Microsoft (NASDAQ:MSFT) Stock Analysis: Post-Earnings Drop at $400 – Buy, Sell, or Hold?

Microsoft Stock Plunges After Earnings – Is This a Buying Opportunity?

Microsoft (NASDAQ:MSFT) dropped 6% after its Q2 FY2025 earnings, sparking concerns over slowing Azure revenue growth and aggressive AI capital expenditures. Despite delivering $69.6 billion in revenue (12% YoY growth) and $3.23 EPS (beating estimates by $0.11), investors reacted negatively to weaker-than-expected Azure performance.

Azure’s 31% YoY revenue growth barely met the low end of company guidance, with growth expected to decelerate further in Q3 FY2025 due to capacity constraints and a stronger dollar, which will create a 2% currency headwind. Microsoft CFO Amy Hood confirmed that Azure’s growth will remain flat QoQ, which disappointed investors who were expecting a second-half acceleration.

At the same time, Microsoft’s AI revenue run rate surged 175% YoY to $13 billion, proving that AI demand is strong, even as short-term infrastructure spending pressures margins. The company spent $22.3 billion on AI-related capital expenditures, causing free cash flow to drop 29% YoY to $6.5 billion, reinforcing the short-term financial strain.

Azure Growth Slows, But AI Demand Remains Strong

Despite the post-earnings selloff, Microsoft’s commercial remaining performance obligation (RPO) surged 34% YoY to $298 billion, with 40% of that revenue set to be recognized in the next 12 months. This indicates strong demand for Microsoft’s cloud and AI solutions, even if short-term growth is decelerating.

The integration of DeepSeek R1 into Azure AI Foundry and GitHub could enhance efficiency and reduce future capital expenditures, which might help Microsoft regain margin expansion in the long run. DeepSeek’s lower-cost AI models could improve profitability, especially as Microsoft scales AI adoption across enterprise clients.

However, Microsoft is still facing infrastructure limitations, with supply chain constraints and data center power shortages limiting Azure’s AI-driven expansion. These capacity issues will likely persist into Q3 and Q4 FY2025, meaning that investors might need to be patient before seeing a full reacceleration in growth.

Microsoft's AI Spending: Strategic or a Risk to Margins?

Microsoft’s aggressive AI expansion is weighing on free cash flow, with capital expenditures reaching 32.5% of total revenue in Q2 FY2025, up from 30.5% in Q1. The company has been heavily investing in NVIDIA GPUs, data centers, and proprietary AI accelerators, which has pressured operating margins.

CEO Satya Nadella remains bullish on AI monetization, stating that Copilot AI and Azure AI demand are exceeding expectations. However, the company needs to prove that these AI investments will deliver meaningful revenue acceleration in the coming quarters.

With Microsoft’s free cash flow declining, some investors are concerned that Microsoft is burning cash on AI without seeing immediate returns. However, as seen with Amazon Web Services in its early years, aggressive infrastructure spending is a necessary step for long-term cloud dominance.

Valuation: Is Microsoft Stock Too Expensive at 31.6x Forward P/E?

Following the earnings drop, Microsoft’s forward P/E ratio sits at 31.6x, slightly below its five-year average. The stock is trading near the $400–$410 support range, a key technical level where buyers previously stepped in after the post-Q1 earnings selloff.

Compared to other AI-driven tech giants, Microsoft’s valuation remains reasonable:

- Microsoft (NASDAQ:MSFT) Forward P/E: 31.6x

- NVIDIA (NASDAQ:NVDA) Forward P/E: 48.2x

- Amazon (NASDAQ:AMZN) Forward P/E: 41.5x

- Alphabet (NASDAQ:GOOGL) Forward P/E: 25.9x

While Microsoft isn’t cheap, it is not overvalued relative to other AI-driven stocks. The company is generating strong revenue growth, but the real question is whether margins will improve once AI capex slows in FY2026.

Microsoft Insider Transactions: Are Executives Buying or Selling?

Looking at Microsoft’s latest insider transactions, there has been no major insider buying activity, which raises questions about management’s confidence in short-term upside. While executives haven’t been aggressively selling, the lack of insider purchases suggests that Microsoft might not see an immediate recovery.

Check Microsoft’s latest insider transactions here.

Technical Analysis: Is Microsoft Stock a Buy at $400?

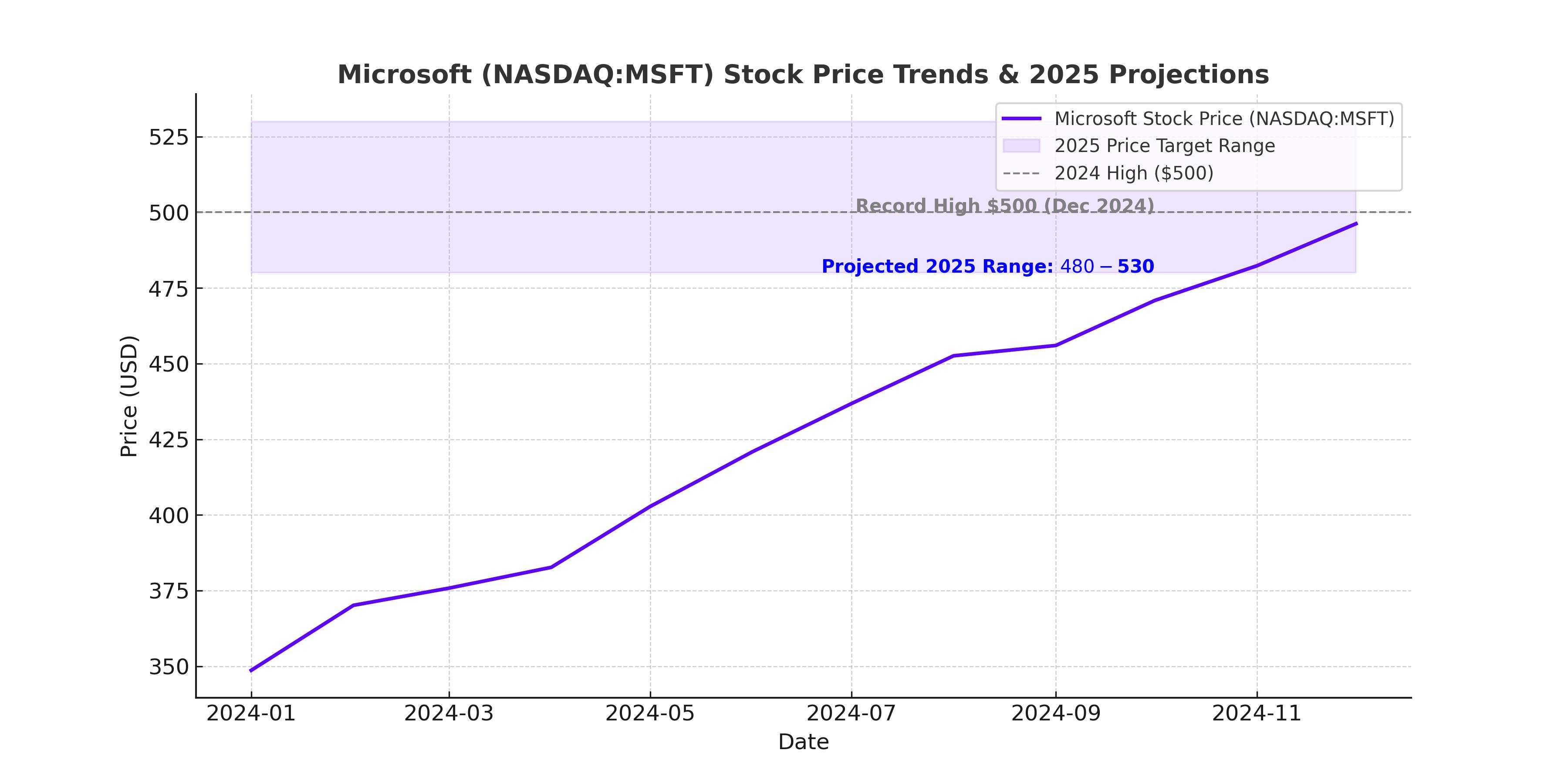

Microsoft is currently trading at a key support zone between $400–$410, a critical level that has held multiple times over the past six months. If this level holds, the stock could bounce back toward $440–$450 in the coming weeks.

However, if Microsoft breaks below $400, the stock could see further downside, potentially retesting the $380 level before finding a stronger base.

Investors should watch:

- Azure growth trends in Q3

- AI monetization progress

- Capital expenditures and margin trends

- Breakout or breakdown at the $400 level

Buy, Sell, or Hold?

Despite short-term headwinds, Microsoft remains a long-term leader in AI, cloud computing, and enterprise software. The post-earnings drop has made Microsoft’s valuation more attractive, but investors need to be patient as Azure reaccelerates and AI investments deliver stronger returns.

At $400–$410, Microsoft stock looks like a buy for long-term investors who believe in its AI-driven future. However, if Azure growth continues to slow in Q3 and margins remain under pressure, the stock could see further downside before a true rebound.

Investors looking for short-term gains might wait for a clearer technical breakout above $420 before entering. But for long-term holders, accumulating Microsoft stock near $400 could be a solid buying opportunity.