/E ratio of 27.6x, offers a balanced risk-reward profile given the company’s ambitious growth initiatives and technological advancements. The substantial investments in AI, particularly through the acquisition of Nvidia’s H100 GPUs and development of the Llama large language model, underscore Meta's commitment to maintaining a competitive edge. Additionally, Meta’s strategic foray into virtual and augmented reality through products like the Quest VR headsets is set to enhance user engagement and unlock new revenue streams. Investors should closely watch the capital expenditures, projected between $35 billion and $40 billion for 2024, as these will significantly impact the company’s profitability. Despite these substantial outlays, Meta’s dominant market position and innovative trajectory present a promising outlook for sustained growth.

Conclusion

Meta Platforms, Inc. (NASDAQ:META) remains a dominant entity in the tech and social media sectors, with impressive daily engagement from 3.24 billion users. The company’s strategic focus on AI, through initiatives like the Llama large language model and AI-powered content recommendations, positions it well for future success. Furthermore, Meta’s expansion into immersive technologies, such as VR and AR, showcases its innovative approach to enhancing user experiences and creating new monetization avenues. While the company faces challenges, including regulatory scrutiny and heavy reliance on ad revenue, its comprehensive investment strategy and strong market presence provide a robust foundation for long-term growth. Investors should weigh the potential growth against these risks when considering META as a long-term investment.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex