Micron (NASDAQ:MU) at a Crossroads – Will AI, HBM, and Government Support Send It Soaring?

With a 35% Upside and HBM Market Expansion, Is Micron a Must-Buy at $95? | That's TradingNEWS

Micron (NASDAQ:MU) – Is AI Demand and HBM Growth Enough to Push It to $139?

Micron (NASDAQ:MU) is Poised for a Breakout – But Can It Deliver?

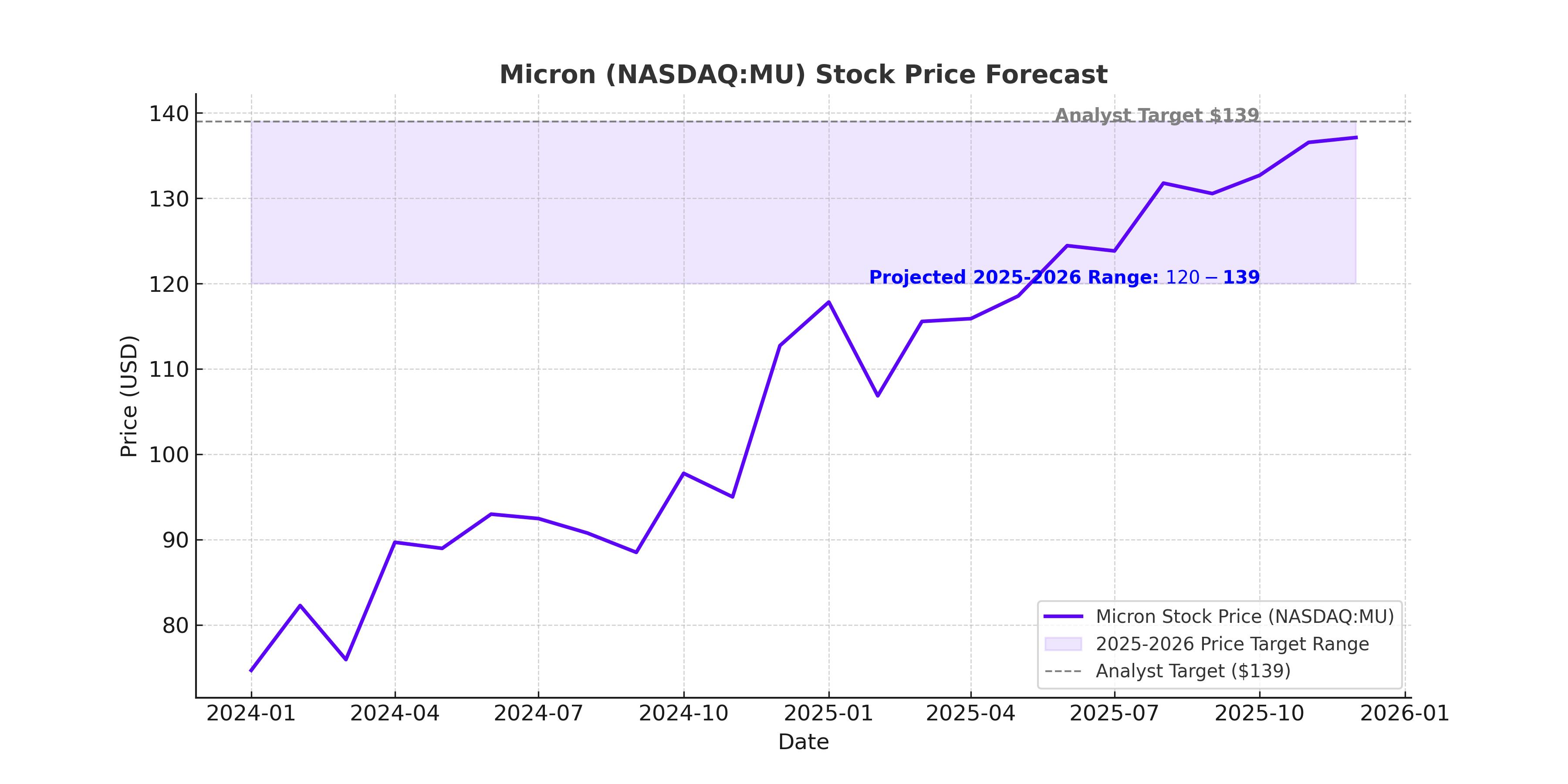

Micron Technology (NASDAQ:MU) is at the forefront of a major industry shift, fueled by AI expansion, high-bandwidth memory (HBM) demand, and government support for U.S. semiconductor manufacturing. With revenue set to surge 33.7% in 2025 and another 29.7% in 2026, the stock is currently trading at $95 with analysts setting price targets as high as $139. But can Micron execute on its aggressive growth strategy, or will competition from Samsung and SK Hynix limit its upside?

Micron’s data center revenue exploded by 400% in 2024, with AI-driven workloads increasing demand for DRAM and NAND memory solutions. The HBM market is forecasted to hit $30 billion in 2025, and Micron expects to secure 20-25% of that share. The company’s recent expansions in the U.S., India, and Singapore are strategically aimed at reducing supply chain risks while capitalizing on the AI revolution. However, competition is fierce, and Micron is facing increasing pressure from industry giants like Samsung, which is aggressively ramping up its HBM production.

Can Micron (NASDAQ:MU) Secure a Dominant Position in the HBM Market?

Micron’s ability to scale HBM production is critical to its long-term success. In 2024, Micron’s revenue from HBM was in the hundreds of millions, but in 2025, that number is expected to grow to several billion dollars. The company has secured new customers beyond NVIDIA, significantly reducing its dependency on a single buyer. While this is a positive development, Samsung and SK Hynix are not standing still.

SK Hynix currently holds 40% of the HBM market, giving it a significant lead over Micron. Meanwhile, Samsung is rapidly investing in next-generation HBM, positioning itself as a major competitor. Micron’s ability to deliver cutting-edge HBM solutions at scale will determine whether it can hit its ambitious 20-25% market share target. Any delays in production or technological shortcomings could allow Samsung and SK Hynix to dominate the sector.

Can Micron (NASDAQ:MU) Overcome Geopolitical Risks and Supply Chain Challenges?

Micron is navigating a rapidly shifting geopolitical landscape, with trade tensions between the U.S. and China posing significant risks to its global operations. Donald Trump’s aggressive trade policies could impact semiconductor supply chains, increasing costs for U.S.-based chipmakers. However, Micron is taking decisive action to mitigate these risks.

Micron secured a $6.1 billion grant from the U.S. government to support domestic DRAM production, with new manufacturing facilities in Idaho and New York. The company is also expanding production in India, reducing its reliance on China. Additionally, Micron has broken ground on a new packaging facility in Singapore, further diversifying its global supply chain. While these investments strengthen Micron’s long-term position, the near-term impact of tariffs and trade restrictions remains uncertain.

Micron (NASDAQ:MU) Financials – Is the Stock Undervalued?

Micron is in a strong financial position, with $7.5 billion in cash reserves and stable debt levels. The company’s revenue is forecasted to reach $33.6 billion in 2025 (+33.7% YoY) and $43.6 billion in 2026 (+29.7% YoY). EBITDA is set to jump 79% in 2025 to $16.3 billion, further climbing to $22.3 billion in 2026 (+37% YoY).

At a current forward P/E of 13, Micron is trading at a significant discount compared to its projected earnings growth. Analysts expect this multiple to drop below 10 by 2026, reinforcing the argument that MU stock remains undervalued at current levels. With a historical EV/EBITDA multiple of 9.4x, Micron’s fair valuation suggests a target price of $139 per share, representing a 35% upside.

The Risks – What Could Derail Micron (NASDAQ:MU)’s Growth?

Micron’s bullish outlook is not without risks. The HBM market is extremely competitive, and Samsung and SK Hynix have a head start in high-performance AI memory solutions. If Micron fails to scale production quickly, it may struggle to capture its projected 20-25% market share.

The memory chip industry is cyclical, and any downturn in DRAM or NAND pricing could squeeze margins. While AI-driven demand remains strong, fluctuations in pricing cycles could impact Micron’s short-term profitability.

Micron is also making heavy capital expenditures, with $14 billion planned for 2025. While these investments are necessary for long-term growth, they could put short-term pressure on free cash flow. Investors should be mindful of any unexpected delays or cost overruns that could impact financial performance.

Final Verdict – Is Micron (NASDAQ:MU) a Buy at $95?

Micron’s strong financial position, AI-driven growth, and expanding HBM market share make it one of the most attractive semiconductor plays. With a projected price target of $139, the stock has a 35% upside, making it a strong buy for long-term investors.

However, the competitive landscape is fierce, and Micron must execute flawlessly to maintain its projected 20-25% HBM market share. Any delays in production, pricing pressure, or geopolitical disruptions could impact the stock’s short-term performance.

For investors with a long-term horizon, Micron remains a compelling investment opportunity. At $95 per share, the stock is undervalued relative to its growth potential, and as AI demand continues to surge, Micron’s strategic positioning could drive significant upside in the years ahead.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex