Microsoft NASDAQ:MSFT Stock - Driving a Strong Buy Recommendation

Diving deep into Microsoft's recent earnings success, including Azure's cloud dominance and aggressive AI investments, underscoring a robust financial outlook and strong buy recommendation | That's TradingNEWS

In-Depth Analysis: Microsoft Corporation's (NASDAQ:MSFT) Recent Performance and Market Prospects

Overview of Recent Financial Performance

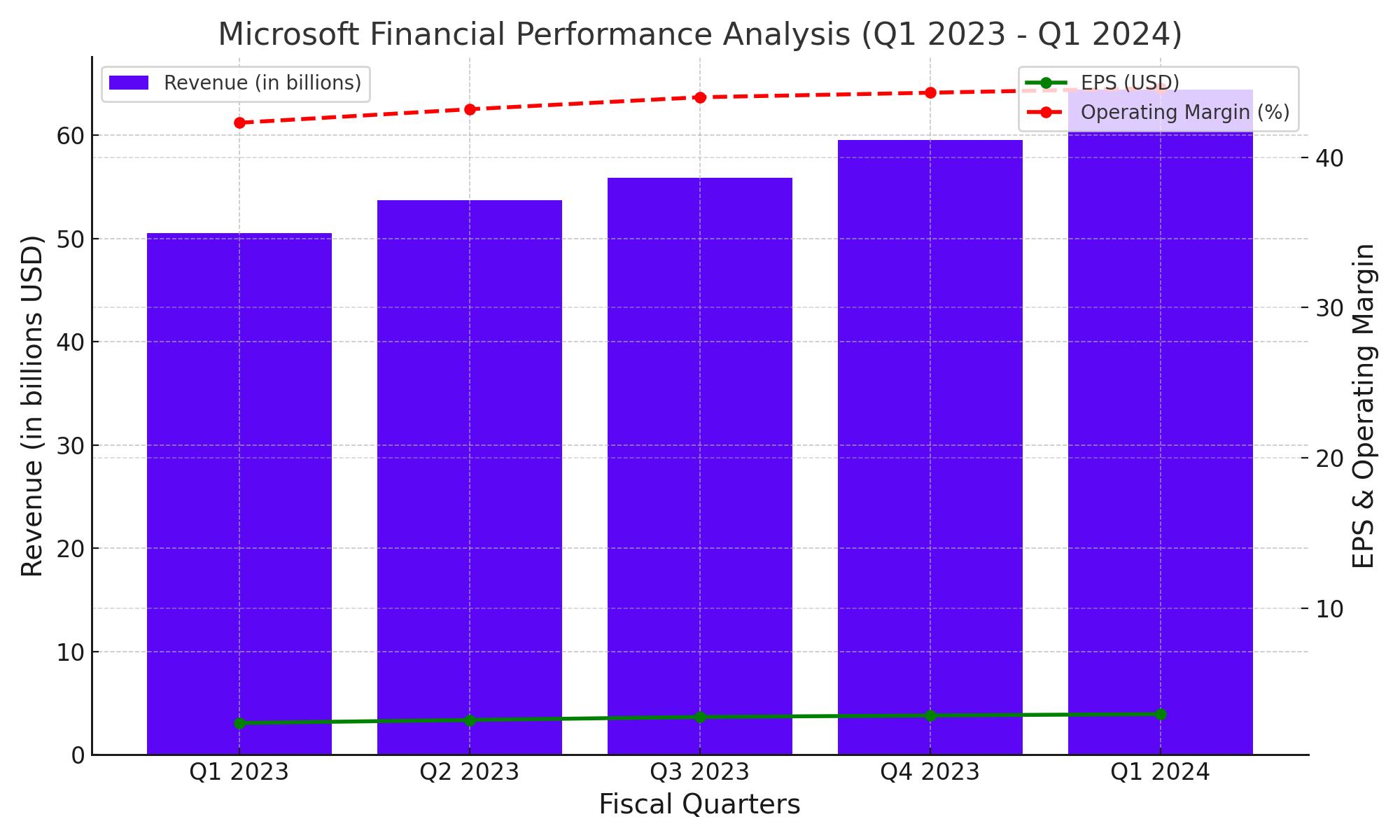

Microsoft (NASDAQ:MSFT) demonstrated robust fiscal health in its recent quarterly earnings, reporting a notable 17% year-over-year increase in revenue. This performance highlights the tech giant's continuous dominance, particularly in its cloud segment. The reported adjusted earnings per share (EPS) jumped from $2.45 to $2.94, driven by significant operating leverage. With an operating margin that expanded from 42.3% to 44.6% year-over-year, Microsoft's financial metrics signal strong operational efficiency and a competitive edge in scaling its offerings.

NASDAQ:MSFT Q1 Earnings Overview

The latest earnings report paints a vivid picture of Microsoft's fiscal strength. Levered free cash flow (FCF) increased from $13.5 billion to $16.9 billion, despite a rise in capital expenditures, indicating healthy profitability and cash generation capabilities. Such financial flexibility has bolstered Microsoft's cash reserves, now at an impressive $80 billion. This financial cushion not only supports ongoing operations but positions Microsoft advantageously for strategic acquisitions and investments.

Market Share and Cloud Dominance

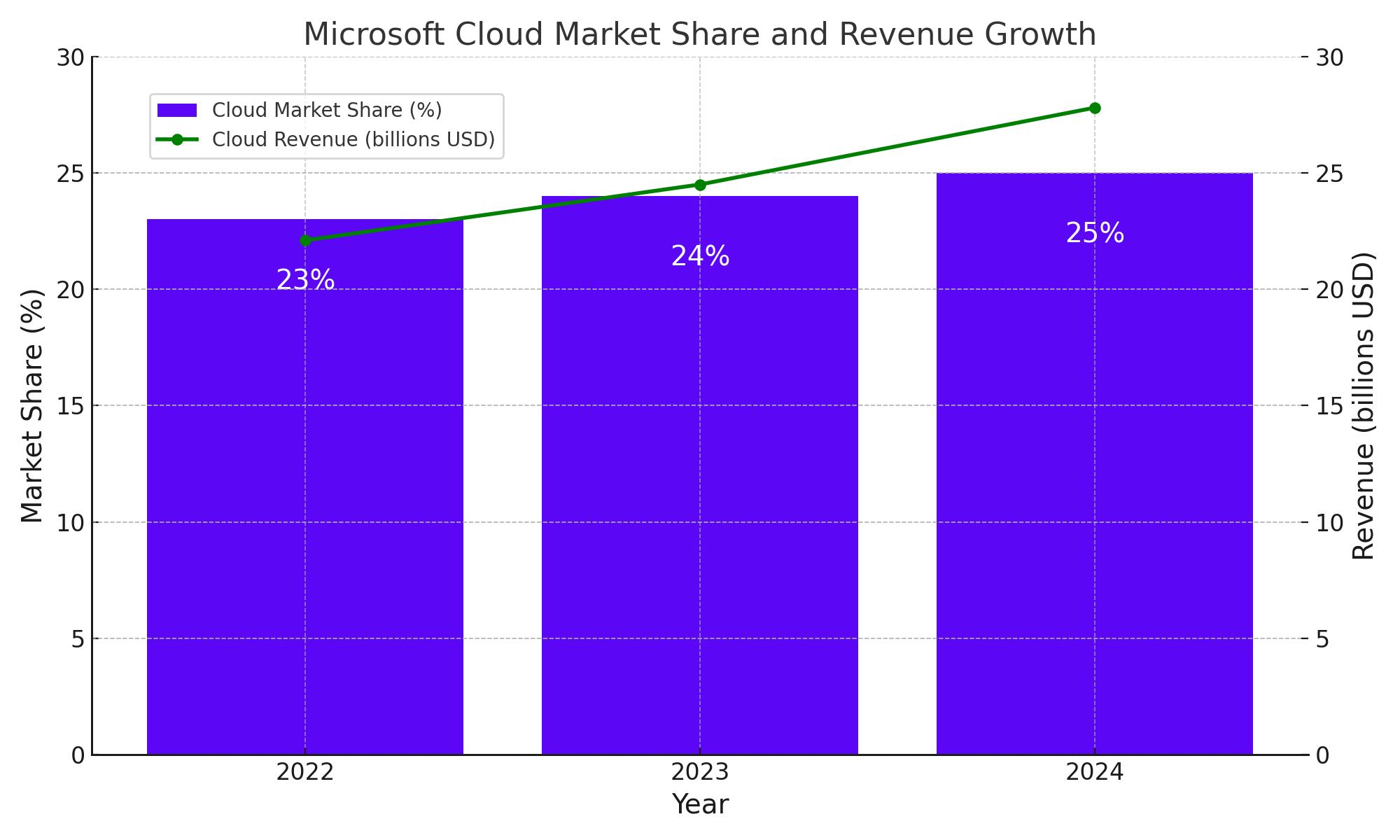

A key driver of Microsoft's success has been its cloud infrastructure segment, led by Azure. According to recent market analysis, Azure now commands a 25% share of the global cloud market, gradually closing the gap with Amazon's AWS. This growth is supported by a 31% increase in Azure's revenue, showcasing the strong demand for cloud services and Microsoft's ability to capitalize on this trend.

Strategic Investments and Future Growth

Microsoft is aggressively investing in its future, particularly in artificial intelligence (AI) and cloud infrastructure. Recent announcements include billions of dollars allocated towards the development of data centers across the U.S., France, Japan, and the UK. Such investments underline Microsoft's commitment to maintaining its leadership in technology innovation, particularly in AI, where it sees a potential market opportunity of $1.3 trillion.

NASDAQ:MSFT Real-Time Stock Analysis and Insider Transactions

For real-time stock analysis and details on insider transactions, stakeholders and potential investors are encouraged to consult dedicated financial platforms. These resources provide up-to-date information crucial for making informed investment decisions.

Wall Street's Outlook and Stock Valuation

Analysts remain bullish on Microsoft, with projections for fiscal Q4 revenue set at $64.4 billion, reflecting a 14.6% growth year-over-year. Such forecasts suggest continued revenue acceleration, with EPS also expected to rise. This optimistic outlook is supported by Microsoft's strategic positioning in the cloud and AI sectors, where ongoing investments are likely to drive future revenue streams.

Comprehensive Valuation and Growth Potential

Despite a 33% rally over the last twelve months, Microsoft is considered roughly 15% undervalued based on discounted cash flow (DCF) analyses. This valuation underscores not only the company's current financial health but its growth potential, especially as it continues to expand its influence in AI and cloud computing.

Market Risks and Competitive Landscape

Potential risks include cooling market sentiment around AI and robust competition in the cloud sector, notably from Google Cloud and AWS. Furthermore, ongoing antitrust scrutiny in the EU could pose challenges to Microsoft's operations. However, Microsoft's comprehensive strategy and market adaptability position it well to manage these risks effectively.

Conclusion: Strong Buy on Microsoft (NASDAQ:MSFT)

Considering Microsoft's continued revenue growth across multiple business segments, significant cash reserves for strategic maneuvers, and aggressive investment in future technologies, the outlook for Microsoft remains exceptionally bullish. The company's ability to innovate and adapt to market demands solidifies its status as a leading investment in the technology sector. Investors are advised to maintain a keen focus on Microsoft's strategic initiatives and market performance indicators to capitalize on potential growth opportunities.

That's TradingNEWS

Read More

-

MercadoLibre (MELI) Stock Price at $2,005 With Street Target Near $2,800

27.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI $10.71 and XRPR $15.19 Ride $1.25B Inflows While XRP-USD Stalls Near $1.86

27.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Toward $4.29 as Colder Weather and Record LNG Demand Tighten NG=F

27.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Wall Street Stalls Near Records as Gold and Silver Go Vertical

27.12.2025 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Holds Near 156.5 as Intervention Watch, BoJ Shift and Fed Cuts Collide

27.12.2025 · TradingNEWS ArchiveForex