Meta Platforms (NASDAQ:META): The AI Leader Driving Market Innovation and Revenue Growth

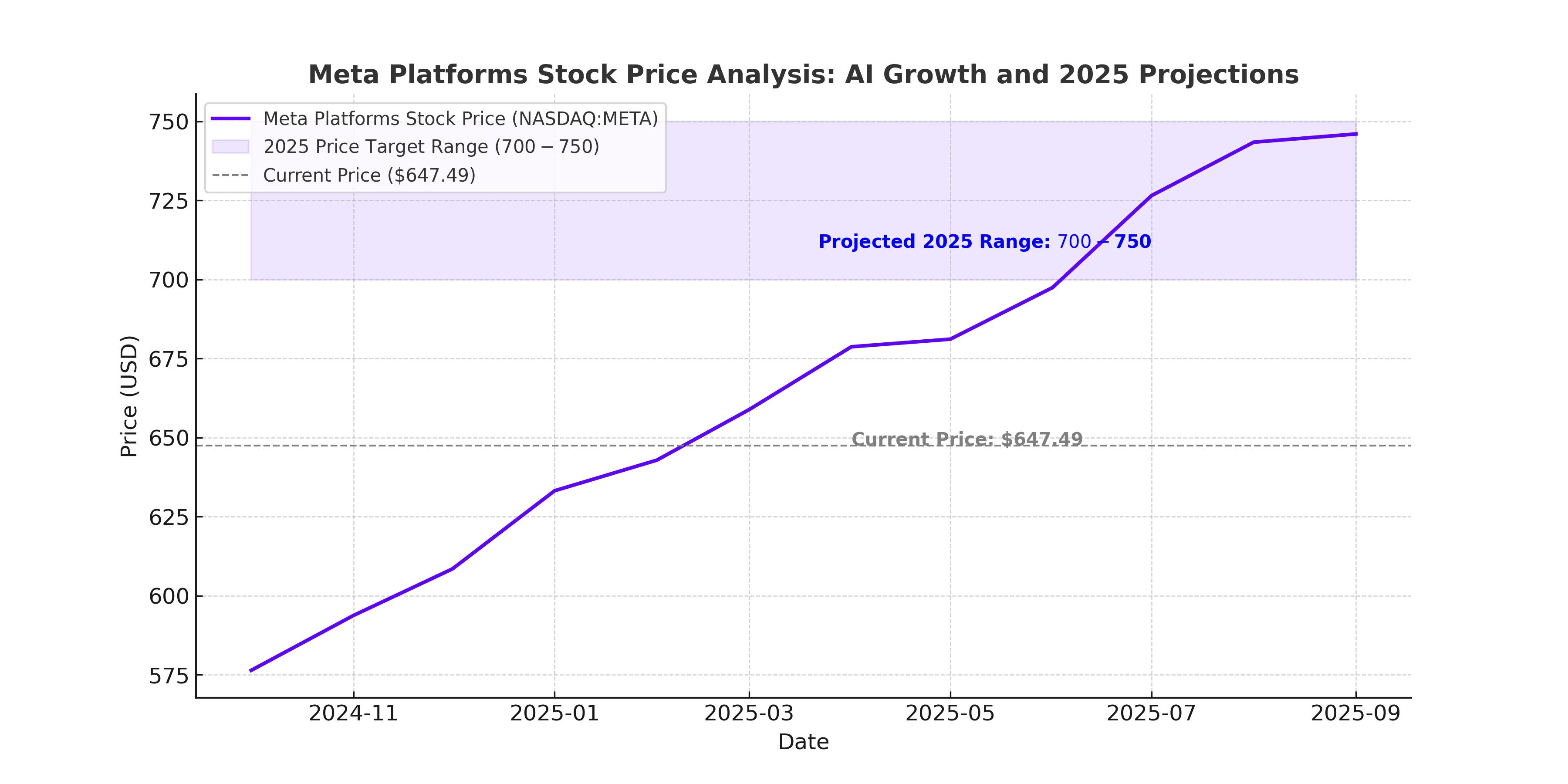

Meta Platforms, trading under NASDAQ:META, has demonstrated impressive resilience and adaptability in the ever-evolving tech industry. The stock has surged by nearly 12% over the past three months, climbing from $580.15 to $647.49. This growth reflects Meta's robust focus on artificial intelligence (AI) integration, particularly in its core advertising business. With an ambitious capital expenditure plan and promising financial projections, the company is well-positioned to shape the future of AI and social media. Live Meta stock chart here.

Strong AI Investments: A Game-Changer for Meta Platforms

Meta's AI initiatives are revolutionizing the advertising landscape. Through the deployment of proprietary models such as Llama 3.3, with Llama 4 on the horizon, Meta enhances ad targeting, delivering higher click-through rates and increasing advertiser spend. The company plans to allocate between $60 billion and $65 billion toward AI and infrastructure in 2025, up from $38 billion in 2024. This move reflects confidence in its ability to capitalize on advanced machine learning technologies to bolster revenue streams.

Recent developments, such as the emergence of the DeepSeek model, raise questions about the efficiency of Meta’s spending. DeepSeek, developed with a fraction of the cost of traditional models, challenges legacy players like Meta to innovate further. However, this could work in Meta's favor, enabling potential cost reductions and increased operational efficiency. Despite market concerns over AI spending mirroring the Reality Labs overinvestment, Meta’s ability to pivot and scale ensures a strong competitive position.

Earnings Preview: Q4 2024 and Forward Projections

Meta’s Q4 earnings, set for release on January 29, 2025, are expected to highlight another robust quarter. Analysts forecast revenue of $46.97 billion, reflecting 17.11% year-over-year growth. Earnings per share (EPS) are estimated at $6.73, a 26.32% YoY increase. The company’s strong performance in prior quarters, coupled with upward revisions—39 out of 42 EPS forecasts revised higher—underscores market optimism.

Meta’s annual revenue for 2024 is projected to exceed $185 billion, with EPS surpassing $25.42. These figures align with Meta's historical trend of outperforming Wall Street expectations. Analysts suggest 2025 EPS could climb to $27-$28, bolstered by expanding ad revenues and cost efficiencies.

Technical Analysis: META’s Stock Momentum

Technically, NASDAQ:META remains in a strong uptrend. After consolidating around the $630-$650 resistance level, the stock is poised to break higher. Analysts anticipate a potential run toward $750 by the end of 2025, supported by solid earnings growth and technical momentum. Immediate support levels are identified near $620, with strong resistance at $700.

From a valuation perspective, Meta’s forward P/E ratio of 27.51 represents a premium to the sector median of 20.23. However, its forward EPS growth rate of 43.47%—542.13% higher than the sector median—justifies the premium. If the forward P/E premium increases to 80% above the sector median, META could see an upside of over 30%.

Risks: Overspending and Execution Challenges

Despite its successes, Meta faces risks associated with its AI spending and broader market dynamics. Comparisons to the dot-com bubble loom large, with critics questioning the returns on $10+ billion annual investments in Reality Labs. Economic headwinds, such as reduced ad spending during downturns, could also weigh on revenue. Furthermore, CEO Mark Zuckerberg’s control of the company introduces unique governance risks, as evidenced by past high-stakes investments.

Conclusion: Buy, Hold, or Sell?

Meta Platforms' dominance in the social media and advertising sectors, combined with its aggressive AI investments, positions it as a market leader with substantial upside potential. The stock's trajectory toward $750 reflects confidence in its earnings growth and technological innovation. While risks remain, Meta’s strategic investments in AI, coupled with its ability to adapt to market challenges, make NASDAQ:META a strong buy for 2025 and beyond. For live price updates and technical charts, visit Meta's stock page.