Meta Platforms (META) Stock: A $600 Powerhouse Leading Tech’s Future

At $600, Meta’s dominance in advertising, AI leadership, and AR innovation makes it a standout opportunity for investors targeting transformative growth and enduring profitability | That's TradingNEWS

Meta Platforms (NASDAQ:META): A Growth Titan Reshaping the Tech Landscape

Meta Platforms (NASDAQ:META) continues to assert itself as one of the most transformative players in the technology sector, leveraging innovation, operational efficiency, and strategic foresight to maintain its leadership. While 2024 marked another year of stellar performance for META, the company’s trajectory into 2025 and beyond holds even greater promise, fueled by advancements in artificial intelligence, augmented reality, and an unparalleled advertising ecosystem.

Dominance in Advertising and Core Business Strength

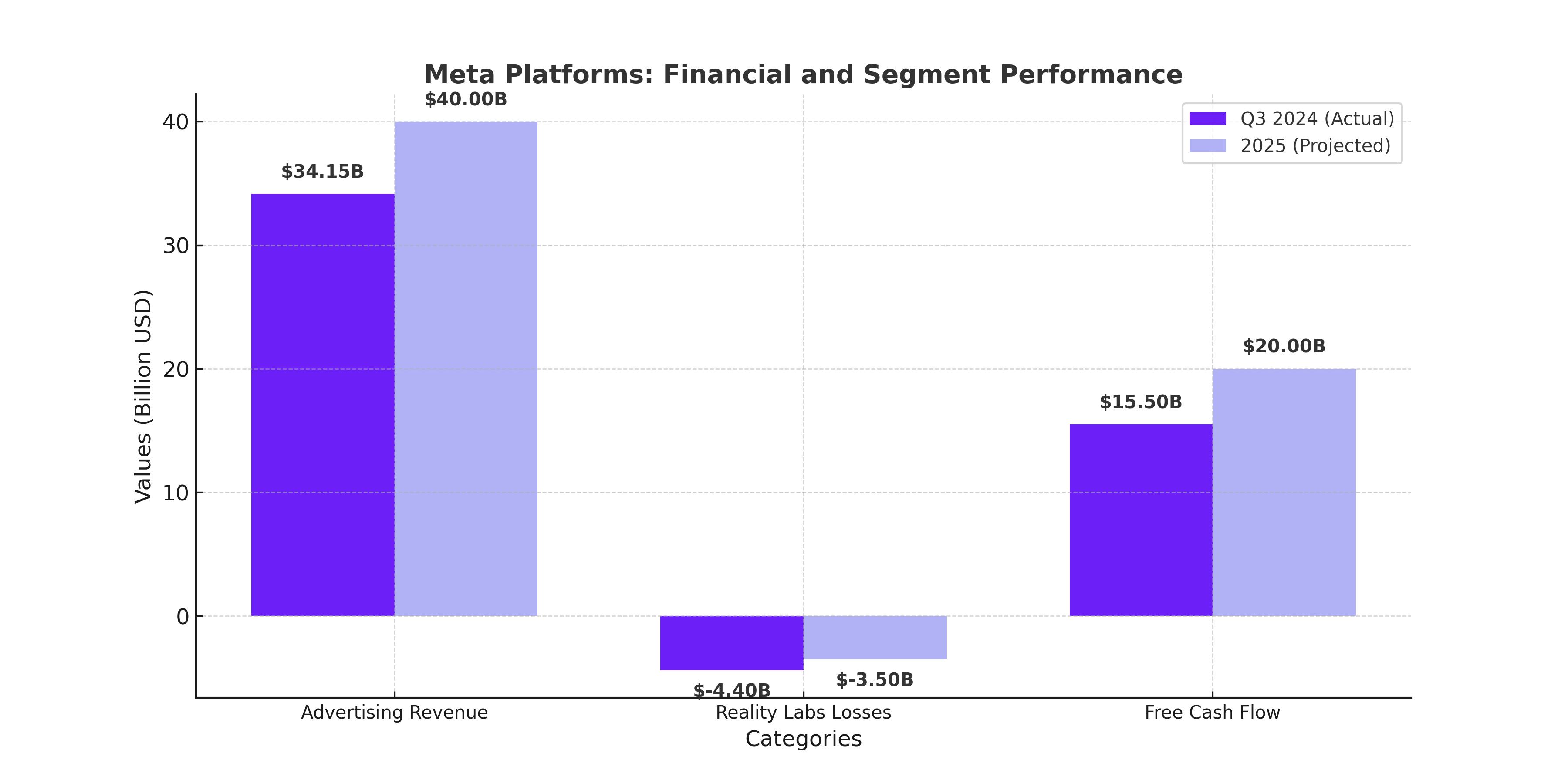

Meta’s core advertising business remains the backbone of its profitability, showcasing a 54% operating margin within its Family of Apps segment. In Q3 2024, the company posted 19% YoY revenue growth, reaching $34.15 billion, with earnings climbing 27% year-over-year thanks to 300 basis points of margin expansion. These results highlight the resilience and scalability of META’s business model, even as it laps challenging comparables from prior years.

Daily active people (DAP) surged 4.8% year-over-year to 3.29 billion, with ad impressions increasing 7% and the average price per ad growing by 11%. This combination reflects Meta’s ability to monetize its user base effectively while delivering value to advertisers. Average revenue per person (ARPP) grew 12.4%, underscoring the increasing efficacy of Meta’s AI-powered ad solutions and its leadership in digital marketing innovation.

AI Investments Driving New Frontiers

Meta’s AI initiatives continue to redefine the capabilities of its ecosystem. The company’s advancements in machine learning have not only enhanced its core advertising business but also laid the groundwork for future growth in personalized user experiences, such as AI-powered recommendations and immersive applications.

CEO Mark Zuckerberg has emphasized that Meta is building “serious infrastructure” to support its AI ambitions, with projected CapEx in 2025 exceeding the $40 billion spent in 2024. These investments are expected to catalyze ROI across the company’s platforms, with applications extending from ad targeting to content moderation and customer engagement tools.

Threads: Meta’s New Growth Engine

Threads, Meta’s emerging social media platform, has quickly gained traction with nearly 275 million monthly active users. Growing by over a million sign-ups daily, Threads positions itself as the next major addition to the Family of Apps. While its revenue contribution remains minimal compared to Meta’s $163 billion annual run rate, its rapid user adoption signals significant monetization potential in the coming years.

Reality Labs: Challenges and Opportunities

Reality Labs, Meta’s ambitious venture into the metaverse and augmented reality, continues to incur substantial losses, totaling $4.4 billion in Q3 2024. However, promising innovations, such as the Ray-Ban Meta smart glasses and the upcoming Orion augmented reality glasses, signal a long-term growth opportunity. Orion, expected to launch around 2027, aims to capture market share in the $700–$1,200 price range, potentially disrupting the smartphone market.

Despite the ongoing financial burden, Meta’s strategic focus on augmented reality underscores its commitment to shaping the future of digital interaction. The unit’s eventual profitability could serve as a catalyst for significant margin expansion and valuation re-rating.

Robust Financial Position and Capital Allocation

Meta’s financial strength is unmatched, with $70.9 billion in cash and $28.8 billion in debt as of Q3 2024. Free cash flow of $15.5 billion allowed the company to repurchase $8.8 billion in stock, demonstrating a disciplined approach to capital allocation. These resources position Meta to weather economic uncertainties while investing aggressively in growth opportunities.

Valuation and Upside Potential

Trading at a forward P/E of 24x for 2025, Meta is attractively valued relative to its growth prospects. With consensus revenue estimates projecting $230 billion by 2027 and an operating margin exceeding 50% in its core businesses, META offers a compelling case for long-term investors. Sum-of-the-parts valuation suggests the Family of Apps alone justifies a 12.5x sales multiple, translating to a 90% upside over the next three years. Including its 4% earnings yield, the stock presents an annual return potential of 28% through 2027.

META: A Transformative Force in the Tech Sector with Strong Upside Potential

Meta Platforms (NASDAQ:META) remains a defining investment in the technology landscape, continuously evolving and driving value for shareholders. At a recent trading price of approximately $600 per share, META presents a compelling case for long-term investors, combining innovation, operational excellence, and financial discipline. Its unrivaled leadership in digital advertising, bolstered by cutting-edge AI integration, forms the foundation of its impressive profitability. Meanwhile, Meta's bold ventures into augmented reality, including its anticipated Orion glasses, underscore its commitment to shaping the future of technology and human interaction.

While tech markets may experience bouts of volatility, Meta’s core strengths—its ability to consistently deliver growth, maintain enviable margins, and capitalize on emerging trends—make it a standout among mega-cap tech giants. Analysts’ projections of continued double-digit growth and its discounted valuation relative to peers enhance its attractiveness. With strategic investments driving both immediate gains and long-term opportunities, META is a top-tier choice for investors seeking exposure to transformative innovation and robust profitability. For detailed price trends and insider transaction updates, visit META’s stock profile.

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex