Meta Stock (NASDAQ:META): Dominating Social Media and AI with Strategic Investments

Analyzing Meta's Global User Base, Financial Performance, AI Innovations, and Strategic Expenditures Ahead of Q2 2024 Earnings Report | That's TradingNEWS

Meta's Expanding Influence

Global Reach and User Engagement

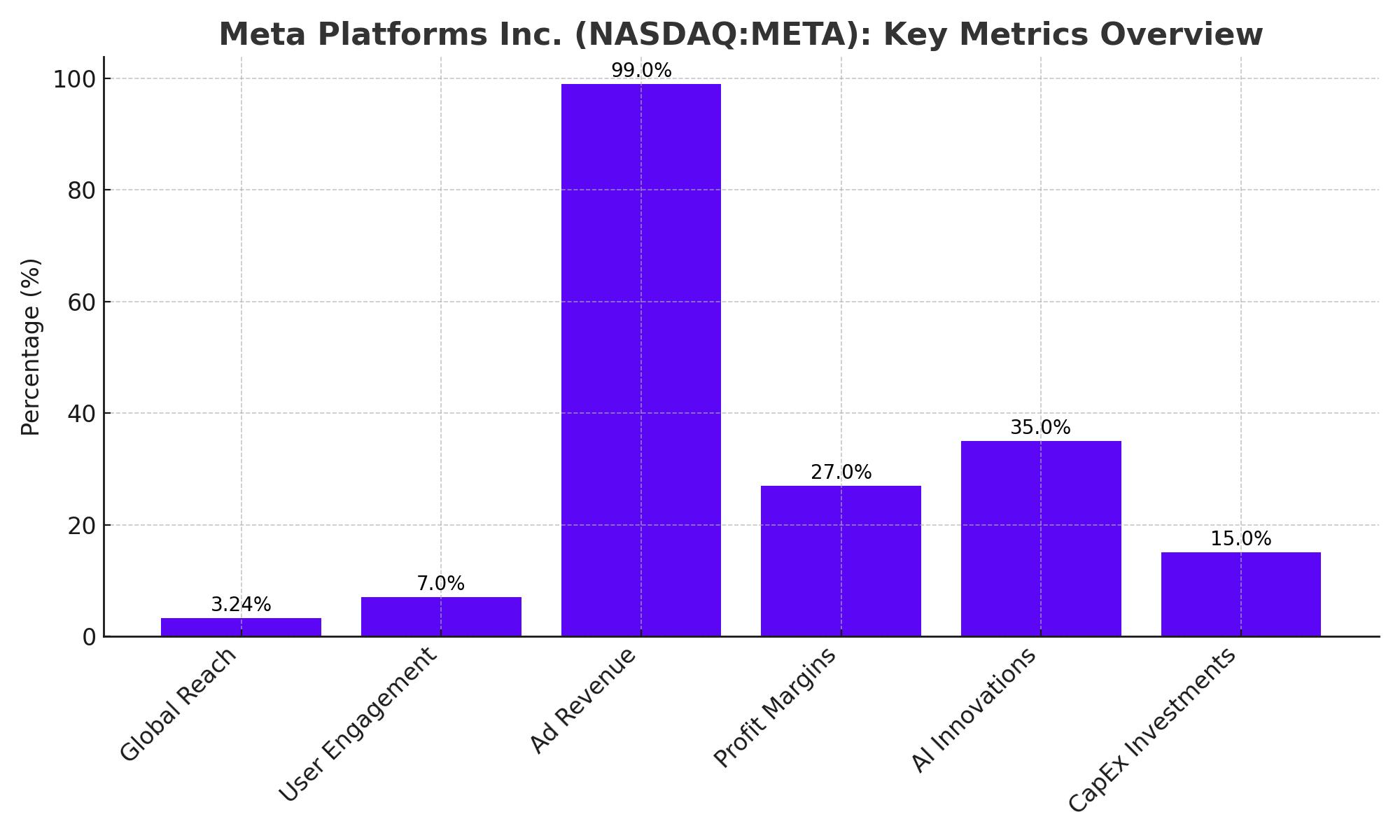

Meta Platforms Inc. (NASDAQ:META) has solidified its position as a leader in social media, with an extensive user base across its various platforms. As of the latest reports, Meta's products are used by 3.24 billion people daily, showcasing the company's vast global influence. The company owns several of the world's most popular social media platforms, including Facebook, Instagram, WhatsApp, and Messenger. Despite concerns about younger users migrating away from Facebook, Instagram remains highly popular among this demographic, ensuring sustained user engagement and growth. Notably, Meta reported a 7% year-over-year increase in daily active users in Q1, a trend expected to continue in the upcoming Q2 earnings report on July 31.

Financial Performance and Revenue Growth

Ad Revenue and Profit Margins

Meta's revenue is predominantly driven by advertising, which constitutes 99% of its total revenue. The company's ability to monetize its vast user base has resulted in significant revenue growth. Over the past five years, Meta has consistently increased its revenue, with a notable 27% jump in Q1 2024 compared to the previous year. This growth was largely driven by a 20% increase in ad impressions and a 6% rise in the cost per impression. Analysts forecast Q2 2024 revenue to reach approximately $38.28 billion, reflecting a 19.65% year-over-year growth. This expectation aligns with Meta's historical performance and its robust advertising model.

AI Innovations and Open-Source Strategy

Meta's AI Advancements

Meta has made significant strides in artificial intelligence (AI), with its recent focus on the Llama large language model (LLM). The Llama 3.1 version, now open source, aims to leverage collective knowledge for rapid advancement. Meta CEO Mark Zuckerberg has expressed confidence that Meta AI will become the most widely used AI globally by the end of the year. The open-source strategy distinguishes Meta from competitors like OpenAI and Alphabet, which maintain proprietary models. By encouraging external contributions, Meta aims to accelerate innovation and potentially outpace rivals in AI development.

Strategic Capital Expenditures and Market Position

Investment in AI and Share Buybacks

Meta's aggressive capital expenditures (CapEx) have been a point of contention among investors. The company plans to invest between $35 billion and $40 billion to enhance its AI capabilities, a move that has raised concerns about immediate returns. Despite these concerns, Zuckerberg defends these investments as crucial for maintaining competitive advantage and driving innovation. In Q1 2024, Meta also allocated $15.01 billion to share buybacks, up from $9.37 billion the previous year, indicating a strong commitment to returning value to shareholders. This strategy has contributed to Meta's robust financial position, with a current market capitalization of $1.24 trillion.

Technical Analysis and Key Metrics

Stock Performance and Valuation

As of the latest trading data, Meta's stock (NASDAQ:META) is valued at $465.71, with a market cap of $1.181 trillion. The stock has experienced significant growth, rising more than 43% over the past year. Despite this run-up, Meta remains undervalued relative to its peers. The forward price-to-earnings (P/E) ratio stands at 30, which, coupled with expected EPS growth of 25%, suggests a potential for continued upward movement. Analysts project a fair value of approximately $1,600 per share by 2029, indicating a 29% compound annual growth rate (CAGR) in a bullish scenario.

Earnings Expectations and Forward Guidance

Q2 Earnings Projections

For Q2 2024, analysts anticipate earnings per share (EPS) of $4.78, a significant increase from $2.98 in the same period last year. This growth translates to an estimated net income rise from $7.79 billion to $12.44 billion. Operating cash flow and EBITDA are also expected to show strong performance, building on the $12.06 billion operating cash flow and $12.80 billion EBITDA reported in Q2 2023. Meta's ability to maintain and expand its profit margins will be crucial for meeting these expectations. The upcoming earnings report will be a critical indicator of Meta's financial health and its ability to sustain growth amid high CapEx and strategic investments.

Conclusion

Strategic Position and Future Prospects

Meta Platforms Inc. (NASDAQ:META) is positioned for continued growth, driven by its extensive user base, innovative AI strategies, and strategic investments. The company's upcoming Q2 earnings report will provide further insights into its financial health and long-term prospects. Investors should monitor these developments closely to make informed decisions about their holdings in Meta.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex