NASDAQ:AMD Battles AI Disruption, Market Pressure & Growth Expectations

NASDAQ:AMD has been caught in the crossfire of AI market uncertainty, trading around $110 as it faces a brutal selloff triggered by DeepSeek’s AI breakthrough. The shockwaves from DeepSeek’s cost-efficient AI training model, which challenges the industry's demand for high-cost compute infrastructure, have raised questions about AMD’s AI revenue potential. While AMD is striving to secure its place in the AI race, its $5 billion AI chip revenue target for 2025 is under increasing scrutiny.

The stock has lost nearly 15% from its 2024 peak of $122, testing critical support levels. Investors are left wondering: Can AMD recover its momentum, or is the AI hype cycle working against it?

AMD vs. DeepSeek: Is the AI Compute Boom Slowing?

DeepSeek, a China-based AI research firm, recently stunned the industry by demonstrating that high-performance AI models can be trained on just $6 million worth of compute power—a fraction of what was previously thought necessary. This revelation sent shockwaves through Wall Street, leading to an aggressive selloff in stocks tied to AI infrastructure, including NASDAQ:AMD, NVIDIA (NASDAQ:NVDA), and Broadcom (NASDAQ:AVGO).

If AI models become more efficient, does that mean less demand for AMD’s AI chips? That’s the billion-dollar question.

For years, AMD has positioned itself as a viable alternative to NVIDIA’s AI dominance, particularly in the data center and AI inference markets. However, if DeepSeek’s efficiency gains prove scalable, the assumption that AI requires more GPUs, more energy, and more compute power could unravel—posing a major risk to AMD’s growth strategy.

AMD is already facing fierce competition in AI computing. While NVIDIA has secured a stranglehold on AI training, AMD’s MI300X GPUs have been making inroads in AI inference workloads, outperforming NVIDIA’s H100 and H200 chips in some areas. However, with NVIDIA’s Blackwell GPU family launching in 2025, AMD’s window of opportunity to capture market share is narrowing.

Data Centers & AI Compute: AMD’s Billion-Dollar Opportunity

Despite concerns over AI efficiency reducing demand for GPUs, AI spending remains at record levels. Major cloud and AI players—including Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), and Amazon (NASDAQ:AMZN)—are doubling down on AI infrastructure investments:

- Microsoft plans to invest $80 billion in AI infrastructure in 2025

- Meta is set to spend up to $65 billion on AI-driven data centers

- Oracle, SoftBank, and OpenAI’s ‘Stargate’ initiative aims to invest $500 billion in AI computing power

The key challenge for AMD is securing a bigger share of these contracts. Right now, Meta is one of AMD’s largest AI customers, using MI300X chips to power its Instagram Reels AI recommendation engine and Llama AI models. Oracle is another major buyer, integrating AMD’s GPUs into its cloud computing infrastructure.

However, without exclusive large-scale AI contracts, AMD risks being left behind as NVIDIA continues to dominate AI chip orders. The upcoming MI350X GPU, expected to be 35x more efficient than its predecessor, could be a game-changer—but only if AMD can convince AI firms to bet on its technology over NVIDIA’s.

The CPU Battle: AMD vs. Intel & The Rise of ARM

Beyond AI, AMD is locked in a fierce battle with Intel (NASDAQ:INTC) and ARM-based competitors like Apple (NASDAQ:AAPL) and Qualcomm (NASDAQ:QCOM) in the CPU market.

While AMD gained market share in x86 CPUs in 2024, particularly in servers and high-performance computing, it is now facing new threats:

- Intel’s Arrow Lake CPUs outperformed AMD’s Ryzen 8000 series in desktop benchmarks

- ARM-based processors are gaining ground, with Apple, Amazon, and Microsoft developing their own custom chips

- AMD’s share of the AI PC market is uncertain, as NVIDIA’s ‘Project DIGITS’ and Qualcomm’s Snapdragon chips compete for dominance

Despite this, AMD’s EPYC Turin CPUs have been crushing Intel’s server chips, with Turin offering 58% higher performance over its previous generation. This has helped AMD capture 24% of the server CPU market, solidifying its position as a leader in data center processors.

However, Intel is fighting back hard, planning to launch its Panther Lake CPUs on a 1.8nm process in 2025. If Intel’s execution improves, AMD could struggle to maintain its advantage.

AMD’s Financials: Strong Growth But Valuation Concerns

AMD’s latest earnings showed solid revenue growth:

- Q3 revenue grew 18% YoY to $6.82 billion

- Data center revenue surged 122% YoY

- Gaming revenue plunged 69% YoY

- Embedded revenue dropped 29% YoY

- Gross margins improved from 47% to 50%

However, despite this growth, AMD trades at a premium valuation of 45x P/E, making it expensive compared to Intel. Investors are now questioning whether AMD’s AI and data center growth can justify its high price tag—or if the market has already priced in too much optimism.

Upcoming Q4 earnings (February 2025) expectations:

- Revenue target: $7.2 billion

- Gross margin target: 52%+

- Data center growth target: 130%+ YoY

- AI chip sales target: $5 billion in 2025

If AMD beats these expectations, the stock could rally toward $130-$140. However, if DeepSeek’s AI breakthrough leads to a reassessment of AI infrastructure spending, AMD’s upside potential could be limited.

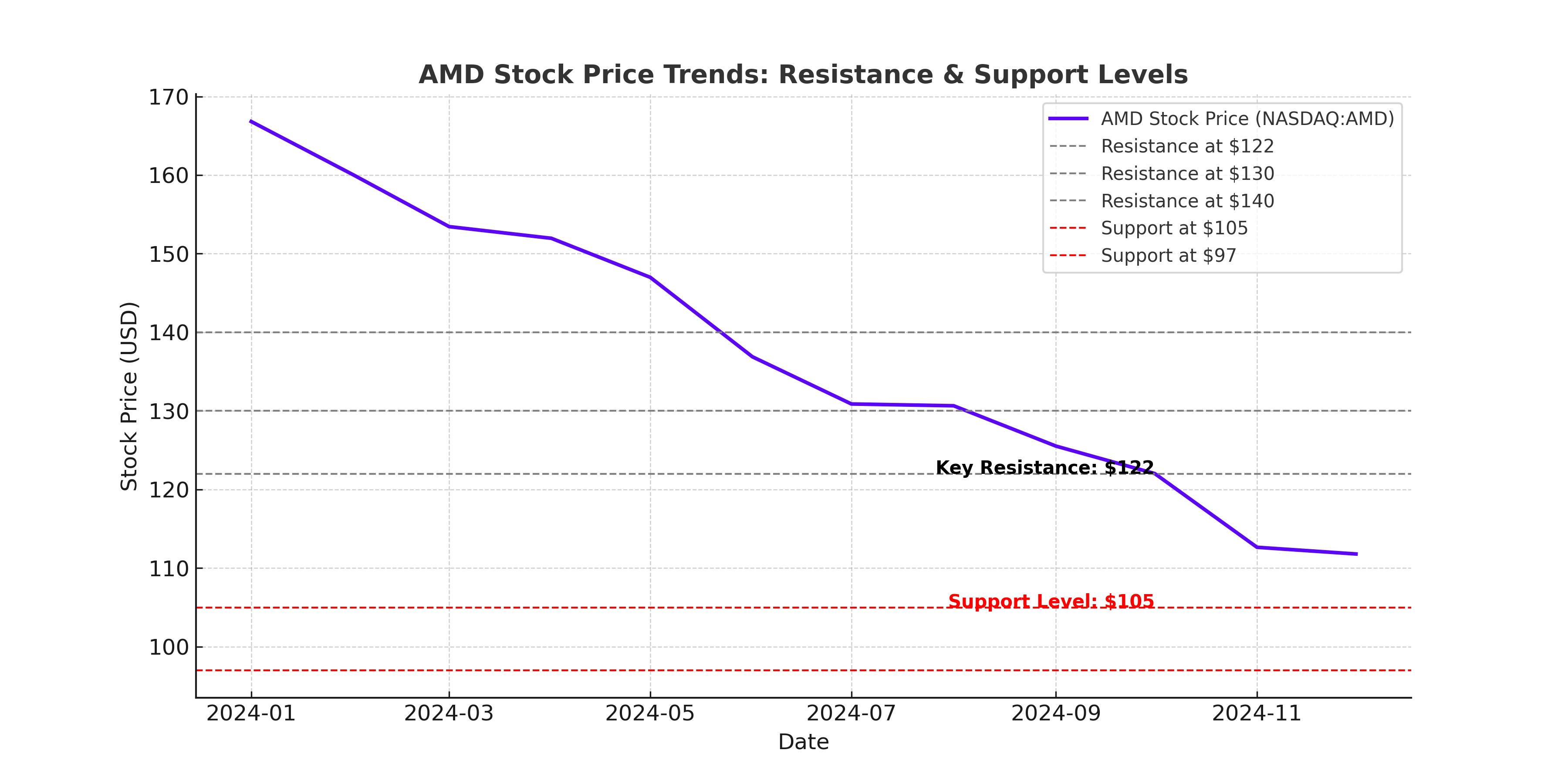

NASDAQ:AMD Stock Price Targets & Technical Levels

AMD is currently trading at $110, having fallen from its 2024 peak of $163.

Key resistance levels:

- $122: Strong psychological barrier and 50-day moving average

- $130: Pre-DeepSeek selloff range

- $140+: Major breakout level

Key support levels:

- $105: Immediate downside support

- $97: Critical technical level—if breached, could trigger further selling

If AMD fails to break above $122, further downside toward $97 is possible.

Buy, Sell, or Hold?

Given the AI market’s explosive growth, AMD remains a strong long-term buy, but short-term volatility is expected. Investors should watch for:

- Q4 earnings guidance: If AMD beats expectations, the stock could rally toward $130+

- AI Inference traction: If AMD secures more contracts in AI inference, its valuation could rise

- DeepSeek’s impact: If AI compute demand slows, AMD’s growth trajectory could be at risk

At $110, AMD presents a strong risk-reward balance. The long-term growth story is intact, but competition from NVIDIA and the shift to ARM CPUs pose challenges.

Final Verdict: Buy at $110, with a 12-month target of $130-$145—assuming AI compute demand remains strong.