Meta Platforms: AI Dominance and Smart Glasses Could Propel Stock to $750 by 2025

Meta’s $47B Q4 ad revenue, AI innovation, and smart glasses investments shape the future of NASDAQ:META stock | That's TradingNEWS

Meta Platforms (NASDAQ:META) Stock Analysis: AI, Smart Glasses, and 2025 Projections

Meta's Dominance in Digital Advertising and AI Growth

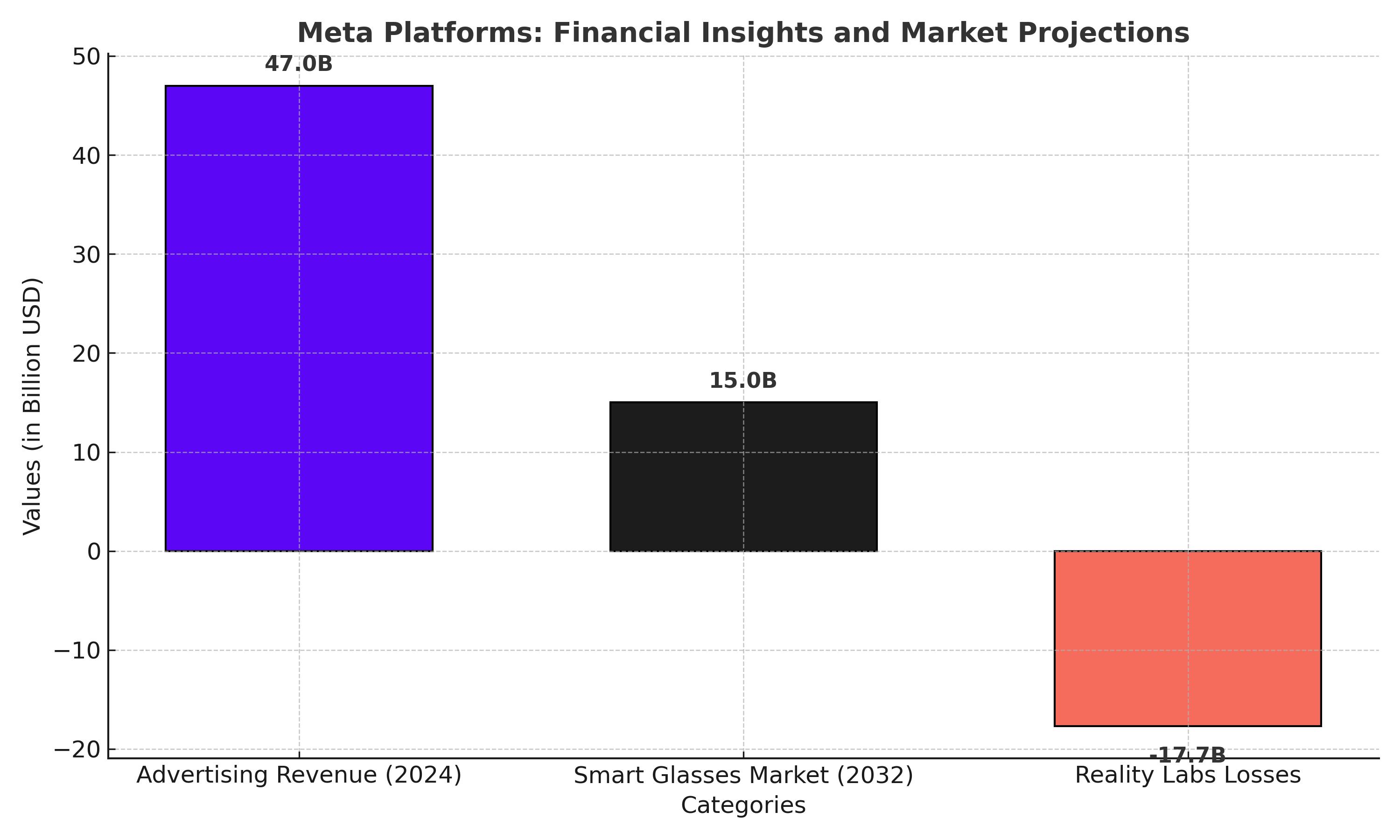

Meta Platforms (NASDAQ:META) has firmly established itself as one of the top players in the digital advertising space, with its vast ecosystem of social media platforms and innovative AI-driven advertising solutions. Meta’s advertising revenue reached $47 billion for Q4 2024, up 17.1% year-over-year, driven by the strength of its AI systems, which have significantly boosted ad efficiency. With over 2.9 billion daily active users across its platforms, including Facebook, Instagram, and WhatsApp, Meta continues to dominate, maintaining a stronghold in the global advertising market. As Meta becomes more AI-driven, the company has witnessed an impressive 37% year-over-year increase in earnings per share (EPS) to $6.03 for Q3 2024, demonstrating the effectiveness of its efficiency gains and the power of AI.

The Potential of Meta’s Smart Glasses: A $750 Target by 2025?

While Meta’s advertising business remains its primary revenue generator, the company is making bold moves into new growth areas, particularly augmented reality (AR) and virtual reality (VR). Meta's Reality Labs division, despite posting substantial losses, has continued to innovate with AR glasses that may eventually replace smartphones. In partnership with Oakley, Meta has developed smart glasses that could target the sports market. These glasses, which may cost around $1,000, will feature a camera at the center of the frame, and will be positioned as a high-end consumer product. Meta is betting heavily on these smart glasses, with the goal of having a device that offers a heads-up display for tasks like checking emails and taking photos by 2030. However, this goal comes at a steep cost. Reality Labs has burned through billions, with an annualized loss of $17.7 billion, as the company invests heavily in developing its smart glasses technology. These investments could pay off handsomely if Meta can capture the smart glasses market, which is expected to grow from $6 billion today to $15 billion by 2032. If the smart glasses become a mainstream product, Meta’s stock could soar, potentially reaching a price of $750 by 2025 based on a 25x multiple of its core earnings.

Meta’s Strong AI Integration Fuels Profitability

Meta’s AI advancements have had a significant impact on its bottom line. The company has invested heavily in AI, which has been integrated across its advertising and social media platforms. In Q3 2024, Meta reported an additional $6 billion in ad revenue, with $4 billion flowing directly into operating income thanks to the efficiency boosts provided by AI. With nearly $22 billion in operating income from the social media business, Meta is in a strong position to continue driving profitability, even with Reality Labs' ongoing losses. As the company’s AI models improve, advertisers are seeing better returns on their ad spend, which should lead to continued revenue growth. Meta's ability to integrate AI into its advertising ecosystem has resulted in stronger engagement and increased average revenue per user, which grew to an all-time high of $12.29 in Q3 2024.

Smart Glasses: Meta’s High-Risk, High-Reward Strategy

Meta’s smart glasses ambition is one of the most exciting—and risky—growth prospects for the company. The company’s aggressive investment in Reality Labs, which focuses on smart glasses and the Metaverse, comes with enormous potential, but also with significant financial risk. The goal of replacing smartphones with smart glasses is a bold one, and it may take years to materialize. While Apple has launched its Vision Pro, which has not yet gained substantial traction, Meta is betting that it can find a unique value proposition that appeals to consumers. The market for smart glasses is still in its infancy, and while projections show potential growth, much of the market remains uncertain. Meta’s development of smart glasses is an expensive endeavor, and its annual losses in the Reality Labs division will need to turn into profits for the company to justify the spending. Despite this, if Meta succeeds in developing a popular product, the rewards could be immense, and investors could see a significant payoff as the smart glasses market expands.

Valuation and Forward Outlook

Meta is currently trading at 24 times its 2025 EPS target of $25.41, which is not excessively high considering the company’s strong AI-driven advertising business and the long-term potential of its smart glasses division. The stock’s relatively low price-to-earnings (P/E) multiple suggests that the market is undervaluing Meta’s future growth prospects. If Meta continues to execute its AI strategy effectively and successfully transitions into new growth areas like smart glasses, the stock could easily reach a price of $750 by 2025, based on a 25x multiple of its core earnings. Analysts are projecting continued growth for the company, with revenue set to rise by 15% next year. However, the risk of Reality Labs not paying off could weigh heavily on the stock if Meta fails to turn its investment into a successful consumer product.

Meta’s Competitive Advantages and Risks

Meta’s biggest competitive advantage lies in its massive user base and its dominant position in the digital advertising market. The company serves nearly 10 million businesses, making it the go-to platform for advertisers looking to reach a global audience. This gives Meta a tremendous moat in the advertising space, which is likely to remain a key driver of growth for years to come. However, there are risks to the business. The company’s reliance on advertising makes it vulnerable to macroeconomic downturns and potential regulation of its advertising model. Additionally, the competition in the smart glasses market could intensify as more tech companies, including Apple and Google, invest in AR and VR technology. If Meta fails to deliver on its smart glasses ambitions or if the market for these devices remains niche, the company could face significant challenges in the coming years.

The Future of Meta’s Smart Glasses and Metaverse Investments

Meta’s investments in the Metaverse and smart glasses represent a long-term play for the company. The ultimate goal of replacing smartphones with smart glasses is still years away, but Meta is positioning itself as a leader in this space. With the backing of Reality Labs and a focus on AI, Meta is laying the foundation for a future where its products are at the center of consumers’ lives. The company’s partnership with EssilorLuxottica, which produces Ray-Ban smart glasses, could be a game-changer, as Meta looks to combine cutting-edge technology with high-end fashion to attract consumers. As the market for smart glasses grows, Meta could capture a large share of the market, driving future growth and enhancing its valuation.

Investor Sentiment and Price Target

Despite its massive run-up in stock price, Meta remains a strong buy for long-term investors. With a solid core advertising business and the optionality of the smart glasses and Metaverse projects, the stock has significant upside potential. Given the low P/E multiple compared to its peers, Meta is still undervalued relative to its growth prospects. The stock is expected to reach $750 by 2025, driven by AI and smart glasses growth, as long as the company can execute on its ambitious plans. Meta’s financial position remains strong, with growing operating income and a robust cash flow from its advertising business. If Meta can successfully transition from a social media company to a leader in AI and AR/VR, the stock could see substantial gains in the next few years.

Final Thoughts

Meta Platforms (NASDAQ:META) remains a compelling investment despite the challenges it faces with Reality Labs. The company’s dominance in digital advertising, combined with its ambitious plans in AI and smart glasses, offers significant long-term growth potential. While there are risks involved, particularly with the uncertainty surrounding the smart glasses market, the company’s solid financials and strong execution give it a strong chance of success. Meta’s stock could reach $750 by 2025, making it a strong buy for investors looking for exposure to both AI growth and the future of consumer technology.

That's TradingNEWS

Read More

-

Nike Stock Price Forecast - NKE at $60: Insider Buying, China Slump and a $75 Upside Target

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD at $1.87: ETF Hunger and Vanishing Supply Put a $2.10 Breakout Back on the Table

28.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Prices Surge Then Slip: WTI Around $56 And Brent Near $61 As Venezuela And China Set The Tone

28.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today: S&P 500 Stalls Near 6,940 As NVDA Stock And Gold Lead Into 2026

28.12.2025 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Tests 1.3500 as Dollar Weakens and Rate Path Divergence Lifts Sterling

28.12.2025 · TradingNEWS ArchiveForex